Infrastructure Funds Take Their Turn in the Spotlight

These funds provide exposure to many timely investment themes, including sustainability, the U.S. infrastructure spending bill, and inflation protection.

For the first time in a while, infrastructure funds are in the spotlight. These funds provide exposure to many timely investment themes, including the additional planned spending from the recently passed U.S. infrastructure bill, the transition to a lower-carbon world, and inflation protection.

For example, Global X U.S. Infrastructure Development ETF PAVE seeks to provide exposure to infrastructure spending in the United States by investing in companies that provide the materials, equipment, or expertise to build and repair the domestic transportation infrastructure. But other funds, like Lazard Global Listed Infrastructure GLIFX, focus on companies that own regulated utilities or assets (such as toll roads) that may have long term, inflation-linked contracts. Its goal is to provide steadier returns relative to global equities, as well as inflation protection. Nuveen Global Infrastructure FGIYX follows a similar approach as Lazard but expands the definition to include energy infrastructure (pipelines). IShares Global Infrastructure's IGF scope is similar to that of the Nuveen fund, but it is not actively managed and instead tracks a modified, cap-weighted infrastructure index.

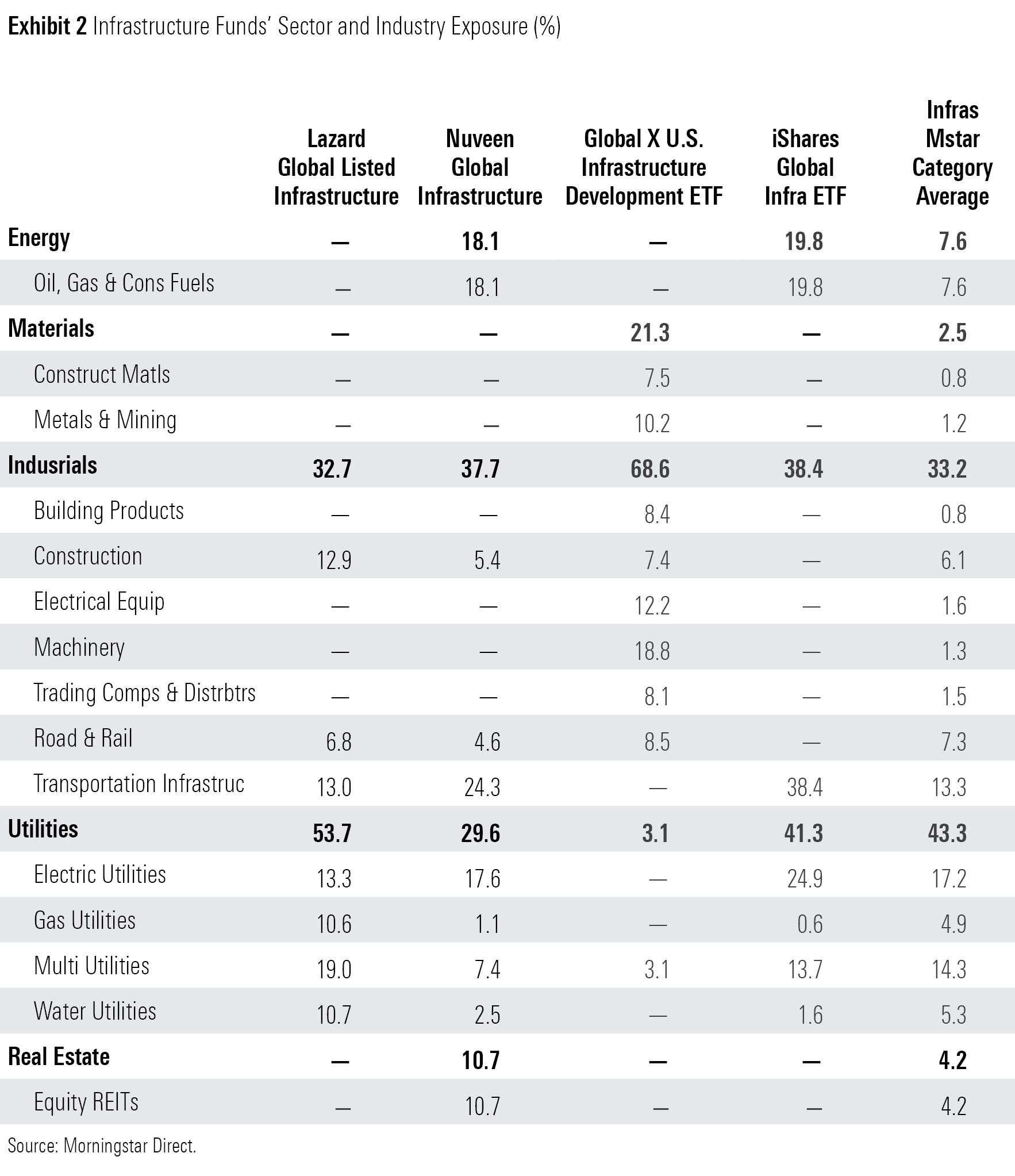

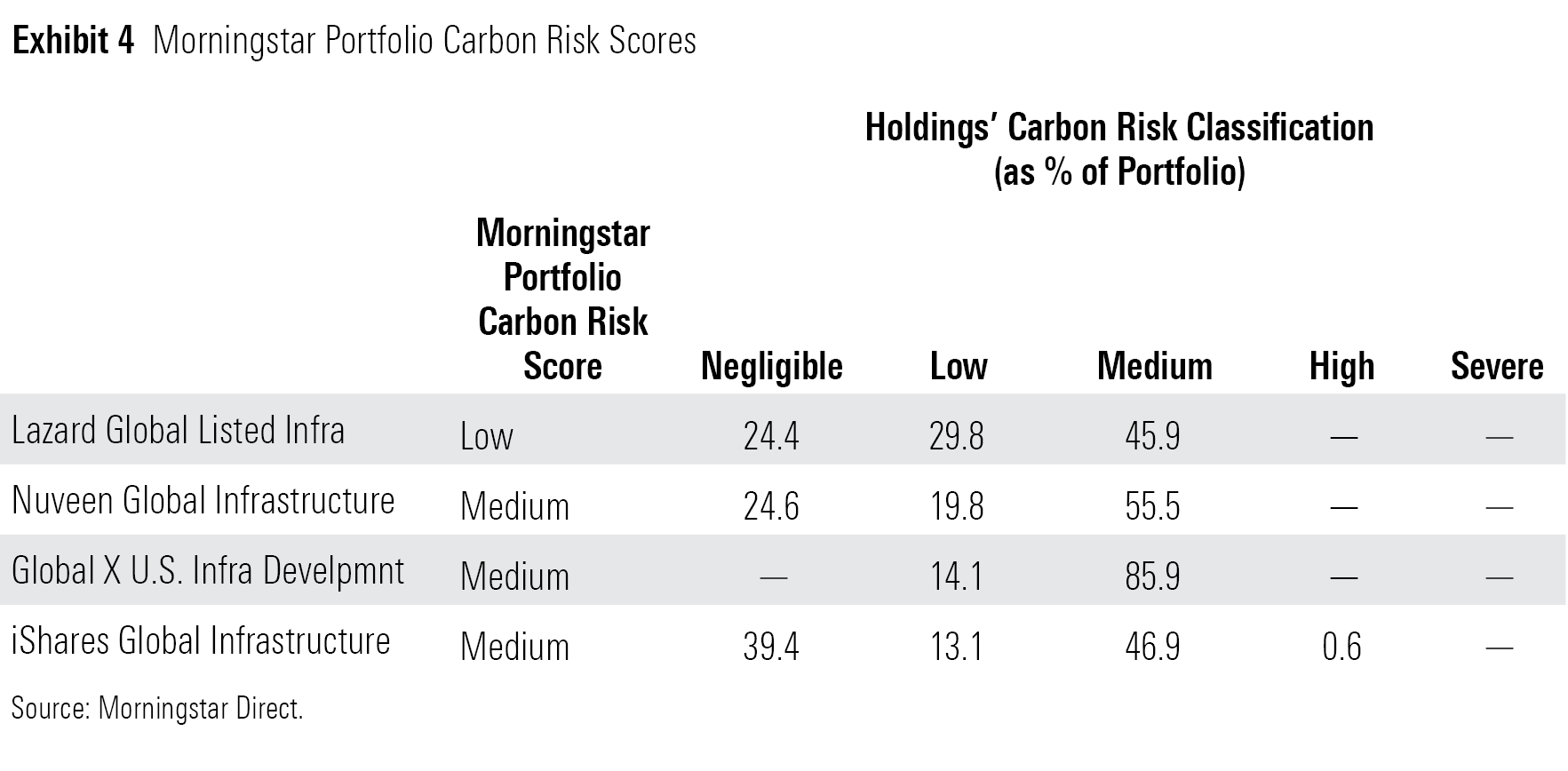

These funds invest in many companies that will be impacted by sustainability investment trends. The infrastructure Morningstar Category's average exposure to the utilities, industrials, and energy sectors is 43%, 33%, and 8%, respectively. These types of companies have higher carbon footprints relative to companies in sectors such as technology and healthcare and are much more likely to be impacted by regulations around carbon emissions reductions. While managing carbon emissions is a bigger challenge for energy companies, some utilities firms stand to benefit if they operate in a regulatory environment that is supportive of renewable energy investment. Long-term investors interested in infrastructure funds should consider the impact of carbon emission regulation on underlying holdings, as it can affect the operations and future value of these companies.

