Brighter Outlook for Bank Technology Providers

We're still ambivalent about recent M&A, though.

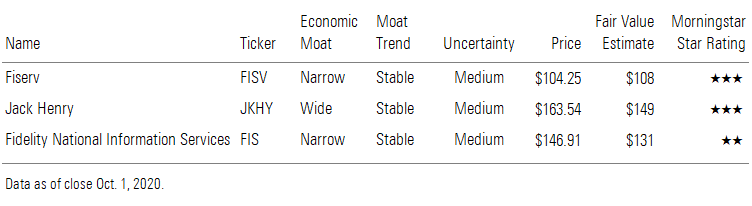

We have boosted our long-term growth and margin assumptions for the three bank technology providers we cover. As a result, our fair value estimates have increased to $131 per share from $98 for Fidelity National Information Services FIS, to $108 per share from $89 for Fiserv FISV, and to $149 per share from $131 for Jack Henry JKHY. Additionally, we have changed our fair value uncertainty rating for Fidelity National to medium from high and raised our stewardship rating for the company to Standard from Poor. We are maintaining our wide moat rating for Jack Henry and narrow moat ratings for Fidelity National and Fiserv. We believe providing core processing and complementary services remains a wide-moat activity, given extremely high switching costs, but mergers and acquisitions have diluted Fidelity National’s and Fiserv’s businesses to a point where a narrow moat rating is more appropriate.

Currently, we see Fidelity National and Jack Henry as modestly overvalued, while Fiserv trades at a slight discount and looks to be the best relative value. Following Fiserv’s merger with First Data last year, the acquiring business is no longer laboring under a heavy debt load. With these financial health concerns removed, we think the company has room to increase investment in the business and start to close the growth gap with its peers. While First Data remains relatively reliant on its banking partners, initiatives such as Clover (a cloud-based point-of-sale platform) suggest it is capable of adjusting to a changing industry. Clover’s small-business solution is similar to Square’s offering and has seen strong growth, with volume at an annualized run rate of $90 billion. This is a drop in the bucket relative to overall volume, but Clover enjoys much stronger pricing and is the type of platform that we think the company needs to move its growth rate more in line with the rest of the industry.

We remain ambivalent about the recent mergers that added acquiring operations for Fidelity National and Fiserv. The COVID-19 pandemic illustrates one of the main negatives of these mergers--the acquiring businesses are now significantly more macro-sensitive than they were when they were more heavily weighted toward their legacy bank technology operations. However, recent results suggest that payment volume has steadily improved from its April lows and is returning to positive year-over-year growth. Unless the recovery from the pandemic takes a sharp negative turn, the long-term secular tailwind appears to be reasserting itself with the worst of the crisis seeming to be past the industry. In the long run, we believe the secular tailwind for electronic payments should boost overall growth for Fidelity National and Fiserv.

Jack Henry is a smaller player and sat out the recent wave of mergers, but we believe its patient approach to growth has bolstered its moat. Fiserv and Fidelity National are essentially roll-ups, and while building a leading position through M&A in an attractive industry is not a negative, it has left these companies with multiple acquired platforms that they must maintain, or risk voiding their switching cost advantages. In contrast, Jack Henry has grown organically and utilized acquisitions only sparingly. As a result, it has built unified platforms for banks and credit unions. Its slimmed-down product set allows it to focus its resources and maintain operating margins on par with its larger peers, and historical results suggest that Jack Henry has increased its share over time.

/s3.amazonaws.com/arc-authors/morningstar/da2d065f-39a9-49e3-8551-1d3832fc658a.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-09-2024/t_fab10267147f40fb93a1deb8a0b6553b_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/E3DSJ6NJLFA5DOKMPQRAH5STMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/da2d065f-39a9-49e3-8551-1d3832fc658a.jpg)