Outlining AIG's Path to Mediocrity

AIG needs only a modest improvement to be materially undervalued.

In May 2017,

AIG does not need to see a dramatic improvement to stop destroying shareholder value; it only needs to move from being a negative outlier to merely subpar. Given that we see no structural issues in its core operations, we believe that the company gradually trending toward results more on par with its peers is a realistic assumption, now that it has a management team with a solid underwriting background. When we compare the current market valuation of AIG with that of its peer group, we see the stock is materially undervalued today even if the company manages to produce only adequate returns going forward.

Commercial P&C Has Been AIG's Achilles' Heel AIG is a highly diversified company and retains some legacy operations that have been put into runoff. The various parts of the business don't move perfectly in tandem, and there is a relatively wide spread in returns across AIG's segments. The life insurance operations are performing quite well, generating a double-digit adjusted return on equity every quarter since the second quarter of 2016. In our view, the cost-cutting that AIG's previous management team did in this area was sufficient to return this segment to adequate returns. The company's runoff operations, as would be expected, generate low returns, but we are encouraged that AIG has avoided any major losses. Runoff operations constitute only 19% of the company's total attributed equity, so the drag from this area should be manageable and decline over time.

The property-casualty segment, though, remains an issue, and we believe that improving underwriting in this segment is the primary obstacle AIG needs to overcome to generate an adequate return overall. A large reserve development charge in the fourth quarter of 2016 and heavy catastrophe losses in the third quarter of 2017 led to substantial overall losses. While these events could be chalked up to mistakes by previous management and an industrywide event that is inevitable for any P&C operator, returns have been subpar even in quarters without major events of this type.

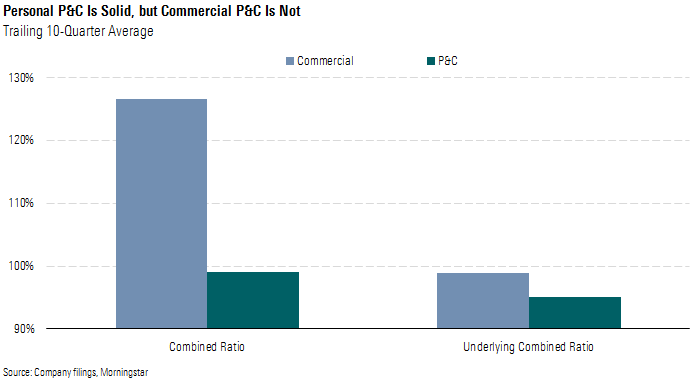

If we compare the reported and underlying combined ratios for AIG’s commercial and personal P&C operations, we see that AIG’s P&C issues are concentrated in its commercial P&C operations. The underlying combined ratio is a common industry metric that excludes the impact of catastrophe losses and reserve development. Catastrophe losses, while an intrinsic and inevitable claims component, are highly volatile quarter to quarter. Reserve development, while also constituting a real loss, relates to policies that were written in the past. Thus, the underlying combined ratio, while not reflective of true underwriting profitability, gives a relatively stable indication of an insurer’s current run rate of underwriting performance. In both bases, AIG’s personal P&C operations significantly outperform its commercial P&C operations in terms of underwriting profits.

Over the past 10 quarters, personal P&C has managed a slight underwriting gain, with an average combined ratio of 99.1%. Personal P&C operations took a hit in recent quarters due to the flurry of natural catastrophes, but this area has largely avoided any reserve development issues, and underlying underwriting profitability has been solid. Excluding the catastrophe-affected quarters, the personal P&C segment has been running a combined ratio in the mid-90s, which is roughly in line with peers and which we believe allows for adequate overall returns.

We think all of the areas of the business outside the commercial P&C operations are performing reasonably well--or as well as can be expected--and that an improvement to an adequate overall return hinges on an improvement in this area.

How Good Is Good Enough for Commercial P&C? We think a look at AIG's commercial P&C operations and those of its peers will demonstrate that the company's ability to reach returns on equity more in line with its peers is not completely out of reach. AIG focuses on a metric it dubs adjusted ROE. While there are a number of adjustments made to get from GAAP ROE to AIG's adjusted ROE, the two key adjustments, in our view, are that the company's adjusted ROE excludes realized investment gains and losses from earnings and eliminates unrealized investment gains and losses and the company's sizable tax assets from the equity base. We see these as appropriate adjustments. Eliminating investment gains and losses from ROE is common industry practice, as quarterly changes on this front are potentially distortive in monitoring an insurance franchise's performance. Eliminating the deferred tax asset is also appropriate, in our view, since these are nonoperating assets. On this basis, AIG generated adjusted ROEs of only 7.7% and 7.6%, respectively, during the past two quarters and topped 10% only once during the past 10 quarters. While there is no one right answer for a company's cost of equity, we use 9% for AIG, which is our standard COE for a company with a medium amount of systemic risk. We believe 10% is also a commonly accepted COE level for financials such as AIG.