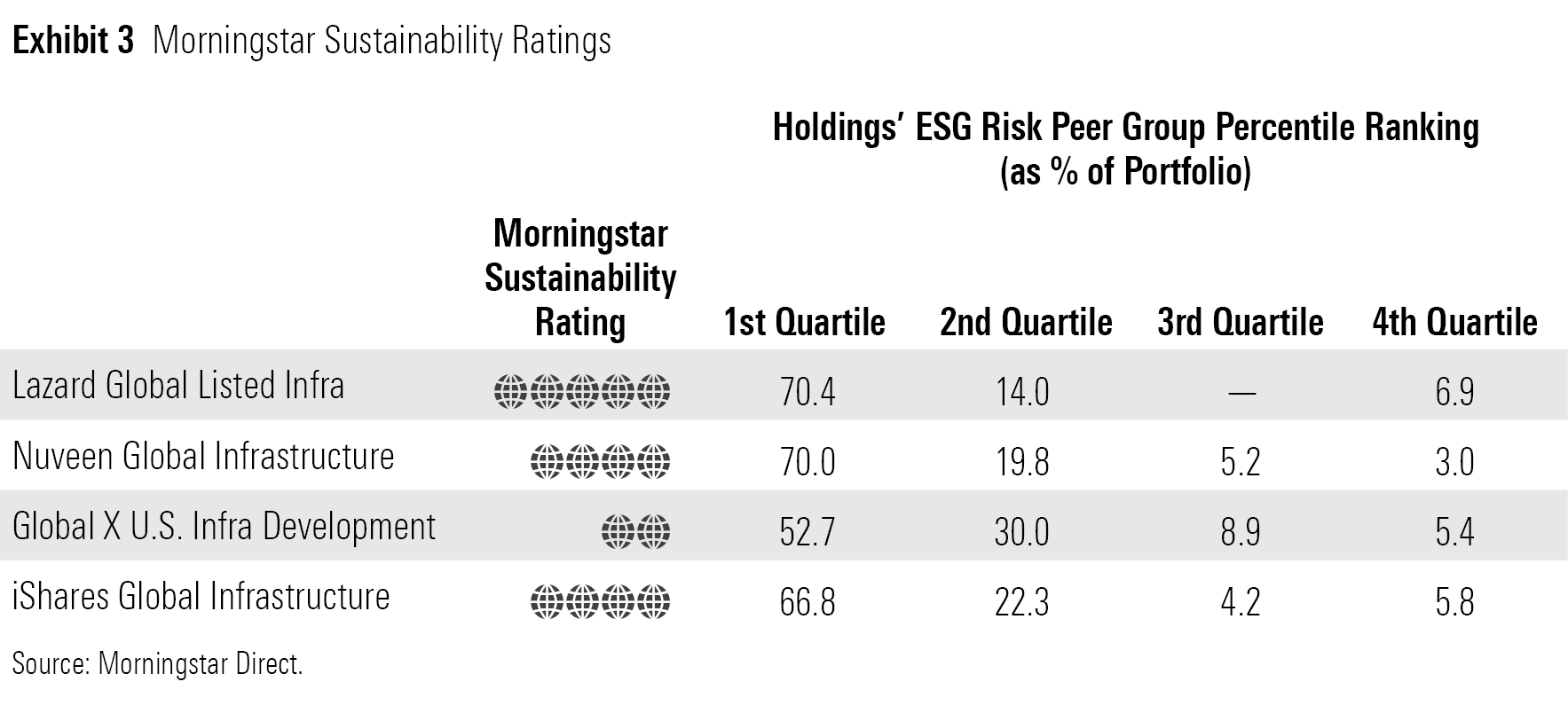

The infrastructure category includes funds with substantively different exposures to these themes. For example, some funds have an energy sector exposure as high as 25% and some have none, which can lead to very different performance profiles, as well as carbon risk exposure. Here's a look at the exposures of four infrastructure strategies and their respective Morningstar Sustainability Ratings and Morningstar Portfolio Carbon Risk Scores.

Exhibit 2 includes the sector and industry exposure of four strategies, as well as the category average. The energy, materials, industrials, utilities, and real estate sectors account for 90% of the infrastructure category's sector exposures, on average, but there is a wide range of sector and industry exposure across the four strategies.

Exhibit 3 provides Morningstar Sustainability Ratings, a five-tier assessment (1 to 5 globes, with 5 globes indicating the lowest ESG risk exposure) that is based on the ESG risk of the underlying holdings. This ESG Risk Rating assessment is a measure of the degree to which environmental, social, and governance risks could potentially put a company's enterprise value at risk. (Morningstar subsidiary Sustainalytics has ESG Risk Ratings for almost 15,000 global securities.) These can include a firm's factory waste, potential lawsuits regarding a product, and employee safety, and how a company manages them. The right side of Exhibit 3 provides a breakdown of each strategy's exposure to companies whose ESG risk is relatively better/worse than that of their industry peers. For example, 70% of Lazard Global Listed Infrastructure is in companies whose ESG Risk Ratings are among the best 25% relative to industry peers, such as toll road operator Atlas Arteria. Lazard Global Listed Infrastructure (as well as the Nuveen and iShares funds) also holds Atlantia, which has the lowest ESG Risk Rating among toll road operators, partly owing to lawsuits over a fatal bridge collapse in Genoa, Italy.

An additional lens into a fund's ESG profile is the Morningstar Portfolio Carbon Risk Score. The Carbon Risk Score includes the classifications of Low, Medium, and High. The portfolio score is based on the underlying holdings' Sustainalytics Carbon Risk Rating, which attempts to quantify the degree to which a company's economic value is at risk in the transition to a low-carbon economy.

