A New Frontier in Cancer Screening and Treatment

If liquid biopsy lives up to its potential, a paradigm shift in cancer detection is possible.

The nascent liquid biopsy market may expand rapidly in the next 5-10 years, and we think one area of expansion--early cancer detection--holds particular promise. We believe liquid biopsies (a noninvasive method of analyzing tumors using fluids such as blood) may induce a paradigm shift in when cancer is detected and then treated, enabling earlier-stage treatments, where survival rates are higher and treatment costs per patient are lower. In general, we see a host of incentives for end users, practitioners, and payers that could enable the widespread adoption of these tests, and we estimate the liquid biopsy market opportunity for early cancer detection could eventually exceed $70 billion in the U.S. alone, with global demand expanding that opportunity even further.

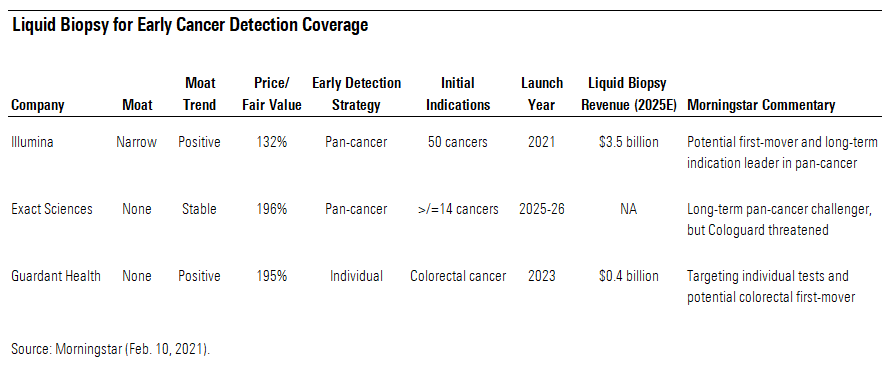

We cover three potential leaders in liquid biopsies for early cancer detection. Illumina ILMN, through its pending acquisition of Grail, could become the first mover and long-term leader in pan-cancer biopsies (for multiple cancers in one test); while the shares recently traded moderately above our fair value estimate, we view them as the most reasonably priced of the three potential liquid biopsy leaders we cover. Exact Sciences EXAS could challenge Illumina/Grail in pan-cancer in about five years, but before then, it is likely to face competition from liquid biopsies in its legacy business--a stool-based test for colorectal cancer--that keeps us cautious about the stock. As the potential first mover in liquid biopsy for colorectal cancer, Guardant Health GH could threaten Exact Sciences and other traditional screening methods, such as colonoscopy, in that indication, but its stock appears rich, given the uncertainty around that opportunity and its other liquid biopsies in development.

Detecting Cancer Earlier Could Save Lives and Money In the next five years, we think liquid biopsies could help transform the way people are screened and treated for cancer. Currently, liquid biopsies are primarily used for therapy selection in late-stage cancer patients and continue to emerge in disease monitoring after the cancer has already been treated. While those two indications should continue to grow substantially, we think the emerging market of using liquid biopsies to detect early-stage cancers has the potential to induce a paradigm shift in terms of when cancer is detected and then treated. Tests in development could help patients get treated at much earlier stages, when the cancer is still localized, which would be very important because detecting cancer at earlier stages could save lives and money.

The importance of catching cancers early in their development cannot be understated in terms of survival outlooks. A recent study in the United States highlighted that 89% of patients diagnosed in Stage 1 or 2 survived five years later, while only 21% survived in that time frame if diagnosed in Stage 4.

Preventing cancer from spreading around the body through early detection and early intervention should significantly reduce the cost of treating each cancer patient, too. The direct cost of treating early-stage cancer is typically much lower than treating late-stage cases because the interventions required to treat early-stage cancer patients are typically much simpler and often fewer in number relative to those required for late-stage patients.

In general, we think the potential to save money on cancer treatments could create incentives for payers in the U.S. and around the globe to encourage methods for detecting cancer at earlier stages, assuming the extra cost of detecting those cancers is lower than the treatment savings. Currently, just over $200 billion is spent on cancer care in the U.S., and that spending is projected to grow to nearly $250 billion by 2030.

Keeping cancer diagnosis levels static at 1.8 million people annually in the U.S., we calculate that shifting cancer care to earlier stages could reduce U.S. cancer care spending by $26 billion in a moderate scenario where 50% of diagnoses are in early stages (versus 31% today) and up to $70 billion in a high-impact cancer screening scenario in which over 80% of diagnoses are made in early stages.

