Top 10 Holdings of Our Ultimate Stock-Pickers' Index

Relatively weak performance from the healthcare sector has created opportunities for long-term investors to consider.

By Joshua Aguilar | Associate Stock Analyst

Every fund investor would like to see the manager of the actively managed funds that they own beat the market every year, but they've been left wanting for well over a decade. The lack of consistent outperformance on the part of large-cap active managers (which are the main contributors to the Ultimate Stock-Pickers concept) has been well documented by S&P Dow Jones indices in its mid-year and year-end S&P Indices Versus Active Funds (SPIVA) U.S. Scorecard. As of the end of June, the index group noted that an astounding 91.9% of active large-cap fund managers had on average underperformed the S&P 500 TR Index during the previous five years. While the results were similar for large-cap core managers (with just 7.8% outperforming the index), large cap-growth managers had an awful time of it (with just 2.6% outperforming the S&P 500 Growth Index) during the same time frame. Large-cap value managers fared somewhat better, though, with 11.2% on average outperforming the S&P 500 Value Index during the five years ending on June 30, 2016.

With the markets being more volatile during the first two quarters of 2016 and the S&P 500 TR Index seeing only a 4.0% gain during the 12 months ending on June 30, 2016, one would have expected large-cap active equity managers to post better relative results on a year-over-year basis. Unfortunately, the results for all large-cap funds were around 325 basis points lower than the index, with the negative year-over-year performance of large-cap growth funds dragging down what were already weaker results from large-cap core and large-cap value funds. That said, the rally in U.S. equities since the November election has improved the relative performance of large-cap active equity managers, with Morningstar's own all large-cap (11.0%), large-cap core (12.9%), large-cap growth (2.3%), and large-cap value (18.6%) categories posting returns that compare more favorably with the S&P 500 TR Index (12.2%).

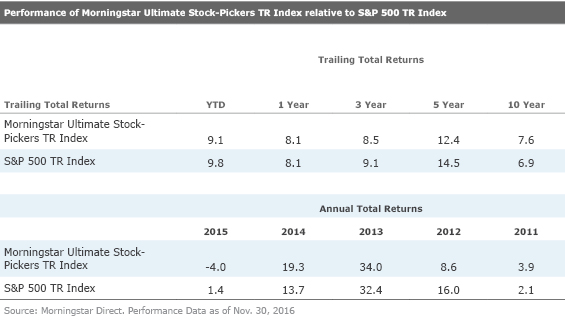

The fund managers represented in our Ultimate Stock-Pickers concept have had their own issues with relative long-term performance, with their three- and five-year performance levels being the biggest detractors. While we had 10 of our 22 top fund managers beating the S&P 500 on a 10-year basis at the end of last week, just three and six managers, respectively, were beating the benchmark on a three- and five-year basis. There is room for encouragement, though, as 11 of our fund managers were beating the S&P 500 on a year-to-date basis at the end of last week, with 10 of those same managers beating it over the prior year, which should lift overall performance as we move forward. We continue to believe that truly successful managers should be able to consistently generate excess returns across multiple periods, while recognizing that different markets can make it easier or tougher for individual managers to outperform. That said, we stand by our belief that a manager's ability to outperform the market over multiple periods is the best way to differentiate luck from skill.

As a reminder, the Ultimate Stock-Pickers concept was devised as a stock-picking screen, not as a guide for finding fund managers to add to an investment portfolio. Our primary goal has been to identify a sufficiently broad collection of stock-pickers who have shown an ability to beat the markets over multiple periods (with an emphasis on longer-term periods). We then cross-reference these top managers' top holdings, purchases, and sales against the recommendations of our own stock analysts on a regular basis, allowing us to uncover securities that investors might want to investigate further. There will always be limitations to our process, as we focus only on managers that our fund analysts cover, and on companies that our stock analysts cover, which serves to reduce the universe of potential ideas that we can ultimately address in any given period. This is also the main reason why we focus so much attention on large-cap fund managers, as they tend to be covered more broadly on the fund side of our operations and their stock holdings overlap more heavily with our active stock coverage universe.

