10 Scary Stocks: 2020 Edition

These are the most overpriced stocks in our coverage universe today.

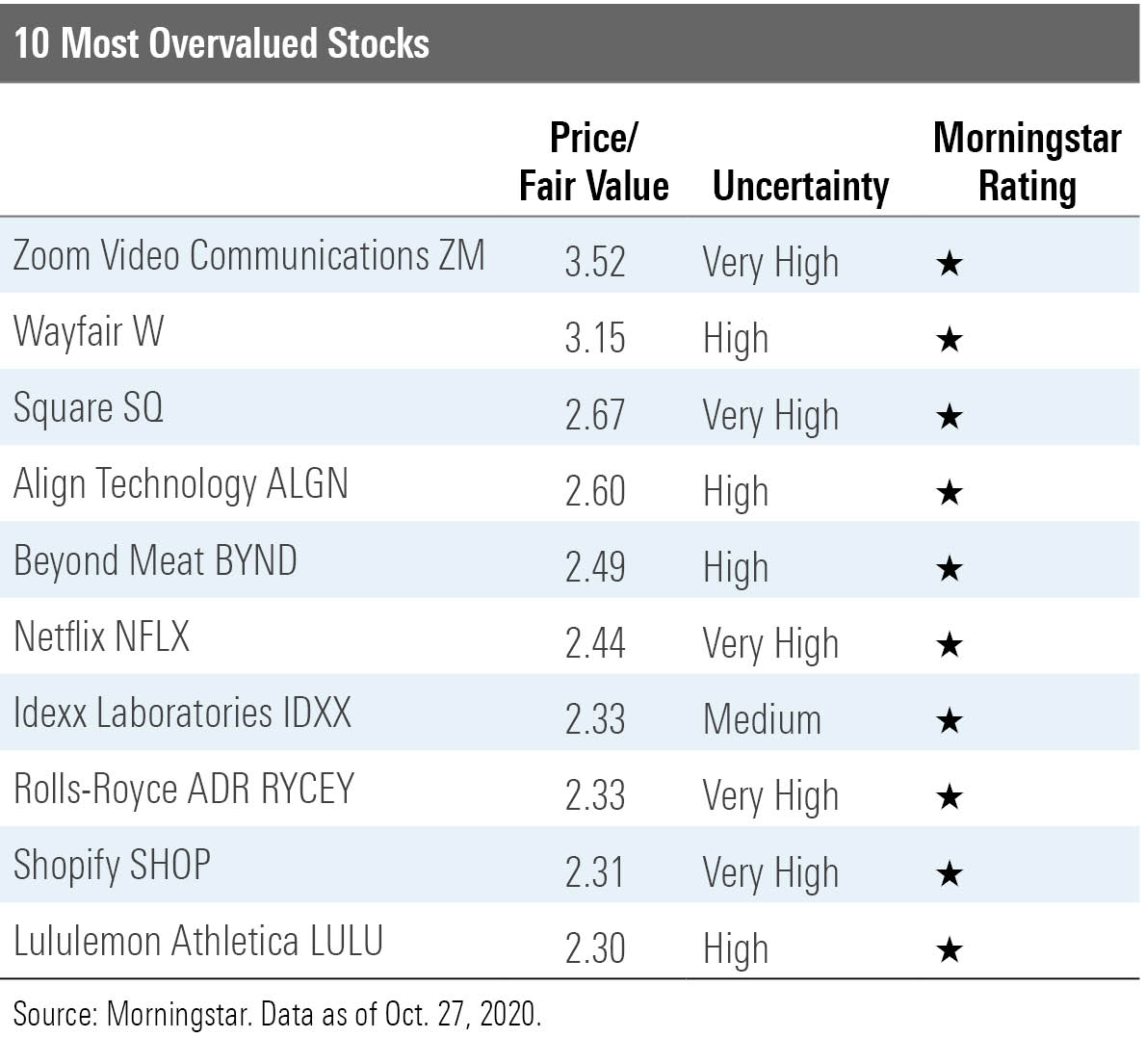

In what has become a Halloween tradition, today we're profiling spooky-expensive stocks. Specifically, we've uncovered the 10 most overvalued names in our coverage based on their price/fair value ratios. (We excluded extreme uncertainty stocks.) The valuations on these names are as frightening as a clown in a sewer.

It's an eclectic bunch. Two of the stocks appearing on this year's roster popped up on last year's list, too, and are apparently perennially overpriced: Netflix NFLX and Shopify SHOP.

Most of the stocks on the list carry high or very high Morningstar Uncertainty Ratings. The uncertainty rating represents the predictability of the company's future cash flows and, therefore, the level of certainty we have in our fair value estimate of that company. Some types of companies have less predictable cash flows than others and carry higher uncertainty ratings. Firms in more economically sensitive industries, including auto manufacturers, retailers, and restaurants, generally carry higher uncertainty ratings. So, too, do companies in highly disruptive sectors such as technology and communication services.

Given the uncertainty around the future cash flows of most of the companies listed here, there's a chance that our fair value estimates may be overly modest. But even once you take into account uncertainty--as the Morningstar Rating for stocks does--these names are still overpriced. In fact, all of the stocks are trading at 1-star ratings as of this writing.

Here's our take on three of the fiendishly priced names.

Zoom Video Communications It's no surprise that Zoom ZM tops this list: The stock is up more than 650% this year. Work- and learn-from-home trends have catapulted revenue--and market enthusiasm for the name.

"The video-first communications platform company continues to penetrate the market by leveraging its cloud-based solutions' ease of use and innovative features," says analyst Dan Romanoff. "We see a long runway for growth as the company gains traction with its Zoom Phones solutions as well, and we are impressed by management's ability to overdeliver in terms of both growth and margins."

After continued earnings blowouts and increasing guidance from management, we've raised our fair value estimate to $153 per share from $116.

"We still cannot support the current share price within our discounted cash flow model," concludes Romanoff.

Dig Deeper: Zoom Again Blows Through Expectations

Wayfair Like Zoom, Wayfair W has also benefited from people working and learning from home--demand has been brisk for the online retailer's furniture and other home furnishings as people try to effectively do their jobs and schoolwork remotely. The stock is up a stunning 195% for the year as of this writing.

We raised our fair value estimate to $87 from $77 per share in response to the robust demand Wayfair has experienced this year, reports senior analyst Jaime Katz.

"We believe sales will continue to slow as parents are further settled in the work-from-home routine and children complete preparation for remote learning workspaces," she says. "Moreover, investor concern still lies with the company's ability to lap these rich growth metrics in 2021, although faster e-commerce adoption abroad could provide faster-than-expected market share growth for the international business."

Square Square SQ, known for providing payment services to merchants, has enjoyed strong results this year form its person-to-person payment network, Cash App.

"Cash App appears to be building significant momentum, which bodes well for its long-term prospects, given the winner-takes-all dynamics at play for payment platforms," shares senior analyst Brett Horn. Due in part to the strength of this side of the business, we raised our fair value estimate to $64 from $49 several weeks ago.

The merchant-acquiring side of the business has struggled during the pandemic--though management reports that volumes have steadily improved over the past few months, suggesting the worst may be behind the company.

"Still, we maintain our concern that the company's micro- and small-merchant customer base could ultimately fail in large numbers if the pandemic drags on," Horn adds.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)