Technology: Opportunities Pepper Most Subsectors

We expect U.S.-China trade talks to lead to greater end product demand down the road.

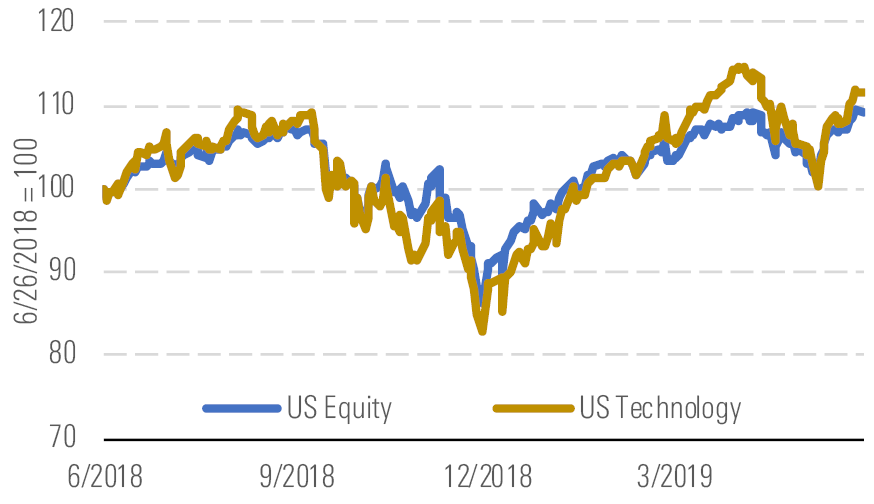

The Morningstar U.S. Technology Index is up 23% year to date through June 25, making it the top-performing sector. U.S. and China trade tensions remain a source of volatility, most notably with the U.S. ban on selling into Huawei, a significant smartphone and network equipment maker. We continue to believe that a highly interwoven tech supply chain will still be quite difficult for the U.S. and China to unwind. In turn, our valuations imply an eventual deal (and resumption of sales into Huawei).

Despite a strong 1Q, Tech had a volatile 2Q - source: Morningstar Analysts

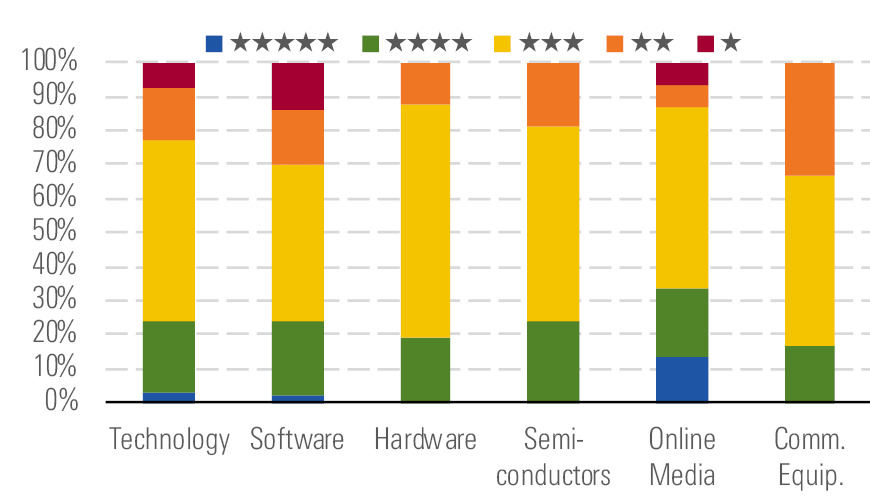

The median technology stock is roughly 4% below our fair value estimate, similar to the 2% premium at the end of the first quarter. We still think semiconductors are the most undervalued subsector within technology. Yet each tech subsector is undervalued to varying degrees. (Exhibit 2).

Semiconductors is the most attractive subsector of tech - source: Morningstar Analysts

