These 3 Network Security Stocks Get a Moat Upgrade

We think their excess returns on invested capital will endure, thanks in part to switching costs.

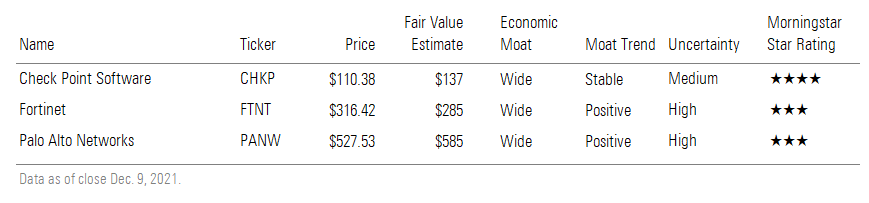

We have upgraded our economic moat ratings for Check Point Software Technologies CHKP, Fortinet FTNT, and Palo Alto Networks PANW to wide from narrow. For our moat trend ratings, we maintained Palo Alto at positive, adjusted Fortinet to positive from stable, and kept Check Point at stable. The moat rating upgrades drove fair value estimate increases as well: to $137 per share from $132 for Check Point, to $285 per share from $250 for Fortinet, and to $585 per share from $550 for Palo Alto.

These three network security companies have established prolific customer switching costs and network effects, helping drive solid records of excess economic returns on invested capital that we expect to endure.

- Customer switching costs come from the security solutions, which are essential for operations. We believe widespread digital transformation initiatives during the pandemic put a spotlight directly on the importance of proper security. We expect the threat landscape to intensify as organizations deal with protecting a mixture of data, applications, and users across various locations. Combine these durable factors with a rising number of standards around cybersecurity protection measures, punitive fines for data miscues, and the massive costs of business disruption caused by successful cyberattacks, and we believe the leading cybersecurity vendors have a robust long-term demand environment.

- Network effects come from the collection and analysis of nascent threat anomalies driving continuous security product upgrades. Organizations want the latest threat preventions, driving a virtuous cycle of security technology upgrades and customer adds.

Cybersecurity is not a winner-take-all market, but we do believe that certain subsegments will have a few dominant players. To us, this means that vendors can establish moats in various subsegments of the $130 billion cybersecurity market, and certain segments like network security (which includes firewall and demands about 20%-25% of security product budgets) can have multiple companies with wide moats. We believe that the network security market will continue consolidating around Check Point, Fortinet, and Palo Alto and that these companies will continue expanding outside their core solutions to gain further spending.

Changing security vendors today is more challenging than it was a decade ago because of the integration of features covering various security aspects, in our view. These three leading cybersecurity companies have built out security platforms containing their core firewall security products plus tangential solutions. The buying pattern of cybersecurity has shifted away from point-based security solutions, which has led to security toolset sprawl within organizations, and toward fewer key vendors that cover particular pieces of security. Based on various industry reports, we estimate enterprises maintain 60-80 different security solutions but want to condense that to 15-20 key vendors. We think Check Point, Fortinet, and Palo Alto have leading platforms that will keep customers locked into their ecosystem for the long haul.

The positive moat trend ratings for Fortinet and Palo Alto come from those companies’ larger, stickier deals being landed with strongly growing customer bases--and those deals can include various products per deal. These companies are also gaining momentum in areas outside their core network security offerings, such as cloud security, automating security responses, and software-defined networking. We believe the two positive-trend companies are making customers more reliant upon their solutions and further locking clients into their ecosystems.

With regard to Check Point’s stable trend, we believe the company has a large, loyal customer base that relies upon its sticky products, but its conservative approach to investing in development and sales and marketing efforts has caused leading competitors to make inroads into the broader security landscape. Nonetheless, we believe these three network security vendors will remain leaders and are essential to daily operations for organizations.

/s3.amazonaws.com/arc-authors/morningstar/d1ac50a8-f491-405e-b965-33941cb88799.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZSPP5AYAJB2RIRVFE2XR23GUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NYUEHSFI4BDCJPQZJ76HH4PKSM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d1ac50a8-f491-405e-b965-33941cb88799.jpg)