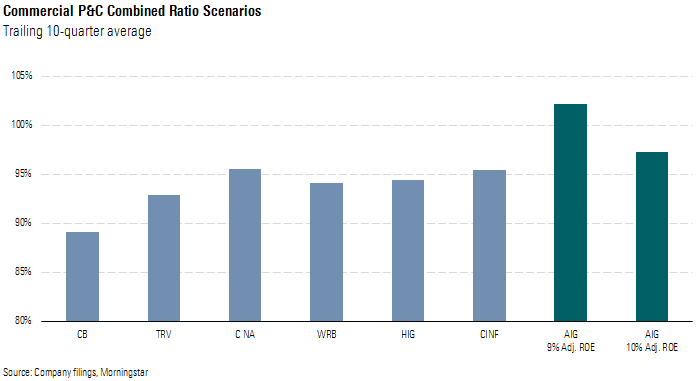

To estimate the magnitude of the underwriting improvement that AIG would need to achieve to generate an acceptable return, we used the company’s trailing 12-month performance and calculated the improvement in overall profitability that would have been necessary to achieve both a 9% and a 10% adjusted ROE over the last four quarters. Assuming that all other metrics stayed equal, we then applied this profitability improvement profile to underwriting income in commercial P&C operations to arrive at the combined ratio that would have been required from this business to achieve either a 9% or 10% adjusted ROE for the company overall. While at first glance it looks like a dramatic improvement would be required, it should be noted that AIG endured a heavy catastrophe load in the back half of 2017 and also took a meaningful reserve development charge in the third quarter of 2017. The combined ratio in the first and second quarters of 2018 came in at 103% and 105%, respectively, not that far off from the 102% necessary for AIG overall to hit the 9% adjusted ROE. So the necessary underlying improvements are not particularly large.

Looking at peers, in our view, provides a better sense of what’s realistic to expect from AIG as it moves past its historical mismanagement. We looked at the average combined ratio for six commercial insurance industry peers over the past 10 quarters. For companies with operations outside commercial P&C lines, we included only their commercial P&C operations. Under both the 9% and 10% adjusted ROE scenarios, AIG would still be the worst underwriter in this group, although it would have moved from a dramatic outlier to a more garden-variety underperformer.

We see no structural reason for AIG to be generating such poor underwriting performance. Its commercial business mix is comparable to peers, and its closest peer in terms of mix and customer base is Chubb CB, which is the strongest underwriter in the group. As a result, we believe mismanagement has been the primary cause of AIG’s historical underwriting issues and it is reasonable to expect some improvement under the new management team.

Duperreault has clearly communicated that fixing commercial P&C underwriting is a key priority. Additionally, AIG expects to reach sustainable underwriting profitability by the start of 2019--that is, to achieve full-year underwriting profitability in 2019 (assuming a normal level of catastrophe losses). If AIG can achieve this, it would demonstrate that Duperreault’s leadership was able to drive a meaningful underwriting improvement in the company’s commercial P&C operations within six quarters of having taken over. Given the magnitude of AIG’s underwriting problems in this business and the inherent delay in improvements showing up in reported results, we view this as a very reasonable time frame to achieve such a target and believe that any skepticism driven by a perceived lack of major progress has been premature. Further, the company should be able to generate an adequate overall return if it can overcome this underwriting profitability hurdle, assuming no major negative surprises elsewhere in the business.

Reserve Development and Industry Trends Paint a Brighter Picture We believe a lack of improvement in AIG's commercial P&C underwriting results over the past couple of quarters has increased skepticism regarding Duperreault's ability to move AIG toward acceptable returns. But the improvements he is making take time to work their way into reported results, and because of the nature of the business, P&C insurers rarely move in a straight line. We also believe that recent quarters have not been devoid of any positive indicators and that industry trends have created some modest headwinds.

