Solar Growth Plans on Track for Utilities

A pause on potential solar tariffs keeps the outlook bright.

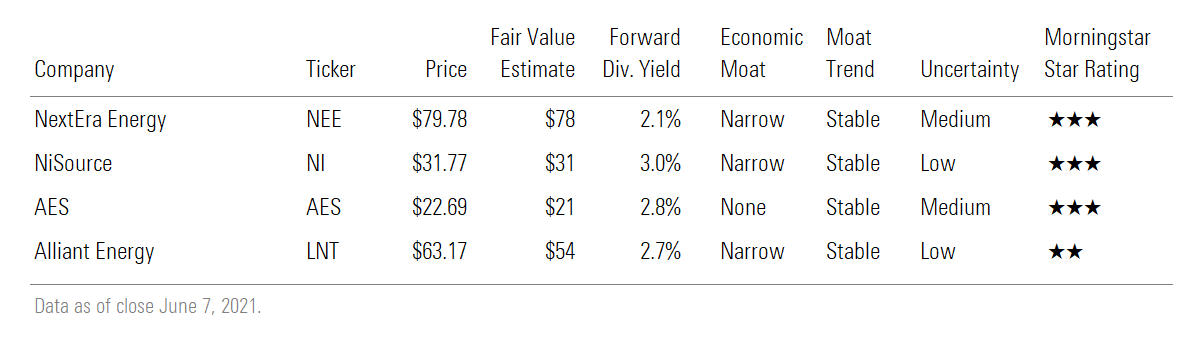

We are reaffirming our fair value estimates, economic moat ratings, and moat trend ratings for the utilities we cover after the Biden administration announced it would not impose solar panel tariffs on East Asian countries for at least the next two years. Some utilities’ management teams had suggested that potential tariffs resulting from a U.S. Department of Commerce anticircumvention investigation would slow their growth plans. We never thought the investigation would have a material impact on our long-term outlooks, though, given the administration’s and most states’ support for renewable energy. The Biden administration also announced plans to boost U.S. solar panel manufacturing, which will support solar growth.

Two of our top picks, NextEra Energy NEE and NiSource NI, were among those utilities whose stocks took the hardest hit because of the solar tariff fears. The management teams of both companies said they were postponing a portion of their large solar growth plans because of tariff-related supply concerns. AES AES and Alliant Energy LNT are among many other utilities that have made solar a key part of their growth plans.

NextEra’s stock fell as much as 16% in the three weeks after management said that it might delay as much as 2.8 gigawatts of a possible 15 GW solar project pipeline. It has since rebounded to near our $78 fair value estimate. We are reaffirming our 8% annual earnings growth outlook. NiSource’s stock fell 11% in late April even before management said $500 million of its planned solar investments could be delayed. It has since rebounded to near our $31 fair value estimate. We continue to assume that NiSource will invest $8 billion over 2022-24, including $2 billion in renewable energy, supporting our 7% annual earnings growth outlook.

Solar panel tariffs remain a risk pending the outcome of the Commerce Department’s investigation into whether Chinese manufacturers sidestepped tariffs by shipping panels through tariff-free Asian countries. We expect an initial Commerce report this fall.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

/s3.amazonaws.com/arc-authors/morningstar/689ab3b8-4029-4d7c-9975-43e4305e927a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5SLJLNMQRACFMJWTEWY5NEI4Y.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ea0fcfae-4dcd-4aff-b606-7b0799c93519.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/689ab3b8-4029-4d7c-9975-43e4305e927a.jpg)