We See Value in Defense, Construction and Industrial Distributors

Housing market has been a bright spot during the pandemic.

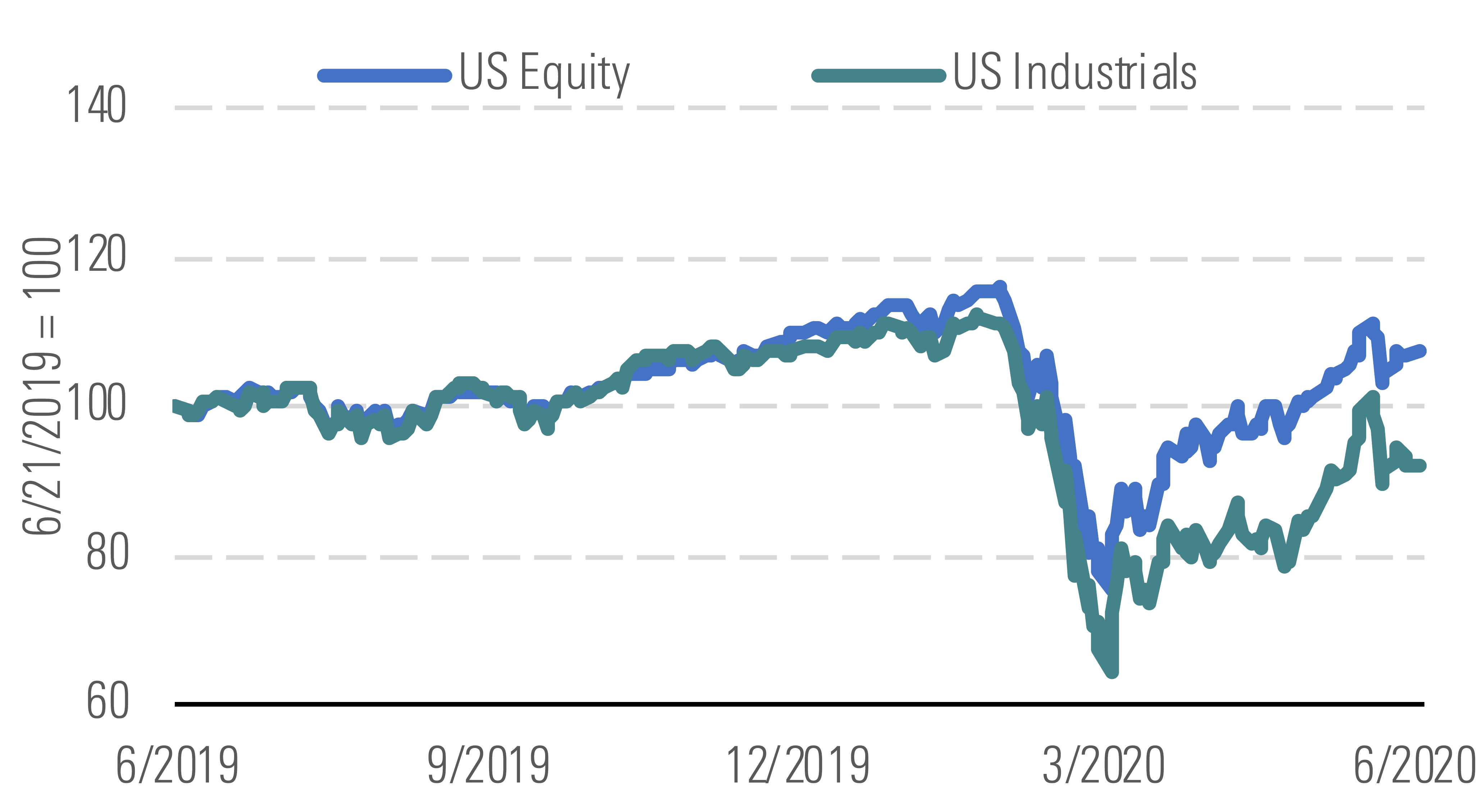

The Morningstar US Industrials Index has significantly underperformed the broader U.S. equity market over the trailing 12 months, falling 7.6% compared with the Morningstar US Market Index's 7.7% year-to-date gain. Most industries represented in the industrials index have underperformed year to date; however, aerospace and defense, construction and construction machinery, and airline stocks were hit particularly hard as investors worried about the coronavirus' long-term impact on air travel and the broader economy. However, as COVID-19 restrictions eased across the United States and signs of an economic recovery began to emerge, investor sentiment in the industrials sector greatly improved. The Morningstar US Industrials Index increased 18% quarter to date, trailing the broader U.S. equity market by 470 basis points.

Despite recent rally, industrials have underperformed year to date. - source: Morningstar

