Is Alphabet Stock a Buy, a Sell, or Fairly Valued After Earnings?

With growing advertising revenue and continued strength in the cloud business, here is what we think of Alphabet’s stock.

Alphabet GOOGL released its first-quarter earnings report on April 25. Here’s Morningstar’s take on what to think of Alphabet’s earnings and stock.

Key Morningstar Metrics for Alphabet

- Fair Value Estimate: $154

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

What We Thought of Alphabet’s Q1 Earnings

We are maintaining our $154 fair value estimate for Alphabet following first-quarter results. We were impressed by:

- Google Search’s advertising revenue growth.

- Continuing strength in the cloud business, which is making headway toward profitability, likely next year.

- Consolidated margin expansion for the first time in three quarters.

- The latest authorized share buyback.

However, YouTube Shorts continues to pressure overall YouTube advertising revenue. Economic uncertainty pushed network ad revenue lower. Plus, increasing competition on the artificial intelligence side—whether in the cloud or the advertising segment—is forcing the firm to keep investing in enhancing computing capabilities. Nevertheless, we believe Alphabet has the necessary technology and talent to successfully battle AI competitors, especially on the search side.

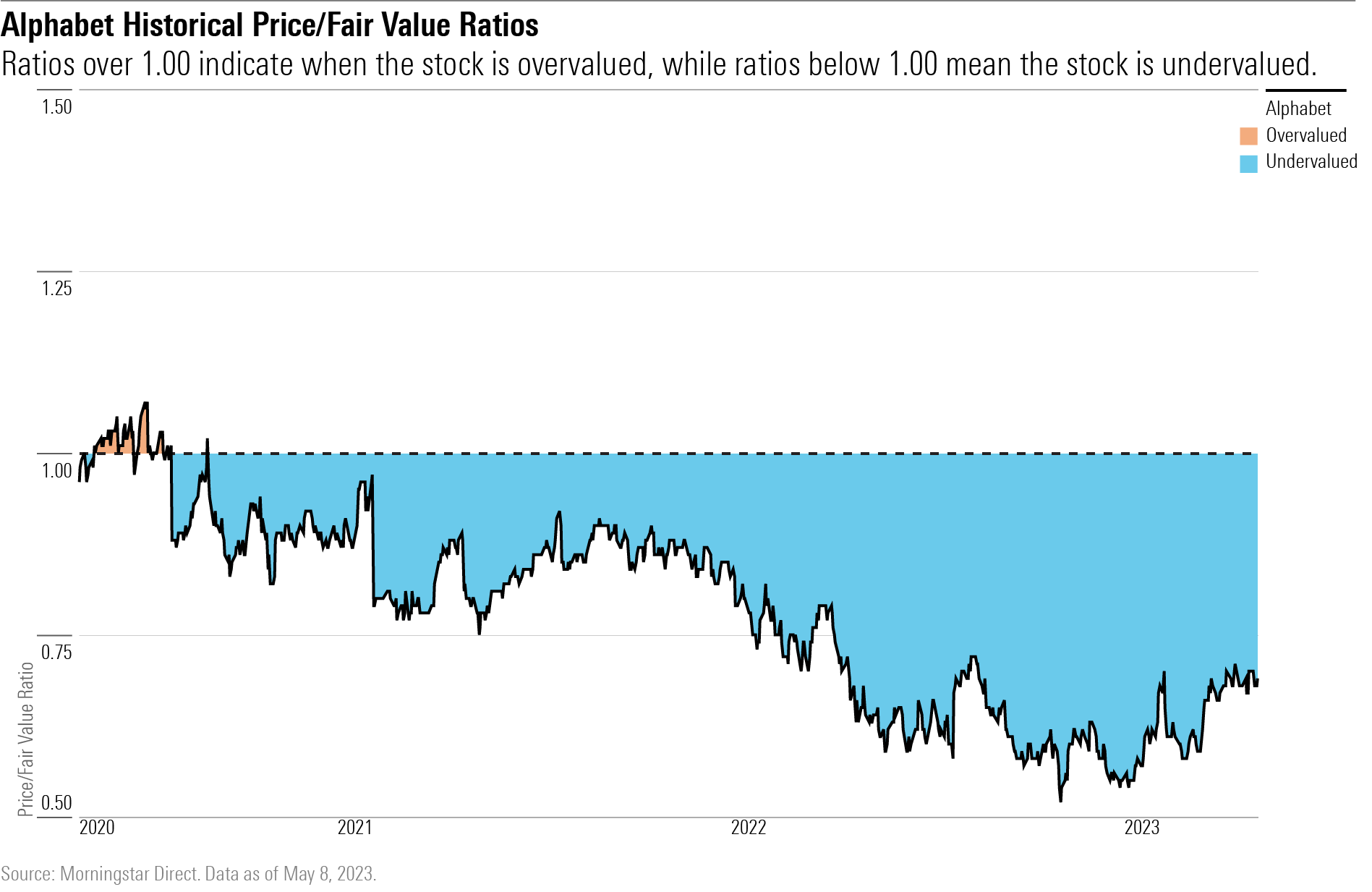

Overall, we believe Alphabet is well positioned to benefit from an improving economic climate, which will accelerate ad spending. On the bottom line, while capital expenditure will not go down this year, the firm’s focus on efficiency should help expand margins beginning in 2024. We continue to view this wide-moat firm as undervalued.

Fair Value Estimate for Alphabet

At a 4-star rating, we believe Alphabet stock is undervalued when compared with our fair value estimate.

Our fair value estimate is $154 per share. We expect advertising revenue to remain over 70% of Alphabet’s total revenue, driven by continuing growth in overall digital ad spending, more specifically in search, video, and mobile. We believe Google will continue to gain traction in the cloud market (20% annual revenue growth through 2027). We model 51% and 54% gross margins for 2023 and 2024, respectively, compared with 55% in 2022, due to the higher cost of YouTube content and higher head count. We expect the growth of other operating expenses to decelerate in the coming years mainly because of much slower growth in head count, helping offset gross margin pressure. As a result, we expect the operating margin to increase to above 25% in 2027 from 21% in 2023.

Read more about Alphabet’s fair value estimate.

Economic Moat Rating

