Is Occidental Petroleum a Buy, a Sell, or Fairly Valued After Earnings?

With stronger production, here’s what we think of Occidental stock

Occidental Petroleum OXY reported earnings on Nov. 8. Here is Morningstar’s take on Occidental’s results and the outlook for its stock.

Key Morningstar Metrics for Occidental Petroleum

- Fair Value Estimate: $61.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Very High

What We Thought of Occidental Petroleum’s Earnings

- Occidental performed better than expected almost across the board. Higher-than-anticipated production and improved operating cost efficiency facilitated strong, consensus-beating earnings and cash flow generation for the quarter.

- North American production remains elevated, but growth has decelerated over the last several months. We don’t anticipate any material changes in activity over the next few months due to standard seasonal impacts, as well as E&P’s prioritization of capital discipline. Occidental continues to focus on cost efficiency, which should pad profit margins moving forward, but we don’t expect material gains relative to competitors.

- Occidental’s oil and gas business delivered 1,220 thousand barrels of oil equivalent per day, exceeding the midpoint and top end of guidance by 2.8% and 1.1%, respectively. Following another quarter of strong performance, management has once again raised its full-year production outlook by 1% to 1,221 mboe/d at the midpoint. We maintain our no-moat rating and $61 fair value estimate following these results.

- Production activity was strong across domestic assets, especially in the DJ and Delaware basins—two key drivers behind management’s guidance raise. Improving well productivity in the Permian will also facilitate increased production through year-end. Well recoveries in the region are still tracking ahead of last year’s vintage on a cumulative basis, though the uptick approximately matches increased lateral lengths. Given the diminishing returns typically exhibited by longer laterals, we view the DJ basin as the larger driver behind Occidental’s upside potential moving forward.

- Rebounding production activity in the Gulf of Mexico also contributed positively to Occidental’s third-quarter performance. A portion of planned maintenance originally slated for the third quarter was pushed to the fourth, and favorable operating conditions facilitated higher-than-expected uptime. Oil production therefore increased by 11,000 barrels per day quarter over quarter, and we expect the region will maintain improved production through year-end.

Occidental Petroleum Stock Price

Fair Value Estimate for Occidental Petroleum

With its 3-star rating, we believe Occidental’s stock is fairly valued compared with our long-term fair value estimate.

We assume oil (WTI) prices in 2023 and 2024 will average $79/bbl and $79/bbl, respectively. In the same periods, natural gas (Henry Hub) prices are expected to average $2.81 per thousand cubic feet and $3.63/mcf. Terminal prices are defined by our long-term midcycle price estimates (currently $60/bbl Brent, $55/bbl WTI, and $3.30/mcf natural gas).

Our fair value estimate is $61 per share. This corresponds to enterprise value/EBITDA multiples of 5.5 times and 4.8 times for 2023 and 2024, respectively. Our production forecast for 2023 is 1.22 million barrels of oil equivalent per day, which is consistent with guidance. That drives 2023 EBITDA to $13.9 billion, and we expect free cash flow to reach $5.9 billion in the same period. Our 2024 estimates for production, EBITDA, and free cash flow are 1.24 mmboe/d, $15.8 billion, and $6.9 billion, respectively.

