Going Into Earnings, Is Meta Stock a Buy, a Sell, or Fairly Valued?

We’ll be watching Meta’s commentary on AI and monetization across its platforms.

Meta Platforms META stock is up 153% over the last 12 months. Ahead of the company’s third-quarter earnings report, here’s Morningstar’s take on what to look for in Meta’s earnings, as well as the outlook for its stock.

Key Morningstar Metrics for Meta Platforms

- Fair Value Estimate: $311.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

Meta Platforms Q3 Earnings Date

Oct. 25, after the close of trading.

What to Watch for in Meta Platforms’ Q3 Earnings

- We are looking for the impact of cost cuts and hopefully more efficient operations during the quarter. Regarding artificial intelligence, we’d like to see whether management will continue to focus on cost control or increase spending due to the emergence of generative AI.

- Regarding generative AI, we expect the firm to provide some color on the adoption of its large language models.

- An update on Threads would be helpful. We do not expect much growth on that front.

- With more usage of generative AI, we’d like the firm to discuss its latest plans for the metaverse, and whether it will relaunch its aggressive investments on that front. We think artificial intelligence is an important component of the metaverse.

- To what extent has generative AI helped monetize WhatsApp? We’d like to see the firm progress a bit more toward diversifying its revenue and reducing its dependence on the ad model.

- In terms of Facebook and Instagram, we would like further indications of Reels monetization improvement, which could also improve overall ad prices on the firm’s platforms.

- We also look for user growth, but nothing significant. The overall user base, which is in the billions, is unlikely to grow much—possibly at only very low single-digit rates.

Meta Platforms Stock Price

Fair Value Estimate for Meta Stock

With its 3-star rating, we believe Meta’s stock is slightly overvalued compared with our long-term fair value estimate.

Our fair value estimate is $311 per share, representing an enterprise value of 12.5 times our 2024 adjusted EBITDA projection. We have modeled a 10% average annual growth over the next five years. As the firm’s increasing efficiency as a result of its restructuring will more than offset its plans to further invest in research and development, content creation, data security, and virtual/augmented reality offerings (the metaverse), we see its average operating margin improving in 2023 through 2027. We expect an average operating margin of 35% during the next five years, above the previous three years’ 34%.

Meta’s revenue growth will be driven primarily by online advertising and increasing allocation of online ad dollars toward mobile, video, and social network ads. We expect solid growth in 2023 ad revenue (14%), followed by 9.4% growth in 2024, assuming an economic rebound and improvement in Reels monetization. We expect Meta’s monthly active users to grow about 2% annually, mainly due to growth in Asia and the “rest of the world” geographies. We also assume a deceleration in overall advertising revenue per user growth to 6% per year over the next five years, down from the average of 14% displayed over the past five years.

Read more about Meta’s fair value estimate.