Carbon risk varies from industry to industry. For example, electric utilities, most of which generate carbon emissions to provide electricity to customers, have an average carbon risk score of 22.7, whereas water utilities, which consume much less power to run its operations, have an average carbon risk score of 7.7. The oil and gas storage and transportation industry has a category average of 25.5. Within each industry, Carbon Risk Scores will vary. Within oil and gas storage and transportation, most firms have a Carbon Risk Score of Medium, but a firm such as Brazilian firm Ultrapar Participacoes SA carries a Carbon Risk Score of Severe, partly because it is domiciled in an emerging market.

How Do These Funds Stack Up?

Gold-rated Lazard Global Listed Infrastructure employs a disciplined approach to security selection and valuation. The team prefers firms that operate in regulated, monopolistic industries with steady demand and inflation-linked revenue, and it avoids names affected by fluctuating commodity prices. The managers consider ESG issues as part of the process, and with a compact portfolio and a long-term focus, they will engage with holdings on matters such as asset sales and acquisitions, as well as plans for reducing carbon output.

This bears out in Lazard Global Listed Infrastructure's Morningstar Sustainability Rating and Morningstar Portfolio Carbon Risk Score. This fund receives a Sustainability Rating of 5 globes, which means that on average, its holdings' exposure to unmanaged ESG risks is low, relative to other infrastructure funds. About half of its portfolio is in utilities, which tend to have above-average ESG Risk Ratings, on an absolute basis. But among the 31 utilities holdings, nine have ESG Risk Ratings that land in the highest decile relative to other utilities companies, which means the fund tends to hold utilities that are among the best at managing their ESG risks relative to peers. The fund also carries a Low Carbon Risk Score relative to its infrastructure peers, partly because it has no exposure to pipeline companies.