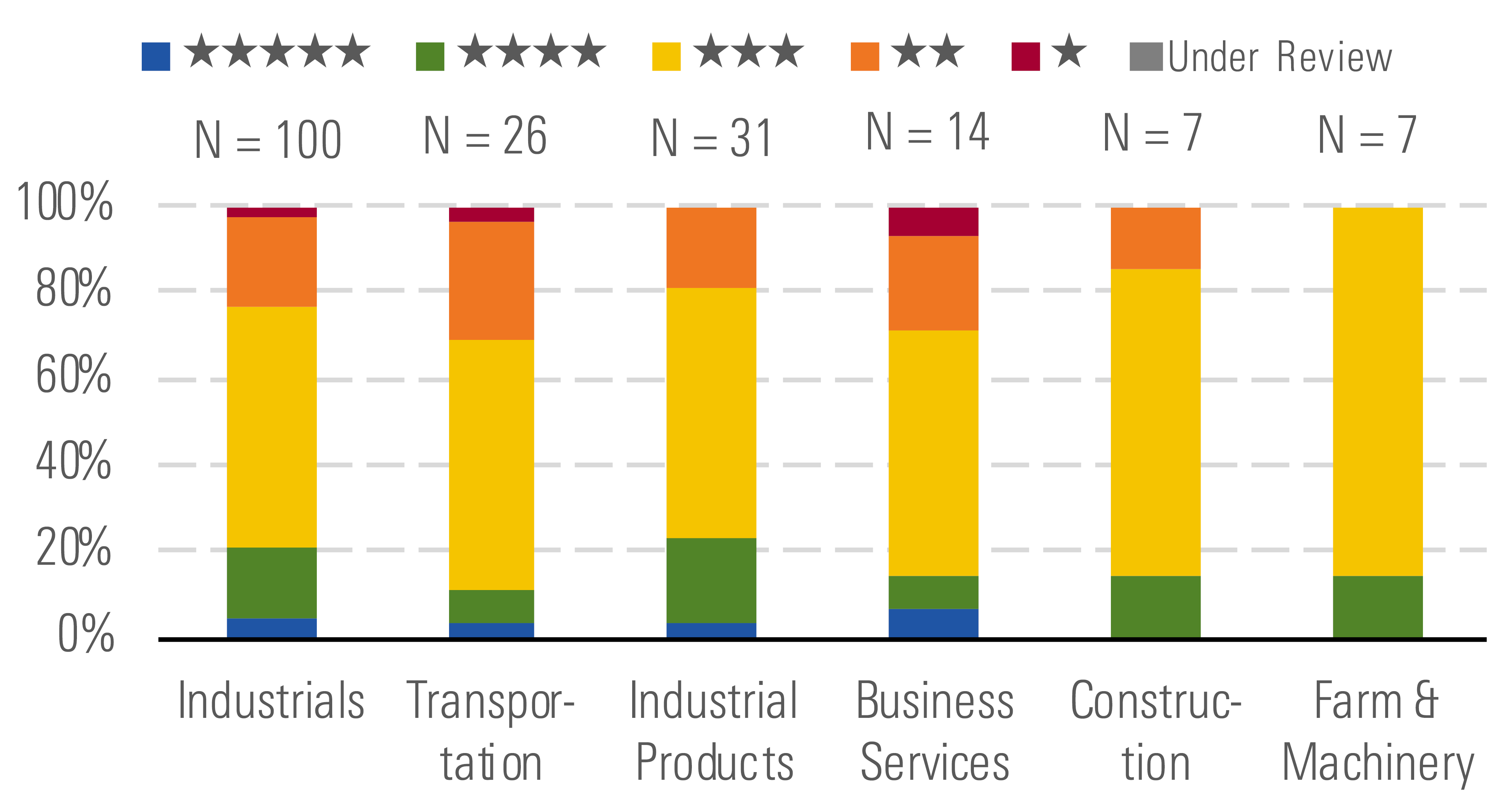

About 20% of our U.S. industrials coverage is 4 or 5 stars. - source: Morningstar