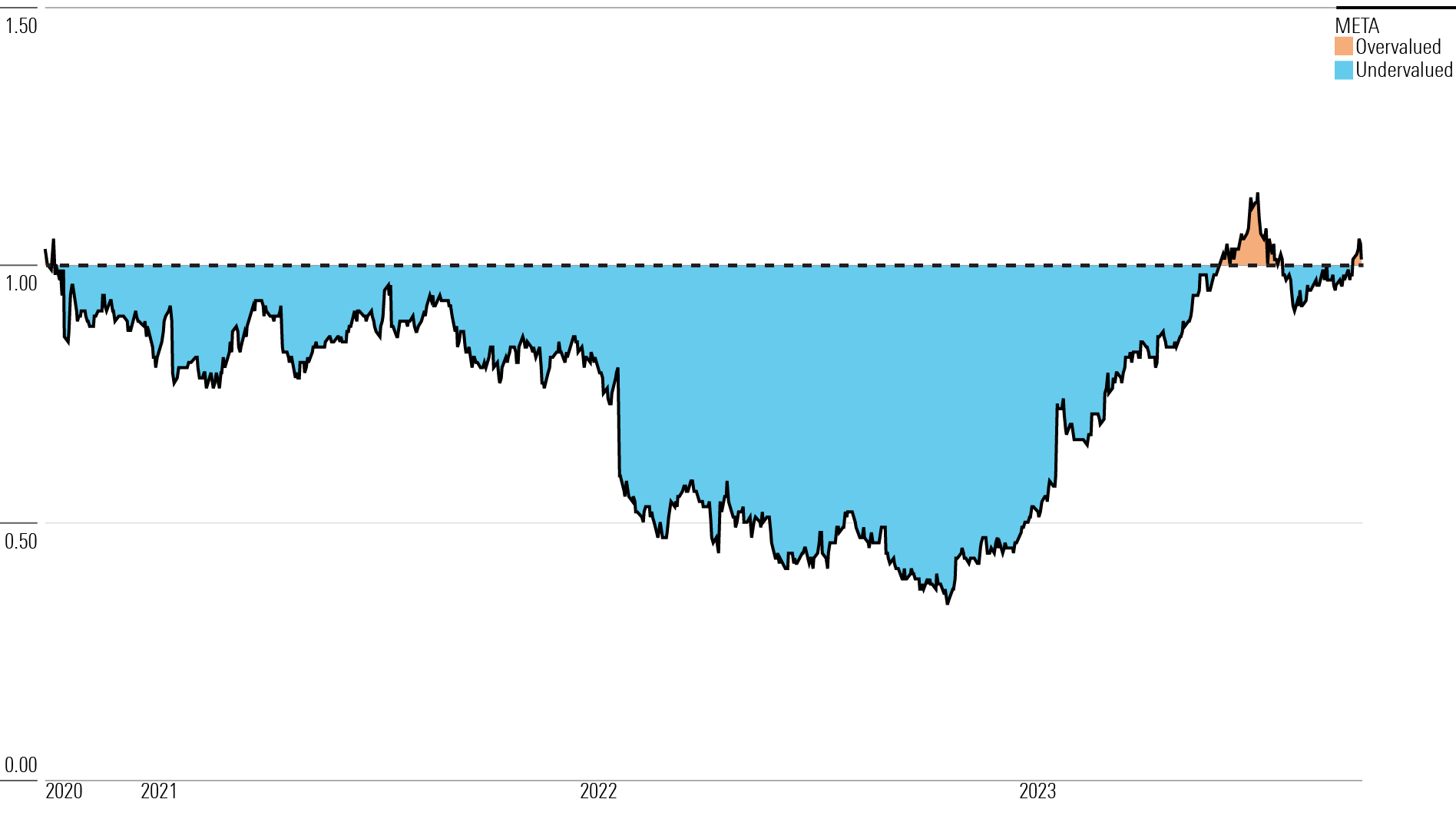

Meta Historical Price/Fair Value Ratio

Economic Moat Rating

We assign Meta a wide moat based on network effects around its massive user base and intangible assets consisting of a vast collection of data users have shared on its various sites and apps. Given its ability to profitably monetize its network via advertising, we think Meta will more likely than not generate excess returns on capital over the next 20 years.

Now that Meta has emerged as the clear-cut social media leader, we believe its offerings—consisting mainly of Facebook, Instagram, Messenger, and WhatsApp—have strengthened the firm’s network effects, wherein all these platforms become more valuable to its users as additional people join and use them. These network effects serve to both create barriers to success for new social network upstarts, as well as barriers to exit for existing users, who might leave behind friends, contacts, pictures, memories, and more by departing to alternative platforms.

Meta has developed additional intangible assets. The firm has accumulated data about everyone with a Facebook and/or Instagram account: their demographic information, what and who they like and dislike, what topics and/or news events are of interest to them, and more. Thanks to Facebook Login, without the need for cookies, the firm knows users’ browsing histories on many outside sites and apps. With access to such data, along with billions of photos and videos uploaded by users, Facebook continues to enhance the social network by offering even more relevant content. This virtuous cycle further increases the value of its data asset, which only Meta and its advertising partners can monetize.

In our opinion, with this type of information about each one of Facebook’s nearly 3 billion monthly active users, Meta provides unique and attractive advertising opportunities for advertisers and businesses, which will allow the firm to generate excess returns on capital over time.

Read more about Meta’s moat rating.

Risk and Uncertainty

We believe that while barriers to exit for the nearly 3 billion users may be increasing, the risk remains of another disruptive and innovative technology (most recently TikTok) coming onto the scene and luring users away from Meta and its apps. We do not expect competition in the form of a substitute for Meta, as most consumers use more than one social network. However, given the fixed number of hours per day, an increase in usage and engagement on one network could come at a cost to others, reducing engagement and the potential return on investment for advertisers.

Furthermore, even with Meta’s dominant position in the social network market, its high dependence on the continuing growth of online advertising could heighten the negative impact of a lengthy downturn in online ad spending, resulting in a much lower fair value estimate.

The firm’s high dependence on user behavioral data also represents an environmental, social, and governance risk. Regulatory agencies around the world could impose limitations on what data Meta can compile and how it can be utilized. Lack of data privacy and security could negatively affect users as well.

Read more about Meta’s risk and uncertainty.

META Bulls Say

- With more users and usage time than any other social network, Meta provides the largest audience and the most valuable data for online advertising.

- Meta’s ad revenue per user is growing, demonstrating the value advertisers see in working with the firm.

- The application of AI technology to Meta’s various offerings, along with the launch of VR products, will increase user engagement, driving further growth in advertising revenue.

META Bears Say

- Meta is currently a one-trick pony, and it will be severely affected if online advertising no longer grows, or if more advertising dollars shift to competitors like Google or Snapchat.

- Despite rapid user growth, many of Meta’s customers may also belong to other social networks, such as Snapchat or TikTok, so the firm will continually have to fight to capture a user’s time and engagement with its properties.

- Regulations could emerge that limit the application and collection of user and usage data.

This article was compiled by Adrian Teague

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_d0e8253d77de4af9ae68caf7e502e1bf_name_file_960x540_1600_v4_.jpg)