That said, by limiting themselves to the largest and most widely followed companies in the investment world, our top managers may miss out on some smaller ideas that have the potential to generate greater levels of outperformance in the long run. A rising, and at times more volatile, U.S. equity market in the aftermath of the 2008-09 financial crisis has also posed problems for our top managers, while historically low interest rates, as well as the constant drum beat of flows into index funds and index-based ETFs, have tended to lift all boats, making it harder to discern the true winners and losers in the marketplace. The rally in the markets since the U.S. elections has left the markets trading slightly above our own analysts' fair value estimates, with our Market Fair Value ratio at 102% at the end of last week. Market valuations as measured by conventional metrics also suggest that the market is currently overvalued.

Of interest to us is the value of the Cyclically Adjusted Price-to-Earnings (CAPE) Ratio, developed by Robert Shiller, which divides the current market price by the average of 10 years of earnings (adjusted for inflation). The ratio currently stands at around 27.9, compared with a historical mean of 16.7 and median of 16.1, with Shiller relying on market data from both estimated (1881-1956) and actual (1957 onward) earnings reports from companies represented in the S&P 500 Index. Historical values have ranged from a low of 4.88 before the bull market run of the 1920s and 44.2 at the end of the dot-com bubble in late 1999. The CAPE Ratio is generally used to assess potential future returns from equities over longer time frames, with higher-than-average CAPE values implying lower-than-average long-term annual returns going forward, which is what we're gleaning from the current ratio. While not intended to be an indicator of impending market crashes, it has provided warnings signs for investors in the past.

If one believes that true active managers should outperform in periods when the index underperforms, we should be in for a period where our top managers start to put some distance between their returns and those of the market. Aside from tracking the holdings, purchases, and sales as well as the ongoing investment performance of our Ultimate Stock-Pickers, we also follow the makeup and results of the Morningstar Ultimate Stock-Pickers TR Index. For those who may not recall, the Ultimate Stock-Pickers index was set up more than a handful of years ago to track the highest conviction holdings of

, a list that includes our 22 top fund managers as well as the investment managers of four insurance companies—

The index itself is composed of three sub-portfolios—each one containing 20 securities—that are reconstituted quarterly on a staggered schedule. As such, one third of the index is reset every month, with the 20 securities with the highest conviction scores making up each sub-portfolio when they are reconstituted. This means that the overall index can hold anywhere between 20 and 60 stocks at any given time. In reality, the index is usually composed of 35 to 45 securities, holding 36 stocks in all at the end of November. These stocks should represent some of the best investment opportunities that have been identified by our Ultimate Stock-Pickers in any given period. It can also have more concentrated positions than one might find in a typical mutual fund, with top 10 (25) holdings in the index accounting for 47.8% (89.7%) of the total invested portfolio at the end of last month. The size and concentration of the portfolio does change, though, as this is an actively managed index that tries to tap into the movements and conviction levels of our top managers over time.

Looking at the top 10 stock holdings of the Morningstar Ultimate Stock-Pickers index at the end of November, there are currently a handful of names trading at a deep enough discount to our analysts' fair value estimates to offer investors a decent enough margin of safety should they decided to invest. Wide-moat rated

