The Costs of Digitizing Education

Institutions and students bear the brunt, but opportunities are considerable.

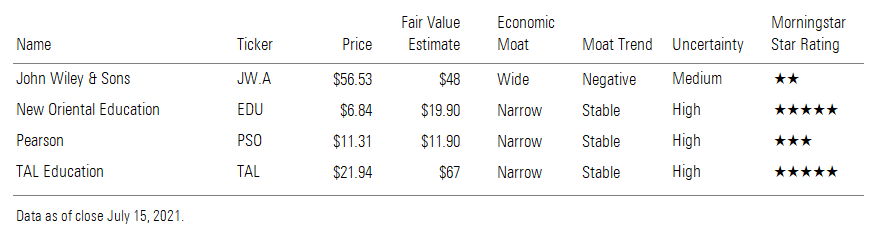

By suddenly shuttering in-person education and forcing classes online, the COVID-19 pandemic threw the costs of education’s digitization into stark relief, from the standpoint of absolute expenditures as well as price/value. Media headlines have publicized online education’s perceived failures as learning outcomes are called into question, students in higher education rebel against tuition rates for the sudden shift to digital learning, and institutions claim heightened costs. We suggest, however, that long-term investors resist what can be a myopic view of the costs of education’s digitization and instead take a wider perspective that acknowledges the traditional system’s challenges and how technology can improve outcomes and economics. Through this lens, we believe the challenges and opportunities faced by the companies we cover--including John Wiley JW.A, New Oriental Education EDU, Pearson PSO, and TAL Education TAL--become more evident.

Value Proposition in Question Well Before Pandemic

The American higher education system had been increasingly called into question before the pandemic amid rising costs, inefficient outcomes, and a rapidly changing skills marketplace that has required greater agility over the course of a career. The cost of a college education has risen dramatically over the past 40 years, with graduates exiting with considerable debt that has drawn scrutiny from politicians and regulators.

Despite being the most educated generation in history, millennials’ household net worth lags that of the prior two generations. While we ascribe some of the differential to the fallout of the financial crisis and ensuing recession of 2008-09, which occurred as millennials were either near their entry into the workforce or in the early stages of their careers, the persistence of the gap weighed against student indebtedness suggests a reckoning is at hand. We believe incumbents in the sector will feel the impact acutely as millennials’ children reach college age, largely in the next decade, with many parents not convinced of the value of a four-year degree.

A college degree still has value, with the median salary of a graduate roughly 65% higher than that of someone holding only a high school diploma in 2019, according to the U.S. Bureau of Labor Statistics. However, a study by the Manhattan Institute, an economic think tank, suggests that not all degrees are created equal, with the bottom quartile of college graduates’ income overlapping the top quartile of those with a high school diploma alone.

While a college degree has become de rigueur for professional positions, skills gaps have also emerged that have imposed economic costs. Before the pandemic, the tight U.S. labor market exacerbated employers’ difficulty in hiring adequately skilled workers. An early 2020 U.S. Chamber of Commerce study indicated that 3 out of 4 hiring managers saw a skills gap in the prevailing labor market, with nearly half indicating that available talent was insufficiently skilled to meet the needs of open positions. Furthermore, a study by the Strada Education Network, a nonprofit organization dedicated to managing the college-to-career transition, indicates more than 40% of bachelor’s degree recipients were underemployed upon graduation. The sharply rising costs of higher education, limited income disparity between large parts of the college and high school graduate populations, skills gap, and college graduate underemployment suggest that conditions are ripe for alternative models of higher education.

Alternative Approaches Have Emerged, With Varying Results

A variety of alternatives to supplement the conventional education system have emerged. Among them, content and services companies we cover (particularly Wiley and Pearson) have focused on early- and mid-career credentialing and certifications to enable workers to develop and demonstrate in-demand competencies, working with corporations to close the skills gap via tailored training approaches and online degree programs.

Corporate America’s need for workers with a very particular set of skills has led to higher training costs, with expenditures from 2017 to 2019 averaging nearly $90 billion versus less than $70 billion from 2014 to 2016. Companies like Wiley have been the beneficiary of such spending, leveraging education content for the benefit of corporate clients. We have a favorable view of the company’s early 2020 acquisition of mthree, a job placement firm that trains early-career IT professionals according to directives from corporate clients and then places them for what amounts to a two-year on-the-job training program. Additionally, certain corporations and academic institutions have partnered directly through internships and other placement initiatives, including Amazon Web Services Cloud Innovation Centers at several universities, and collaborations with companies as diverse as IBM, Siemens, Caterpillar, and General Electric. We believe these and similar programs can help to narrow the skills gap in a lucrative way for education content providers as they leverage competencies and materials already available in-house.

