Financial Services: Most Stocks Still Cheap in a Higher-for-Longer Interest-Rate Environment

We believe the market has overly penalized banks and that shares are undervalued.

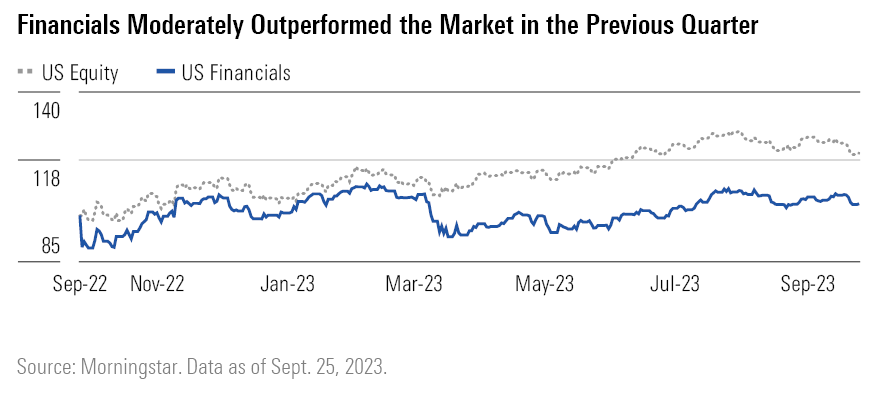

The Morningstar US Financial Services Index significantly underperformed the Morningstar US Market Index over the past 12 months—up only 3.8% compared with 20.3% for the benchmark. But the category moderately outperformed during the third quarter of 2023, up 1.5% compared with the market’s decline of 2.3%.

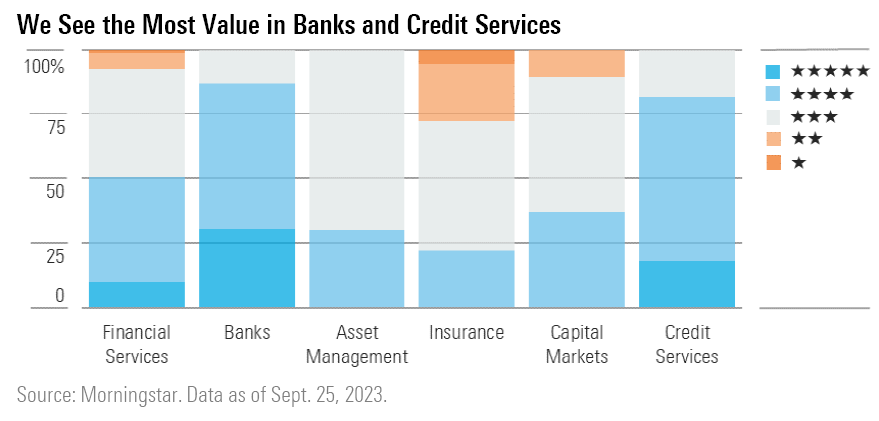

The median North American financial sector stock currently trades at a 13% discount to its fair value estimate, compared with a 14% discount at the end of the second quarter of 2023 and a 23% discount at the end of the third quarter of 2022. We currently rate around 50% of the North American financial sector stocks that we cover as undervalued 5- or 4-star stocks, while about 7.5% are rated as overvalued 2- and 1-star stocks.