Also, this merely reflects the treatment cost differentials between early- and late-stage diagnosis without considering the value of higher survival rates in terms of the saved lives. Such benefits could include work-related benefits and, of course, the more intangible benefits related to saving individual lives. For example, the value of a quality-adjusted life year in the U.S. is around $129,000, and one study recently estimated the present value of future earnings after cancer mortality at over $145 billion in the U.S. as of 2020. So in addition to potentially saving the broad healthcare system money through lower treatment costs, extending lives by detecting cancer at an earlier stage may create significant value beyond that for the economy and society as a whole.

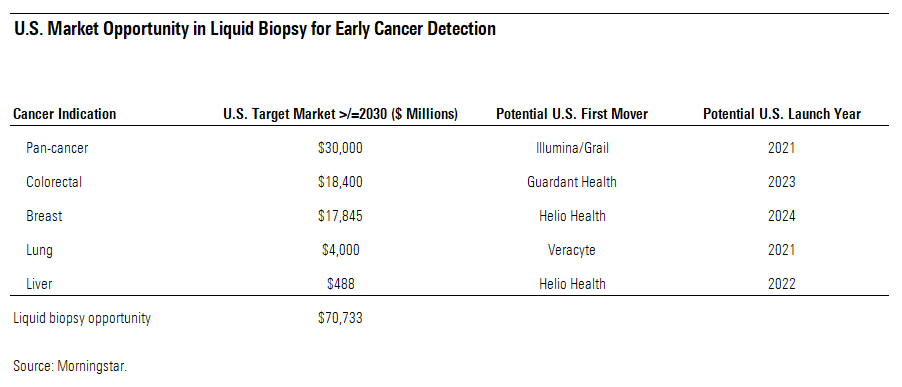

Individual Test Opportunities May Even Be Larger Than the Pan-Cancer Opportunity Liquid biopsy makers are targeting this early cancer detection opportunity in two major ways: cancer-specific tests in high-risk populations and pan-cancer tests to detect multiple types of cancer in a broader population of asymptomatic individuals. In the U.S., which we think will be the key driver of the liquid biopsy market for the next 5-10 years, we currently value the pan-cancer opportunity at roughly $30 billion annually. Cumulatively, the cancer detection opportunity may be even larger in individual indications as well; we estimate that the U.S. market opportunity in colorectal, breast, lung, and liver cancer indications could exceed $40 billion annually. We suspect that obtaining reimbursement in these individual indications may even be easier than in the pan-cancer opportunity, especially when existing screening guidelines and payment rates are already established for traditional screening programs in individual indications while there are not any equivalent tests in pan-cancer.

The colorectal cancer screening market represents a large opportunity for liquid biopsy makers, primarily because of the unattractiveness of existing screening methods, which contribute to about 40% of people skipping screenings as guided, even though the gold standard (colonoscopy) only requires a test every decade. We think this creates a large opportunity for liquid biopsy makers, and several companies (Guardant Health, Helio Health, and Freenome) aim to enter the U.S. in the next five years with liquid biopsies that boast similar sensitivity (cancer detection) and better specificity (lower false positive) metrics than the two key existing screening methods: colonoscopy (invasive) and Exact Sciences’ Cologuard (noninvasive). We estimate that the liquid biopsy market opportunity in the U.S. for the early detection of colorectal cancer could be worth about $18 billion of annual sales eventually.

We see some potential to improve on breast cancer screening as well. We think that over 40% of the population that is indicated for annual mammograms in the U.S. could probably benefit from a test that is not based on imaging because of dense breast tissue, which can reduce the sensitivity of mammograms significantly. Also, a liquid biopsy could benefit individuals who repeatedly generate suspicious mammograms each year to prevent the cascade of other potentially inconclusive imaging exams and/or expensive and invasive tissue biopsies. We estimate that the U.S. liquid biopsy opportunity in breast cancer could generate up to $18 billion in sales annually.

In addition, we see significant potential to improve on how high-risk and other individuals are screened for lung cancer through noninvasive techniques. Currently, in the high-risk population, just 6% adhere to regular screening guidelines. We think that low adherence rate may be related to some of the drawbacks associated with the high false-positive rate of the existing screening method that can lead to unnecessary and risky follow-up exams, which are tissue biopsies of the lung. Overall, we see a substantial opportunity in the U.S. but an even larger opportunity worldwide, especially in some emerging markets, where smoking rates remain higher. China looks like a large market opportunity, with two noninvasive pipeline candidates focused specifically on that market in the next five years. Liquid biopsy firms appear to be targeting two key markets initially--the U.S. ($4 billion) and China ($6 billion, according to Frost & Sullivan)--representing a roughly $10 billion combined opportunity.