We assign Alphabet a wide moat rating, thanks to durable competitive advantages derived from the company’s intangible assets, as well as the network effect. We believe Alphabet holds significant intangible assets related to overall technological expertise in search algorithms and machine learning, as well as access to and accumulation of data that is deemed valuable to advertisers. Google has the world’s most widely used search engine, and such a large and growing user base has created a network difficult to replicate, in our view. We also believe that Google’s brand is a significant asset; “Google it” has become eponymous with searching, and regardless of actual technological competency, the firm’s search engine is perceived as being the most advanced in the industry. Based initially on its technology, Google has successfully increased its users’ dependence on its products to keep transforming the usage of those products into something habitual. In our opinion, Alphabet’s network effects are derived mainly through its Google products such as Search, Android, Maps, Gmail, YouTube, and more. With more usage, more data about users’ behavioral interests is gathered, analyzed, and applied to rank ads more accurately based on their relevance and click-through rate probability. Businesses and advertisers pay Google to place their search ads, targeted based on users’ locations and previous searches, within Maps’ search results list and directly on the map.

Read more about Alphabet’s moat rating.

Risk and Uncertainty

Our Morningstar Uncertainty Rating for Alphabet is High, primarily the result of high dependency on continuing online advertising growth. The firm’s high dependence on user behavior data also represents an environmental, social, and governance risk, mainly due to the risk of data privacy and security, which could affect not only Google’s advertising business but also users’ trust in the firm’s products as data can be misused. Google faces antitrust pressure and various claims and investigations brought by different companies and regulatory agencies regarding search bias and its overall market dominance in online advertising.

Read more about Alphabet’s risk and uncertainty.

GOOGL Bulls Say

- As the number of online users and usage increase, so will digital ad spending, of which Google will remain one of the main beneficiaries.

- Android’s dominant global market share of smartphones leaves Google well positioned to continue generating top-line growth as search traffic shifts to mobile from desktop.

- The significant cash generated from the Google search business allows Alphabet to remain focused on innovation and the long-term growth opportunities that new areas present.

GOOGL Bears Say

- There is little revenue diversification within Alphabet, as it remains heavily dependent on Google and the state of the search ad space.

- Alphabet is allocating too much capital toward high-risk bets, which face a very low probability of generating returns.

- Google’s dominant position in online search is not maintainable, as more companies and regulatory agencies are contesting the methods through which the company has been extending its leadership.

This article was compiled by Maggie Guidici.

Get access to full Morningstar stock analyst reports, along with data and tools to manage your portfolio through Morningstar Investor. Learn more and start a seven-day free trial today.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)