Is Groupon Stock a Buy, a Sell, or Fairly Valued After Earnings?

With a decline in billings and a planned cash raise, here’s what we think of Groupon’s stock.

Groupon GRPN reported earnings on Nov. 10. Here is Morningstar’s take on Groupon’s results and the outlook for its stock.

Key Morningstar Metrics for Groupon

- Fair Value Estimate: $17.50

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Very High

What We Thought of Groupon’s Earnings

- While there were some early indications of a turnaround, such as a significant slowdown in the year-over-year decline of gross billings, Groupon continued to burn cash during the quarter, further increasing its risk of becoming cash-strapped.

- For this reason, the firm announced it will raise nearly $100 million through the combination of a fully backstopped rights offering and the sale of some of its stake in SumUp.

- Given the rights offering, management also provided fourth-quarter guidance and some color regarding 2024, most of which was in line with our projections. After considering the dilutive impact of the rights offering, we lowered our fair value estimate to $17.50 from $19 per share.

- For the second consecutive quarter, the firm had negative free cash flow, which reduced its cash balance from $118 million to $86 million at the end of the second quarter.

- Groupon is likely to improve its financial flexibility, as it expects to raise around $80 million from the rights offering, which is backstopped by its largest shareholder, Pale Fire Capital.

- The sale of a portion of the firm’s holding in SumUp will be for around $19 million.

- Lastly, the company expects to generate free cash flow not only in the fourth quarter but also in the full year 2024.