We see significant potential to improve on how high-risk and other individuals are screened for liver cancer. Sensitivity on existing methods for high-risk individuals looks inadequately low, and the U.S. Food and Drug Administration appears to recognize that situation with the grants of breakthrough status for two liquid biopsies in development from Helio Health and Genetron GTH, respectively. Overall, we see a moderate opportunity for liver cancer screening in the U.S. but an even larger opportunity worldwide, especially in China, which has a large population of hepatitis B and C carriers who are at high risk of liver cancer. Considering that very large potential, it is not surprising that Helio Health and Genetron are aiming to enter China first, rather than the U.S. We estimate that the liver cancer screening market opportunity is around $500 million annually in the U.S., but the Chinese market could be much larger. China has over half of the world’s liver cancer cases, and according to Frost & Sullivan, China’s liver cancer screening market could reach a $7 billion opportunity by 2023, assuming about 30% of the 120 million of hepatitis B or C carriers in that country are tested annually at $200 per test.

Pan-Cancer Tests Could Change Paradigm While large opportunities exist in individual tests, one of the biggest problems in detecting cancer is that that most cancers currently lack regular screening programs, especially outside of high-risk populations. In the cancers that lack regular screening methods for the early detection of cancer, diagnosis often happens when there are active symptoms, which are typically only detectable in later stages, when the cancer has already spread to other parts of the body. Because of the lack of regular screening options outside of only a very small number of cancers, it is not surprising that 71% of cancer-related deaths in the U.S. are in cancers with no recommended screening guidelines for the broad population. We think this dynamic could pave the way for a variety of new tests, including a pan-cancer liquid biopsy that screens for many different types of cancers in just one blood draw.

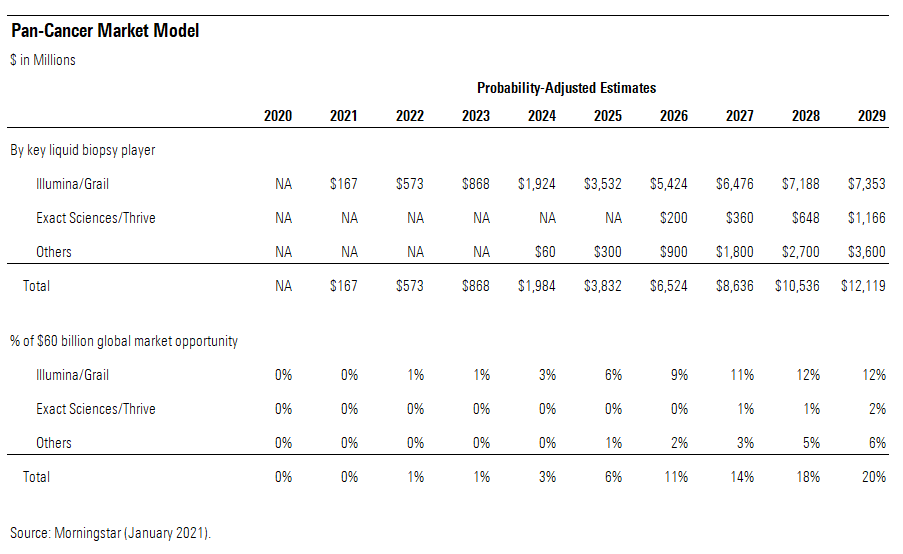

Successful expansion of a pan-cancer test could significantly change the paradigm of detecting and treating cancer, and Grail (pending acquisition by Illumina) looks set to introduce such a test in 2021. Uncertainty surrounds the potential demand and pricing, though. Also, with several shots being taken on goal, that first mover may not be guaranteed dominance in the very long run. However, the Illumina/Grail test metrics look tough to beat currently, and we think this test should have a strong growth trajectory during the next 10 years.

We estimate that the pan-cancer testing market could be very large, at roughly $30 billion in the U.S. and $30 billion outside the U.S. as well. While we suspect the realization of that target market opportunity will land well outside our 10-year explicit forecast period, we recognize the large potential. In the U.S., we think adding a pan-cancer test to annual physical exams could be a reasonable growth strategy during the next 10 years. With about 1 in 5 American adults (an estimated 50 million) getting a physical each year, the U.S. market opportunity is about $30 billion by our calculations at the initial price of $600 per test. Similar to other medical technology markets, we think the non-U.S. markets could roughly equal that U.S. opportunity in the long run.

Opportunities and Threats If Liquid Biopsy Meets Its Potential If liquid biopsy technology for early cancer detection expands significantly, a spectrum of opportunities and threats could influence the financial prospects across several areas of the healthcare industry. Positively, we see significant opportunities for companies focused on introducing liquid biopsies to detect early-stage cancers. Additionally, the expansion of liquid biopsy technology in early cancer detection could have indirect beneficiaries, including the reference laboratories.

