Our Ultimate Stock-Pickers’ Top 10 Buys and Sells

Funds see value in a diverse range of sectors.

For roughly the past decade, our primary objective with Ultimate Stock-Pickers has been to uncover investment ideas that our equity analysts and top investment managers find attractive, in a manner timely enough for investors to gain some value. As part of this process, we analyze the quarterly and monthly holdings of 25 separate investment managers: 22 managers oversee mutual funds covered by Morningstar’s manager research group and three Ultimate Stock-Pickers run the investment portfolios of large insurance companies. As the data from their holdings becomes available, we identify trends and outliers among their holdings as well as meaningful purchases and sales that took place during the period under examination.

In our last article, we walked through our early read on our Ultimate Stock-Pickers’ individual purchasing activity during the first quarter of 2023—focused on high-conviction and new-money buys that were made during the period, based on the holdings of almost all our top managers. Now that all but one of our Ultimate Stock-Pickers have reported their holdings for the period, we think it is appropriate to examine our managers’ high-conviction holdings, purchases, and sales in aggregate. As stock prices have changed since our Ultimate Stock-Pickers made their buying and selling decisions, we urge investors to analyze securities at current valuation levels before making any investment decisions—we will provide our fair value estimates, moat ratings, stewardship ratings, and uncertainty ratings to help them along the way.

Similar to the previous quarter, Morningstar’s analysis shows eight of the top 10 conviction holdings have a wide economic moat, with the other two having a narrow moat. On the conviction sales list this quarter, seven companies have a wide moat and one has a narrow moat.

Considering that many of the Ultimate Stock-Pickers are long-term investors, we were not surprised to see that the many of the names composing our top 10 conviction holdings list were the same as the prior quarter. Alphabet (Google’s holding company) and Microsoft retained the top spots on our list with 17 and 15 funds holding, respectively. Similar to last quarter, our Ultimate Stock-Pickers’ conviction holdings favored the financial services sector this quarter with five companies making the top 10 list. In our list, our Ultimate Stock-Pickers hold three names from the technology sector and one name each from the communication services and healthcare sectors. Our current fair value estimates imply that at the time of writing, Apple, Marsh & McLennan Companies, and UnitedHealth Group are trading at a premium and therefore overvalued.

All the names on our top 10 conviction holdings list were held by at least 11 of the funds we examined. In this edition of Ultimate Stock-Pickers, we’ll take a closer look at Microsoft, which commonly appears in our top 10 conviction holdings list and currently sits in 3-star territory. We also highlight narrow-moat Paccar, which was a high-conviction purchase in the first quarter, and wide-moat JP Morgan Chase, which appeared on our high-conviction sales list.

Ultimate Stock-Pickers' Top 10 Stock Holdings (by Investment Conviction)

Since taking over as CEO in 2014, Satya Nadella has reinvented Microsoft into a cloud leader such that it has become one of two public cloud providers that can deliver a wide variety of PaaS/IaaS solutions at scale. Microsoft embraced the open-source movement and has largely transitioned from a traditional perpetual license model to a subscription model. The company has also enjoyed great success in upselling users on higher-priced Office 365 versions, notably to include advanced telephony features. These factors have combined to drive a more focused company that offers impressive revenue growth with high and expanding margins.

Morningstar analyst Dan Romanoff believes that Azure is the centerpiece of the new Microsoft. Although Romanoff estimates that Azure is already an approximately $45 billion business, it grew at a staggering 45% rate in fiscal 2022. Azure has several distinct advantages, including that it offers customers a painless way to experiment and move select workloads to the cloud, creating seamless hybrid cloud environments. Since existing customers remain in the same Microsoft environment, applications and data are easily moved from on-premises to the cloud. Microsoft can also leverage its massive installed base of all Microsoft solutions as a touch point for an Azure move. Azure is an excellent launching point for secular trends in AI, business intelligence, and Internet of Things, as it continues to launch new services centered around these broad themes.

Microsoft is shifting its traditional on-premises products to become cloud-based SaaS solutions. Critical applications include LinkedIn, Office 365, Dynamics 365, and the Power platform, with these moves now beyond the halfway point and no longer a financial drag. Office 365 retains its virtual monopoly in office productivity software, which Romanoff does not expect to change in the foreseeable future. The company is also pushing its gaming business increasingly toward recurring revenue and residing in the cloud. Romanoff believes that customers will continue to drive the transition from on-premises to cloud solutions, and revenue growth will remain robust with margins continuing to improve for the next several years.

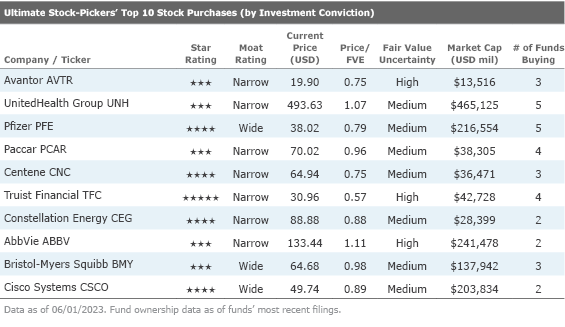

Ultimate Stock-Pickers' Top 10 Stock Purchases (by Investment Conviction)

The Ultimate Stock-Pickers’ Top 10 Stock Purchases list contained many names with moats that were distributed across a range of sectors, including basic materials, energy, industrials, healthcare, finance, and technology. In particular, we highlight truck manufacturer Paccar, which was purchased by four funds during the quarter.