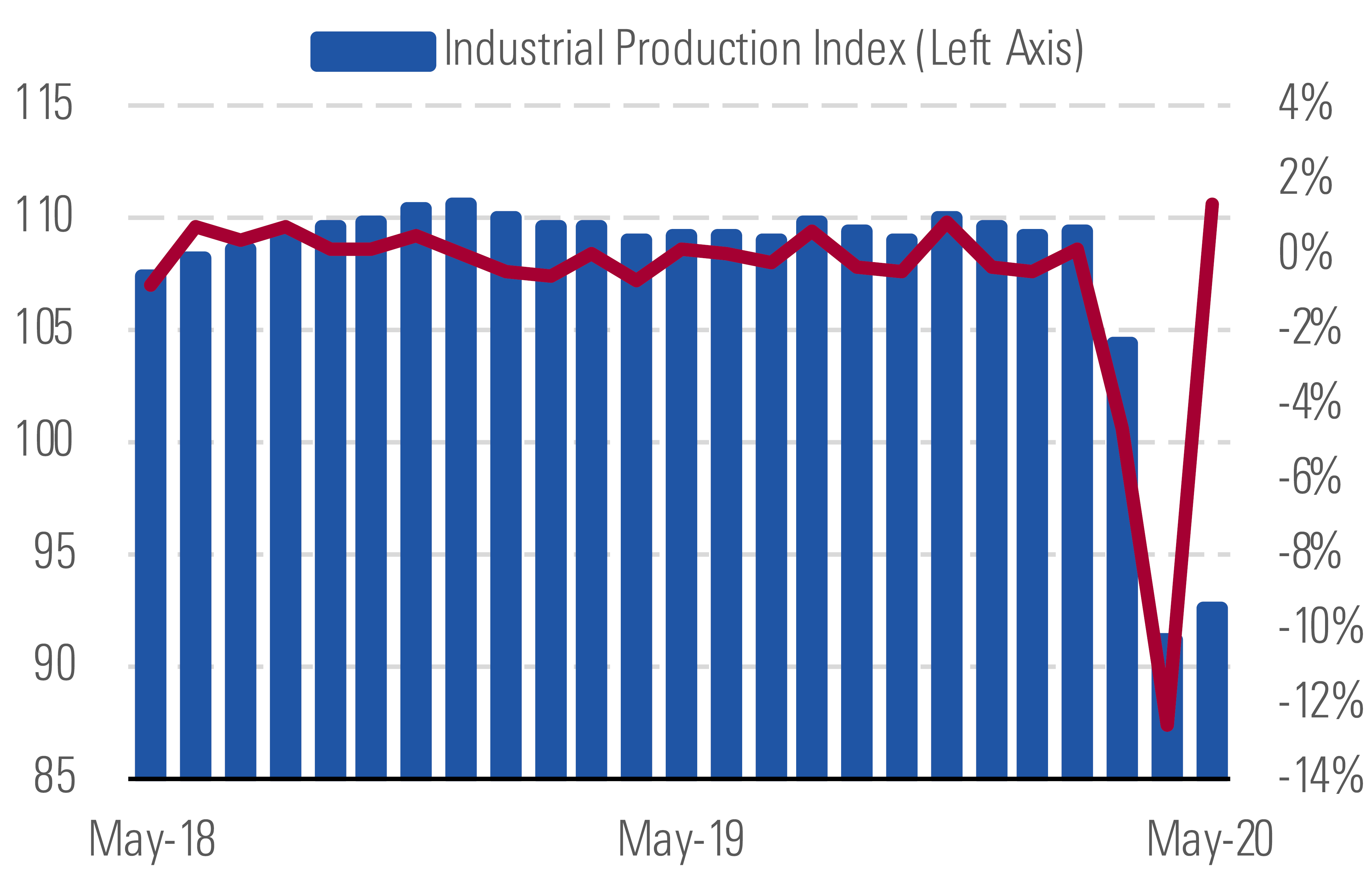

After a steep decline in April, industrial production modestly rebounded in May as the U.S. economy began to reopen. Manufacturing increased 3.8% month over month; automobile and aerospace and transportation manufacturing increased 120.8% and 8.1%, respectively. We expect industrial production will continue to rebound as the U.S. economy recovers, which will benefit manufacturing and industrial distribution companies. The housing market has been a bright spot during the pandemic, and some forward-looking indicators, such as purchase mortgage applications, point toward a V-shape housing recovery. In addition to a rebounding U.S. housing market, a potential infrastructure bill would be a boon for construction-oriented industrials companies.

After a steep decline in April, industrial production rebounded in May. - source: Morningstar