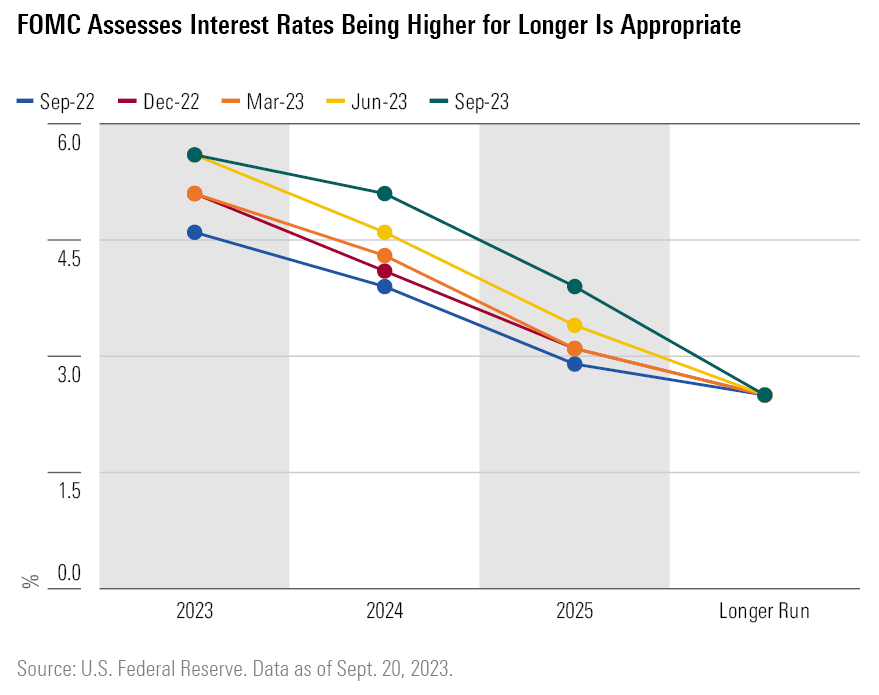

At the Federal Reserve’s September meeting, participants kept their federal-funds rate target at 5.25%-5.5% and maintained their median assessment for the federal-funds rate at the end of 2023 at 5.5%-5.75%. However, the median participant assessment of appropriate future monetary policy rates increased from June to 5.1% for 2024 and 3.9% for 2025. It seems participants are signaling that interest rates will be higher for longer.

Many banks and credit service companies have sold off this year, and we currently rate them as the more undervalued industries in this sector. They are facing an earnings headwind from higher interest rates increasing funding costs that lower net interest income growth.

Additionally, credit costs should continue to climb as the Fed cools the economy, excess savings from the COVID-19 restrictions run out, and student loan payments resume. We are also likely to see headlines concerning the capital position of financial institutions, as higher interest rates increase the unrealized losses on their fixed-income securities portfolios and higher regulatory capital guidelines are debated.

While these are all negative developments, we believe the market has overly penalized the banks for these issues, and that shares are undervalued based on long-term normalized earnings.

Top Financial Services Sector Picks

Charles Schwab

- Fair Value Estimate: $80.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: High

- Morningstar Uncertainty Rating: Wide

Charles Schwab SCHW is a fundamentally strong company that has sold off due to headline risks and earnings headwinds that should soon reverse. The recent increase in U.S. interest rates will likely add to the company’s unrealized loss position on its U.S. Treasury and agency mortgage-backed securities holdings, even as it decreases shareholder equity. That said, Schwab is still solid from a regulatory capital perspective, and it has access to liquidity. In the next couple of quarters, we expect the company to pay down increasing amounts of its high-cost borrowings, which will boost its net interest income and earnings.

Wells Fargo

- Fair Value Estimate: $61.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Medium

- Morningstar Uncertainty Rating: Wide

While Citigroup C is a bit cheaper than Wells Fargo WFC overall, we like that Wells has a stronger franchise from a profitability perspective and is further along in its turnaround timeline. Given the potential timelines at play, plus the difficulties that come with franchises like Citigroup (which are structurally less profitable than peers), we would favor Wells today. Wells is also not dealing with the same capital or earnings pressure issues as many regionals, lowering its exposure to rate risk. While the timing is always difficult to gauge, the bank could have a positive regulatory catalyst in 2024, and it seems to be setting up for outperformance on net interest income in the third quarter of 2023. The regulatory timeline and further banking sector stress remain important risks to consider.

PayPal

- Fair Value Estimate: $135.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: High

- Morningstar Uncertainty Rating: Narrow

PayPal’s PYPL shares have since fallen about 80% from their pandemic peak to a level materially below their pre-pandemic price. With market confidence in the stock at a low ebb, we see a potentially good long-term opportunity. While we recognize the headwinds the firm faces in the near term, in the long term, its fate remains tied to the high-growth e-commerce space, with Venmo providing some additional upside option value. Historically, PayPal has demonstrated it can take a share in this area, and we think it continues to do so on an overall basis. We believe the company retains a strong competitive position.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_d0e8253d77de4af9ae68caf7e502e1bf_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)