Refiners' Good Times Keep Rolling

But we think this is already priced into the shares.

Independent refiners have outpaced the rest of the sector since last fall, when hurricane activity disrupted operations sufficiently to reduce inventories, inflating margins while creating bottlenecks that widened crude spreads. Despite normalization of operations, the strong margins and wide crude spreads have persisted, creating a very favorable environment for refiners. Although elevated gasoline inventories present a risk, distillate inventories are near five-year lows, while demand for both is strong and the economy is healthy, suggesting total margin strength will continue. Meanwhile, pipeline constraints don’t appear likely to be alleviated until late 2019, likely extending wide crude spreads for another year. At that point, the impact of IMO 2020 is likely to begin, which could ultimately extend the favorable market conditions another couple of years until the global refining system adjusts. In short, the outlook is good. While we see valuations as largely reflective of this outlook, cash returns to shareholders are likely to be strong as well, offering a reason to hang on.

Gasoline Margin Weakness Could Spoil the Party Since last fall, refining margins have been strong, reaching their highest levels since 2015. However, the strength has largely been concentrated in distillate margins, as gasoline margins have fallen below 2017 levels. While we previously expressed concerns about gasoline demand, given rising prices, it has performed relatively well, falling just 0.2% through August compared with the same period in 2017 despite a 12% increase in prices. In fact, weekly demand reached record levels in late August even as gasoline retail prices were about 15% higher than the same week a year before.

Although already at their lowest in four years, gasoline margins remain at risk, however. Thanks to strength in distillate margins and wide crude spreads, refiners’ total margin has remained attractive, encouraging high utilization rates; combined with capacity increases, this has resulted in record levels of production. While gasoline exports have grown, this has been insufficient to overcome the higher production volumes, leading to record inventory levels in absolute levels, while days of supply have risen to the top of the five-year average range. Last year at this time, disruptions following the landfall of Hurricane Harvey led to a correction in inventories and a rebound in gasoline margins. Other than another storm, however, it’s unclear what could reduce inventories and bolster margins. Despite demand having held up relatively well, the strong economy has failed to translate into materially higher demand, given the price headwinds and structural changes in demand patterns. As such, it’s unlikely that continued economic strength in 2019 will bring a boost in demand growth to alleviate inventories, unless a decline in prices stimulates demand growth, as it did in 2015 and 2016. In the meantime, distillate margins are likely to remain healthy, encouraging refiners to run at high utilization levels at the same time that gasoline demand experiences seasonal weakness, which could result in an acceleration of inventory builds and weakening of gasoline margins beyond typical seasonality until the summer driving season kicks off in 2019.

Distillate Margins and Crude Spreads Look to Pick Up the Slack The potential for weakening gasoline margins leaves the onus for margin support on distillate margins and crude spreads, both of which retain their favorable outlook. Like gasoline, distillate production is at an all-time high; however, strong domestic demand combined with a strong export market has left inventories sitting at the low end of the five-year average range in both absolute and days-of-supply terms. Although we've observed continued falling intensity, strong GDP growth of nearly 3% this year has driven distillate demand growth of 1.6% year to date, putting full-year demand on track to be the highest in five years. Meanwhile, distillate exports continue to set records. The tight inventory picture has margins sitting at multiyear highs and portends future margin strength.

In addition to strong distillate margins, refiners have benefited from wide crude spreads. As a result of pipeline unavailability out of Canada and the Permian Basin, differentials have widened over the past year. While we expect U.S. refiners, particularly those in the midcontinent, to continue reaping the rewards of wide spreads, the situation remains temporary. In the Permian Basin, we expect sufficient pipeline capacity to be on line by the end of 2019, which should result in spreads narrowing to a few dollars from the $7.50/barrel average year to date. The situation in Canada will take a bit longer, but by 2020 we estimate sufficient pipeline capacity will be available, which should narrow our long-term estimate to $17/bbl West Texas Intermediate from $24/bbl over the past year.

IMO 2020 Could Be the Guest That Keeps the Party Going IMO 2020 could be the catalyst that keeps margins strong for a few more years, extending the cycle beyond what might otherwise be expected. However, this particular tailwind is largely priced into shares, resulting in greater downside risk if these favorable conditions do not come to fruition.