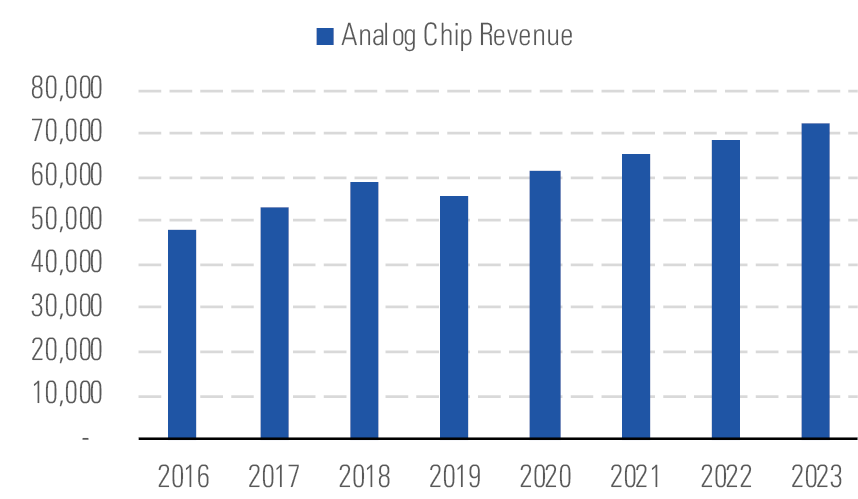

The near-term picture in semis remains relatively weak after a couple of years of tremendous growth. Stock prices have been volatile in recent months, swinging based on optimism or pessimism around U.S.-China trade tensions. Semis stocks sold off in the fourth quarter, recovered a bit in the first with optimism around a trade settlement and the March quarter being a "bottom" for the industry, but fell again in the second quarter with renewed tariff concerns. Ultimately, we still anticipate the U.S and China reaching some sort of a trade truce that will result in greater end product demand and, in turn, the sensors, processors, and connectivity chips needed in virtually every type of electronics device. Analog semis are, in our opinion, the best gauge of broad-based chip demand, and we still anticipate a rebound in the long term (Exhibit 3).

We see no signs of automotive chip revenue slowing down - source: Morningstar Analysts

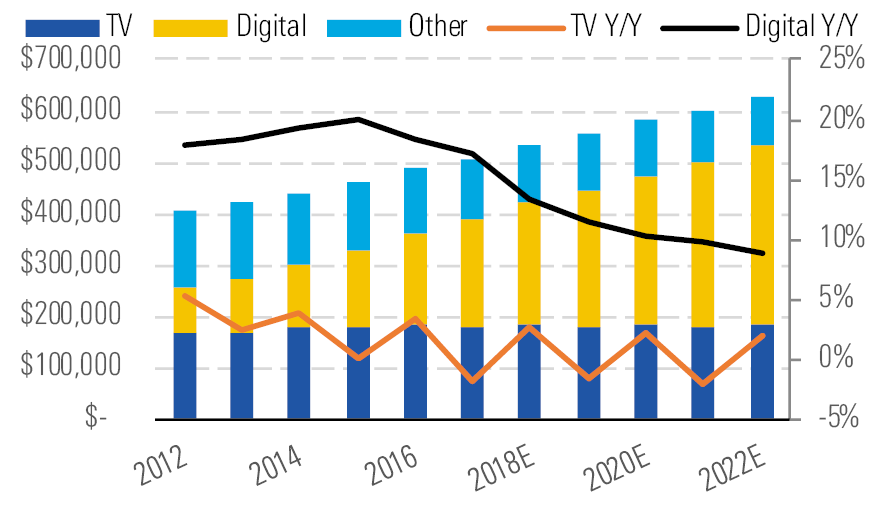

Online media stocks are also cheap. In the U.S., bellwethers like Alphabet and Facebook face data privacy and government anti-trust concerns. Yet we think these online leaders will withstand such challenges, and we still foresee tremendous growth in global digital advertising in the years ahead, outpacing growth in TV and other media vehicles (Exhibit 4).

Digital advertising growth continues to outpace traditional - source: Morningstar Analysts

Top Picks Intel INTC

Star Rating: 4 Stars

Economic Moat: Wide

Fair Value Estimate: $65

Fair Value Uncertainty: Medium

Wide-moat Intel trades at an attractive discount to our fair value estimate of $65 per share. The chip titan's comprehensive product portfolio tailored to computers from the data center to the edge gives us confidence in the firm's long-term growth prospects, despite a declining PC market. We applaud Intel's scattershot approach to address challenges in computing (artificial intelligence and cloud), connectivity (5G), and memory (3D NAND and 3D XPoint). Its acquisitions (Altera, Mobileye, Nervana, and Movidius) have unlocked new growth vectors for Intel to tackle while augmenting the capabilities of its old guard in client computing and data center.

Microchip Technology MCHP

Star Rating: 4 Stars

Economic Moat: Wide

Fair Value Estimate: $112

Fair Value Uncertainty: Medium

Wide-moat Microchip Technology is one of the highest-quality firms in our semiconductor coverage. Microchip remains a leading supplier of the "brains" needed for a variety of smart devices categorized as the “Internet of Things.” We find Microchip under the hood (figuratively and often literally) of the latest cars with the most advanced electronics, and think it is poised to profit from rising chip content per vehicle. We're confident in Microchip's wide moat rating, thanks to high customer switching costs associated with electronics redesigns, intangible assets associated with the firm's proprietary chip designs, and decades of expertise and reliability.

Palo Alto Networks PANW

Star Rating: 4 Stars

Economic Moat: Narrow

Fair Value Estimate: $305

Fair Value Uncertainty: High

Narrow-moat Palo Alto Networks became the firewall market leader in 2018, and we expect its growth rate to outpace peers as it expands its portfolio in high-growth areas for cloud-based cybersecurity, analytics, and automation. Complexities associated with managing a multitude of products from various software and hardware vendors and a dearth of cybersecurity talent leads our view that firms and government entities are clamoring for consolidated security platforms. We believe that Palo Alto's security platform is at the leading edge and will remain in demand as customers prefer to add on to a Palo Alto subscription than manage another vendor.

/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_d0e8253d77de4af9ae68caf7e502e1bf_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)