Perhaps the most significant response to the pressures facing higher education is the prospect of online learning, which we believe can provide ways to address concerns about the traditional system’s costs and outcomes. By moving content online, where it can be delivered without expensive on-site facilities and freed from limits on class sizes, distance learning should improve costs. Also, a more flexible delivery of courses to not only full-time pupils but also older students should help transition to a lifelong learning-type model that is more consistent with the changing roles and responsibilities that workers can expect in an age of rapid innovation and automation. However, practice has not necessarily confirmed theory, as most visibly seen in the wake of the pandemic’s unexpected shift of in-person learning into the virtual realm.

Pandemic Shows Cost of Unplanned Digitization

Even before the pandemic, questions had been raised about the efficacy of online programs. A 2020 study in European Political Science concluded that online courses see less favorable retention, learning outcomes, and graduation rates than their in-person counterparts, even with the same professors and class content. Another study, published in Economics of Education Review in 2019, suggested that not only do purely online programs generally underperform their traditional counterparts in terms of learning outcomes, but so too do hybrid approaches.

The pandemic has amplified such findings. A survey conducted by Wiley Education Services suggests that nearly 3 in 4 students felt they did not learn as well in spring 2020 as a result of the pandemic and distance learning; more than 60% of faculty echoed the assessment of their pupils’ outcomes.

Students’ dissatisfaction with distance learning in the fall semester of 2020 as infection rates increased and kept campuses closed has spurred calls for tuition rebates and reductions, with limited success. In addition to learning outcomes, students cite the lost nonclassroom elements of the college experience, particularly social opportunities. While attempts to garner price reductions are not surprising, there are signs that students are choosing to eschew the digital classroom, with undergraduate enrollment down 4% as of October 2020, according to the National Student Clearinghouse Research Center.

We’re Not Writing Off Digital Learning, Though

We believe the outcomes indicated during and before the pandemic suggest a lasting role for in-person learning. However, we are not prepared to dismiss online learning outright. Rather, we believe the failings of pandemic-era remote education are attributable to the crisis’ imposition of an unexpected, one-size-fits-all approach with little planning. Although the tuition pressure reinforces the notion that undergraduates see online education as inferior to its in-person counterpart and suggests that pricing power is limited, the complaints come from a cohort that expected to receive the cocurricular and extracurricular opportunities that an American on-campus education typically provides.

The pandemic does shed some light on the incremental costs of digitizing a course designed to be delivered in person. While available data is largely anecdotal, institutions such as Metropolitan State University of Denver and Texas Woman’s University have reported incremental costs of $2 million and $9 million (or up to $600 per student), respectively, excluding losses from forgone room, board, and reduced enrollments. However, expenditures were likely held down by the speed with which the pandemic hit, as measures to take coursework online have been rudimentary.

We do not deny that there are incremental costs for the institution in hybrid models that, in a normalized environment, offer in-person and online learning. Even for purely online programs, while physical infrastructure needs and costs are lower, institutions still need to invest in faculty and infrastructure with efficiency, which is particularly important as the flexibility that online students enjoy also limits their patience and increases their willingness to end their studies. However, we also see a revenue opportunity that can serve as a powerful offset. Online courses can allow universities to leverage faculty salaries across a larger student base as facilities-related limits on enrollment erode, with lower-cost teacher assistants and digital tools used to augment the experience and provide in-person support. The National Center for Education Statistics suggests that instruction costs (mostly faculty salaries and benefits) account for around 30% of postsecondary institutions’ expenditures. We believe these costs are largely fixed and can be leveraged by adding students.

Dual-channel approaches should grant universities greater flexibility to offer courses to midcareer professionals as well as degree-program students, effectively allowing for a self-selection that offers younger learners the nonacademic benefits of a traditional classroom experience while motivated online enrollees receive a more content-focused value proposition. If the content is delivered well across both channels, we believe this dynamic can provide universities the cost leverage benefit of digitization without the negative student response that the pandemic’s digitization experiment has evoked.

