Banco Santander's Moat Flows Beyond Spain's Borders

Economic moats at the bank's subsidiaries are reservoirs that preserve the narrow moat at a global level.

Narrow-moat

Powerful Network of Retail Banks in Many Regions With a significant market share in 10 countries, Banco Santander is one of the largest retail banks in the world, with more than $750 billion of deposits. In our view, its network of banks contains some very high-quality operations. The company was founded in Spain in the mid-1800s, but under the leadership of third-generation chairman Emilio Botin, who died in 2014, Banco Santander expanded at a large scale in Latin America in the 1990s. During the 2000s, it expanded into the United Kingdom and United States through opportunistic acquisitions. Santander has transformed all of these acquisitions over the years into highly successful extensions of its Spanish operation by imparting its expertise in retail banking, training local management teams and instilling the Santander culture of conservatism throughout the organization. Each geographic market is operated as a stand-alone subsidiary within the Santander network. In most cases, the individual units have been able to duplicate the same competitive advantages of the original Spanish bank, making the company as a whole a narrow-moat bank, but also a collection of moaty businesses in different markets.

Santander's total deposit growth has been a bit muted over the past five years at 1%-2% because of weak growth in Europe and the U.K. However, since 2010, deposit balances in the bank's U.S. and Latin American businesses have averaged 9%-10% annually. We expect deposit growth to return to low to mid-single digits in the European operations and mid- to high-single-digit growth to continue in the American markets over the next five years, resulting in total deposit growth of 5%-6%.

The bank is in the top four in deposit market share in nearly all of its major geographic segments, a clear indication that few banks are able to generate as much low-cost deposit funding as Santander. Furthermore, the bank has shown an ability to expand its share of deposits in these markets, which will help maintain its funding advantage. While healthy market shares by banks are common and should be expected by investors, the ability to turn strong market share into sustainable cost and switching-cost advantages is less common. However, Banco Santander has done just that, in our view.

Geographic Diversity and Subsidiary Structure Have Several Advantages We think Banco Santander is being penalized for owning Latin American banks--primarily in Brazil--but its geographic diversity in even downtrodden markets is a benefit over the long term, in our view. It provides the company with resiliency in times of stress, like the recent fallout in the Spanish market. We don't think Brazil's troubles are going to overwhelm the banks we cover, as the state-operated banks will bear the lion's share of a general rise in defaults. While state banks increased loans at a torrid pace beginning in 2012, privately run banks like Santander Brasil focused on high-quality borrowers. Our forecasts do not imply that the privately operated banks will be fully shielded from credit problems, but asset quality is much stronger at a bank like Santander Brasil than the national averages. Our assumptions include slower growth and a modest rise in credit costs through the next two years, but Santander Brasil remains on solid footing, in our view. The Spanish housing and economic crisis provides insight into how an internationally diversified bank fares versus a domestically concentrated bank. Looking back on Santander's performance versus large Spanish peer Banco Popular POP, we can see the role that expansion into new markets played in drastically reducing the need for a strong Spanish economy to deliver solid results. Santander was able to weather the crisis in decent shape, a far different outcome from Banco Popular, which was forced to raise dilutive capital in 2012. Meanwhile, Santander was able to sell a stake in its Mexican operations in one of the largest initial public offerings ever in Mexico in 2012, taking advantage of a positive outlook for the country that supported a strong deal price.

Even though Santander has established strong businesses in several countries across the Western Hemisphere, we think investors continue to perceive it primarily as a Spanish or European bank. While this was still somewhat true as recently as 2005, when the company earned roughly one third of its profits within Spain, by 2010--before large credit losses in the Spanish system--Santander's home country operations contributed less than one fourth of total profits to the organization. By 2014, only 14% of profits were attributable to Spanish operations; we expect this to rise somewhat as the country continues on a path of recovery, but stay far below previous levels.

Santander has become much less dependent on operations in all of Europe over the past 10 years as well. European operations contributed two thirds of profits in 2005, but by 2010, this was reduced to just over half. The major driver of this was the simultaneous effect of Santander's purchase of ABN Amro's Brazilian bank and the strength of the Brazilian economy. A 20% surge in the value of the Brazilian real versus the euro over that time also helped profit growth in euro terms. The ramp-up in Brazilian profits came despite the bank's decision to sell a 25% stake in the company through a public listing in 2009.