The implementation of the International Marine Organization’s new sulfur emissions standards in 2020 could prove to be a boon for U.S. refiners. Consensus holds that most vessels will switch to marine gas oil, a middle distillate, from high-sulfur fuel oil to meet the new requirements, given the high up-front cost of installing scrubbers to continue using HSFO or switching to liquefied natural gas. This decision could result in upward of a 3 million barrel a day swing in demand from HSFO toward MGO. The impact on market prices is likely to be higher diesel prices (the International Energy Agency estimates a 20%-30% spike) and lower residual fuel prices. Differentials of heavy crude will also probably widen as refiners cut heavy runs to reduce residual fuel production in response.

In such a scenario, U.S. independent refiners would find themselves in an advantageous position, as their competitive advantages would be further accentuated. U.S. refiners hold relatively high complexity ratings, given their years of investment in upgrading capacity, which would allow them to capture those wider heavy differentials while producing less residual product and more higher-value distillates. U.S. refiners in the Gulf Coast would benefit from the increased flow of Western Canadian Select volumes from the added takeaway capacity. However, WCS differentials might remain wider for longer than we expect, as prices remain depressed, given WCS’ low API gravity/high sulfur content. In contrast, light crude prices are likely to fetch higher prices as demand increases, thanks to their lower residual fuel yields. Again, U.S. refiners have an advantage, as domestically sourced light crude should continue to trade at a discount, owing to transportation costs offering another cost-advantaged feedstock for U.S. refiners to exploit.

Expectations Are Already High, However While this outcome would unquestionably benefit U.S. refiners, given their favorable competitive position, the market seemingly already anticipates those conditions as well as the concurrent earnings uplift. Looking at future curves, we see an uplift in diesel margins over the next three years, which probably reflects the potential increase in diesel demand from IMO 2020. Meanwhile, the market does not seem to be anticipating any further weakness in gasoline, as margins are relatively stable, albeit below the levels of recent years. However, outside of an unlikely demand increase in the near term, there is the risk that global gasoline inventories could swell as refiners increase production to capitalize on the higher distillate margins. The more sanguine margin outlook appears to be reflected in refiners' earnings estimates, with 2020 refiners' consensus earnings per share 75% higher on average than in 2018.

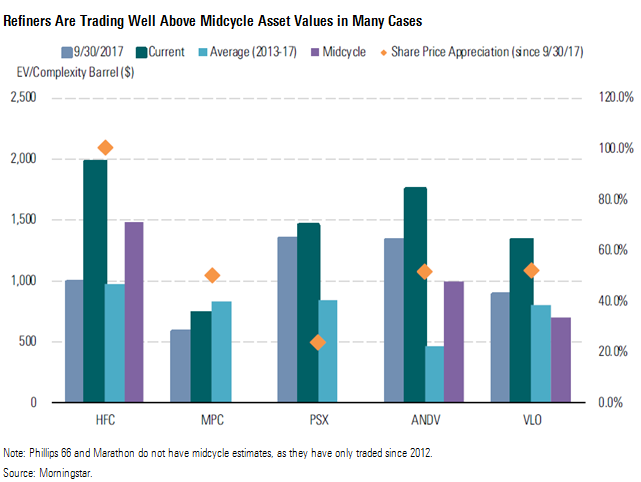

When looking at valuations, current share prices seem to treat these higher margins and earnings as sustainable. In most cases, our fair value estimates, which are based on discounted cash flows using midcycle margins in terminal valuations, are below current share prices. Furthermore, price/earnings ratios using the 2020 elevated earnings estimates are just below long-term historical averages. Applying historical multiples to 2020 consensus EPS estimates and discounting those values back to year-end 2018 shows limited upside, suggesting high expectations are already largely baked into share prices.

Finally, when we analyze enterprise value/complexity barrel ratios, in most cases they are above midcycle levels and are well above the depressed levels at which they’ve traded at times during the past ten years. Although this metric can lack accuracy with respect to timing--that is, it can remain high or low for years--it does provide a good indication of value. We prefer to buy when this metric is low and sell when its high. Further upside is possible, but that depends largely on the realization of high expectations surrounding IMO 2020.

