Ultimate Stock-Pickers' Top 10 High-Conviction Picks and New-Money Buys

While overall activity for our managers decreased again, we did uncover a few ideas worth considering.

By Eric Compton | Stock Analyst

For the past eight years, our primary goal with the Ultimate Stock-Pickers concept has been to uncover investment ideas that not only reflect the most recent transactions of our grouping of top investment managers but are timely enough for investors to get some value from them. In cross-checking the most current valuation work and opinions of Morningstar's own cadre of stock analysts against the actions (or inactions) of some of the best equity managers in the business (see the full roster here), we hope to uncover a few good ideas each quarter that investors can dig into a bit deeper to see if they warrant a long-term commitment.

With close to three fourths of our Ultimate Stock-Pickers having reported their holdings for the third quarter of 2016, we have a sense of the stocks that piqued their interest during the period. While the story of the fourth quarter will be how well our top managers positioned their portfolios in the run-up to and aftermath of the election, the story of the third quarter was one where the markets were largely calm (relative to the disruption caused by the Brexit vote in late June). As such, it was no surprise to see the level of buying activity during the most recent period being more tepid than it has been in past periods. In fact, while the number of top managers making new-money purchases did increase slightly during the period, many of the positions that were initiated were small, with no single security seeing more than one fund making a conviction, new-money buy. And as has been the case during the first two quarters of the year, our top managers were net sellers during the most recent period.

For those that may not recall, when we look at the buying activity of our Ultimate Stock-Pickers, we focus on both high-conviction purchases and new-money buys. We think of high-conviction purchases as instances where managers have made meaningful additions to their portfolios, as defined by the size of the purchase in relation to the size of the portfolio. We define a new-money buy strictly as an instance where a manager purchases a stock that did not exist in the portfolio in the prior period. New-money buys may be done either with or without conviction, depending on the size of the purchase, and a conviction buy can be a new-money purchase if the holding is new to the portfolio.

We also recognize that the decision to purchase any of the securities we are highlighting in this article could have been made as early as the start of July, with the prices paid by our managers being much different from today's trading levels. As such, it is important for investors to assess the current attractiveness of any security mentioned here by checking it against some of the key valuation metrics—like the Morningstar Rating for Stocks and the price/fair value estimate ratio—that are generated regularly by our stock analysts' ongoing research efforts.

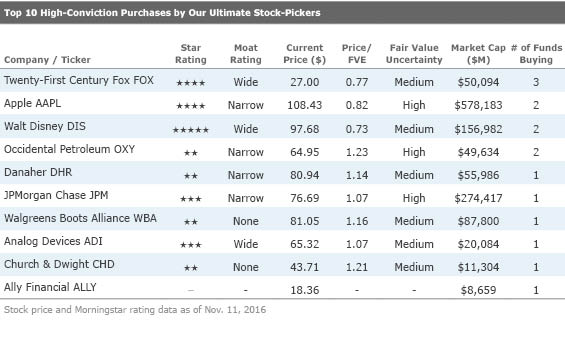

Looking more closely at the top 10 high-conviction purchases during the third quarter of 2016, the buying activity was again well spread out among different sectors. This time around there were two Financial Services names, two Technology names, and two names each from the Consumer Cyclical and Consumer Defensive sectors. Not too surprisingly, given the track record of our top managers, most of the buying activity during the period was focused on high-quality names with defendable economic moats—exemplified by the greater number of wide- and narrow-moat names in the list of top 10 high-conviction purchases.

Top 10 High-Conviction Purchases made by Our Ultimate Stock-Pickers

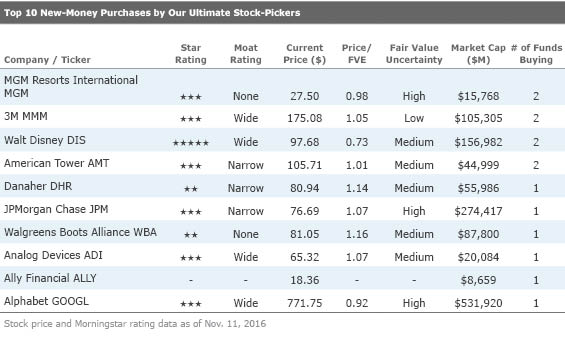

There was also a decent amount of crossover between our two top 10 lists this quarter, with six of the names—wide-moat rated

Top 10 New-Money Purchases made by Our Ultimate Stock-Pickers

On a separate note, there was a larger number of 2- and 3-star rated names on both lists, no doubt affected somewhat by the post-election rally in the markets. While there is always room for disagreement on the prospects of an individual firm, the fact that the overall buying activity of our top managers continued to decrease (with the group being net sellers once again) and valuations seem to be stretched signals to us that caution is warranted. Keeping this in mind, there were still a few names that caught our eye as being worthy of further consideration by investors.

