Is the Housing Market Starting to Rebuild?

We share the cautious optimism of America's homebuilders.

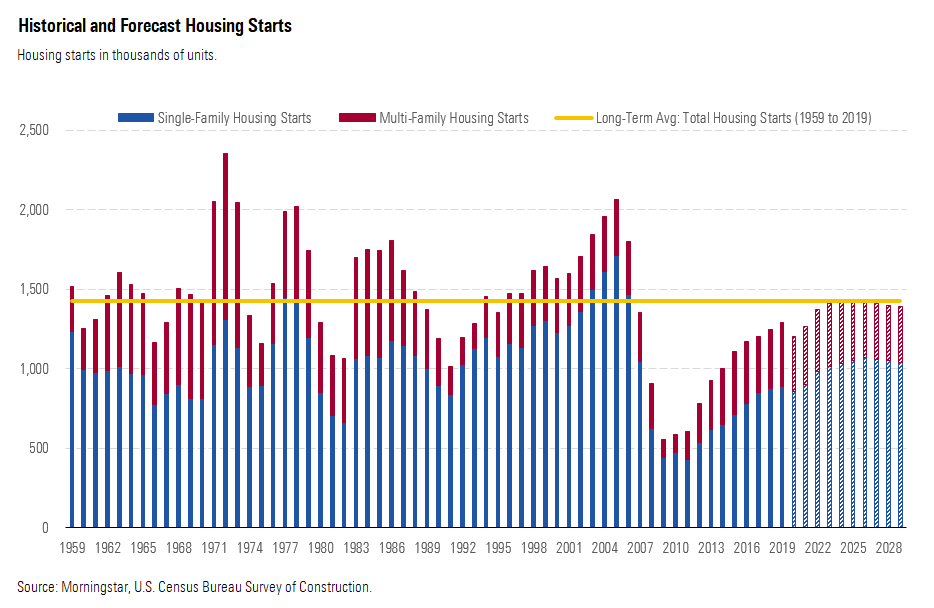

The coronavirus pandemic sapped the energy from a stellar start for 2020 homebuilding. Single-family starts were down about 20% in April and May, and multifamily construction fell by more than a third. Even though there should be a sequential improvement in June, it will be no picnic. As we enter the third quarter, however, we are cautiously optimistic about a gradual rebound in homebuilding.

Rock-bottom mortgage rates, a sharp rebound in homebuilder confidence, and recovering permit issuance are all signs that we may be passing the bottom. Mortgage rates sitting at record lows have brought ownership within reach for many Americans, especially after considering costly rental rates. This financial dynamic should support single-family home demand.

Supply conditions look similarly supportive. Limited vacant homes are supporting home prices despite the economic slowdown. Stable prices have allowed for a rapid rebound in homebuilder confidence, jumping to 58 (expansionary) in June from a low of 30 in April. Also, seasonally adjusted permits rose 14% from April to May, which is a leading indicator for near-term housing starts. While neither measure has returned to early 2020 levels, they suggest we are returning to a more normal trajectory.

We think these factors support our above-consensus forecast of just over 1.2 million new homes built in 2020. However, plenty of risks remain, and new-home construction is not yet out of the woods. Continuing unemployment stands at 19.5 million as of mid-June, and extra federal unemployment benefits are set to expire at the end of July, unless Congress agrees on an extension. Should those benefits dry up, mortgage delinquencies could rise sharply, leading to a pullback in financing availability. In the U.S. South, builders and buyers are contending with a sharp spike in coronavirus cases that have unwound reopening plans. Conditions for homebuilding remain delicate.

Lennar Is Our Top Homebuilder Pick Lennar LEN management has placed a greater focus on expanding its entry-level communities, which should bode well for the company's growth prospects. Entry-level homes now account for approximately 40% of Lennar's homebuilding business, and we expect its entry-level mix to continue to expand.

Lennar is reducing its exposure to owned land, which should improve returns on invested capital and derisk its balance sheet. Lennar has entered into agreements with regional land developers, which will increase access to optioned land. Management has said that these relationships will allow Lennar to acquire property at a discount to its market value or participate in land development profits. Optioned land currently accounts for 30% of Lennar’s land position, and management expects to improve this ratio to 40% within two years.

Lennar's investment in its multifamily business, which is relatively young, distinguishes it from many other homebuilders and should create significant shareholder value down the road. Lennar began its multifamily strategy as a merchant builder that builds, stabilizes, and sells rental properties. Through the creation of Lennar Multifamily Venture, the company will use internal and third-party capital to develop and hold its income-producing rental assets. We think this strategy will reduce the company's cyclicality and strengthen cash flows as the business matures. Brian Bernard, CFA, CPA

Management Sets AvalonBay Apart We have not materially changed our fair value estimates for the residential real estate investment trusts we cover, given that we view the coronavirus pandemic as having a material impact only on their near-term results. The names all sold off in March and April as uncertainty quickly grew about the economy and the fundamentals of these companies. However, the early results for April and May lead us to believe that the short term may not be as bad as previously feared. Additionally, while the effects of the pandemic and the economic recession that it has triggered might linger through 2021, we have not materially altered our long-term outlook for the fundamentals of these companies. We believe that interest rates are likely to remain historically low for some time, and the high dividend yields provided by REITs will continue to be attractive to income-oriented investors.

We believe that long-term investors should focus on the eventual recovery of the residential names and take the recent sell-off as an opportunity to invest. While all of the apartment REITs are currently trading at attractive discounts to our fair value estimates, we recommend AvalonBay Communities AVB because of its exemplary stewardship. Management’s experience in creating shareholder value coming out of the prior recession gives us confidence that AvalonBay will show discipline in managing its balance sheet and find opportunistic acquisitions to expand the company.

AvalonBay owns and operates high-quality multifamily buildings in urban and suburban coastal markets with demographics that allow the company to maintain high occupancies and strong rent growth. The company regularly recycles capital by selling noncore assets or exiting markets and using the proceeds for its development pipeline or acquisitions with promising growth prospects, a sound strategy that continues to produce strong returns. Kevin Brown

/s3.amazonaws.com/arc-authors/morningstar/1d297fbb-3ca6-4b00-8c51-21e8e65e343e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NYUEHSFI4BDCJPQZJ76HH4PKSM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/L4B22R7UFVDBJN2ZYJWBSMCIJA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZU2N7Y2TDFFL3EAFRGYANDSBJY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1d297fbb-3ca6-4b00-8c51-21e8e65e343e.jpg)