Cash Returns Offer Reason to Stay Longer While the potential uplift in earnings during the next few years might not translate into materially higher share prices from here, it is likely to result in increased shareholder distributions. Refiners have steadily increased dividends and repurchased shares during the past five years. We expect those policies to continue. While any large increase in earnings during 2020-21 is unlikely to result in greater-than-average dividend growth, as management teams aim to keep dividends within long-term earnings capability, it will probably result in greater repurchases.

Not every company has

We expect other refiners could match Valero’s explicit goal based on our analysis of free cash flow. Valero’s payout target of 40%-50% of operating cash flow translates into approximately 70% of estimated free cash flow during 2019-20. Assuming the midpoint of 45% as the target for other refiners indicates that most would pay out a similar percentage of free cash flow, with Marathon closer to 80% and HollyFrontier closer to 60%. Total yields (total cash distributed as a percentage of current market capitalization) would average 13%, with Marathon slightly higher at 14%. However, cash distributions are unlikely to be uniform, as Phillips 66 and Valero will pay out more in dividends, evidenced by their higher dividend yields of nearly 3%, compared with closer to 2% for the rest of the group. Meanwhile, Marathon, Andeavor, and HollyFrontier will probably tack more toward share repurchases. During the next two years, we estimate they could repurchase 9% of shares outstanding on average.

While lack of a meaningful margin of safety keeps us from outright recommending any refiner, reasonable valuations, the likelihood of strong market conditions, and healthy cash returns to shareholders make us reluctant to call a top. In fact, we see shares mostly as fairly valued, not overvalued, implying they will appreciate at their cost of capital, which would imply share prices roughly 30% higher in three years. Volatility is likely to present buying opportunities during that time as expectations around near-term earnings fluctuate depending on the development of gasoline margins or the outlook for IMO 2020.

Of the group, we favor Marathon Petroleum as it is the only company that trades at a discount to our fair value estimate, as well as one of the deepest discounts to its midcycle P/E on 2020 earnings, while holding one of the highest potential yields over the next two years. Furthermore, it is still holding about $5 billion in cash, the bulk of which should go toward repurchases over the next 12 months. The closing of the Andeavor acquisition, along with delivery of synergy targets, could prove to be a catalyst. Finally, it is well positioned for IMO 2020, with a high complexity rating and low residual fuel yield. Marathon and Phillips 66 have also underperformed as the market tacks more toward merchant refiners like Valero and HollyFrontier to take advantage of wide spreads and lower renewable identification number, or RIN, prices.

RINs Go From Headwind to Tailwind While strong margins and wide crude spreads have powered earnings, merchant refiners like HollyFrontier and Valero have also benefited from the fall in RIN prices. Though the ultimate outcome of renewable fuel standard reform remains uncertain, recent actions by the Trump administration in granting more small-refinery waivers have raised doubt about its viability. As a result, RIN prices are trading at multiyear lows of $0.215, reducing a key cost item for merchant refiners like HollyFrontier and Valero that has weighed on earnings in the past few years. At current prices, costs equate to about $0.30/bbl for each company, compared with about $1.00/bbl the past couple of years, when RIN prices averaged $0.75.

Valero’s latest guidance for RIN expense is $500 million-$600 million in 2018, which is lower than the $749 million in 2016 and $942 million in 2017, although the actual figure could end up being even lower, given the decline in prices since guidance was offered. The difference translates into an improvement in EPS of about $0.40 in 2018. HollyFrontier’s costs have fallen even further. Its full-year 2017 expense was $288 million, but in the year to date it has incurred only $62 million, which is net of $97 million in small-refinery exemptions it has received. Based on its first-half expense, HollyFrontier would see a full-year increase in EPS of about $0.75 compared with 2017.

We previously incorporated sustainably higher RIN prices into our forecast for both companies. However, we have now reduced those expectations. RIN prices remain a source of risk for both companies, but particularly HollyFrontier, as the ultimate future of the renewable fuel standard remains in doubt. That said, with strong lobbying efforts behind it, ethanol blending requirements are unlikely to completely vanish.

/d10o6nnig0wrdw.cloudfront.net/05-22-2024/t_5149c138d4cf43a79de97f899e7ecd1a_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/D2LN64PPEJFUFPSWUNYVGCCDLA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G72FVQEVDVFALKWGMBYTU7K2RE.jpg)