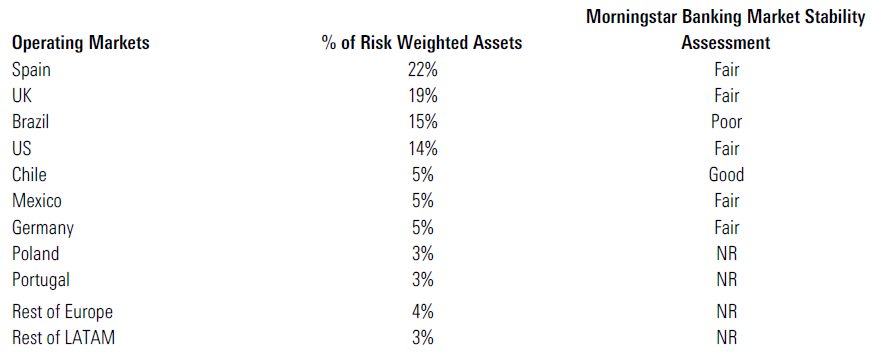

Santander Operates in a Variety of Market Environments Diversification doesn't necessarily add to a bank's economic moat, but we do like the resiliency it creates for Santander to be able to endure stress in one of its operating regions. With that said, investors have taken an unfavorable view of some Santander's particular exposures, namely the emerging markets in Latin America, and consider them a bigger drawback than benefit. It's true that these exporting economies have suffered slowdowns largely attributed to the falloff in Chinese demand for iron ore, soy, copper, and oil, but we believe the long-term prospects of these countries will improve with economic diversification and deepening, despite near-term difficulties. Further, we think the negative investor sentiment surrounding Latin America could be misplaced with regard to Santander's Chilean and Mexican operations.

Of all the markets in which Santander operates, Chile is one of the most stable, in our view, reflected in our rating that it is a good market for banks. We believe Chile's regulatory environment is sound, the country consistently scores well on the World Bank's ease-of-doing-business rankings, and the competitive environment is very positive for banks because limited competition contributes to very healthy profitability. Chile's macroeconomic outlook is somewhat of a concern because of falling copper prices, but we think the country's many positives offset this worry somewhat. (For reference, only 5 of 21 other markets were graded as highly as or better than Chile, with Australia and Canada as notable examples.) Mexico's banking stability also rates as well as many of the largest and most developed economies. This view is driven by a favorable competitive environment, but fares less well from a political or ease-of-doing business standpoint than Chile and is also weakened by macro concerns.

Santander Operates Primarily in Environments With Fair Banking Market Stability

Source: Santander company filings and Morningstar research

The obvious red flag is Brazil, because we rate the stability of its banking market as poor and Santander has a large relative exposure to the country. Since 2010, when Brazil posted its robust GDP growth of 9% and was grouped with other major growing economies as part of the BRIC nations along with Russia, India, and China, its growth rate has only headed south, turning negative in 2014. If macro headwinds weren't enough, a corruption scandal at Petrobras has shaken confidence in the country's government officials, many of whom are implicated in having accepted bribes from construction companies when awarding contracts. Worse still is that the bribes are alleged to have taken place under the watch of Brazilian President Dilma Rousseff, as she was chairwoman of the board at the time. Ultimately, the distraction could lead to near-term gridlock in the country's congress, delaying much-needed pro-growth reform. With that said, banking in Brazil is very profitable. If the near-term headwinds abate, the country's long-term growth trajectory could recover--the World Bank projects almost 3% growth as soon as 2017.

Subsidiary Model Has Several Advantages Even if the turbulence in Brazil drags on longer than the anticipated one to two years and the impact of falling commodity prices continues to weigh on exporters like Chile, Santander's subsidiary model creates a layer of protection to keep these issues from spreading to its other units. Each subsidiary is autonomous from the parent in capital and liquidity concerns, and in some cases, it trades publicly as an independent entity. This is an attractive structure, in our view, and adds to the overall resiliency of the global bank. Subsidiaries are able to issue debt or equity to raise funds independently, but still possess an implicit guarantee from the global bank--the parent would probably step in to provide capital rather than face any sort of dilution or loss of assets, allowing it to achieve a lower cost of debt, relative to local peers, or higher equity prices in a share sale. At the same time, it relieves the parent from the balancing act of allocating a finite amount of capital resources.