Wide-moat rated Walt Disney was the only 5-star rated stock on our top 10 lists. We highlighted Disney last quarter, noting that

Disney shares have been in a slump since late 2015. Morningstar analyst Neil Macker believes this sell-off has only created an opportunity for investors and continues to view shares of Disney as undervalued. Critics have consistently underestimated Disney's ability to fully monetize key assets in ways no other competitor can and often with a vision that most only see after the fact. The Pixar acquisition, which many felt was overpriced, turned into a financial and strategic home run. The acquisition of the Marvel franchise has also fared well, and the latest success of the Star Wars franchise, another acquired asset, has proven yet again the power of Disney's brand and varied platforms, which include movies, home video, merchandise, theme parks, and even musicals. In addition to its Disney-branded businesses, the firm also owns powerful media networks, including ESPN and ABC. ESPN is unrivaled in sports television, both in content and profitability, and the channel is a must have for television bundles.

With so much going for Disney, it can be hard to see what could go wrong, but there are threats emerging. One major change taking place in the media environment is the switch from cable and traditional distribution networks to over-the-top distribution, where content is offered over the Internet, outside of the formal distribution channels. While this could be problematic in theory, Macker argues that it will be the content owners who still win in the long run. From this viewpoint, Disney is still immensely valuable because of all of the historical content it owns and all of the future content it is likely to produce. While many firms, such as Netflix and Amazon, are producing their own original content, Macker believes Disney's portfolio will still be profitable and quite enviable for years to come.

Competition has also been heating up in the sports network arena, with new entrants and pressure on the traditional cable business suggesting the best times may be over. However, Macker argues that ESPN still has the most attractive portfolio of sports rights, and its history of being able to consistently increase fees should allow the channel to retain its position as the dominant sports network. These fee increases should also help cushion any losses of subscribers in the future.

Disney recently reported fiscal fourth-quarter results, and while some may view them as disappointing given the firm's 10% decline in its EBITDA, Macker points to fiscal 2018 and beyond, where there should be a very strong slate of films including four Marvel films, three animated movies, and two Star Wars films. ESPN should also benefit from the proliferation of new over-the-top pay TV providers such as DirecTV Now. Macker sees average top-line growth of roughly 5% through 2020, with operating margins improving 80 basis points to 24.8% by 2020. Shares currently trade at a 27% discount to Macker's fair value estimate of $134, with the company expected to buy back $7 billion-$8 billion of stock in the near term.

Apple had a great [third] quarter, as its stock rose 18.3% to $113.05 from $95.60 and boosted the Fund's return by 58 basis points. The stock moved higher as signs indicated that the recent iPhone 7 launch would beat investor expectations. We continue to admire Apple's competitive position, ability to innovate, and vibrant ecosystem, so we've held onto the stock even as it's moved higher.

Colello also likes Apple's competitive positioning, awarding the firm a narrow economic moat, with a positive moat trend. Colello notes that there are minimal switching costs associated with smartphones, as all of these devices can perform most necessary functions—such as placing calls, sending texts, browsing the web, running apps, and so on—but believes that Apple has done a much better job at trying to develop switching costs than many of its peers. He believes that Apple's switching cost advantages arise from its iOS operating system, and appear to be increasing thanks to iCloud and other native services. While many complain that innovation has declined since Tim Cook took over as CEO, Colello believes the firm is still innovating, with the introductions of Apple Pay, Apple Watch, and Apple TV standing out. He also notes that Apple recently held a product launch event that featured substantial upgrades to its Macbook Pro lineup as well as a new TV viewing guide app for the Apple TV box and iOS devices. Colello believes the Mac and TV demonstrations showed that Apple continues to move the ball forward on the integration of hardware and software, with innovation at the company being far from dead. More importantly, Colello sees the firm maintaining the loyalty of its massive iPhone user base.

