Ultimate Stock-Pickers: Top 10 Buys and Sells

The downturn in the global equity markets provided our top managers with the opportunity to add to existing holdings and make new-money purchases.

By Greggory Warren, CFA | Senior Stock Analyst

As we noted in our last article, our primary goal with the Ultimate Stock-Pickers concept is to uncover investment ideas that not only reflect the most recent transactions of some of the top investment managers in the business, but are timely enough for investors to get some value from them. Based on that early read of the buying and selling activity of our top managers during the third quarter, we noted that the ongoing trend of high-conviction purchases of firms with economic moats trading at reasonable prices, as well as the trend of selling off portions of holdings that had met or exceeded estimates of intrinsic value, had continued during the period. Now that we have all of the holdings of our top managers under wraps, we can add more color to our initial findings.

For starters, we can reiterate the fact that most of the conviction buying that took place during the third quarter (and early part of the fourth quarter) was focused on high-quality names with defendable economic moats--exemplified by a greater number of wide- and narrow-moat names in our list of top 10 (and top 25) high-conviction purchases during the period. And not surprisingly, we can also note that four of the high-conviction purchases we highlighted in our

--wide-moat rated

this time around. We should, however, also highlight the main difference between the two lists of high-conviction purchases--that is, the first list (published in our last article) is just an early read on individual high-conviction and new-money purchases (with at best some 85% of our Ultimate Stock-Pickers having posted their holdings for the most recent period), whereas the focus of this article is on the aggregate data of all of the buying activity of our top managers (which includes not only high-conviction and new-money purchase but all other buying activity during the most recent period).

As for the top 10 stock sales we saw this time around, there continued to be a fair amount of outright selling, although most of it (along with the trimming of positions that took place during the period) seemed to be focused on positions that have reached a fair value benchmark for our Ultimate Stock-Pickers or were the targets of acquisitors. Even with all of this buying and selling activity, as well as the changes that were made to the Investment Manager Roster during the first quarter of 2015, our top managers were underweight in Energy, Utilities, Communication Services, Healthcare, and Real Estate relative to the weightings of those sectors in the S&P 500 at the end of September. They also held overweight positions in the Financial Services, Consumer Defensive, Technology, and Basic Materials sectors (with their exposure to Consumer Cyclicals and Industrials being more or less in line with the benchmark index).

- source: Morningstar Analysts

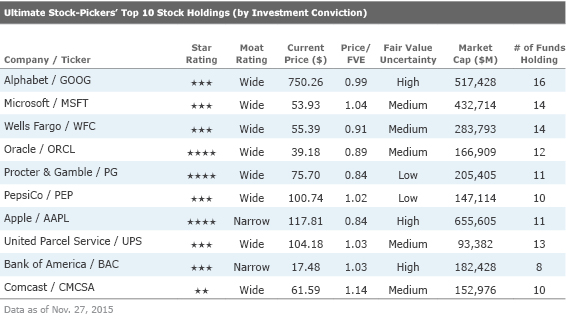

Our Ultimate Stock-Pickers' buying and selling activity during the most recent period also affected the list of top 10 holdings of our top managers, with wide-moat rated

more than five and a half years ago. Between common stock holdings and warrants to purchase shares, Berkowitz's stake in AIG eventually consumed about half of his total portfolio before he started dramatically selling off holdings this year. AIG now accounts for less than 20% of Berkowitz's common stock holdings.

- source: Morningstar Analysts

As we noted above, four of the top 10 stock purchases this time around--Oracle, Intel, American Express and Halliburton--were also represented on our list of top 10 high-conviction purchases in

, which highlighted stock purchases above a certain threshold based on an early read of the data we were receiving from our Ultimate Stock-Pickers. Six of the top 10 stock purchases this time around--wide-moat rated Intel,