The structure has operational benefits as well. Centralized risk and technology functions have led to superior efficiency versus peers in many of the bank's operating areas. For instance, best practices to prevent fraud and money laundering are developed at the parent level but employed by all of its subsidiaries at little additional cost. In Chile and Mexico, Santander's roughly 40% average cost/income ratio in the past five years was the lowest of any major peer in each country, and we expect that performance to largely continue. In Brazil, Santander is far more efficient than all but the top two competitors and should continue to close the gap with more diversified revenue streams, like investments in credit card processing and insurance. Further, best practices developed in any given unit can quickly be recognized at the group level and deployed in another subsidiary to improve performance. This will be particularly helpful, since mobile banking is likely to advance more quickly in developed markets. Santander will be able to easily adopt these new capabilities and distribution channels in its less-developed markets to stay ahead of local competitors, which have fewer resources.

Santander Has Capital Necessary to Support Low-Risk Business Structure We believe some investors misunderstand the durability of Santander's subsidiary model and fail to recognize the low-risk nature of its retail banking operations, which constitute more than 70% of the group's profits, while another 10% of profits are generated in private banking, one of our favorite financial services businesses because it tends to be moaty, with sticky customers, economies of scale, and low capital requirements. The bank earns the remaining 20% of profits through wholesale banking, which we view as a less moaty business, but the vast majority of company profits are derived from low-risk businesses. Santander has a fully loaded common equity Tier 1 ratio of 9.8% (Basel III) as of June. Some investors view Santander as undercapitalized because this ranks at the low end of European peers. But we think Santander's low-risk businesses and, perhaps more important, the segmented operating structure do not require the bank to hold the same level of capital as many of its peers, largely because it can quickly obtain additional capital through several channels.

If a unit like Santander Brasil found itself in need of capital, Santander could issue additional shares of the Brazilian unit, issue shares at the parent level and inject capital into the Brazilian unit, or sell a stake in another subsidiary and inject capital into Brazil. If parent Banco Santander needed to bolster capital, it could do so quickly by selling a stake in one of its publicly traded subsidiaries, issuing debt in an overcapitalized subsidiary and paying a special dividend to the parent, or selling additional shares at the parent level, as it did in early 2015.

Ultimately, the publicly traded subsidiaries provide a readily available market price for the businesses that could easily be transferred into additional capital at the group level. This would come at the expense of future profits, but it illustrates that Santander could draw on the value of its subsidiaries in an expedient manner to raise additional capital if needed. Furthermore, Santander is on the cusp of increasing its fully loaded common equity Tier 1 ratio to an even more comfortable 10%-11% within the next year, which would put it closer to its peers.

Late in 2014, the European Central Bank carried out an Asset Quality Review of 130 European banks to assess the potential capital needs of its member banks under baseline and adverse scenarios. This assessment, however, used a less stringent "transitional" common equity Tier 1 capital calculation. Banco Santander fared particularly well in the assessment, with a predicted transitional common equity Tier 1 capital ratio that declined to only 8.9% by 2016 in an adverse scenario, still well above regulatory minimums. This ranks favorably versus a peer group of some of the largest European banks. Further, Santander's estimated capital buffer in an adverse scenario was EUR 19 billion, the second-largest expected buffer for any of the banks evaluated, trailing only Credit Agricole's ACA estimated EUR 21 billion capital buffer. While these capital ratios do not fully reflect Basel III standards due to be enforced at the beginning of 2019, we think the results indicate that Santander is not undercapitalized.

Even after scoring well in the AQR assessment, Santander raised EUR 7.5 billion of equity capital early in 2015 through a public share offering. This raised the bank's transitional common equity Tier 1 ratio to 12.2%, putting it close to European peers with respect to the transitional calculation. While this metric requires fewer deductions from common equity compared with the fully loaded measure, it indicates, along with the AQR results, that Santander has sufficient loss-absorbing capital. Even so, we expect the bank will continue to work toward increasing its capital to qualify for the fully loaded calculation.

Valuations Are Attractive, With Varying Degrees of Risk and Reward With respect to Santander's Latin American operations, we think the market is suffering from an overly short-term perspective and getting caught up in the rush for the exits from emerging markets, generally, as shown in the depreciation of currencies. Year to date, the Brazilian real is down 30% versus the U.S. dollar, while the Chilean and Mexican pesos are down 14% and 13%, respectively. From a purely domestic perspective, Santander Chile, Santander Mexico, and Santander Brasil have the ability to deliver long-term value creation but are weighed down by economic factors like falling commodity prices and political disorder (Brazil) that are out of their control. Because of these factors, we believe the shares of Banco Santander and the subsidiaries that we cover are trading at attractive discounts to fair value.

Good System Stability Helps Santander Chile Earn a Wide Moat Santander Chile consistently delivers high levels of profitability, which we believe is more than likely to continue in even difficult environments, given the support of a strong Chilean banking system. We assign the bank a wide moat on the basis of its cost advantage and customer switching costs, as well as the advantage that we ascribe to Chile's system stability score of good.

