With Charles Schwab Under Pressure, Is the Stock a Buy, a Sell, or Fairly Valued?

With one-time charges related to cost savings and interest-rate pressures, here’s what we think of Charles Schwab stock.

Charles Schwab SCHW took a dive in 2023 as a result of concerns about its capital, liquidity, and trajectory of net interest income, or NII.

The banking turmoil ignited by the collapse of Silicon Valley Bank in March focused the market’s attention on the buildup of unrealized losses on fixed-income securities and the related reduction in capital. The run on deposits at SVB also reminded investors of the liquidity risks of banking and the loss of confidence that banks experienced amid the global financial crisis.

Even if SVB hadn’t failed, Schwab and other depositary institutions would still be seeing a transition in their NII. Client cash sorting (moving cash from low-interest-yielding accounts to higher-yielding accounts and securities) is decreasing interest-earning asset balances, increasing funding costs, and pressuring NII. We believe all these uncertainties should be resolved for Schwab soon.

Key Morningstar Metrics for Charles Schwab

- Fair Value Estimate: $80.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

What We Thought of Charles Schwab’s Q2 Earnings

Schwab’s stock may be feeling some pressure from recently announced one-time charges related to its expected $500 million cost-savings initiative, as well as the 10-year Treasury rate. The company said it expects to incur $400 million to $500 million of costs over the remainder of 2023 and in 2024, related to reducing headcount and its real estate footprint as part of that plan. The expected savings are much more important and beneficial than the one-time charges, so this is a net positive for shareholders.

We believe the stock has declined in recent days partly from the overall pullback in the stock market and potentially from the higher 10-year Treasury rate. In the long run, a higher Treasury rate is positive for the company, as it will lead to higher NII from its bank. However, a high rate also leads to more unrealized losses on fixed-income securities portfolios at banks and Schwab due to interest rate risk.

- Schwab’s capital ratios significantly exceed current regulatory requirements. New requirements won’t be fully phased in until 2028, and the firm will have ample time to meet them. We estimate the company can increase common shareholders’ equity to over $50 billion by the end of 2025, which would about triple the current tangible common equity and adjusted common equity Tier 1 capital.

- Schwab’s liquid balance sheet assets and borrowing capacity, primarily from the Federal Home Loan Bank system and the Federal Reserve’s Bank Term Funding Program, total more than $300 billion and are more than enough to meet potential deposit outflows. Additionally, we calculate that each quarter, the company has from high-single-digit billions to as much as $20 billion of cash inflows that it can use to fund deposit outflows.

- Based on recent cash-sorting metrics and data from 2007, when the federal-funds rate was above 5%, we believe Schwab will soon be able to consistently pay down its high-cost supplemental funding. We estimate that quarterly NII could grow by between $100 million and $140 million for as long as eight successive quarters from the reduction of high-cost funding.

- We recently increased our fair value estimate for Schwab to $80 per share, which implies over 25% upside from recent trading levels.

