Are Independent Refiners Still Buys?

Shares have rallied, but valuations are still compelling as the near term remains uncertain.

2020 has taken a turn for the worse for the oil refiners. Originally well positioned to enjoy a tailwind from the implementation of IMO 2020 regulations (wider heavy crude differentials, stronger distillate margins), refiners are now slashing capacity to adapt to crashing product margins and a collapse in demand. Demand for the remainder of the year remains uncertain, with the market largely anticipating a strong summer gasoline season as U.S. travelers look to get out of the house but avoid air travel. As a result, the jet fuel market will remain weak and spill over to the distillate market as refiners blend excess jet fuel into distillate, creating excess supply.

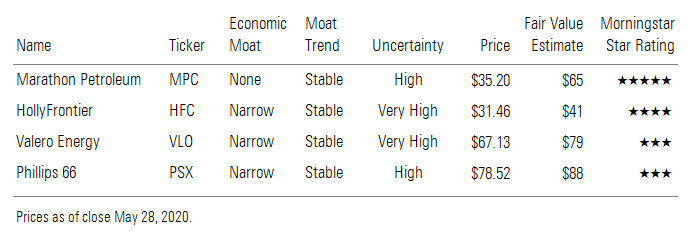

Despite the near-term uncertainty, we think investors should get interested in refining shares for two reasons. First, while destroying near-term demand, the coronavirus should not affect long-term demand, leaving our midcycle product margin and crude differential forecast unchanged. Second, valuations are attractive and continue to discount a return to normalized conditions. While volatility in the shares probably isn’t finished, refiners are worth a look, given their valuations and low risk of near-term financial distress. On the basis of discount to our fair value estimate as well as asset-based metrics, Marathon Petroleum MPC stands out, followed by HollyFrontier HFC.

Inventories Exploded and Margins Collapsed U.S. efforts to quarantine beginning in March took a heavy toll on domestic refined product demand. During the month of April, weekly demand for gasoline, distillate, and jet fuel fell on average 44%, 61%, and 15%, respectively. The decline in gasoline demand appears to have troughed in the first week of April with declines in subsequent weeks less extreme, albeit still severe. Meanwhile, distillate demand appeared to be worsening by late April/early May compared with earlier in the month. Jet fuel demand continues to bounce along the bottom with declines of 70% in the first week of May, at about the same level as the second week of April. Inventories have ballooned as a result, in absolute and demand-adjusted levels.

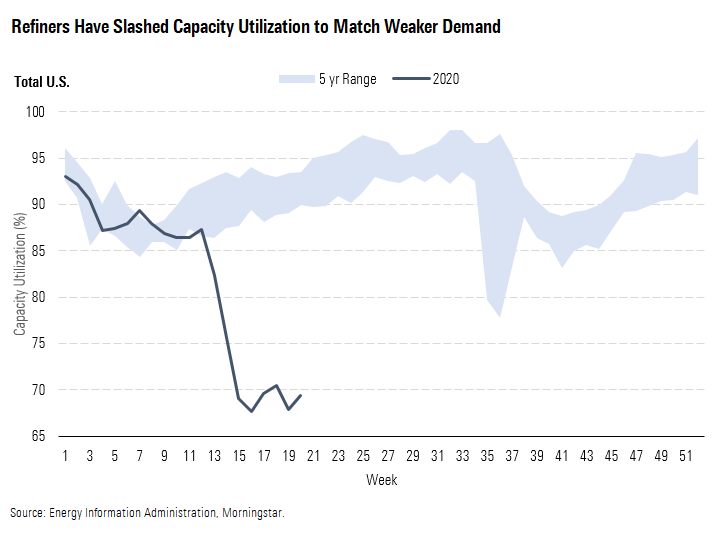

Refiners acted quickly to reduce utilization to match demand levels. Utilization levels for April fell to 70% on average, compared with 89% in 2019. After bottoming at 68% in mid-April, utilization has begun to increase slightly, most recently to 71% the last week of April, but second-quarter guidance from refiners suggest further increases are limited, as most forecast approximately 70% for the quarter.