With a 17% share of the deposit market, Santander Chile's funding costs are consistently low--interest expense on liabilities was 3.5% in 2014, slightly behind major peer Banco de Chile BCH at 3.3%, but on the very low end of Chilean standards. It possesses one of the largest branch networks in the country, allowing it to attract borrowers and maintain a top position in deposit market share. With high customer switching costs attributable to the wide range of products and services it provides for its clients, the bank is able to pay modest deposit yields. Further, it can obtain cheap debt financing given the support of its global parent. In early 2015, the bank issued a CLP 50 billion ($80 million) bond that ultimately was priced only 85 basis points above local reference benchmarks, while the secondary market implied that a 100-basis-point spread was more likely given market conditions. This advantage leaves Santander Chile in a position to aggressively compete for the highest-quality loans to increase interest income.

Santander Chile is consistently the most efficient operator in the country, which contributes to reliably strong returns on equity. The bank has reported a lower efficiency ratio than any of its four major peers in Chile over the past five years, hovering at or below 40%. We attribute this to the scale advantages that parent Banco Santander has created with centralized technology and risk controls that can be used by all of its global subsidiaries. Santander Chile rarely has to spend significant resources to develop new systems or processes on its own, which will keep it as the most efficient operator in Chilean banking, in our view.

Chile's regulators are reliable and independent, and banking supervision is considered "robust" by the International Monetary Fund. The competitive environment is quite good because there are few major competitors in the market, and soft price competition bolsters profitability. The political environment is stable, and little reform is needed since Chile scores highly on the World Bank's ease-of-doing-business index. The macroeconomic environment is more mixed, however. Falling copper prices and weak demand from China are considerable concerns for industrial activity and trade and could affect consumers by stoking inflation. At the same time, the country is a beneficiary of low energy prices, which has helped keep inflation low, and it is planning to diversify its energy sources away from fossil fuels to mitigate risks of higher energy costs.

Santander Chile is one of the most profitable banks in all of Latin America, historically producing returns on equity near or above 25%. While profits have moderated somewhat in recent years with modest increases in expenses, we expect returns on equity to continue to pace near 20% in the medium term, with earnings rising at a 10% annual average.

Santander Mexico Has Opportunity to Expand Share in Deepening Market Santander Mexico has established a formidable retail banking business in Mexico, a banking market that we believe could generate sustainable growth for many years to come. Santander Mexico is the fourth-largest bank by market share of deposits and loans and is gaining on its rivals. It is also one of the most profitable with its superior operational efficiency. Over the past five years, Santander has averaged a cost/income ratio of 40%, while its major peers have operated closer to 50%. Santander Mexico maintains consistently strong asset quality, which we expect to continue.

We consider Mexico's overall banking system stability to be on par with major markets like the U.S. and U.K., though it took decades of turmoil to reach this point. In the 1980s, banks were nationalized to save the system from crumbling and privatized by the early 1990s partially because the government faced its own fiscal crisis and needed cash. Another bailout in the mid-1990s forced a much-needed reform of the system, and strict regulations and lending requirements were instituted. Only a few large banks emerged from the most recent crisis, and the small handful of remaining competitors allows all of them to earn healthy returns. Perhaps the most intriguing aspect of the Mexican market is its potential for sustained long-term credit expansion. Private credit/GDP is roughly 30% and mortgage debt/GDP is only 11%, far below even many emerging markets. Further, financial inclusion is quite low, partially as a result of the limited access to bank branches, with only 15 branches per 100,000 adults. As banking becomes more digitized, physical limitations will matter less, and increased participation could expand the base of creditworthy borrowers. The industry has the capacity to increase credit but remains very conservative in granting loans--not necessarily a bad thing. If Mexico can safely increase credit/GDP levels to be more in line with markets of its size and scope, bank lending will increase much faster than overall economic growth, to the benefit of the country's banking industry.

We expect narrow-moat Santander Mexico to capture more than its current share of the growth in Mexico's banking market. We think the bank's superior efficiency will allow it to compete aggressively for new client relationships, and solid underwriting will maintain the stability of the business. We expect returns on equity to average in the high teens in the medium term, potentially rising as high as 20% by the end of our forecast period.