Negatively, the widespread adoption of liquid biopsies for early cancer detection could affect tools used in the early detection of cancer (such as mammogram equipment or colonoscopy endoscopes) and tissue biopsy-related tools. More indirectly, if cancer is increasingly diagnosed at earlier stages, some companies may see reduced demand for some of their products and services, such as hospitals where surgeries on late-stage cancer patients are performed.

Companies That Could Benefit The most obvious potential winners in the expansion of liquid biopsy tools are the testmakers themselves. Illumina is the only liquid biopsy-focused company we cover that operates with a moat (narrow), but that moat primarily relates to the legacy genome sequencing equipment and consumables business, where its tools are the current standard. That legacy business has both intangible assets and switching costs as moat sources, and we think Illumina will remain competitively advantaged because of its legacy business for at least the next 10 years. The liquid biopsy tools that Illumina plans to acquire in the Grail deal could add to its intangible asset moat source, but we really do not see any significant switching costs associated with this diagnostic test pipeline currently.

Therefore, we think Illumina will need to continue to innovate to attract demand in pan-cancer liquid biopsies to beat potential competition in the long run. Fortunately for Illumina, the company looks unlikely to face any significant competition in the pan-cancer indication within the next five years, and we think it will be very difficult for potential pan-cancer tests in development to match the Grail test in terms of the number of cancer indications tested for in one blood draw and in terms of sensitivity and specificity even within the next 10 years. Beyond that, our confidence in its ability to remain ahead of the competition declines significantly, and we think the potential for disruptive technology risk will be high for Illumina and other liquid biopsies in the very long term.

The uncertainties around the sustainability of economic profits based on diagnostic tests like these that have limited switching costs contribute to our no-moat views for Exact Sciences and Guardant Health, as well. However, Guardant’s pipeline of individual liquid biopsies contributes to a positive moat trend for the next five years. Exact Sciences’ pan-cancer test opportunity will likely hit just outside the five-year period that determines our moat trend. Additionally, Exact Sciences’ legacy operations (primarily Cologuard, a stool-based test for colorectal cancer screening) could face threats from new liquid biopsy entrants to that market in the next several years.

On the basis of our current assessment of these companies’ valuations, we think the market is very exuberant about the liquid biopsy opportunity, so investors focused on value may have to pick and choose their entry points. Currently, Illumina appears to offer the best relative value of the three companies we cover, and even that valuation may only be right for certain investors, particularly those focused on growth at a reasonable price.

Beyond our explicit five-year forecast, we expect the emergence of liquid biopsies to increase esoteric test volume enough to accelerate total volume growth by about 150 basis points for the reference labs, which is generally positive as greater volume for the largest independent labs translates into operating leverage gains. Considering that liquid biopsies fall into the larger category of esoteric, higher-margin complex tests, this development could also shore up margins. However, the specific margin for liquid biopsies will depend on what the assay maker charges for the test as well as the reimbursement levels that payers set.

Historically, the gap between the two prices offers the labs margins that are far more attractive than those on routine, more commodified tests. Nonetheless, the higher profitability of esoteric tests also leaves them more vulnerable to the threat of cuts as payers seek to hold down healthcare spending.

The other twist for reference labs is the possibility that they might internally create their own or collaborate with other in vitro diagnostics makers to develop comparable liquid biopsies. This often depends on reimbursement rates and the technical aspects of the underlying tests. However, because we’re still at the very early stages of establishing reimbursement for liquid biopsy and adoption has yet to take off, we view any direct entry from labs as a very long-term opportunity.

Companies That Could Face Threats Several areas of the healthcare industry could be negatively affected in the long run if there is strong adoption of liquid biopsy technology. Specifically, tools used in the early detection of cancer (such as mammogram equipment or colonoscopy endoscopes) may face direct competition from liquid biopsies. Indirectly, if cancer care is increasingly diagnosed at earlier stages, some companies may see reduced demand for their services or therapies, including tissue biopsy-related tools. Also, we think hospitals and oncology-focused biopharmaceutical companies may face medium threats, although some of those threats could be offset by opportunities, especially in biopharmaceuticals.

/s3.amazonaws.com/arc-authors/morningstar/27df33e4-c5eb-4dc8-805e-babc7c688b65.jpg)

/s3.amazonaws.com/arc-authors/morningstar/25f6cec7-4aec-4c24-9c04-68c62140ab65.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6A6R4SGLDNGMXHAH3K2CIQTF3Q.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PVJSLSCNFRF7DGSEJSCWXZHDFQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F5UMFVVKMVFRPGGUY4LONIK6OY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/27df33e4-c5eb-4dc8-805e-babc7c688b65.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/25f6cec7-4aec-4c24-9c04-68c62140ab65.jpg)