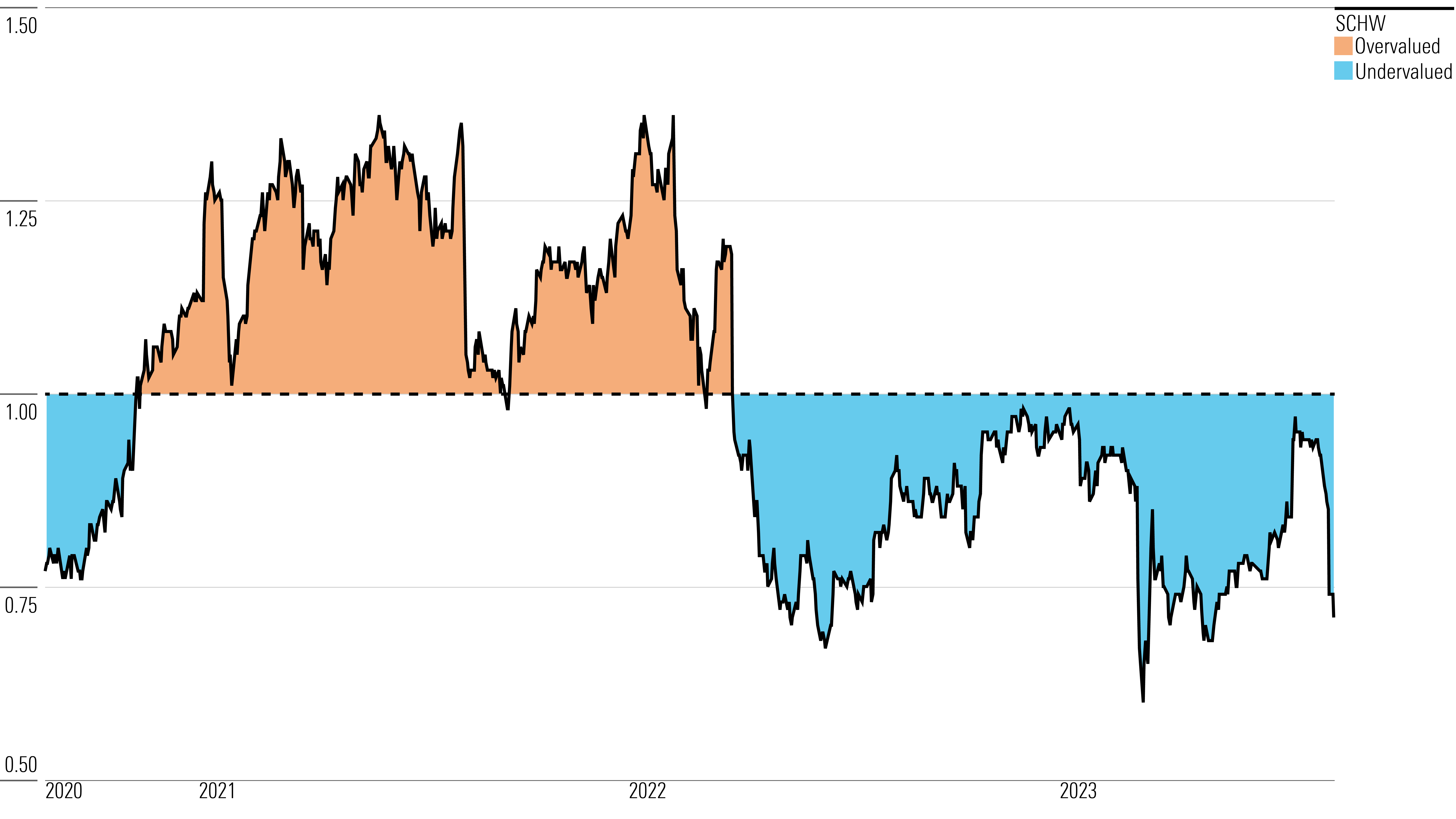

Charles Schwab Stock Price

Fair Value Estimate for Charles Schwab

With its 4-star rating, we believe Schwab’s stock is undervalued compared with our long-term fair value estimate. After incorporating our updated thoughts on cash sorting and making other adjustments to our model, we raised our fair value estimate to $80 per share from $70. This implies over 25% upside from recent trading levels to our fair value estimate.

Over the next five years, we forecast a 7% compound annual growth rate for net revenue and a compound annual growth rate of over 11.5% for adjusted earnings per share. Much of the benefit from paying down the high-cost supplemental funding shows up in 2024 net revenue and EPS. We forecast net revenue and EPS will be relatively flat in 2025 compared with 2024, though, as the Federal Reserve lowers interest rates and Schwab’s net interest margin contracts.

After net interest margins reset from our forecast of the federal-funds rate settling in around a normalized level of 2.5% in 2025, Schwab should experience a prolonged earnings tailwind thanks to increases in deposits and the company reinvesting the proceeds of maturing securities at higher rates.

Read more about Charles Schwab’s fair value estimate.

Charles Schwab Price/Fair Value Ratios

Economic Moat Rating

We assign Schwab a wide economic moat. Given its massive scale and industry-leading cost efficiency, we believe the company could endure severe competitive pressures and still earn above its cost of capital.

After the company’s commission pricing cut in 2019, we still forecast returns on capital in the low-to-mid teens, well above the company’s cost of capital, which we estimate in the high single digits. In the long run, we believe returns on invested capital could even exceed 20%. We also estimate that over 20% of client assets are in either a Schwab proprietary or a controlled product, which allows the company to extract more profits on client assets than other brokerages where their clients use primarily third-party products.

Retail brokerage moats are primarily built on cost advantages. These companies’ scalable infrastructure allows them to process additional trades at low costs, which produces high incremental operating margins. Many retail brokerages also have banking subsidiaries that rank well compared with traditional banks in terms of low funding costs, credit costs, and operating expenses. Their strong banking subsidiary profitability—recent operating margins have been around 70%—comes from not having to support a physical branch presence, brokerage clients that are less sensitive to interest rates than traditional banking customers, and catering to generally higher-net-worth clientele with collateralized lending products.

Read more about Charles Schwab’s moat rating.

Risk and Uncertainty

Major risks to Schwab include the future of interest rates, a decrease in deposits, and fee pressures.

Interest rates are the key driver of the company’s earnings over the next several years. Due to the staggered reinvestment of its portfolio, interest rates have to remain at a high level for the portfolio to fully reprice. In a recession with accommodative monetary policy, portions of the company’s investment portfolio could be stuck at a lower rate.

Even if such a recession is short-lived, long-term interest rates have been in a generally declining trend for years. Low long-term interest rates will affect Schwab’s reinvestment opportunities for much of its banking portfolio, while short-term interest rates, such as the federal-funds rate, will affect its floating-rate securities.

While we currently believe that nominal long-term interest rates will eventually track back to about 4.5%, structural changes in the economies of developed countries may have permanently set long-term interest rates lower, along with the profitability of Schwab’s banking business.

Asset-management revenue could also come under pressure, but it’s likely to be more from an asset mix shift to passive investment products from the company’s proprietary and Mutual Fund OneSource products, which have higher revenue yields.

Read more about Charles Schwab’s risk and uncertainty.

SCHW Bulls Say

- Schwab is solidifying its position as a leader in investment services and may be able to expand into other financial services.

- Merging with TD Ameritrade will come with material revenue and expense synergies that will be realized over the next couple of years.

- Schwab’s scalable and vertically integrated business model should enable it to convert an increasing percentage of revenue into earnings and be in the better parts of the value chain as the investment services industry evolves.

SCHW Bears Say

- A loss of deposits and higher funding costs are potential near-term negatives for the firm.

- While Schwab has the resources to adapt, financial technology innovation has increased in recent years and could disrupt parts of the investment services industry. Zero-dollar-commission business models and robo-advisors are recent trends that have challenged the status quo.

- A Europe- or Japan-like scenario of interest rates near 0% for an extended period would significantly reduce earnings and likely necessitate a change in business model. The Fed may have to lower interest rates if a recession occurs.

This article was compiled by Monit Khandwala.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BG4IFJHA25B6RKD3XNUYKROBBM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4QBQ2NBJMFG5HGQTDEYCXY5OOI.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)