The quick collective action by refiners could not avoid a buildup in inventories, however. The increase was especially severe on a demand-adjusted basis (days of supply), given the collapse in demand. It did at least stem the buildup in gasoline inventories, leaving distillate inventories more problematic for a recovery.

While distillate demand has held up relatively well, refiners have been mixing surplus jet fuel into the distillate pool, increasing supply and creating a buildup in inventories that might otherwise be limited, given the relatively stronger demand and reduced utilization levels. As a result, distillate production has remained at 2019 levels and jet fuel production has recently fallen to 40% of 2019 levels, despite utilization levels falling 20% from 2019 levels. This supports the idea that jet fuel is flowing into the distillate pool. Using our estimates of what jet fuel production would be, based only on the decline in 2020 utilization levels, we have determined that as of the last week of April, about 750 thousand barrels per day of jet fuel production, or 15% of 2019 distillate production, might be in the distillate pool.

The difference between the direction of inventory levels is reflected in the path of refining margins. While gasoline margins initially turned negative on the drop in demand and buildup in inventory, the recently improving inventory position has translated into a margin recovery. Meanwhile, distillate margins are continuing to weaken as inventories grow. If the trend continues, the result could be gasoline margins becoming more attractive than diesel margins, a benefit for U.S. refiners that typically produce more gasoline. This would mark a reversal of the past several years, when much stronger distillate margins have supported total gross margins and encouraged high levels of utilization.

Lagging Jet Fuel Demand Could Weigh on 2020 Margins We expect a quick recovery for the primary refined products of gasoline and distillate. We expect jet fuel demand to recover much more slowly. The uneven recovery in refined product demand could ultimately cause issues for inventories and margins that weigh on refiners' profitability for the remainder of the year even as demand improves.

We expect gasoline demand should recover as shelter-in-place orders are relaxed and travel for recreation, shopping, and work increases. We continue to project year-over-year declines in demand, but those declines should moderate in the third and fourth quarters, assuming economic activity resumes at a steady pace throughout the year. While those working at home and avoiding commuting may continue to do so for a longer period, or even permanently, that effect might be somewhat offset by those who choose private vehicles to avoid public transportation. Meanwhile, those opting for a summer vacation might be more inclined to drive as opposed to fly, considering the concerns about coronavirus transmission on a plane and the potential added hassles of flying, given new COVID-19 mitigation measures.

Distillate demand has fallen less than either gasoline or jet fuel largely because distillate (diesel) is used to power heavy-duty over-the-road trucks and trains and is more closely tied to overall economic activity. While all economic activity has suffered, the decline in demand for goods has not been as severe as activity related to travel by light-duty vehicles. Unlike typical global recessions, which have hit investment expenditure and durable goods consumption much harder than services consumption, this recession will be focused more on services, given the need for social distancing. As economic activity broadly increases throughout the year, we expect distillate demand to increase as well.

In contrast, we expect jet fuel to register steep declines for the remainder of the year. Though social distancing requirements might drive down capacity utilization, which would normally mean more flights, we see that as more than offset by an unwillingness to fly, given the potential for COVID-19 transmission. While we expect air travel demand to recover throughout the year from currently depressed levels, it might take time--perhaps until a vaccine is developed, which we do not anticipate will occur until late 2020 at the earliest--for air travel to recover to previous levels. Even then, we expect vaccine production to be limited and supply reserved for healthcare workers and at-risk populations. Broader distribution is unlikely to take place until the first half of 2021. Furthermore, we anticipate that those who are willing to travel by airplane will prefer to do so domestically as opposed to internationally; this would require smaller, narrow-body planes that use less fuel per trip than larger, wide-body aircraft used for international travel.

This imbalance in demand recovery could create problems for refiners. Given that gasoline is U.S. refiners’ primary output (46% of yield in 2019), we’d expect them to increase utilization rates from currently depressed levels to meet recovering gasoline demand and capture improved margins. With little leeway to flex between production (approximately 10% of volumes), refiners’ increase in utilization will also drive greater volumes of distillate, jet fuel, and other products.

With improved domestic and export demand, the market would probably be able to absorb the typical increase in distillate production that would come with higher levels of utilization. Jet fuel presents a problem, however, as refiners are likely to produce more than is required and as a result continue mixing it into the distillate supply. Consequently, total distillate supply could still outpace demand, which will create excess supply, build inventories, and weigh on margins.

