Our Ultimate Stock-Pickers' Top 10 Buys and Sells

In aggregate, our roster of top investment managers is looking more and more like the S&P 500.

By Burkett Huey | Associate Equity Analyst

For the past nine years, Ultimate Stock-Pickers' primary goal has been to uncover investment ideas our equity analysts and top investment managers find attractive, in a manner timely enough for investors to gain some value. As part of this process, we scour the quarterly (in some cases, the monthly) holdings of 26 different investment managers, 22 of which manage mutual funds that Morningstar's manager research group covers, and four of which manage the investment portfolios of large insurance companies. As they become available, we attempt to identify trends and outliers among their holdings as well as any meaningful purchases and sales that took place during the period under examination.

In our last article, we walked through the Ultimate Stock-Pickers' purchasing activity during the second quarter of 2018. The piece itself was an early read on the purchases--focused on high-conviction and new-money buys--that were made during the period, based on the holdings of almost all our top managers. Now that all our top managers have reported their holdings for the second-quarter 2018, and several managers have reported their July holdings, we now have a much more complete picture of what they were up to during the period. As stock prices have changed since our Ultimate Stock-Pickers chose to purchase or sell the holdings in the second quarter, we urge investors to analyze a security at current valuation levels before making any venture, and we provide our fair value estimates, moat ratings, stewardship ratings, and uncertainty ratings to help investors make these decisions.

We were not surprised to see a continuation of a long-standing trend of net selling by our Ultimate Stock-Pickers. We caution readers, however, because this may be more indicative of capital flowing into passive products than our managers taking a more bearish stance. Despite the net selling, our Ultimate Stock-Pickers still made several high conviction purchases and sales.

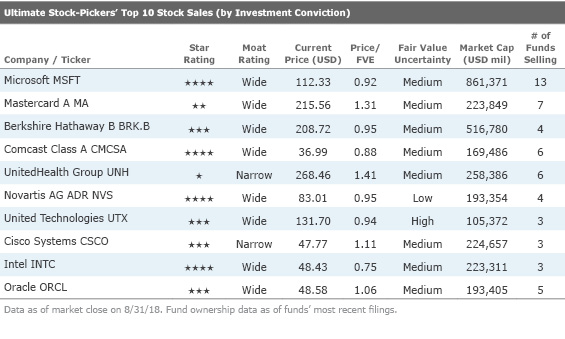

Our Ultimate Stock-Pickers continue to buy, sell, and hold high-quality companies that Morningstar believes have developed sustainable competitive advantages and thus are granted economic moats. Morningstar's analysis shows that all but one of the top 10 high-conviction purchases have an economic moat, with EQT Corp being the outlier. We do note that Charter Communications was granted a moat by our quantitative moat analysis and is not covered by an analyst. All the companies comprising the top 25 conviction holdings list and the top 10 conviction sales list have been granted either a narrow or wide economic moat by Morningstar analysts.

From a sector allocation perspective, the aggregate weightings of our Ultimate Stock-Pickers are more in line with the S&P 500 than they had been last quarter. Our Ultimate Stock-Pickers used to meaningfully underweight healthcare and overweight technology relative to the S&P 500 but are now within 100 basis points of the S&P's weightings. Weightings for our managers are within 100 basis points of the S&P 500 for real estate, communication services, and consumer goods. Our Ultimate Stock-Pickers continue to underweight energy and utilities, and overweight financial services and basic materials. Ultimate Stock-Picker FMI Large Cap Fund 's comparison of today's market to older tech-driven bull markets exemplifies this slight shift out of technology:

"Today's stock market is very reminiscent of previous speculative periods. In a nod to the bacchanalian year 1999, over two thirds of the IPOs in the past 18 months were money-losing companies. Over the past 40 years, money-losing companies constituted just 38% of new offerings. Today's figures don't include the herd of money losing "unicorns," which are private startup companies valued over a billion dollars. Wall Street's deception, otherwise known as "adjusted earnings" (non-GAAP), is just an in-your-face version of the '90s bull market's beat-the-quarter-by-a-penny phenomenon practiced so assiduously by the likes of Jack Welch at GE and Dennis Kozlowski at Tyco. Today's record-high share buyback activity (despite high valuations), frenzied mergers and acquisitions action, and massive levering of corporate balance sheets, completes the financial engineering trifecta. The obsession with market share (revenue) to the detriment of earnings (think Amazon, Netflix, and many of the biotechnology companies) harkens back to the Japanese bull market of the 1980s, where investors were told that market share was all that mattered, and that they shouldn't worry about valuations since the Japanese valued companies differently. The same dynamic took place 10 years later in the Internet 1.0 bull market, when investors were counseled to count eyeballs instead of dollars. The way the stock market is being driven by a narrow group of names (FAANG and their ilk) takes a page out of the "nifty fifty" playbook, circa 1972, when stocks like Eastman Kodak, Avon Products, and Sears ("one decision stocks") were among the most popular. As in almost all bull runs, growth stocks have been beating value stocks, and investors can't fathom how it could ever flip."

We were not surprised to see that that composition of our Ultimate Stock Picker's top 10 conviction stock holdings remained constant from last period, although there were some small changes in their relative positions. After

"We bought just a little, about 6 million of the shares are attributable to another fellow in the office that's owned it for a considerable period of time. The rest are my portfolio, but I bought just a little bit—I like to buy them cheaper. It's very difficult. We started buying or I started buying when the stock was maybe 100, I was buying it kind of as fast as I could, and I ended up buying some as high, a whole lot higher, I don't want to name the exact price, but a whole lot higher. I'd rather have it go down for one thing. If it goes down, Apple is going to buy a lot of stock back, already buying stock back. If it goes down 10% it means they get to buy 10% more shares and my interest will go up 10% more for spending that money."