Groupon Stock Price

Fair Value Estimate for Groupon Stock

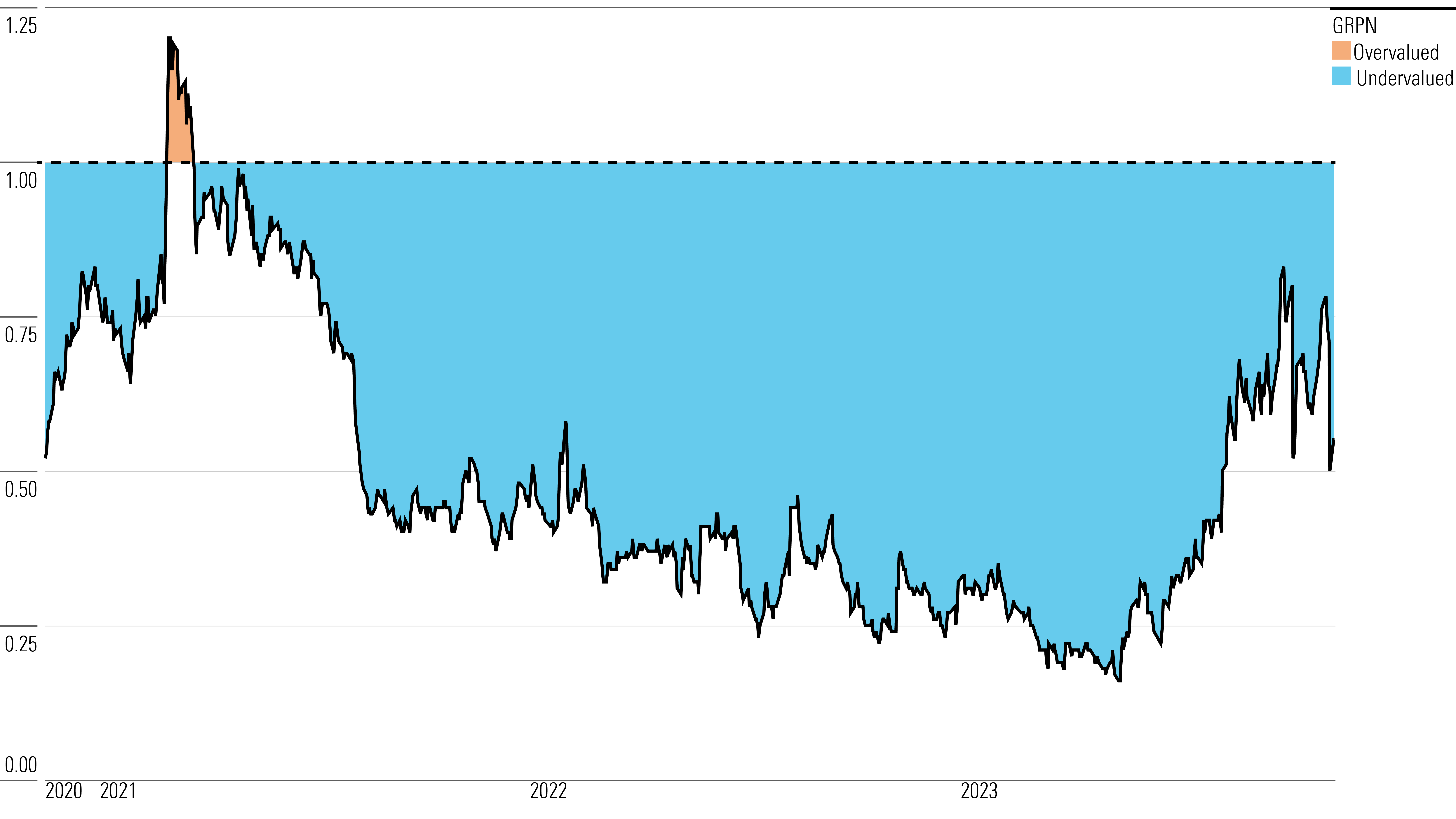

With its 4-star rating, we believe Groupon’s stock is undervalued compared with our long-term fair value estimate.

Our fair value estimate for Groupon stock is $17.50 per share, representing a 2024 enterprise value/sales multiple of 1.6. After the discontinuation of the goods business, we have modeled a return to consistent local and travel revenue growth in 2025-27, averaging nearly 4% per year, driven by the firm’s investment in acquiring new customers, enhanced design of its app, and growth in overall e-commerce on mobile devices. We expect operating leverage beginning in 2024, mostly due to growth in high-margin local and travel revenue, lower headcount, completion of the cloud transition, and ongoing cost control.

We project that Groupon’s operating margin can expand to nearly 14% by 2027. With a successful turnaround likely in 2025, uncertainty remains about whether the firm can effectively compete with behemoths that have much larger user bases, such as Meta Platforms META and Alphabet GOOGL, which are attracting more local marketing ad dollars.

Groupon Historical Price/Fair Value Ratio

Read more about Groupon’s fair value estimate.

Economic Moat Rating

We do not expect Groupon to consistently generate excess returns on capital and in turn develop an economic moat, what with the size-limited and high-touch local markets that it targets. It’s difficult for the company to develop durable moat sources like a network effect, customer switching costs, or a cost advantage.

In simple terms, Groupon provides consumers with daily deals (in the form of online vouchers) from local merchants. Groupon’s online discounts cover a variety of services, including restaurants, health, beauty and fitness, and home and garden. Groupon also works with some national merchants, and its discounts cover various travel offers. Groupon’s average take rate on the purchase and/or usage of the vouchers, which represent less than half of the firm’s revenue, is 30%-35%.

For example, a salon may normally charge $40 for a haircut but offer a daily deal of $20 with a Groupon voucher. Groupon may capture up to $6 (or 30%) of the price of the voucher, remitting the rest to the salon. Local merchants enter into these agreements with Groupon in the hopes of acquiring customers and repeat business in the long run, essentially treating the voucher as a marketing or advertising cost.

Read more about Groupon’s moat rating.

Risk and Uncertainty

Our Morningstar Uncertainty Rating for Groupon is Very High. The firm is in a crowded space with fierce competition from much larger companies with significantly more users and access to much more capital. While there have been some positive signs since Groupon launched its restructuring program, it is still uncertain whether this will bear fruit in the long run.

The company is maintaining its leadership in the daily deals space against smaller companies, but since the barriers to entry remain low (and since the line between daily deals, e-commerce, and online marketing is becoming more blurred), we think larger players such as Amazon AMZN and Alphabet will have significant leverage. The company faces more risk, as it has moved into additional crowded markets such as travel, and the returns generated from those markets are more likely to be minimal.

Read more about Groupon’s risk and uncertainty.

GRPN Bulls Say

- Groupon should maintain its first-mover advantage as it leverages its current relationships with local merchants to provide more attractive offerings for consumers.

- As more local businesses become tech-savvier, they may need less hand-holding from Groupon’s salesforce, which could lead to lower costs for the company.

GRPN Bears Say

- Groupon has needed to continuously spend to acquire customers and build relationships with merchants, and this spending may limit its profitability.

- If merchants become disenchanted with Groupon’s daily deals, they may either flock to competitors or push back against its high take rate.

- Operating leverage, if any, is only for the short term, as Groupon will have to keep spending more to acquire new customers to increase transactions and return on investment for merchants.

This article was compiled by Tom Lauricella.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZSPP5AYAJB2RIRVFE2XR23GUQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NYUEHSFI4BDCJPQZJ76HH4PKSM.jpg)