Brazil's Woes Won't Stop Santander Brasil From Improving Profitability We think Santander Brasil has established a narrow moat in the Brazilian banking market and is well positioned to reap the rewards of a cost advantage in a concentrated environment to deliver long-term excess profits for shareholders. The bank was created through the acquisition of ABN Amro's Brazilian assets, which allowed Santander to propel into a top-three position of market share among privately controlled banks. Santander publicly listed the individual unit to raise capital to be invested in gaining greater share, particularly in the growing credit card and insurance businesses of Brazil. The bank was careful with its treasure chest of capital, though, and the excess capital on the balance sheet resulted in reported returns on equity that trailed far behind major peers Itau Unibanco ITUB and Banco Bradesco BBD. This left many wondering whether it would ever be able to match the earnings power of the two leading banks.

From our perspective, the bank's operating characteristics are far more important than reported returns, because Santander Brasil's advantages will ultimately drive long-term excess returns, in our view. We focus on the bank's funding costs, operating costs, and credit costs. On these measures, Santander Brasil stacks up well against its peers. The bank's interest expense on average interest-bearing liabilities is in line with Itau and Bradesco. This implies that it can compete for deposits on the same level as its larger peers. Operating efficiency is equally good, and credit costs are reasonable, considering the greater consumer lending focus. While Santander's returns on equity have only tracked in the high single digits Itau and Bradesco consistently generate near 20%. But given that Santander Brasil has roughly the same advantages as its much larger and longer-tenured peers, we think the earnings power exists for it to increase earnings nearly in line with its rivals.

In addition to the disappointment of reported earnings, Santander Brasil's stock is suffering from the fact that it operates in Brazil. We have rated Brazil as a poor banking market from a stability perspective, mostly weighed down by a very weak near-term macroeconomic picture as well as the current political turmoil. In the long term, the country's potential is fueled by a relatively young populace, rapidly improving education, and capacity to drive better productivity through improved infrastructure, but it will take cooperation in government to repair the country's balance sheet and institute pro-growth reform to return Brazil to a solidly positive trajectory. For this reason, Santander Brasil is a high-risk/high-reward investment today, in our view, as the currently depressed valuation does not recognize the bank's true long-term earnings power.

We expect balance sheet growth to be muted to low-single-digit levels over the next two years, but this won't necessarily prevent Santander Brasil from improving profitability. We've long expected credit costs to rise after a recently strong period in credit quality and already price in the expected rise in losses. Still, the bank can drive earnings higher in the near term with continued investment in fee-based business, which has picked up recently. In our view, returns on equity should rise in the near term to the midteens, which will demand a higher valuation than current levels.

Developed Markets Provide Lower Risk at Parent Level For investors wary of diving into emerging or Latin American markets, we think the parent group offers a great way to gain exposure to the potential long-term upside of these markets while benefiting from the diversity and strength of more developed markets like the U.K., where Santander's advantages are also strong. We believe Banco Santander has established an economic moat in Brazil, Chile, and Mexico as well as its home country of Spain and will continue to deliver strong profitability over the long term. In the near term, the company will lean on its developed-market operations to drive earnings, but we think Latin America, where the World Bank expects to see growth rise to 3% by 2017, will ultimately return as a long-term growth driver for Banco Santander.

Our fair value estimate values the company at roughly 1.4 times tangible book value and only equivalent to the book value of shares. We believe this is a highly attractive price for such a resilient and strong global bank with considerable earnings power. We expect that declines in Latin American currencies will weigh on near-term growth because of negative translation into euros, but that the individual units will continue to expand their balance sheets and earnings at a healthy pace. For the bank as a whole, we expect the loan portfolio to grow near 4% over the next five years, with total group net interest margin rising from a recent 2.8% toward a long-run rate of 3%. This will achieve a growth rate of 6% for the bank's net interest income. We expect falling credit costs in Spain to offset credit deterioration in Latin America and thus maintain a stable loss rate of 1.5% over the next five years. We think net fee income can grow at a mid-single-digit pace over our forecast period fueled by revenue diversification, particularly in the U.S. and Latin American operations. Santander's ability to drive operational leverage will continue to bolster returns, in our view, as we think expenses can stay flat in the near term, driven by further rationalization of the branch network. As such, we expect Santander's cost/income ratio to improve from recent levels above 52% closer to a long-run rate in the mid-40s. We believe Banco Santander is poised to drive returns on tangible equity to 15% in the medium term, well ahead of our 11% cost of equity assumption.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PVJSLSCNFRF7DGSEJSCWXZHDFQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F5UMFVVKMVFRPGGUY4LONIK6OY.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-03-2024/t_8ba91080cb4d43acae9d9119875abede_name_file_960x540_1600_v4_.jpg)