Bruce Berkowitz at Fairholme was actually a big contributor to the new-money purchases, initiating stakes in Citigroup, IBM, and Canadian Natural Resources during the period, so we thought we'd focus on those three names this time around (having already committed time to Intel and American Express in past articles). Citigroup is not a new holding for Berkowitz, who established sizable stakes in the bank in the fourth quarter of 2009 and first quarter of 2010, before selling it off dramatically in the fourth quarter of 2011 (and eliminating what little stake he had in the name by the end of the first quarter of 2015). His purchase of more than 3 million shares makes it a top 10 holding in a portfolio that has traditionally had fewer than 25 stock holdings. While there was little input from the other managers that were also buying Citigroup, Morningstar analyst Jim Sinegal considers the name to be a top pick in the Financial Services sector, trading at 80% of his $68 per share fair value estimate. Sinegal notes that the bank has been hit hard by fears over its emerging market exposures, with the company's shares dropping 9% in August and another 7% in September in tandem with the decline in global equity markets. While the stock has rebounded some since the end of the third quarter, with the shares currently trading at end of August levels, Sinegal feels that there is more room for Citigroup to run.

Although he'll be the first to admit that there are reasons to be wary of the bank, he believes that the firm's progress toward improving its financial health, risk management processes, and operating profitability has been underappreciated by investors. The new Citigroup is awash in capital and its global presence truly differentiates it from nearly all of its peers. With a large portion of revenue coming from Latin America and Asia, Sinegal notes that the bank is poised to ride the growth of these economies through the coming decade. At the same time, he highlights the fact that Citigroup is not merely a domestic lender, remaining a bank of choice for many global corporations thanks to its ability to provide a variety of services across borders. Developing economies should offer an attractive combination of high margins and rapid credit growth over time, in comparison with the low rates and declining leverage that Sinegal expects to persist in the U.S. and other Western economies for the next few years. That said, investors should be prepared for the volatile results that tend to come out of emerging economies, which will have an impact on stock performance (much as it has this year).

IBM is a name that has also crept onto our list of top purchases in the past, with Warren Buffett at Berkshire Hathaway being the most prolific and high-profile purchaser of the shares. Berkshire added to its 79.6-million-share stake in the technology giant this past quarter, picking up another 1.5 million shares. It is now Berkshire's fourth-largest holding (at 9% of total equity holdings), with the insurer holding 8% of IBM's common shares outstanding. While Berkowitz has not gone in that heavily with his stake, picking up 750,000 shares during the third quarter, it was still a meaningful purchase for his portfolio. Morningstar analyst Peter Wahlstrom continues to see value in the shares, currently trading at 80% of his $174 per share fair value estimate. He notes that IBM holds a defendable position across its three key segments: enterprise software, IT services, and hardware. While the firm has experienced its share of challenges over the decades, Wahlstrom highlights the fact that underlying profitability has steadily improved via cost reductions and a shift toward software and higher-value services.

IBM is also navigating the secular trend toward distributed open-standard computing by adding partnerships (like

As for Canadian Natural Resources, the narrow-moat firm is currently trading at a 20% premium to our $20 per share fair value estimate. Morningstar analyst Stephen Simko notes that Canadian Natural Resources is one of Canada’s largest exploration and production firms, with oil and gas production in Canada, the North Sea, and Africa. The firm holds a dominant land position in western Canada, where it is Alberta's largest producer of primary heavy oil and a pioneer of polymer flooding. By using its size to achieve economies of scale in its core operating regions, Canadian Natural Resources has become a low-cost producer in natural gas and polymer floods and is an average- to slightly below-average-cost producer in heavy oil. As a result, it can acquire competitors' properties and improve the economics of the properties. Simko considers the firm's nearly 100% ownership of most of its assets to be an advantage, as it allows the company to choose optimal projects based on market conditions.

Canadian Natural Resources has traditionally generated above-average netbacks relative to its peers--a trend that he believes will continue as the firm's heavy oil production gains ever increasing access to the Gulf Coast market. Despite all of its successes, though, Simko notes that the company cannot fend off the current oil price environment, which is expected to reduce its ROIC to single digits over our near-term forecast period (which is the main reason it has a no-moat rating). That said, he also notes that Canadian Natural Resources has had a history of quickly adapting to changing market conditions and allocating capital accordingly, and believes that this has been the case over the past year or so. Higher oil and gas prices and/or higher realized production volumes could provide upside to his current valuation, while meaningfully lower prices would have a negative impact. Because of the potential commodity price volatility, Simko considers Canadian Natural Resources to have a high degree of economic uncertainty, requiring a much wider margin of safety for new investors.

