Real Estate Rebounds

The sector currently trades in line with our fair value estimates.

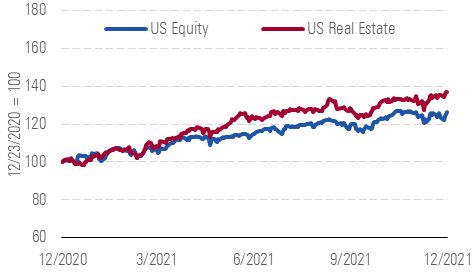

The Morningstar U.S. Real Estate Index is up 36.8% over the trailing 12 months, outperforming the 26.4% performance of the broader U.S. equity market over the same period. However, the Real Estate Index trailed the broader index in 2020, so real estate's outperformance in 2021 is in part due to the sector rebounding from its underperformance last year.

Real Estate Has Had a Higher 12-month Return Than the US Equity Index

Source: Morningstar analysts

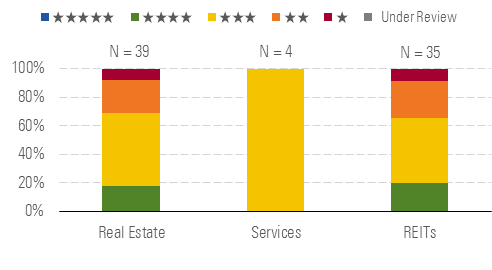

The real estate sector is currently trading relatively in line with our fair value estimates. Our real estate coverage currently trades at a 1% premium to our estimate of fair value, which is in line with our total North American coverage trading at a 3% premium to our fair value estimates on average at the end of the third quarter. Currently, 50% of the real estate sector is trading in the 3-star range while only 18% of our real estate coverage is trading in the 4-star range and none is trading at in the 5-star range.

There Are Few Discounts Among the Real Estate Companies

Source: Morningstar analysts

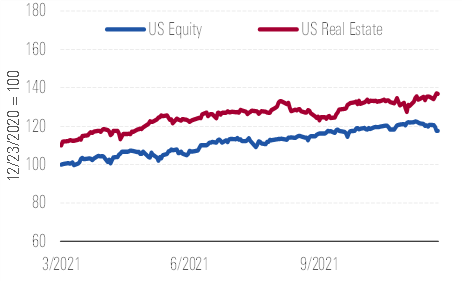

The real estate index has outperformed the broader US Equity Index in the second quarter through the fourth quarter. After the rapid deployment of vaccines across the U.S. early in 2021, fundamentals for many real estate sectors recovered faster than anticipated, leading to many REITs improving 2021 guidance on their first quarter earnings calls in early May. Many sectors saw continued occupancy and tenant health improvements through the summer months, leading to further guidance raises for many companies on second quarter earnings calls in late July and early August and again on third quarter earnings calls in October.

Real Estate Has Outperformed Since Reporting First-Quarter Earnings

Source: Morningstar analysts

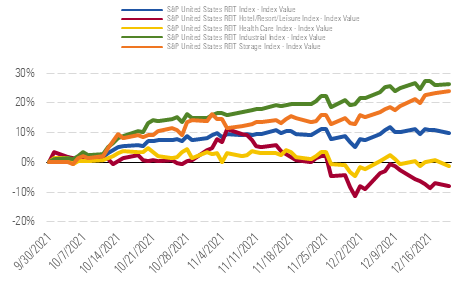

However, fear that the delta and omicron variants would lead to higher case counts and thus further shutdowns caused the divergence among the more sensitive real estate subsectors thus far in the fourth quarter. The hotel and healthcare sectors were among the sectors most hurt by shutdowns during the pandemic. While the vaccine allows travelers to return to hotels and keeps residents of senior housing facilities safe, travel restrictions and quarantines that may arise from the variants cause a significant drop in occupancy for both sectors. Despite short-term disruption, we continue to believe that both the hotel and healthcare sectors will see years of strong growth ahead of them. Meanwhile, the industrial and self-storage sectors, the sectors that performed the best during the pandemic, have significantly outperformed as demand for shipping and storage space has continued to surge.

Fears of Further Shutdowns Have Hurt Hotel and Healthcare Performance

Source: Morningstar analysts

Top Picks

PKw

Star Rating: ★★★★

Economic Moat Rating: None

Fair Value Estimate: $24.50

Fair Value Uncertainty: Very High

While the coronavirus had a significant impact on Park's operating results with high-double-digit revPAR declines and negative hotel EBITDA in 2020, the company has seen a significant rebound in 2021. Leisure travel has rebounded to near pre-pandemic levels, leading to a return of positive hotel EBITDA. However, business and group travel have been slower return as office workers have yet to fully return to the office. Still, we think business and group demand will eventually return to pre-pandemic levels by 2025, leading to years of strong growth for Park.

MAC

Star Rating: ★★★★

Economic Moat Rating: None

Fair Value Estimate: $30.00

Fair Value Uncertainty: Very High

Class A malls continue to outperform other forms of brick-and-mortar retail. The stock sold off significantly during the height of the pandemic as fears of the coronavirus impact on brick-and-mortar retail sales grew among investors. Macerich has long-term leases with tenants, so they continued to receive rent even during the worst months of the crisis. However, brick-and-mortar sales quickly rebounded as people returned to stores with foot traffic at malls returning to pre-pandemic levels during the summer months of 2021. As a result, Macerich is seeing improving occupancy levels and re-leasing spreads across its portfolio.

VTR

Star Rating: ★★★★

Economic Moat Rating: None

Fair Value Estimate: $69.00

Fair Value Uncertainty: Medium

Ventas owns high-quality assets in the senior housing, medical office, and life science fields. While the company's medical office and life science portfolios should be relatively unaffected by the coronavirus outbreak, the senior housing portfolio has experienced a very significant impact to occupancies as the virus has the highest lethality rate among senior citizens. However, while the virus will continue to negatively impact net operating income through 2021, the industry should see strong long-term growth from the coming demographic wave of baby boomers aging into senior housing facilities.

/s3.amazonaws.com/arc-authors/morningstar/b9459b20-3908-4448-a36c-b728946ddbe5.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ODMSEUCKZ5AU7M6BKB5BUC6G5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TGMJAWO4WRCEBNXQC6RFO5TOAY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/b9459b20-3908-4448-a36c-b728946ddbe5.jpg)