Stocks With Low ESG Risk Look Undervalued

That’s a sharp contrast to 2022.

It’s a common belief in academia and elsewhere that stocks with the lowest environmental, social, and governance risk are doomed to lower returns, partly because they were driven higher by inflows in recent years and partly because investors accept lower returns to own them.

That’s not the case going into 2024—at least, if valuation is a predictor of performance.

Indeed, according to research by Adam Fleck, head of research at Morningstar Sustainalytics, the companies with the least ESG risk are undervalued. It’s “consistent with the broader market,” Fleck says. In fact, they’re also trading at comparable valuations to those stocks with the highest ESG risk.

It’s a marked shift from two years before, when the companies with the least ESG risk were expensive.

ESG Stocks Look Cheap

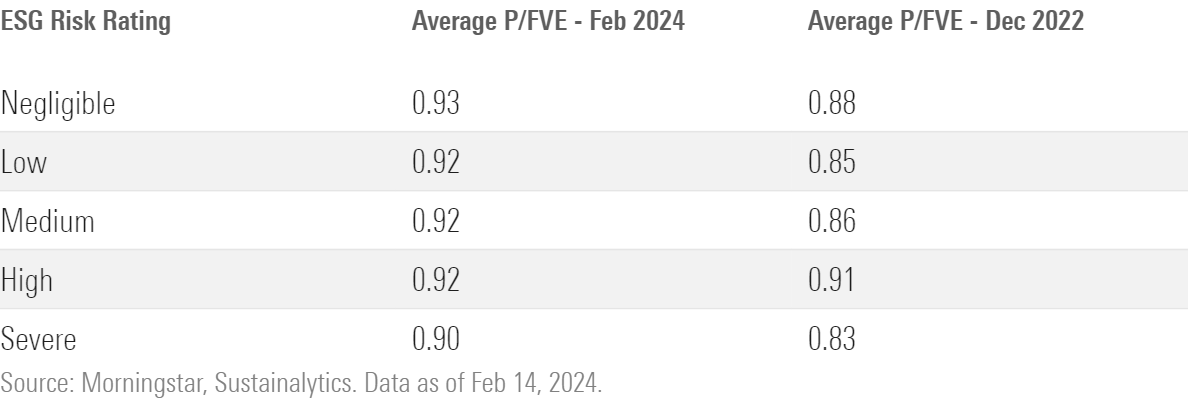

Fleck looked at roughly 1,600 companies covered by both equity research analysts and Sustainalytics. He found that the average price/fair value estimate ratios were relatively consistent across all five ESG Risk Ratings.

Low ESG Risk Is Looking Cheap

Fleck cautions that sample size is an issue in the research. Only 30 companies are rated as having Severe ESG Risk. If the extremely overvalued National Silicon Industry Group were excluded, then the Severe ESG Risk category’s average price/fair value falls to 0.80. National Silicon Industry Group carries a price/fair value estimate ratio of 3.64.

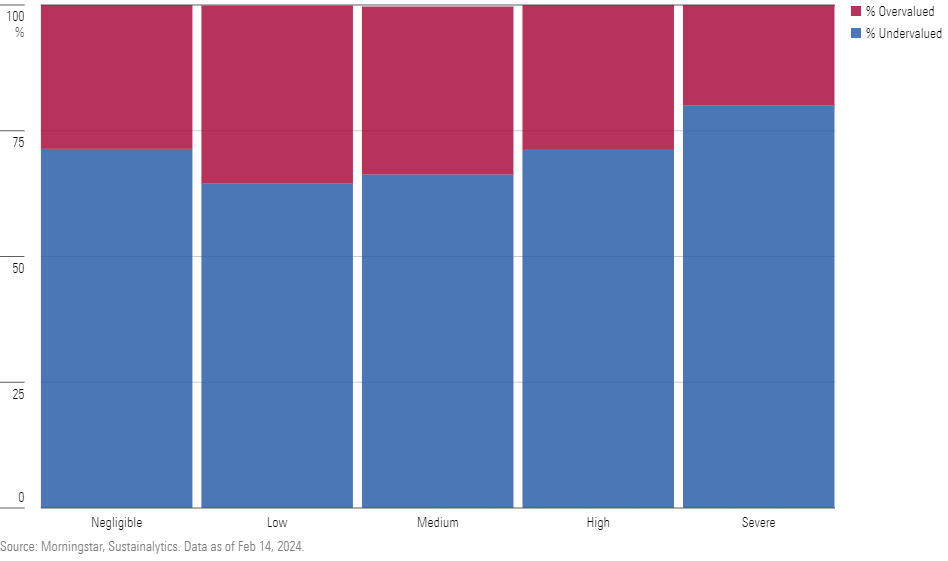

“There are plenty of undervalued stocks in every ESG Risk category,” Fleck adds.

Cheap Stocks in Every Category

Two years ago, stocks with the lowest ESG risk were expensive. Companies with Sustainalytics’ ESG Risk Ratings of Negligible and Low had average price/fair value estimates slightly above 1.00. The riskier ratings at the time were undervalued.

ESG Investors Refocus on ‘Financial Materiality’

Today’s valuations show that “the ESG discussion is evolving,” Fleck says. “Gone are the days in which investors flocked to the lowest carbon emitters and shunned oil & gas, with valuation a secondary consideration.”

Indeed, the more-balanced valuation outcomes suggest investors “may be settling into a focus on financial materiality when incorporating ESG risks. I think this is arguably a healthier place to center the sustainable-investing conversation,” he concludes.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)