Refreshing Our Beverage Coverage

Two brewers get another look.

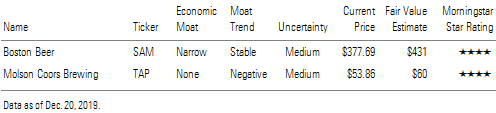

We recently took another look at Boston Beer SAM and Molson Coors TAP, which resulted in a large fair value estimate increase for one and a moat downgrade for the other.

We see Boston Beer as a stellar operator at the high end of malt beverages, despite meaningful competitive intensity. We’ve maintained our narrow economic moat rating, although our competitive outlook has both puts and takes. However, we’ve raised our fair value estimate to $431 per share from $244, primarily because of a reduction in our systematic risk rating and consequent discount rate to align with our global beverage coverage, as well as more robust top-line expectations. In our view, there is an adequate margin of safety in the shares at their current price, and we would advise investors looking for alcoholic beverage exposure to take a sip.

We believe Boston Beer’s moat is predicated on intangible assets and a cost advantage. The latter may seem like a misnomer, given the subscale nature of the company’s operations relative to the multinational brewers. However, we believe the company's superior unit economics versus the thousands of craft breweries operating in the United States--which not only position themselves in the market exactly as Boston Beer does (as a craft brand) but also are much closer competitors in terms of consumers’ purchasing decision at the shelf (we don’t believe the typical craft consumer is choosing between Sam Adams and Bud Light)--constitutes a scale-based advantage that allows Boston Beer to generate more rents than most of its competitors. Still, with price being less of a consideration for craft consumers, we view cost advantage, and thus the ability to compete on price, as a secondary moat source.

We expect mid- to high-single-digit top-line growth in the out years of our explicit forecast, underpinned by Boston Beer’s stalwart position in secularly advantaged categories like hard seltzer. We also model meaningful operating margin expansion (above 16% in 2023 versus less than 12% in 2018), driven by volume leverage and a reduced reliance on third-party breweries.

Hard seltzer has been increasing its volume by multiple factors over the past four years. In our view, continued growth in this category is not only achievable but likely, as it is underpinned by consumers’ move toward low-calorie and low-sugar items, which we don’t expect to change. With hard seltzer expected to double yet again in 2020, which would be the fifth consecutive year of triple-digit growth, we anticipate that Boston Beer’s steady leadership puts it in a good position to maintain its growth trajectory. Boston Beer’s Truly and rival White Claw have consistently maintained 80% market share essentially since the category’s inception.

In our opinion, Molson Coors is disproportionately situated in secularly disadvantaged beer segments as the alcoholic beverage industry has fragmented. Consequently, we have downgraded our economic moat rating to none from narrow and believe that any vestiges of moatworthy traits will continue to erode. We have cut our fair value estimate to $60 per share from $66 to reflect the valuation implications of our moat downgrade as well as slightly less rosy margin assumptions, offset by a reduction in our systematic risk rating and consequent discount rate to align with our global beverage coverage.

There are remnants of moatworthy traits in Molson Coors' operations, specifically a meaningful volume and production footprint as well as a broad distribution apparatus. These are typically bastions of competitive advantages in consumer goods. Nevertheless, we believe the company’s scale resides in beer segments with structurally higher bars for garnering moats, given the commoditized nature of the drinks. A paucity of resonant higher-end trademarks, as well as Molson Coors’ reliance on less economical license agreements, supports our view that the company’s situation will worsen.

Our fair value estimate is underpinned by fairly anemic performance on the top and bottom lines. Volume erosion should drive near-term revenue declines, and the attendant adverse effects on operating leverage should constrain margins in the medium term. Still, as management plows more resources into its above-premium portfolio, we think the top line can grow by low single digits longer term, leading operating margins to expand from 12.8% in 2018 to 13.3% in 2023.

/s3.amazonaws.com/arc-authors/morningstar/ea4f99a5-80a8-462c-a385-10ed87a00b28.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RNODFET5RVBMBKRZTQFUBVXUEU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ea4f99a5-80a8-462c-a385-10ed87a00b28.jpg)