Has Decline in Homebuilder Stocks Created Opportunity?

What Morningstar's analyst thinks of D.R. Horton, Lennar, and Toll Brothers today.

U.S. homebuilder stocks have had a dreadful start to 2022, underperforming the Morningstar US Market Index by nearly 10% year to date as of Feb. 4. We believe the market has become fearful that rising interest rates will soften housing demand and homebuilder earnings power has peaked. We can't say we totally disagree with this thesis. The combination of high home prices and rising mortgage rates reduces homeownership affordability and will price some prospective buyers out of the market. We also don't think recent lofty homebuilder gross profit margins will persist over the longer term. However, in our view, the market is now pricing in an overly bearish outlook and the homebuilder sell-off has been too punitive.

Based on our analysis, U.S. housing stock is undersupplied by 3.8 million units, and we believe that demographics remain favorable for the homebuilding industry. We continue to project that housing starts will average about 1.6 million units annually this decade and the supply/demand mismatch will ease. Our 10-year outlook suggests that compared with exceptional 2020-22 results, both slower growth and lower profit margins lie ahead, but we still expect above-historical-average performance for the homebuilding industry.

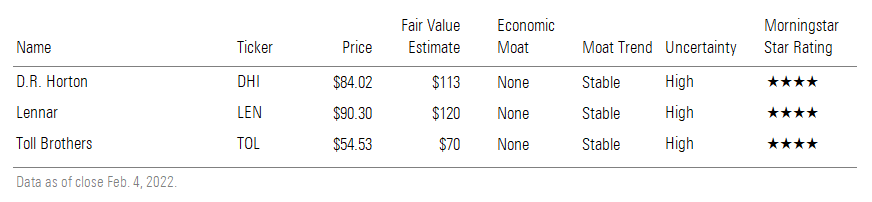

The U.S. homebuilder stocks we cover--D.R. Horton DHI, Lennar LEN, and Toll Brothers TOL--now trade at approximately 20% discounts to our fair value estimates. While we view all three stocks as attractive investment opportunities at current prices, each has different operating strategies that investors should consider.

- D.R. Horton is the largest homebuilder by volume and is positioned to post the fastest homebuilding growth of the three due to its strong entry-level position and more speculative building strategy.

- Lennar is the largest homebuilder by revenue, and its upcoming spin-off offers investors a special-situation opportunity.

- Toll Brothers is the top luxury homebuilder and, in our view, is least exposed to interest-rate risk.

We believe that household formations among younger Americans (millennials have become the largest generation) will continue to fuel the need for more housing over the next 10 years. We also expect to see more in-migration from expensive housing markets (for example, New York and the Bay Area) to more affordable markets in the Southern United States (for example, Texas and Florida). D.R. Horton is very well positioned to capitalize on this trend due to its favorable position on the affordability curve and its strong position in the South.

Lennar’s investments in ancillary businesses distinguishes the company from many other homebuilders. Management announced plans to spin off its multifamily, single-family for rent, and land businesses during the second or third quarter of fiscal 2022, although recent market volatility could delay the transaction. The separation of these ancillary businesses, which tend to generate lumpier earnings, should damp Lennar's earnings volatility.

Toll Brothers is the leading luxury homebuilder in the U.S. with an average selling price well above the public homebuilder average. The average selling prices of Toll's fourth-quarter home deliveries and contracts were approximately $883,000 and $1,000,000, respectively. While we think Toll Brothers will continue to capitalize on what we see as favorable long-term housing demand dynamics, given its luxury build-to-order focus and higher average selling price, we don't think it is as well positioned to capture demand from first-time millennial buyers as lower-priced homebuilders like D.R. Horton. That said, we think Toll has less interest-rate risk than many other homebuilders because its homes are often purchased by more-affluent buyers who are better able to absorb higher mortgage payments or are all-cash buyers (18% in fiscal 2021).

All three homebuilders have made significant progress becoming more capital-efficient through an increased mix of land option contracts. Land option contracts, which grant homebuilders the right, but generally not the obligation, to buy land at predetermined prices, can mitigate many of the risks associated with outright land purchases. An option contract strategy generally leads to lower average land inventory on the balance sheet and higher, more consistent returns on invested capital and free cash flow. At the end of the most recent fiscal quarter, D.R. Horton's owned/optioned mix was 26% owned and 74% optioned, Lennar's mix was 41% owned and 59% optioned, and Toll Brothers' mix was 45% owned and 55% optioned.

D.R. Horton and Lennar have stronger balance sheets than most public peers. At the end of the most recent fiscal quarter, D.R. Horton and Lennar had net total debt/capital ratios (including leases) of approximately 13% and 14%, respectively, compared with the public homebuilder average of about 28%. Only PulteGroup PHM (12%) and NVR NVR (which has more cash than debt) had stronger ratios. Toll Brothers' ratio was in line with the group average.

We believe our key valuation assumptions for D.R. Horton, Lennar, and Toll Brothers are pragmatic. Over the next 10 years, we expect relatively modest top-line growth (3%-5%) as housing starts remain elevated but annual growth slows. We expect market share gains will be a primary factor augmenting D.R. Horton's, Lennar's, and Toll Brothers' top-line growth. In terms of profitability, we expect gross profit margins will revert to near long-term averages for all three homebuilders. The homebuilding industry is enjoying very strong pricing power now, but as growth slows, we believe heightened price competition will return. Finally, we assign all three homebuilders an above-average systematic risk to equity rating (resulting in an 11% cost of equity assumption) and a high fair value uncertainty rating, given the cyclicality of the homebuilding industry.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)