Morningstar analyst Dawit Woldemariam thinks Paccar will continue to be a top-two truck manufacturer, even with the eventual shift to autonomous and electric vehicles. The company has long been known for its premium truck brands, Kenworth, Peterbilt, and DAF. Paccar’s trucks are some of the strongest performing, most durable, and fuel-efficient on the market. These factors have led to the company’s strong brand reputation among fleet owners and truck drivers.

Paccar’s strategy focuses on creating high-quality premium products for customers, which Woldemariam believes will continue to translate into near-term market share gains. He also thinks Paccar will continue to extend its global reach, as government authorities in Brazil, India, China, and Australia introduce new emission standards. Woldemariam believes this will force fleet owners to refresh their fleets with more emission-compliant trucks over the next few years, benefiting Paccar. The trucking industry is currently going through a fundamental shift, brought on by new emission regulations across the globe. Woldemariam believes Paccar is making the necessary investments today in order to succeed in a zero-emission world. In early 2021, the company entered into a partnership with Aurora, an autonomous driving software provider, and it has also launched BEV prototypes. Woldemariam expects Paccar to reach modest production volume over the next few years, as electrification in the trucking industry proliferates.

Woldemariam expects Paccar to excel in the near term, given strong tailwinds in the trucking industry. The global health pandemic depressed freight demand early on, but trucking activity has since rebounded. Strong consumer spending on consumer goods and e-commerce growth pushed demand higher. Woldemariam expects new truck orders to increase in the near term, as the current backlog of orders is likely to supply production for the remainder of the year. In good times, truck operators replace aging trucks and opt to expand their fleets to meet strong demand. Longer term, Woldemariam thinks Paccar will be one of the leading players in the trucking industry and will be largely zero-emission. The company can use strong returns from its diesel business to fund investments.

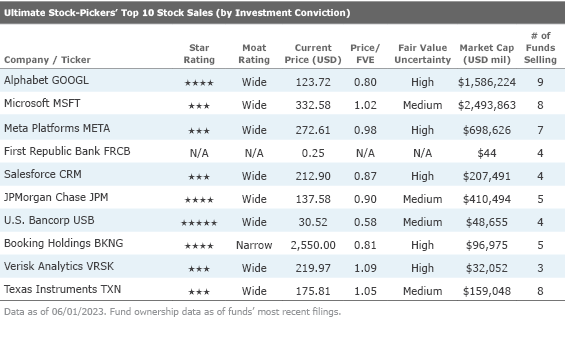

Ultimate Stock-Pickers' Top 10 Stock Sales (by Investment Conviction)

Similar to the previous quarter, the activity on the top 10 conviction sales list was a mix this quarter in regard to sector. Two of the names appear on both the high-conviction holdings and sales lists in the quarter. Four of the names on the conviction sales list trade at a discount to our fair value estimates, while one name, US Bancorp, trades in 5-star territory. Of note this period was JP Morgan Chase, which currently trades at a discount to Morningstar analyst Eric Compton’s fair value estimate of $153.

JPMorgan Chase is arguably the most dominant bank in the United States. With leading investment bank, commercial bank, credit card, retail bank, and asset and wealth management franchises, JPMorgan is truly a force to be reckoned with. The bank’s combination of scale, diversification, and sound risk management seems like a simple path to competitive advantage, but few other firms have been able to execute a similar strategy. Even the best-managed banks are not immune to the occasional stumble—and being so large can have its downsides, including increased complexity, difficulty managing so many businesses, and higher capital requirements—but JPMorgan has managed to seemingly put all the pieces together in a more cohesive and less error-prone way than peers. With the importance of scale and technology only increasing for the banks, Compton thinks it will be hard for competitors to catch up.

JPMorgan benefits from an unrivaled combination of scale and scope within the United States, which has only become more important during the recent banking industry turmoil, but management is not resting. JPMorgan has gone through several iterations of investments to generate share gains and started its next cycle of expansion in 2022, with investments set to continue in 2023. While this is causing pressure on expenses today, Compton expects the bank will take incremental share across its different business lines for years to come and open up new avenues for growth.

For example, the bank has invested in Brazil and in the U.K., where the plan is to build out full banking services with a focus on digital platforms. JPMorgan is also hiring more financial advisors and bankers, and has made investments in its consumer ecosystem by acquiring a travel agency, a restaurant review platform, and a travel loyalty rewards tech platform. Over time Compton thinks these programs will help acquire more customers, but calculating the exact payoff is difficult and will take years of work, regardless. According to Compton, the bank’s acquisition of First Republic will be mildly accretive based on the balance sheet alone, with any incremental wealth management gains only improving the math.

Disclosure: Ari Felhandler has ownership in Microsoft. Rue Shetty and Eric Compton have no ownership interests in any of the securities mentioned above. We also note that Morningstar’s Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RZEYRM7QNVE63FSD5LZOBHHTTQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/AET2BGC3RFCFRD4YOXDBBVVYS4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IORW4DN3VVC3BC4JO7AQLSJTF4.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)