Acquisitions like this have also provided the company with a significant presence in the primary care markets of women's health, gastrointestinal, urology, and central nervous system therapeutics, which should drive sustainable earnings growth for the foreseeable future. As for what has led to a nearly 40% decline in the company's stock price over the past year, Waterhouse notes that the specialty pharmaceuticals industry has been (and continues to be) turbulent due to several industrywide headwinds—increasing customer buying power, more generic competition from a decline in the FDA backlog, fewer large patented drugs coming off patent, and rumors of collusion charges for some generic firms. In addition, the industry has faced many company-specific self-inflicted wounds such as Valeant's Philidor debacle, criticism of Mylan's EpiPen price hikes, and Perrigo's botched integration of Omega. Add to that a president-elect who has spooked investors with his comments about bringing down drug prices. While Allergan has benefited from having $15 billion available this past year to spend on share repurchases (funded by the company's sale of its generics segment to Teva at the end of 2015), much of the buying has already been locked in (primarily through an accelerated share repurchase program). With the shares trading at depressed prices, Waterhouse expects the firm to continue to buy back shares (albeit at more normalized levels) going forward. He does note, though, that the firm has initiated a quarterly cash dividend of $0.70 per share, with the first payment starting in the first quarter of 2017.

Wide-moat rated

Offsetting some of the negative news generated by solanezumab has been a more positive outlook for the firm's diabetes drug Jardiance, which received approval from the FDA to expand the drug's label to include a reduction of cardiovascular death, differentiating it from other oral diabetes drugs on the market. Conover was impressed by the drug's ability to achieve a 38% reduction in cardiovascular death rates and notes that the benefits for participants started shortly after treatment began. Jardiance's strong efficacy, combined with a clean side effect profile and a very low rate of ketoacidosis is another big positive, in Conover's view. This suggests to him that the drug should be moved to either front-line treatment or following the administration of standard of care medication. Conover believes that the Jardiance label change could not only strengthen Lilly's overall competitive position but lead to peak sales of more than $5 billion, adding to the company's earnings power and growth prospects.

Looking at the year-over-year performance of the Morningstar Ultimate Stock-Pickers index from Dec. 1, 2015, to Nov. 30, 2016, the top 10 contributors to that outperformance included two healthcare names, as well—narrow-moat rated

The election of Donald Trump, combined with Republican majorities in Congress, has created a greater level of uncertainty for Healthcare stocks. A repeal of the Affordable Care Act (ACA), which seems to be a top priority for the Republicans, is more likely, in Damien's view, to end up being more of a modification than a complete repeal of the law as several groups key to their majority have benefited from the legislation. If the ACA were to be repealed, though, the outcome would likely mean a lower demand for healthcare combined with less industry fees and profit restrictions. Conover notes that the passage of the ACA was largely a compromise for industry stakeholders, which mandated increased insurance coverage in return for lower costs. Reversing this mandate would largely be a net neutral to the Healthcare sector, with the drug, biotech, and insurance industries slightly benefiting, hospitals and drug supply chain firms negatively impacted, and the remaining industries less affected. The drug industry, in Conover's view, would likely lose some volume gains, as the close to 20 million newly insured patients from the ACA will likely lose some insurance coverage and spend less, but the mandated costs of ACA would likely more than offset the lost revenue.

As for Aetna, which offers traditional and consumer-directed health insurance products and related services, the company's shares were already trading well above our analyst's $82 per share fair value estimate prior to the election before running up another 15% afterward. At more than 150% of our fair value estimate, Aetna is a long way away from offering a margin of safety for long-term investors. While a Trump administration and a Republican-controlled Congress are more likely to ease regulatory constraints, this will do little to alter what has been a narrowing of the firm's profitable growth markets. Morningstar analyst Vishnu Lekraj believes that Aetna has the scale and other material competitive advantages to produce outsized economic profits over an extended period but sees most of this already built into the stock price. He thinks that the firm paid a rich premium for Humana (with the deal having the potential to be moderately detrimental to shareholder value) but does note that Aetna may have been forced to act, given that at least one of its rivals also made a play for Humana. Lekraj also thinks that another overhaul of the U.S. healthcare market will only add to the uncertainty that has hung over this part of the market.

Given the weaker relative performance that we've seen from the healthcare sector this past year, it is not too surprising to see seven names from the sector—wide-moat Allergan,

Disclosure: Joshua Aguilar has ownership interests in Walt Disney Co and Berkshire Hathaway. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RNODFET5RVBMBKRZTQFUBVXUEU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)