Evidence on the longer-term cost implications of online instruction is somewhat mixed. A study by Boston Consulting Group and Arizona State University found that online courses reduced costs per credit hour at four institutions by as much as 50% on the customary average. The savings are likely driven by scale, with greater numbers of students leveraging instruction costs. However, greater use of less costly, nontenured staff in online instruction probably generates some of the savings, with uncertain implications for the quality of education (while adjunct faculty is less experienced, we believe younger professors are more likely to be able to adapt to digital delivery).

We believe third-party solutions providers can materially affect institutions’ cost and outcomes by generating efficiencies and optimizing content delivery. Such partners effectively specialize in efficient delivery of services and infrastructure, leaving the university to focus on its core, content-related competence. We believe academic institutions with online degree programs do not achieve meaningful differentiation through functions like student recruitment, software-based classroom administration, courseware delivery, and student retention services; instead, universities’ brand strength is dictated more by their prestige and the quality of instruction. By leveraging the investments needed to provide such services over a large client base, we expect that scaled providers can deliver superior service at a compelling cost, all while creating more optimized tools and services based on experience honed over a wider range of engagements than an in-house effort.

Online Instruction Can Live Up To Its Promise

Solutions providers primarily deliver their services through bundled, tuition-share arrangements or a la carte, fee-for-service engagements. Bundled approaches can effectively have the solutions provider take control of all aspects of the program apart from the instruction, with tuition revenue split between the provider and institution (roughly equally in many cases). This arrangement favors smaller universities drawn to an agreement in which the partner fronts the initial capital investment and provides a comprehensive solution from the ground up. Universities with more-established online capabilities and fewer capital constraints engage third-party providers on a more targeted basis to solve isolated problems (such as advertising or retention). In both cases, contracts can be long (over five years), imposing switching costs that are exacerbated by universities’ desire to avoid forcing instructors to spend time retraining on another platform or reconfiguring their syllabus to conform with a different provider’s technological capabilities.

The tuition-share approach has come under U.S. regulatory scrutiny recently, with politicians concerned about such arrangements in the context of legal provisions that bar academic institutions from linking admissions staff’s compensation to recruitment outcomes. As tuition-share arrangements often see the partner firm handle recruitment duties, U.S. legislators have launched investigations, although the Department of Education has issued guidance suggesting such agreements are permissible. We do not expect the regulatory environment to change in a way that materially affects incumbent solutions providers’ prospects.

Critically, we believe solutions providers’ results show that online instruction can live up to its promise. Both Wiley and 2U (a leading online program management provider we do not cover) have indicated that their student retention rates are above 80%, far better than the low 60s for all undergraduate programs, including traditional learning. We ascribe the difference to the sophisticated tools the solutions providers use to identify struggling students (behavioral analytics, activity tracking data, and proactive engagement) and intervene.

Not all programs are well suited for an online program management partnership. Wiley suggests that factors including the structure of the program, likelihood of the academic institution’s brand resonating in the market in which the program will be offered, and tuition relative to alternatives all influence the chances of success, as does the strength of the local labor market. Furthermore, faculty must be comfortable with the prospect of maintaining academic rigor in an online offering, while institutions must be convinced that their brand will be protected and that the partnership will afford sufficient control and oversight. We believe Wiley has taken a measured approach to partnership development, concentrating on the relationships most likely to deliver success for institutions, students, and itself. Under the right circumstances, we believe third-party solutions providers can create revenue expansion opportunities while improving retention and improving programs’ cost structures.

Although providers and service partners have invested considerably to meet education’s digital future, capital expenditures have remained manageable. While some of the effect is offset by acquisitions (particularly for companies like Wiley, which has prudently bought capabilities to accelerate its transformation), internal investment nevertheless has held fairly steady for service partners. This is not to say that digitization has been costless for these companies; rather, they have been able to modulate investment in their legacy print businesses to finance their growing digital capabilities.

Similarly, service partners’ operating margins have not deteriorated significantly as a result of digitization, and we expect the dynamic to hold prospectively as well. Although digitization does trigger implementation and infrastructure expenditures, savings from rising cost and content leverage serve as a powerful offset.