Based on our rough modeling, we estimate utilization rates should recover to average 80% during the third and fourth quarters in order to meet the higher gasoline demand in our forecast. Using historical yields and our demand forecasts for distillate and jet fuel, we estimate excess jet fuel could result in an additional 30% of distillate supply for the remainder of the year if it is all diverted to the distillate pool.

However, there is a limit to how much jet fuel a refiner can mix into the distillate pool, given the configuration of the refinery. As such, all excess jet fuel supply is unlikely to make it into the distillate pool as utilization increases. As our analysis suggests, though, the increase in jet fuel production as utilization increases will outweigh demand, potentially resulting in a glut of jet fuel. Either way, refiners could face weakness in margins outside the gasoline portion of their output.

Shares Have Rallied, but Valuations Still Attractive Regardless of the murky near-term outlook, we see little deviation from the prior long-term demand outlook for refined products. A greater number of people working at home could erode gasoline demand, but it's unlikely to affect demand materially in the short term, given the limited number of workers for whom this is an option, the potential for public transportation substitution with personal vehicles, and the time needed for companies to transition to a more permanent remote workforce. We continue to see electric vehicle adoption as a long-term threat, but we expect any material impact to be more than a decade off. Meanwhile, distillate demand should continue to grow with GDP, while the long-term demand for more air travel seems intact as well.

While we plan to monitor each of these issues closely for any signs of impact on long-term demand from the fallout of COVID-19, our midcycle margin assumptions are unchanged for now. Thus, our long-term financial forecast for refiners is intact, leaving valuation the biggest question. Refiners are certainly much less inexpensive than they were in late March, as a furious rally has pushed shares 90% higher on average from their low. However, the group continues to trade at an average 24% discount to our fair value estimates. Our discounted cash flow-derived long-term estimates remain our primary valuation tool, given the importance of our long-term assumptions, as opposed to reliance on near-term earnings forecasts that remain highly uncertain for the next 18 months. Using forward multiples based on our current earnings estimates for 2020 and 2021 implies that shares are expensive, but crack spread futures curves remain depressed and not reflective of a potential recovery, in our opinion. Estimates for 2022, which use our midcycle assumptions, imply that shares are inexpensive.

To gauge valuation without relying on any financial forecast, we can look at implied asset values. Adjusting market-implied enterprise values for nonrefining segments (retail, marketing, chemicals) and master limited partnership ownership where it applies, we can calculate the value that the market is assigning to the underlying refining assets and compare that with historical valuations. Removing publicly traded MLP ownership can be particularly important for Phillips 66 PSX with Phillips 66 Partners PSXP and Marathon Petroleum with MPLX MPLX. These MLPs constitute 11% and 37% of our fair value estimate for their parents, respectively, and their units are down 25% and 26% year to date.

Based on market-implied asset values--adjusted EV/complexity barrel--the refiners, except for Valero VLO, are currently trading well below where they have been for the last five years. Valero’s recent and current asset valuations are affected by its decision to repurchase its MLP. As a result, midstream earnings are now combined with the refining segment, increasing that segment’s and the assets’ value relative to how those assets were valued in 2014-19 when they were housed in an MLP. As such, comparing current values with 2014-19 is less useful.

We prefer to use these asset values as markers of valuation and sentiment as opposed to precise measures. In other words, when low, the shares are cheap as the market is overly pessimistic on their prospects by pricing in near-term weak market conditions. The market appears to be valuing assets in line with 2010 levels, when shares were still suffering from the fallout of the global financial crisis. They are also lower than mid-2016 levels, the last time refiners looked very cheap, after which the shares doubled on average the next two years. We think that could prove to be the case with the group again as improved near-term conditions would result in an increase in our fair value estimates. After the recent run, Marathon continues to stand out for the pessimism reflected in its share price, as it trades at the greatest discount to our fair value estimate and asset values are well below historical levels.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VZ75Y7YOWNC7PPE5HNPGTGWCUI.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZPLVG6CJDRCOTOCETIKVMINBWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZSPP5AYAJB2RIRVFE2XR23GUQ.jpg)