Apple reported fiscal fourth-quarter results last month. The biggest near-term issue Colello saw in the period was the supply constraints around the higher-priced iPhone 7 Plus, which will weigh on gross margins in the near term (and likely contributed to the fall in Apple's stock price post earnings). While the company's current revenue forecast is not indicative of tremendous iPhone unit or revenue growth, Colello's long-term valuation for Apple hinges on a steady iPhone business with repeat device sales made to loyal customers, buffeted by the switching cost advantage provided by the iOS ecosystem. In this context, Apple's results gave Colello confidence that his thesis remains intact.

Twenty-First Century Fox had the greatest number of funds buying with conviction during the most recent period, as

We think Fox is significantly undervalued, in part because of underappreciated businesses like Star, which provides nearly 25% of television content in India, equity affiliates that include Fox's 39% ownership of Sky, and non-controlling ownership stakes in Hulu and Endemol Shine. In total, we think Star, Sky, and the other affiliate stakes could represent more than $10 per share of value while contributing only modestly to earnings. After adjusting for our appraisal of these underappreciated assets, we think the core of Fox trades for only 8-9 times earnings.

Morningstar analyst Neil Macker believes Twenty-First Century Fox enjoys strong competitive advantages based on its worldwide cable networks and its film and television studios. Just as the ever increasing importance of quality content will benefit Disney in the future, Macker sees it benefitting Fox, which owns robust film franchises and a strong television production studio (producing such prime-time hits as Modern Family, the X-Men movie series, and more). In addition to this, the firm also own Fox News and broadcasting rights for the NFL, college football, and MLB as well as the international cable assets Yacktman highlighted. Macker believes that the combination of an established and growing broadcast network and the ownership of valuable content assets give Fox a wide moat.

That said, investors should keep in mind that Fox is heavily dependent on advertising revenue for its network profitability, and the operating leverage of building out and maintaining these networks remains high. While content will continue to be valuable, Fox is also exposed to some of the viewing preference shifts that are taking place, which affect the networks more than pure play content providers. Helping to counteract some of this is Fox's exposure to still expanding emerging and developing markets, like Asia. With the stock trading at a 23% discount to his fair value estimate of $35 per share, Macker believes there is a decent enough margin of safety for investors to consider the name.

Among the more fairly valued names that showed up on our top 10 lists this time around, Danaher, Walgreens, and JP Morgan saw some of the highest conviction buying activity, but in each case, it was a single manager making the purchase. For Danaher, the managers at

A new position was established in Danaher, a provider of professional, medical, industrial, and commercial products and services, typically characterized by strong brand names, innovative technology, and market-leading positions. The company continuously drives revenue and cost improvements utilizing Kaizen business practices and should benefit from accretion from the recently completed acquisition of Pall Corp. The company became more focused on the faster growing healthcare market following the spin-off of Fortive, businesses that were more exposed to industrial end markets. Celgene was increased as we believe the stock was attractively valued, and we expect solid earnings growth.

Danaher follows a unique business model for a public company. It is essentially a conglomerate that grows through significant M&A, overhauls the acquired assets using Danaher's management system, and counts on the superiority of that system so that Danaher creates more value from the acquired assets than the previous owners did, all while not overpaying. As one might guess, this strategy relies heavily on the capital allocation and managerial acumen of upper management. Morningstar analyst Michael Waterhouse believes that Danaher has some unique benefits and that a focus on innovation within more niche areas has helped lead to sticky relationships and strong brand reputation. While Danaher competes in many different business lines, after its latest spin-off the firm is more concentrated in healthcare—being a major player in life science, diagnostic, and dental markets. The Kaizen business practices mentioned by Montag & Caldwell refer to a business model developed originally in Japan that focuses on continual improvement. A bet on Danaher is largely a bet on its management and its ability to make wise M&A moves and to better manage the assets it does own as well as those it acquires in the future. Waterhouse believes the shares are slightly overvalued right now and that investors may do better to wait for more attractive prices.

Disclosure: Eric Compton has no ownership interests in any of the securities mentioned above. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BG4IFJHA25B6RKD3XNUYKROBBM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4QBQ2NBJMFG5HGQTDEYCXY5OOI.jpg)