Generally speaking, we think the top 10 conviction stock purchases are still currently trading either at or below their fair value, with the exception of

PepsiCo's stock recently bounced back from a relative low point in early May, after the beverage and snack maker reported strong second-quarter earnings and a recovery in its North American beverage business following a somewhat weak first quarter.

Morningstar's analysis indicates that PepsiCo has built a defendable economic moat, enjoys strong growth, and is currently trading attractively. Morningstar Analyst Sonia Vora points to PepsiCo's consistent net pricing increases, which she estimated on a five-year historical basis to be 1.7% above inflation, as evidence of the company's brand based intangible assets. Further, Vora contends that PepsiCo's scale also allows the company to enjoy a cost-advantage based on significant purchasing power for the corn, sweeteners, and plastic packaging materials inputs that are used in both its beverage and snack businesses.

These two moat sources, its intangible assets, and cost advantages, lead her to a wide-moat rating for PepsiCo. Vora's revenue outlook assumes continued strength in the snacks business, as new product launches and packaging innovations drive increased consumer demand. She also projects growth coming from emerging markets, where per capita consumption remains lower than in developed regions. Underlying her outlook is the expectation that PepsiCo continues to demonstrate price leadership and innovate its product portfolio, which is expected to earn the company approximately a 3% compounded annual revenue growth rate over the next five years.

PepsiCo is trading at a 9% discount to Vora's low-uncertainty fair value estimate and is currently priced to yield 3%-plus in dividends, which Vora contends is a buying opportunity for long-term income-seeking investors.

The second purchase we found worth highlighting was Columbia Dividend Income Fund's conviction purchase into wide-moat

Gilead Sciences develops and sells therapies that treat a diversified group of lethal diseases. Andersen's bullish thesis on the company is partially based on the idea that the market is undervaluing the potential market size for treating NASH, a liver disease that can advance to liver failure and cancer.

Although scientists do not yet completely understand the causes of NASH, there is a strong association between NASH and obesity, as an estimated 82% of NASH patients are considered obese [Reference: Younossi et al. 2016. "Global epidemiology of nonalcoholic fatty liver disease—Meta-analytic assessment of prevalence, incidence, and outcomes." Hepatology. Vol. 64, No.1, P. 73–84]. Although no effective treatments are on the market yet, Andersen estimates that the NASH treatment market opportunity is currently $18.5 billion in the United States and the European Union using her base-case assumptions that 20% of a potential 10.3 million eligible patient population get diagnosed. Andersen sees the rising rates of obesity as an indicator that a presently large NASH treatment market has potential to grow. Gilead currently has several treatments that have progressed relatively well into the regulatory pipeline to address this multi-billion-dollar opportunity and thus could earn lucrative patents to manufacture treatments for this disease. Andersen is maintaining her wide-moat rating and an $86 per share fair value estimate for the firms.

Turning to conviction sales, we see a somewhat familiar list of companies. Four of the top 10 conviction sales were part of the list last month. Wide-moat Microsoft continues its three-quarter run as the most widely sold security during second-quarter 2018. Shares of the technology firm were sold by 13 of the 17 managers who held it at the beginning of the second quarter. Two of our Ultimate Stock-Pickers--

“I think they can deliver growth in excess of the S&P 500, but I think it is going to be challenging to do much above the S&P 500 given Berkshire’s size. I think there is going to be more share repurchase as a percentage of the total capital deployed in the future. [Berkshire's management gets] what Berkshire is about and how it has built its record. It speaks well to Warren and Charlie that they have this formidable line-up of people ready to take over in the future. I just think it is going to be very challenging to compound at very high rates, which is why I think you have seen the share of Berkshire’s assets in the Sequoia Fund going down gradually over time.”

One conviction sale that Morningstar's analysis disagrees with was

From a valuation perspective, the conviction sale that was most aligned with Morningstar's analysis was FMI Large Cap Fund's and Oakmark Equity and Income Fund's sale of the narrow-moat

Morningstar analyst Vishnu Lekraj contends that UnitedHealth's MCO business faces regulatory risk related to passage of the ACA that limits his fair value estimate to $190. The passage of the ACA capped gross profitability by mandating that minimum proportions of each dollar spent on insurance premiums are used to pay customers’ medical claims. This would limit the amount of money an MCO would be able to earn. Further, the company depends on government funding for its Medicare and Medicaid participant population, but poor state and federal government budgets along with ACA-mandated payment cuts will have the combined effect of pressuring profits for MCO insurance companies. Finally, Lekraj expects expensive revenue growth for MCOs, as many of the newer participants belong to the higher-cost Medicare and Medicaid cohorts. This presents a problem for health insurance companies because these new members, who tend to skew both older and sicker, and carry a materially higher level of medical costs.

Disclosure: Burkett Huey has an ownership interest in Microsoft, while Eric Compton has no ownership interests in any of the securities mentioned here. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WC6XJYN7KNGWJIOWVJWDVLDZPY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HHSXAQ5U2RBI5FNOQTRU44ENHM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/737HCNGRFLOAN3I7RKGB7VPEKQ.png)