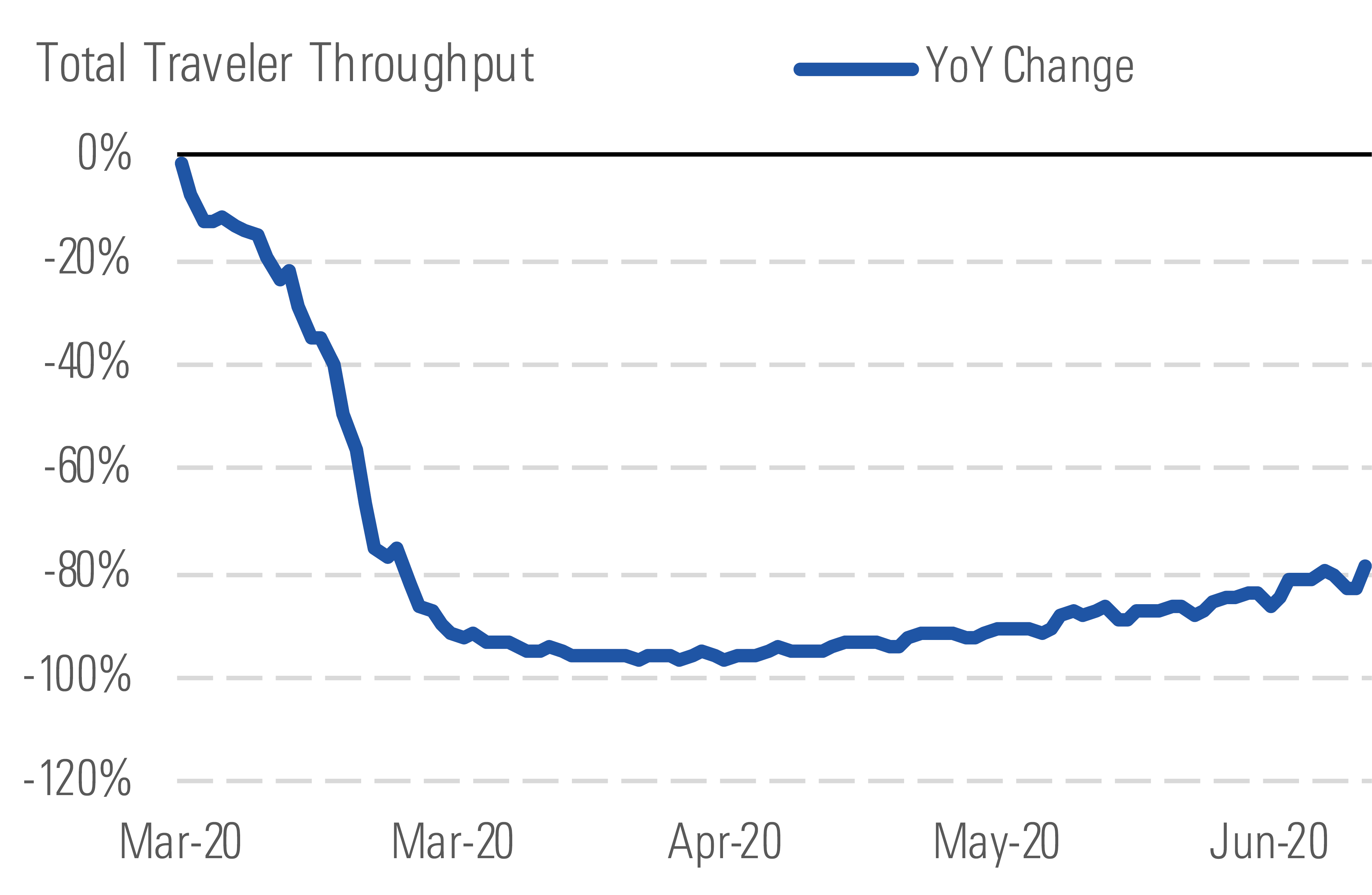

While U.S. air travel is still significantly below prior-year levels, demand has been increasing since mid-April as more Americans set aside coronavirus fears and return to the skies. If this trend continues like we expect, we see upside for many airline and aerospace and defense stocks.

More Americans are returning to the skies. - source: Morningstar

After strong quarter-to-date sector stock performance, only about 20% of our U.S. industrials coverage looks undervalued to us; last quarter, about 70% of our coverage had 4- or 5-star ratings. Still, we see attractive investment opportunities across the aerospace and defense, construction, and industrial distribution industries.

Top Picks

Crane CR Economic Moat Rating: Narrow Fair Value Estimate: $80 Fair Value Uncertainty: Medium

Crane, which owns a portfolio of moaty, leading-market-share businesses that manufacture highly engineered, mission-critical products, remains one of the most undervalued stocks in our industrials coverage. Market sentiment has rapidly turned negative on the narrow-moat company because of its exposure to both the aerospace and the oil and gas end markets. We acknowledge that the company faces multiple near-term headwinds; however, we think plenty of bad news is already priced in at current levels, and shares are trading at an attractive margin of safety for long-term investors.

Herc Holdings HRI Economic Moat Rating: None Fair Value Estimate: $49 Fair Value Uncertainty: Medium

Herc Holdings is the third-largest equipment rental company in North America, with 3% market share, trailing United Rentals and Sunbelt Rentals. COVID-19 affected many elements of Herc’s business in late March and April, and rental revenue declined as much as 25%. However, construction has continued in many geographies, and infrastructure development has proceeded largely without interruption and could increase significantly as a result of future stimulus packages advocated by President Donald Trump. These projects will require large amounts of equipment and, given the uncertainty, rentals may be favored over purchases.

Wesco International WCC Economic Moat Rating: Narrow Fair Value Estimate: $87 Fair Value Uncertainty: High

Wesco recently acquired Anixter International. At over $17 billion in sales, the combined entity will dwarf W.W. Grainger as the largest U.S.-based industrial distributor. Wesco's $200 million cost synergy target seems like an achievable goal, and we also see opportunities for revenue synergies (from cross-selling and enhanced pricing power) and improved capital efficiency as digitalization efforts promote a shorter cash conversion cycle. We think investor sentiment will become more favorable for Wesco as the market begins to realize the growth, earnings power, and free cash flow generation potential of the combined entity.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RNODFET5RVBMBKRZTQFUBVXUEU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)