How a Top T. Rowe Price Manager Is Positioned for a Continued Bear Market

T. Rowe Price All-Cap Opportunities' Justin White holds stocks like Visa and Chubb, names he sees as both inflation- and recession-resistant.

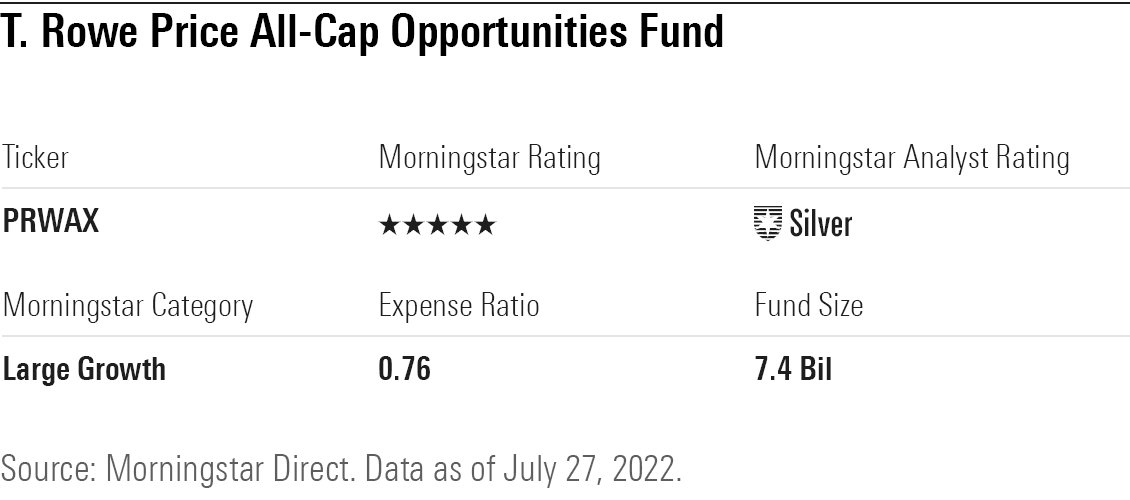

Justin White, manager of the top-performing T. Rowe Price All-Cap Opportunities Fund PRWAX is positioning for a protracted slog for the stock market.

White, who has run the Silver-rated, $7.4 billion fund since April 2016, thinks the bulk of the pain from the bear market has been inflicted on stock investors. The T. Rowe Price manager is starting to tiptoe back into some battered growth-stock names, having correctly begun to pivot away from the market’s most expensive stocks even before the second half of 2021.

But White cautions there’s likely still a tough row to hoe before investors can be more certain the worst is over.

The main obstacle for the broad market, he says, is uncertainty about the course of any recession as the Federal Reserve battles inflation. “Doesn't mean that stocks can't go higher for three or four months... but I’m of the belief that we haven’t seen the ultimate lows from this bear market,” he says.

As a result, the T. Rowe Price fund holds a number of stocks he believes will be both inflation- and recession-resistant. These include:

• Credit card company Visa V

• Software provider Veeva VEEV

• Insurer Chubb CB

• Pharmaceutical company Moderna MRNA

Stocks, Not Sectors, Will Matter

Against this backdrop, White expects returns to be driven more by individual stock performance than broad sector trends. “It isn’t a simple call like just don’t own tech,” he says. “You have to pay attention to the macro (economic) trends … But it’s going to be name by name rather than broad brush.”

All-Cap Opportunities has been in the lineup at T. Rowe Price since 1985 but has only been under its current name since March 2021. Unlike most stock funds that are constrained to a particular style of stocks such as value or growth, or specific range of company sizes, PRWAX's portfolio can include stocks from across the U.S. market. White looks for stocks that have four fundamental qualities: business quality, such as durable competitive advantages, improving expectations on earnings and sales, or improving fundamentals such as revenue acceleration or margin growth, and valuation.

PRWAX’s Track Record

Over the past 12 months, All-Cap has taken its lumps like every stock fund, losing 18.9%. However, that decline is still better than 63% of all large-growth funds, and so far in 2022, it is among the top 20% of funds in the category with a 20.6% loss.

The fund's long-term record is even stronger. Over the last three years it has returned 13.8% annually, better than 94% of funds in the category. PRWAX also ranks among the top 10% in its category for five-year returns and 10-year returns. Morningstar senior analyst Adam Sabban writes, "White's keen judgment and nimble trading have much to do with the strategy's success."

The T. Rowe Price manager says PRWAX for the most part tilts toward large-company growth stocks, a group that had fueled much of the stock market’s multiyear advance.

But by 2020, White was already wary of valuations among the big technology and consumer stocks that had been leading the bull market. “We were clearly in a paradigm where people didn’t care about valuations,” he says. “I knew a lot of the valuations didn’t make sense and there was a vulnerability for when that paradigm changed. As we saw with the dot.com bubble, there was a lot of downside for stocks.”