Bronze-rated Nuveen Global Infrastructure holds a greater variety of infrastructure names, such as ports and waste management companies, and can have an above-average allocation in emerging-markets names, which it uses to diversify its country exposure. This broader portfolio allows the team to take a more active approach to portfolio management. While the process is rooted in fundamental stock-picking, the team frequently trades around its holdings to reflect its views on the macro environment or to execute relative value trades. The team also integrates ESG considerations into the process by identifying the most relevant ESG issues for each holding and how each company is addressing these issues relative to industry peers. This analysis helps the team determine the potential impact of ESG risks on the value of the company.

Given its higher exposure to energy companies and emerging-market firms, its Sustainability Rating lands at 4 globes. But like the Lazard fund, about 70% of its holdings have ESG Risk Ratings that land within the top quartile relative to their industry peers, which reflects the effectiveness of the team's approach to managing ESG risks in its portfolio. Its Carbon Risk Score lands at Medium. While it has an above-average exposure to pipeline names, this carbon exposure is offset by an above-average exposure to telecom infrastructure, toll roads, and airports, which tend to have negligible carbon risks.

Global X U.S. Infrastructure Development ETF, which launched in March 2017, is a relatively new fund that tracks an index comprising companies that provide exposure to infrastructure development in the U.S. This includes companies involved in the construction and engineering of infrastructure projects, the production of infrastructure raw materials, and the transportation of materials and equipment. With this thematic approach, the fund is not diversified and has a significant concentration in the industrials sector with a 69% allocation, more than double the infrastructure category average of 33%. This fund is also one of the few funds in the category that carries a Morningstar thematic fund designation. These thematic funds attempt to harness secular growth themes, and many have exhibited strong returns as well as flows. This fund's assets under management have ballooned from $782 million at the end of 2020 to $5.2 billion as of Nov. 30, 2021, a period when asset flows were tepid for the rest of the infrastructure category. Many of the underlying holdings enjoyed a strong rally in anticipation of infrastructure spending increases stemming from the 2021 Infrastructure Investment and Jobs Act. Year to date through Nov. 30, the fund gained 28.3% versus the category average of 8.3%. Its highly cyclical orientation can also result in steeper declines. During the first quarter of 2020, the fund dropped 30.2%, while the category average fell 21.4%.

This passively managed strategy does not include any ESG considerations as part of the index construction process. And because of its focus on construction-related companies, it has above average exposure to industries that tend to have higher ESG risks, such as steel producers and cement factories. The index also includes small caps, which tend to have weaker ESG risk controls. With these exposures, the fund carries a Sustainability Rating of 2 globes and a Carbon Risk Score of Medium.

While the Global X fund has a narrow scope, iShares Global Infrastructure ETF, which is also passively managed, attempts to provide broad exposure to the infrastructure sector by holding the 75 largest energy infrastructure, transportation, utilities, and telecom service providers. All by one of its top 10 holdings' (accounting for about 40% of the portfolio) ESG Risk Ratings rank within the top quartile relative to industry peers. The exchange-traded fund also carries a Sustainability Rating of 4 globes, despite not incorporating ESG factors into its process. Also, its modified market-cap-weighted approach leaves the fund overweight in toll roads and airports, which results in an overweight in companies with Negligible Carbon Risk Scores for an overall Portfolio Carbon Risk Score of Medium. However, this weighting approach also creates a large exposure to energy names relative to the category average. This cyclical tilt can result in underperformance during stress periods; in the first quarter of 2020, the fund underperformed infrastructure peers with a 29.3% decline.

/s3.amazonaws.com/arc-authors/morningstar/de44b91c-c918-4e53-81c3-ce84542f3d36.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ROHC7ZXJXZU7LIKGTTYJTD667I.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RFJBWBYYTARXBNOTU6VL4VSE4Q.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/de44b91c-c918-4e53-81c3-ce84542f3d36.jpg)