- source: Morningstar Analysts

As for the top sales, there continued to be a fair amount of outright selling, with most of this activity (along with the trimming of positions that took place during the period) focused on positions that had reached a fair value benchmark for our Ultimate Stock-Pickers or were the targets of acquirers, which was the case with narrow-moat rated

The second new addition to the Fund is Intel, the well-known maker of semiconductors. We bought Intel in July after it had dropped 20% on a year-to-date basis. This weakness resulted in an attractive price-to-earnings (PE) multiple of 13x and a generous 3.3% dividend yield. While Intel is best known for chips designed for personal computers, we’re more interested in its data center group (DCG) business, which now represents over 50% of earnings. The proliferation of data-hungry applications offered by Google, Facebook, Uber, Alibaba and others has placed unprecedented demands on data centers. Intel’s DCG chips enable data centers to satisfy these demands in a fast and energy-efficient manner. Over the long-term, we expect Intel’s DCG earnings growth to more than offset any softness related to its mature PC business. While we were buying Intel, we were selling one of its competitors, Qualcomm. This latter stock was a long-term investment that didn’t live up to our expectations, despite the company’s enviable competitive position and strong secular tailwinds. We sold Qualcomm because we think the company’s best days are probably behind them. So far, the Intel-for-Qualcomm swap has been a good move, as Intel is up modestly from our average cost, and Qualcomm has gone down since we sold it.

On a relative basis, Qualcomm (trading at 70% of our $68 per share fair value estimate) looks to be a better bargain right now than Intel (trading at a 10% premium to our $31 per share fair value estimate). Morningstar analyst Brian Colello lends some support to Parnassus' claim, noting that after strong revenue growth earlier this decade, Qualcomm's revenue may have peaked in the near term with $26.5 billion earned in fiscal 2014. He notes that lost chip business with Samsung and a failure to adequately collect royalties in China have caused revenue to fall 5% in fiscal 2015 (and will likely decline another 10% in fiscal 2016). That said, he's not entirely convinced that the company's best days are behind it. Qualcomm is a significant innovator of CDMA network technology, the backbone of all 3G networks. As more 3G-capable smartphones hit the market and carriers expand their 3G networks, Colello expects Qualcomm to be poised for solid licensing revenue growth. While the firm doesn't have the same dominant IP portfolio in 4G technologies like LTE, it has generated more than enough essential patents to enable it to strike new deals with many large handset makers at fairly similar royalty rates. He also expects that for at least the next decade, the overwhelming majority of 4G handsets will be backward-compatible with 3G technologies, enabling Qualcomm to collect higher 3G royalty rates.

While recent investigations by the Chinese and South Korean governments could serve to put a meaningful dent in this licensing business, Colello expects Qualcomm’s licensing business to withstand these and any other government investigations going forward. As he noted earlier this month, South Korea’s Fair Trade Commission released a report with recommendations and remedies that should be imposed on Qualcomm’s licensing practices. In essence, the report recommended that Qualcomm’s royalties within South Korea (and large customers like Samsung and LG) should be based on the price of the baseband chip (roughly $10 or so today) that connects the phone to 3G and 4G networks, rather than on the price of the phone (which averaged $186 for fiscal 2015). While the recommendation was concerning for Colello, who sees it as the greatest sign yet that Qualcomm’s wide moat licensing business could be disrupted by litigation and regulators at the behest of large OEMs (with Samsung believed to make up about 20% of South Korea’s total GDP, which likely provided it with hefty influence into the investigation), he remains in the camp that Qualcomm’s IP pertains to all areas of the phone and to wireless network transmissions, rather than just to IP tied to the chip. He also highlights a silver lining to be found in Qualcomm’s 2015 settlement with the Chinese government, where royalties on this sort of IP was still ruled to be based on the price of the phone, not the chip. That said Colello does note that his fair value uncertainty rating for Qualcomm is high, requiring a much wider margin of safety for new investors.

If you're interested in receiving e-mail alerts about upcoming articles from The Ultimate Stock-Pickers Team, please sign up here.

Disclosure: Greggory Warren has no ownership interests in any of the securities mentioned above. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4QBQ2NBJMFG5HGQTDEYCXY5OOI.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2RGHQJTF4ZEURNSAGBY7CSHCUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EAAEIIRVVNE7HNVXBSGTD3WPSI.jpg)