That summer he began to trim back the portfolio’s growth holdings, including reducing stakes in virtual medicine company Teladoc Health TDOC, electronic agreement company DocuSign DOCU and some of the other mega-cap market leaders. Meanwhile, he moved into some economically sensitive stocks such as food-service equipment company Middleby MIDD.

Still, his fund rode the growth stock wave. Throughout 2020, Amazon AMZN was the fund’s top holding, accounting for more than 10% of the fund’s portfolio at the end of the second quarter of that year.

White took notice when Cathie Wood’s ARK Innovation ETF ARKK saw returns collapse in 2021 as stocks with some of the biggest gains in 2020 began to reverse course. “I was mapping it against the Nasdaq bubble process and thinking, ‘this feels like there is something similar going on.’”

Cutting Back on Growth Stocks

By the fourth quarter, he had started trimming even further on growth stocks, including reducing his position in Meta META. But he wasn’t ready to jump off the mega-cap growth stocks wagon.

Then, in late 2021, came what White saw as the paradigm shift he was looking for when the Fed removed the wording “transitory” from its view of inflation.

White says that for the past decade, easy-money policies from the Fed have provided a backstop for the market. “Every time the market sold off, the Fed bailed us out and that emboldened people to think valuations didn’t matter,” he says. “When they got rid of the ‘transitory’ language that sent a message of ‘we’re not going to backstop the market anymore, we need to get inflation under control,’” he says.

“I thought “this is a big deal … and I used it as a chance to get rid of a lot of the holdings I had been holding onto grudgingly,” White says.

