President Biden’s Stock-Buyback Tax Proposal: What to Know

The president has proposed a 4% surcharge on share repurchases.

The Plan

In February’s State of the Union address, President Biden recommended that when companies buy shares of their outstanding stock, they pay a 4% tax on the purchase price. Businesses currently render 1%, courtesy of the inaccurately named Inflation Reduction Act of 2022. (That bill’s impact on inflation, states the Penn Wharton Budget Model, is “statistically indistinguishable from zero.”)

There are three primary reasons the president favors a higher stock-buyback tax rate. He mentioned one of them in his speech. He wants companies to spend their free cash on expanding their businesses, rather than on attempting to boost their share prices: “Big Oil … invested too little of [their] profit to increase production and keep gas prices down. Instead, they used those record profits to buy back their own stock, rewarding their CEOs and shareholders.”

(It’s not entirely clear to me why a green-energy proponent would encourage oil companies to expand their production, but never mind that.)

A steeper tax rate would also increase federal revenue. Because President Biden has promised that “nobody earning less than $400,000 a year will pay an additional penny in taxes,” his tax options are limited. This proposal would add meaningful government revenue, while ostensibly affecting only corporations.

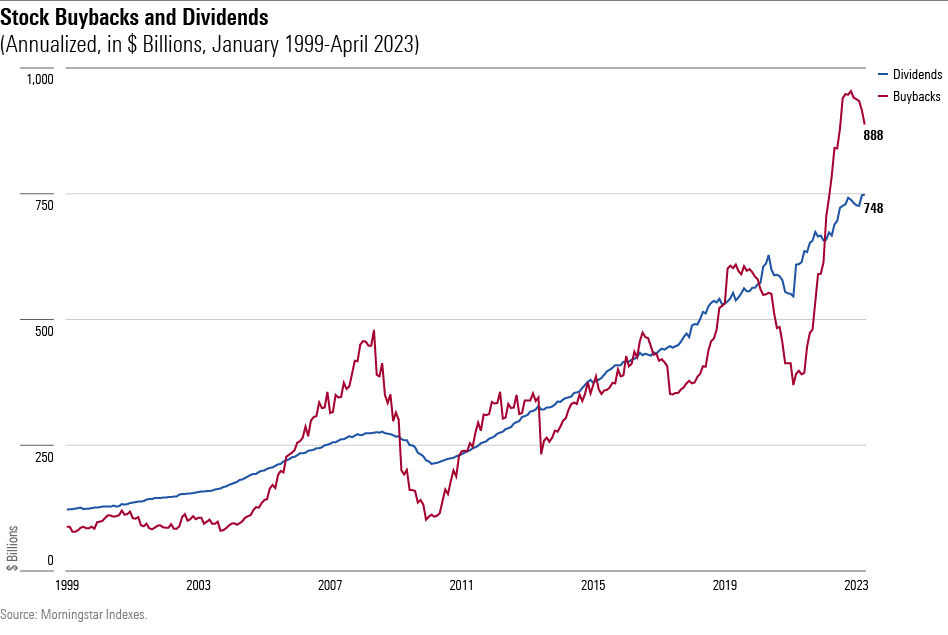

The final justification is to rationalize the tax code. The following chart depicts the annualized amount, in billions of dollars, spent by constituents of the Morningstar US Market Index on 1) dividend distributions and 2) share repurchases. The former has grown more slowly than the latter, presumably because their payments are taxed. Stock buybacks have not been taxed until very recently, and then only lightly. Economists tend to dislike decisions that are motivated by tax avoidance.

The Rebuttal

The business community is less than enthralled. For example, Democratic-leaning Warren Buffett, who publicly supported both Bill Clinton and Barack Obama, tartly commented two weeks after the president’s announcement, “When you are told that all repurchases are harmful to shareholders or the country, or particularly beneficial to CEOs, you are listening either to an economic illiterate or a silver-tongued demagogue (characters that are not mutually exclusive).”

In particular, Buffett disputes the president’s goal of encouraging corporate investment. The doctrine of shareholder value, which Buffett (along with most other corporate leaders) openly salutes, states that CEOs should act like Goldilocks. They should make neither the largest possible investment, nor the smallest, but instead the amount that best suits their individual circumstances.

Also, argue the dissenters, President Biden offers a false dilemma. The choice is not binary between 1) repurchasing stock and 2) investing in operations. when facing a higher share-repurchase tax, businesses have many other options. For example, they can hold cash, buy securities, increase their dividends, and/or retire debt. None of those actions would advance the president’s goal.

Critics also claim that increasing the stock-buyback surcharge would, in fact, invalidate the president’s tax pledge. As Mitt Romney reminded us, companies are people, too. If taking their money lowers their collective stock market value (which it surely must) and if taxpayers who earn less than $400,000 own U.S. equities (which many do) then it stands to reason that the president’s proposal will indirectly violate his taxpayer guarantee.

Those are the leading objections. The skeptics have largely ignored the tax-distortion issue, as it is theoretical. Nor have they disputed that raising the stock-buyback tax to 4% from 1% will increase federal revenue.

The Verdict

Here is my take.

1) Investment

The business community is correct. Raising the tax rate to 4% from 1% will not meaningfully affect CEOs’ decisions. Executives who preferred buying shares to expanding their businesses are unlikely to change their minds because they must pay another three cents on the dollar. After all, if their stock prices rose, they would not be fazed by paying $10.30 per share instead of $10.

And as mentioned above, those who are dissuaded by the tax increase from repurchasing shares can use their money for so many things other than new investment.

2) The Tax Pledge

Here again, the critics are correct. if this proposal were to pass, the president’s insistence that American households making less than $400,000 per year would not pay “one penny” more of taxes under his administration would be breached in spirit. Millions of retail taxpayers would pay an indirect tax, through the lower amount of their shares.

That said, households representing the top 1% of wealth own 53% of retail equity assets (counting funds as well as directly held shares), while those in the top 10% possess 89%. Also, the effect of the tax on stock prices would be very mild. Thus, although raising the buyback tax would indeed affect everyday Americans, it’s a stretch to attack the president’s proposal as harming “the little guy.” As political infractions go, it’s very much a misdemeanor.

3) Revenue Implications

Hiking the stock-buyback tax would help federal finances. At current levels of share repurchases, the proposal would bring an additional $27 billion per year into federal coffers. As discussed, I doubt that amount would much decline if the proposal were enacted. Over time, it would probably continue to rise.

Conclusion

Given that Republicans control the House of Representatives, President Biden’s stock-buyback tax proposal will not be enacted anytime soon. Were it to occur, however, the new policy would stimulate little in the way of new investment. On the bright side, although the critics are largely correct in claiming the president is attacking a relatively benign target, increasing the share-repurchase tax is unlikely to cause significant harm. As political proposals go, that is no small victory.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2UWGQD7LCJCYNF3WQ5HHLP7UBE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)