Disney Earnings: Profits Soar but Key Underlying Metrics Stay Muted; Long-Term Questions Remain

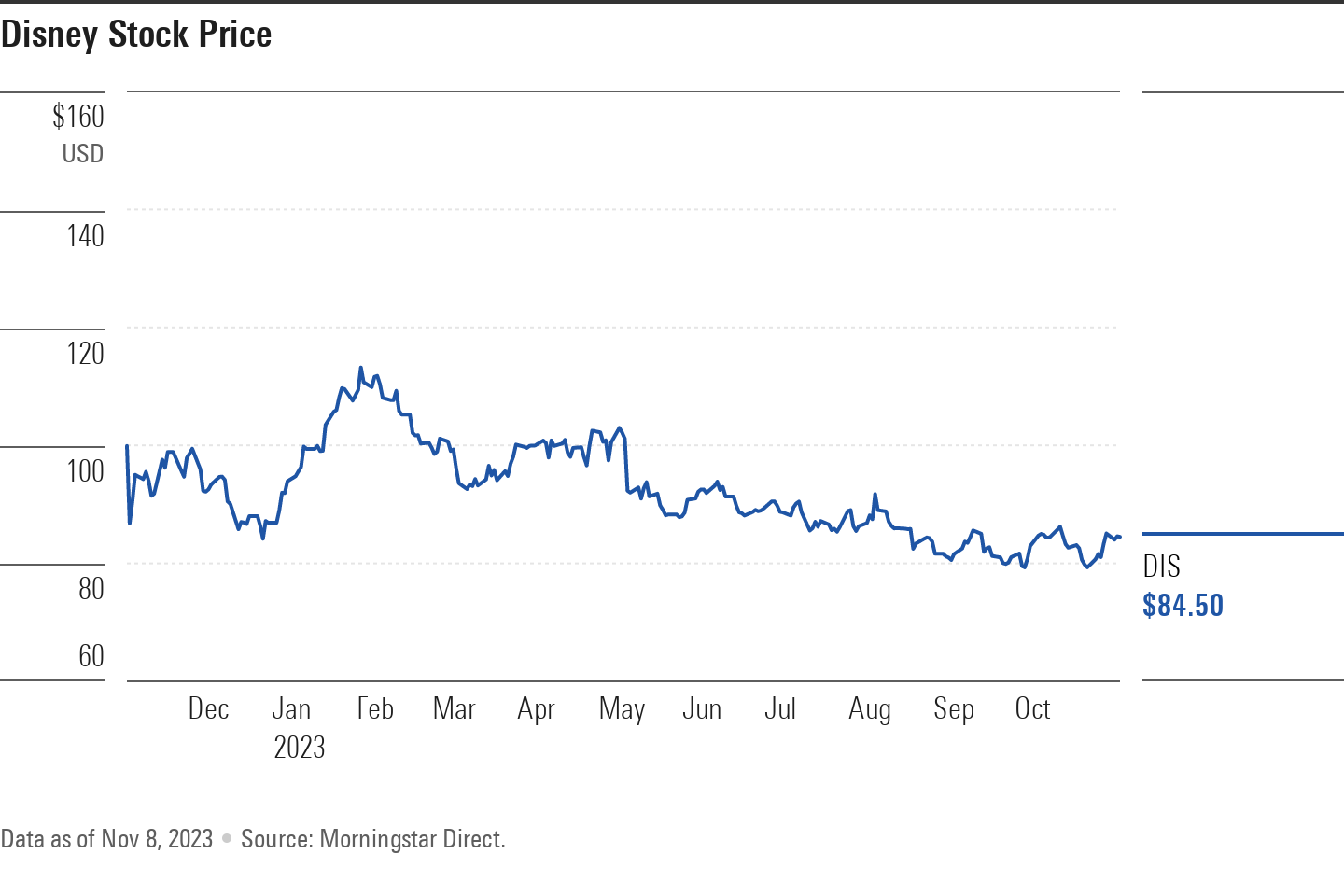

Even with challenges, we feel the market is too pessimistic about Disney stock.

Key Morningstar Metrics for The Walt Disney Company

- Fair Value Estimate: $145.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

What We Thought of Disney Earnings

Disney’s DIS fiscal fourth quarter displayed the firm’s financial might and why we think shares remain undervalued despite challenges it faces. Most notably, the firm has cut costs significantly, sending free cash flow skyrocketing. However, TV-related struggles continue, and the headline-grabbing 7 million streaming subscriber additions featured only minimal growth domestically. We question how successfully Disney can funnel its declining linear business straight into its direct-to-consumer streaming offerings, but with such valuable franchises and levers to pull, we feel the market is too pessimistic. We’re maintaining our $145 fair value estimate.

Profits and free cash flow were the stories of the quarter, in our view. Total segments’ operating income was up 86% year over year, driven mostly by the experiences segment and a $1 billion improvement in DTC losses. The firm still expects streaming services to reach profitability by the fourth quarter of fiscal 2024. Firmwide, Disney is on track to reach $7.5 billion in annual cost reductions by 2024. Despite planning to increase capital spending by about $1 billion, the firm expects $8 billion in free cash flow in 2024, up from about $5 billion in 2023.

International Growth Fuels Disney’s Subscriber Gains

Apart from experiences, sales growth was not compelling. Fourth-quarter entertainment revenue grew 2% year over year, with 12% DTC growth more than offsetting a 9% decline in linear networks sales and a slight decline in content sales and licensing. As has been the case with peers, linear networks advertising was weak. However, affiliate revenue was also down despite higher rates, and we don’t see opportunity for significant improvement in either of these revenue streams as long as pay-TV subscribers and linear viewership continue declining.

Sales growth in DTC was almost entirely due to a jump in international subscribers, as average revenue per subscriber was little changed across services, and subscriber bases for domestic Disney+ have been flat over the past year.

In the quarter, Disney+ added 500,000 domestic subscribers and nearly 6.5 million international subscribers, in a year when Disney+ added almost 10 million subscribers. Now that the firm will own 100% of Hulu, it intends to offer a merged Disney+/Hulu app experience. Along with an eventual addition of ESPN to DTC offerings, we expect both subscribers and monetization to increase significantly.

Sports revenue was roughly flat year over year, which we see as encouraging considering the challenges linear networks are facing. The 1% growth at ESPN was entirely due to ESPN+, which added 800,000 subscribers in the quarter and almost 2 million over the past year.

The experiences segment remains very strong, with sales up 13% and the operating margin improving by 3 percentage points to 21.5%. International parks and domestic cruises were the main sources of the growth, and management continues to lean into this segment.

Disney Stock Price

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/83fcd1d4-0576-422a-a260-91e1689417ed.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/83fcd1d4-0576-422a-a260-91e1689417ed.jpg)