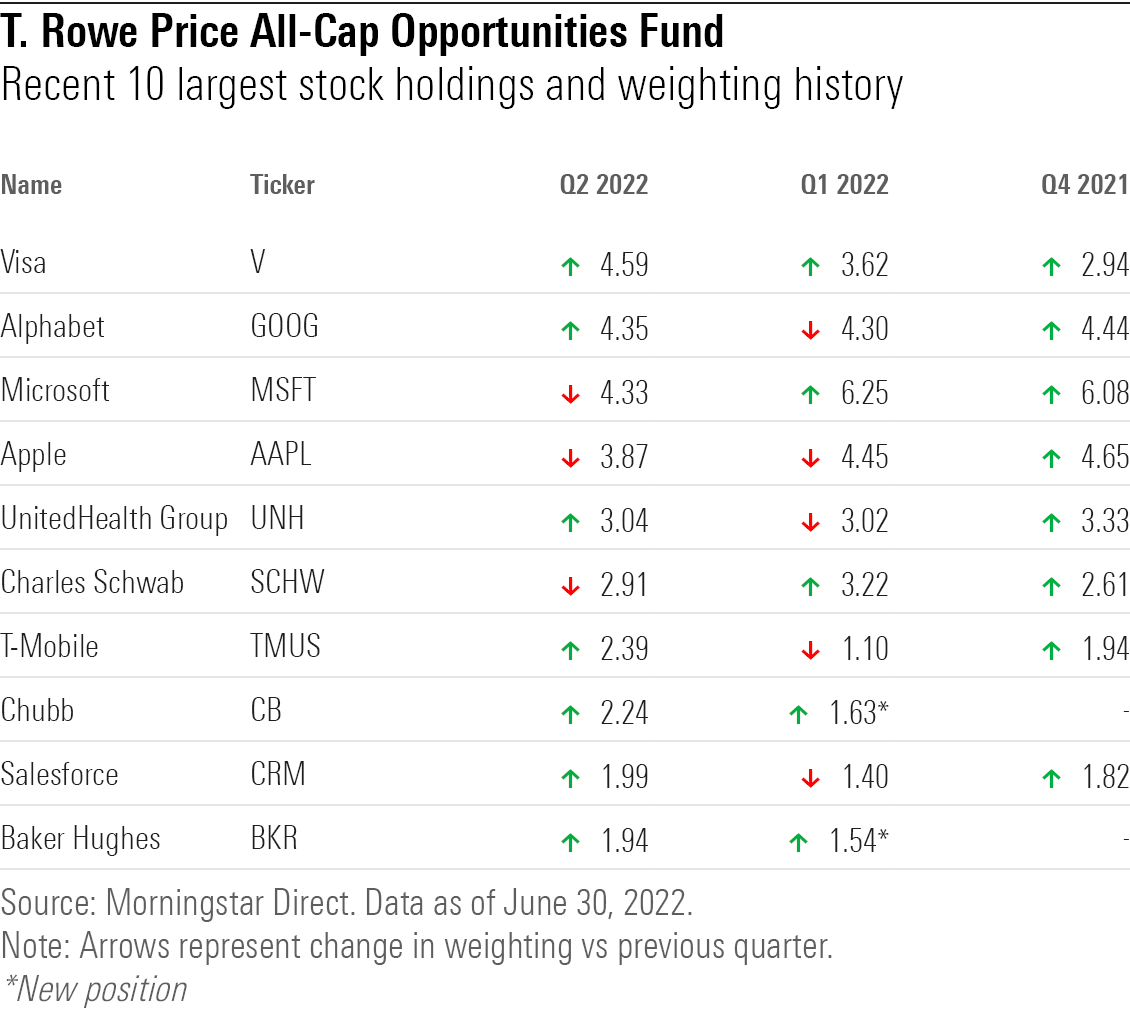

Among the more aggressive sales were Shopify SHOP, Roblox RBLX, and Wix.com WIX. White exited Meta completely by the end of 2021, and, as of the end of June 2022, Amazon was no longer in the portfolio. Microsoft MSFT and Apple AAPL are still top positions as of June 30, but he owns less of those stocks than their weightings in the Russell 3000 index, against which the fund’s performance is benchmarked against.

At this stage, White says many investors appear to be getting more comfortable with the possibilities of a recession, thinking that when one arrives it won’t be severe. He points to strength in the jobs market as one factor supporting the economy.

Against this backdrop, White doesn’t see investors as broadly overexposed to stocks, and if anything, that pension funds have been buying stocks to rebalance positions hit by the downturn. “A lot of the pain has been inflicted,” he says.

He points to Advanced Micro Devices AMD, which lost nearly 50% of its value in the first half of this year. If AMD were to start reporting earnings that topped analyst expectations and began raising future earnings estimates, “it’s not going to get cut in half again,” he says. “A lot of that unwind has happened.”

Looking for Recession- and Inflation-Resistant Stocks

Still there are risks out there in the economy, he says, with a recession likely in the cards. He believes that the rise in inflation has been fueled by structural changes in the economy and the Fed will have a tough time getting inflation down to its 2% target rate. “It feels like it’s going to be a protracted affair,” he says.

That leaves him cautious on some stocks, even among those the fund has been holding.

“A company like Google looks pretty cheap, but the consensus has earnings (growth) running about 20%,” he says. “Online advertising is basically the advertising market in the now and (earnings) growth could go negative if we have a real recession. So, you have stocks like that where there are risks to earnings and it’s not as cheap as it looks.”

White highlights a few of the companies he owns:

Visa

“Visa is great business, it actually benefits from inflation because the more inflation there is, the more you spend in nominal terms,” he says. “So, it’s a business where we think the benefits of inflation have been maybe a little bit understated in the numbers, and the benefits of cross-border travel to Europe, and next year to Asia resuming, have been a little bit understated.”

While there is a risk that a significant recession could hit consumer spending, Visa should be insulated by its wide profit margins, he says. “It’s dangerous when you are Target and your margins are 6% and then go to 2%, but if you are Visa and you go from 80% to 77%, maybe the stock isn’t great, but versus the market the earnings will probably be pretty resilient.”

Chubb

“It doesn’t matter what the economy is doing, people still need to buy property-casualty insurance,” White says. “The contracts are usually annual so there is a repricing each year. They also have a securities portfolio that funds claims and that … benefits from rising rates.”

White says he expects Chubb to post earnings per share of $25 in 2025, up from $18.79 for the past twelve months, and it currently trades below 8 times earnings, well below the market.

“It’s not very sexy, but on my framework, it’s a solid business, the valuation is attractive, and the fundamentals are solid to arguably improving,” White says.

Veeva Systems

While White is tiptoeing back into technology, he cautions that with the paradigm shift in the market, “I don’t think going back to the stuff that won in the 2010s is the playbook anymore. But there are some software companies that are really high quality, where valuations have come in enough, that I’m willing to own it and make a bet right now.”

The driver, White says, is Veeva’s core business of software that helps pharmaceutical companies keep track of clinical trial data. “Their fundamentals are going to be less vulnerable than other tech companies because their end market is health care, which is less cyclical,” he says.

He compares that to cloud software companies. “Cloud platforms are great businesses, but when venture capital spending dries up what happens?” he asks. “Does cloud spending slow down? Do you hire fewer developers?”

“With a company like Veeva I think you get the benefits of its recurring revenue model, it’s high quality and you don’t have the end market risk to it,” he says.

Moderna

“The question (for Moderna) is, is there going to be an ongoing booster market for COVID and I think the answer is ‘yes,’” White says. “And as it shifts from the government buying doses to the private sector negotiating doses, the pricing is going up on each dose. If the pricing in 2023 is more like $30 than the less than $20 that they have been getting, so even if you have fewer doses, (Moderna stock) is priced as though they don’t make any money from (COVID) vaccines after 2024.”

“If the growth in vaccines just hangs in there, or even bleeds down a little bit each year, the numbers have to come up a ton,” White says. And with a durable revenue stream, "there is so much cash building up it’s a stock that could double in a couple of years even if the market goes down,” he says.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZU2N7Y2TDFFL3EAFRGYANDSBJY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FNDLNORUIBFD5KKEXASUD67L6Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BHGJBKNFZRB7NHXO3ZLRNAHOIY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)