Digitization Can Reduce Student Costs, but Flexibility Could Be Bigger Boon

From students’ perspective, education’s digitization also bears costs and benefits, factors that will ultimately dictate the degree to which legacy content providers are disrupted. We see course materials as a continuing area of impact. In the textbook market, outcomes are decidedly mixed. The print textbook business has been in decline for years, a trend that we believe is driven not only by sales of digital counterparts, but also new and used rental volumes, used book sales, and the rise of nonbook and open courseware alternatives. Additionally, subscription models have emerged to alleviate the strain of purchasing new textbooks.

Used print book sales and rentals particularly frustrate publishers’ selling efforts by effectively forcing publishers to compete against their own past sales. The strength of the used print book market means that publishers effectively only achieve high sell-through in the first year a new edition is offered; after that, the used and rental markets develop. Although freely available materials and open educational resources are also a source of competition, such items constitute only about 15% of the higher education market, with used and rental materials about 2-3 times larger, so the secondary market poses a far greater threat to publishers. Digitization sidesteps this issue by increasing publishers’ control over the volume they sell, particularly if digital books are made available on platforms that make sharing difficult. By choking off the availability of used texts, digital content delivery can be a favorable development for publishers from a competitive standpoint, as it forces either purchases of a new volume or a still-lucrative rental of a current-edition e-book.

We believe digitization’s ultimate implication for publishers is favorable. On a title-for-title basis, shifting sales from print to digital reduces revenue and absolute profits, as print copies tend to be more expensive (up to 60% by our estimate, based on a December 2020 search of select popular titles on Amazon). However, percentage margins on virtual products are at least comparable and can even be higher as printing, binding, and distribution costs are saved. Furthermore, digital content benefits the publisher by eliminating obsolescence risk, bookstore returns, and warehousing costs, while also providing greater control over pricing.

Perhaps most significantly, content providers can use digital textbooks and other learning materials to improve economics by driving sell-through higher, even while reducing the amount students are expected to pay for materials. In addition to lower marginal costs for digital products relative to print alternatives, we see opportunities for significantly greater sell-through as lower prices lead fewer students to forgo purchasing course materials for cost reasons. In a recent survey, 85% of respondents indicated they had delayed or declined purchasing course materials, with virtually all doing so for cost reasons.

In our view, digitization and student price sensitivity create an opportunity for legacy content providers to offset losses in their print departments. Although this dynamic can be established via an existing textbook catalog, we believe the profitability opportunities are more enticing for interactive digital courseware that can also boost student engagement and outcomes.

This view is based on courseware’s potential for greater cost leverage as the software platform, format, and testing architecture can be deployed across subjects and the interactive content and assessments can be integrated into broader classroom management solutions. Although building the initial offering incurs up-front costs, once courseware products achieve scale, Wiley indicates their gross margins exceed those of print and digital textbooks, particularly considering higher sell-through, as there is no competing secondary market.

Billing for access at the class, department, program, or university level ensures sell-through and creates avenues to impose switching costs as the materials become more tightly integrated and instructors take advantage of customization options to create a bespoke resource that would be difficult to replicate easily on another platform. Even the revenue impact can be mitigated by the sell-through dynamic, and particularly as digital materials are sold directly, while bookstores’ markup on print volumes can exceed 20%.

Relationships can also be stickier for courseware, as instructors are reluctant to switch to a different provider once their course syllabus is tailored to a particular offering. Furthermore, the courseware offering is integrated into the institution’s technology infrastructure, imposing some additional switching costs.

From students’ perspective, bundling course content into the tuition and other fees charged by an academic institution reduces flexibility to avoid expenditures, but the lower prices nevertheless stand to improve access to up-to-date learning materials. Just as important, digital learning offers new opportunities to defray the cost of a formal education and opens potential upskilling opportunities. For example, online program management services provider 2U states that 84% of its graduate school program alumni worked full time while enrolled, versus the national average of 43%.

The chance to continue drawing a paycheck carries important implications, as students can offset tuition costs through salaries and corporations can use online programs to upskill high-potential employees. Extending courses’ value proposition to midcareer employees (potentially coupled with certification or credentialing programs) provides a means for academic institutions to improve their cost profile while addressing the skills gap.

/d10o6nnig0wrdw.cloudfront.net/05-09-2024/t_fab10267147f40fb93a1deb8a0b6553b_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/E3DSJ6NJLFA5DOKMPQRAH5STMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)