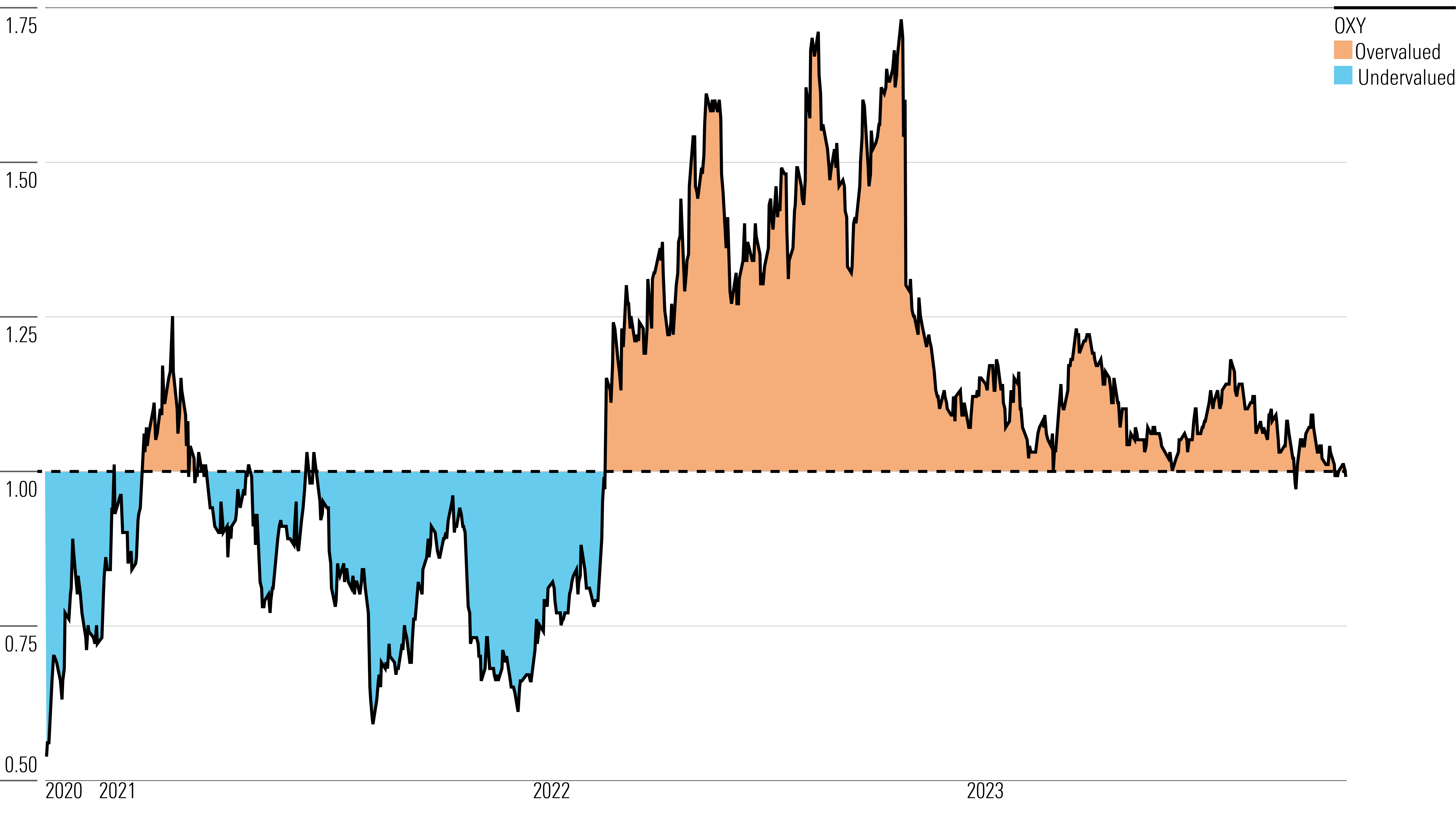

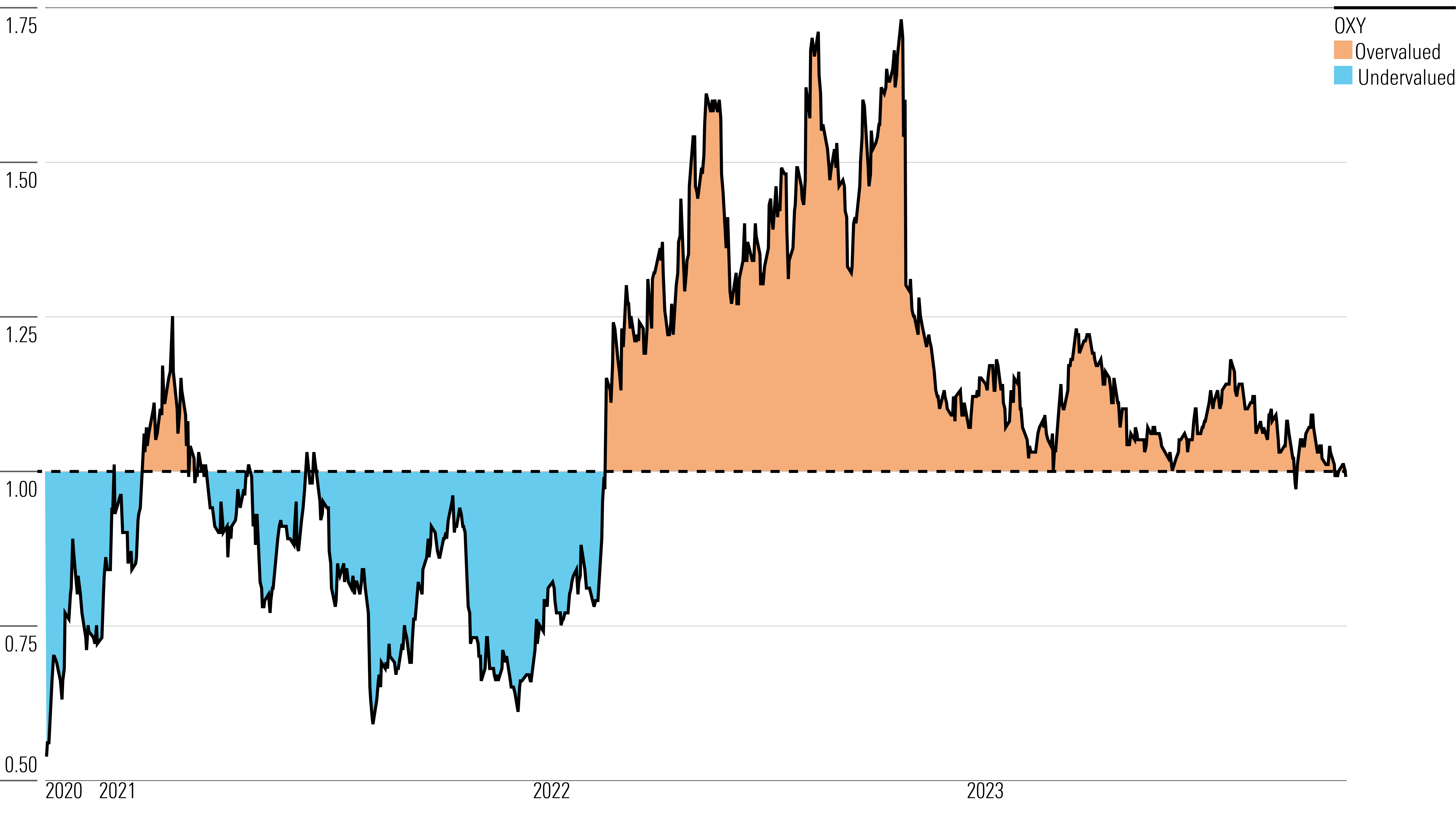

Occidental Petroleum Historical Price/Fair Value Ratio

Read more about Occidental’s fair value estimate.

Economic Moat Rating

The upstream oil and gas industry realized fairly recently that investors are more interested in consistent and stable returns than breakneck production growth. Most firms are now committed to conservative capital programs with low reinvestment rates and generous shareholder distributions. But a handful of producers were doing this long before the rest of the industry hopped on the bandwagon, and Occidental was one of them. The firm generated substantial excess returns on invested capital from 2008 to 2014.

However, this track record was upended by the collapse in global crude prices at the end of 2014, and economic profits evaporated the following year. Like its peers, Occidental eventually adapted by improving efficiency and using new technology to reduce costs. But right when profitability was recovering, the company jumped into a large and expensive corporate acquisition in 2019, which took several years to digest. The target, Anadarko Petroleum, did not itself warrant a moat, and Occidental paid a substantial takeover premium. We believe the firm is on the cusp of consistently earning its cost of capital again, but the margin of safety is too thin to award a moat at this time.

What’s more, like all E&P firms, the firm is exposed to a range of potential environmental, social, and governance issues that could hurt its ability to generate strong returns. The most significant exposures are greenhouse gas emissions (both from extraction operations and downstream consumption), and other emissions, effluents, and waste (primarily oil spills).

Occidental Petroleum Historical Price/Fair Value Ratio

Read more about Occidental’s fair value estimate.

Risk and Uncertainty