While AIG needs to work toward underwriting profitability to restore the market’s confidence in the franchise, a necessary first step is moving past its history of large reserve development charges. On this front, the trend has been positive. After taking a meaningful but manageable reserve development charge in the third quarter of 2017, after Duperreault’s team reviewed reserves coming in, AIG has actually recorded favorable reserve development during the last two quarters. The amounts have not been large, and we believe it will still take at least a few years until the market is fully confident in the adequacy of AIG’s reserves given its history, but this, in our view, has been a meaningful step and a sign that Duperreault has effected some positive change,

Second, when we look at underlying combined ratios, we can see that the peer group’s combined ratio has deteriorated a bit over the past 10 quarters. A relatively weak pricing environment has been a top-of-mind topic in the space recently, with results suggesting that pricing has not been fully keeping pace with claims trends. Whether this is due to normal pricing variation or the anticipation of higher interest rates and investment income (which would lower the underwriting income an insurer would need to generate to achieve a targeted return) is debatable, and the trend has not been dramatic. Still, AIG presumably would not be immune to this trend, which could be obscuring signs of progress that the company might be making. The average underlying combined ratio for the peer group increased from 92.3% in 2016 to 92.9% during the first half of 2018. However, that average was skewed somewhat by Chubb, which realized meaningful cost synergies after the merger with ACE at the start of 2016. Excluding Chubb, the average underlying combined ratio for the peer group increased from 92.7% in 2016 to 93.8% in the first half of 2018.

Market Valuation on AIG Is at Rock Bottom, and We See Upside We believe that the skepticism surrounding Duperreault's tenure has left the market valuation for AIG's shares well out of line with its peer group. On a price/book basis, excluding unrealized investment gains and losses (AOCI) and goodwill, AIG carries the lowest multiple of any large domestic insurer. We prefer to look at book value excluding AOCI and goodwill when assessing the value of insurers like AIG. Because insurers tend to be buy-and-hold-to-maturity investors, we think that temporary marks based on changes in interest rates do not reflect any actual economic impact on insurers and should therefore be excluded from book value. As for goodwill, we believe its inclusion obscures the true economic performance of the underlying franchise, and we exclude it from our calculations as well.

On this basis, AIG trades at only 0.8 times book value compared with an average multiple of 1.7 times for the peer group. Primarily P&C insurers like AIG tend to trade at a higher multiple than life insurers, as we believe that the market (correctly) sees P&C insurance, while not a particularly moaty industry, as a much better business than life insurance, which is almost entirely devoid of moats; life insurers do not benefit from the niche products or scalable platforms that some P&C insurers enjoy. Additionally, life insurers are more exposed to capital market conditions, and their results are much more opaque, given the long life of some products. Within the peer group we’ve chosen for AIG, P&C insurers currently trade at an average multiple of 1.9 times, while life insurers carry an average multiple of only 1.4 times. AIG’s mix is slightly weighted toward P&C operations, which creates substantial valuation upside if Duperreault can effect positive (and sustainable) change in the company’s underwriting results. We don’t believe the market is currently pricing in this possibility.

To estimate the multiple improvement AIG could see if Duperreault manages to improve returns, we conducted a regression analysis on the peer group between book multiples and historical ROE. To best correspond to AIG’s method for calculating adjusted ROE, we used the current book value excluding AOCI and goodwill for the valuation multiple. We then calculated the average historical ROE over the same book value basis since 2013, excluding realized investment gains and losses from net income. A number of companies recorded large tax gains in 2017 due to tax reform, and we excluded this from the ROE calculation as well. Finally, we excluded some insurers like Markel that have relied heavily on capital gains as part of their overall return, as our ROE calculation doesn’t capture this component. This left us with 14 peer companies for the analysis.

One key difference between AIG and its peers is that the company carries significant deferred tax assets on its balance sheet as a result of its historical issues. To compensate for this, we broke out this component of AIG’s book value per share. The economic value of these assets is below the carrying value as the carrying value does not account for the time value of money. Using a reasonable discount rate and an assumption that AIG will use its DTAs over the next six to seven years, we estimate that the economic value is approximately 70% of the carrying value. We then used the results of the regression analysis to estimate the implied market multiple on the operating portion of AIG’s book value assuming AIG could sustainably generate an adjusted ROE of 9% and 10%, respectively. The result of this exercise suggests significant upside from the current stock price if management can improve returns in line with our expectations. Based on this analysis, the stock is materially undervalued even if AIG manages to produce only adequate returns going forward.

This analysis results in implied valuations that are a bit above our current $76 fair value estimate. We would credit this to two factors. First, our valuation accounts for some modest value destruction while AIG works toward an acceptable return. Second, the companies we cover in this peer group currently trade at an average price/fair value estimate of 110%, suggesting the peer group as whole is modestly overvalued.

Valuation metrics as of Aug. 31.

/s3.amazonaws.com/arc-authors/morningstar/da2d065f-39a9-49e3-8551-1d3832fc658a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PLMEDIM3Z5AF7FI5MVLOQXYPMM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/I53I52PGOBAHLOFRMZXFRK5HDA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CEWZOFDBCVCIPJZDCUJLTQLFXA.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/da2d065f-39a9-49e3-8551-1d3832fc658a.jpg)