As with most E&P firms, a deteriorating outlook for oil and natural gas prices would pressure Occidental’s profitability, reduce cash flows, and drive up financial leverage. An increase in federal taxes or a revocation of the intangible drilling deduction U.S. firms enjoy could also affect profitability and reduce our fair value estimates.

In addition to to reputational threat posed by material ESG exposure, these issues could force climate-conscious consumers away from fossil fuels in greater numbers, resulting in long-term demand erosion. Climate concerns could also trigger regulatory interventions, such as fracking bans, drilling permit suspensions, and perhaps even direct taxes on carbon emissions.

Due to the current volatility of oil markets, we assign Occidental a Very High Uncertainty Rating.

Read more about Occidental’s risk and uncertainty.

OXY Bulls Say

- Occidental has a dominant position in the Permian Basin, which is the cheapest source of production in the United States and is expected to be a major growth engine in the next few years.

- Occidental’s conventional assets in the Gulf of Mexico and the Middle East complement its shale operations nicely by generating stable cash flows from assets with a much lower base decline rate.

- The low-carbon ventures segment is synergistic with Occidental’s chemical business, and the firm’s EOR portfolio holdings and expertise give it a natural advantage in carbon capture.

OXY Bears Say

- Though the Permian wells exhibit high initial production rates, they also decline very quickly.

- The Anadarko acquisition bolstered Occidental’s Permian footprint but left it with other assets it didn’t really want, such as its WES Midstream stake and North Africa operations.

- Occidental will have to share the spoils from its ambitious carbon capture plans, and since it isn’t providing financing or engineering, it will have to give away a sizeable working interest.

This article was compiled by Tom Lauricella.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)