After Earnings, Is Tesla Stock a Buy, a Sell, or Fairly Valued?

With a strategic shift in focus and likely slower growth ahead, here’s what we think of Tesla’s stock.

Tesla TSLA released its fourth-quarter earnings report on Jan. 24, after the close of trading. Here’s Morningstar’s take on Tesla’s earnings and stock.

Key Morningstar Metrics for Tesla

- Fair Value Estimate: $200.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Very High

What We Thought of Tesla’s Q4 Earnings

- Tesla’s fourth-quarter results were slightly above our expectations, as both companywide operating profit margins and automotive gross profit margins were up sequentially versus the third quarter. We expected margins would be flat or slightly down as price cuts weighed on profitability, but unit production cost reductions offset lower prices.

- Management’s commentary in the earnings release and subsequent call signaled a strategic shift away from cutting prices in order to grow deliveries. Instead, Tesla will focus on further unit cost reductions as the company looks to improve per-unit profitability. This means the company will likely see slower growth in the near term. As Tesla is a high-growth stock, entering a phase of slower growth may lead to the stock falling out of favor. That said, the firm is setting itself up for longer-term growth through the development of the new affordable sport utility vehicle. This vehicle will grow deliveries, while the unit cost reductions should boost long-term profit margins.

- Shares trade just below our $200 per share fair value estimate, and we recommend investors wait for a larger margin of safety before considering an entry point. Given that Tesla is a high-growth stock entering a lower-growth phase, if the stock falls due to the market assuming Tesla’s growth story is broken, shares may offer a compelling valuation in the future.

Tesla Stock Price

Fair Value Estimate for Tesla

With its 3-star rating, we believe Tesla’s stock is fairly valued compared with our long-term fair value estimate.

In 2024, we forecast Tesla will see a far slower growth rate, with deliveries increasing just 10% to a little under 2 million, from a little over 1.8 million in 2023. We forecast lower average selling prices, as Tesla will likely have to cut prices in key markets like China, in line with peers. We forecast automotive gross margins will be 18% in 2024, in line with 2023 results.

In the longer term, we assume Tesla will deliver a little over 5 million vehicles per year in 2030. This includes fleet sales, an expanding opportunity for the firm. Our forecast is well below management’s aspirational goal of selling 20 million vehicles by the end of this decade, but nearly 3 times the 1.81 million vehicles delivered in 2023.

We think Tesla will be successful in continuing to reduce its manufacturing costs on a per-vehicle basis. We forecast segment gross margins will recover to the mid-20% range by the end of the decade—well above the 19% generated in 2023 but below the 29% margin achieved in 2022.

Read more about Tesla’s fair value estimate.

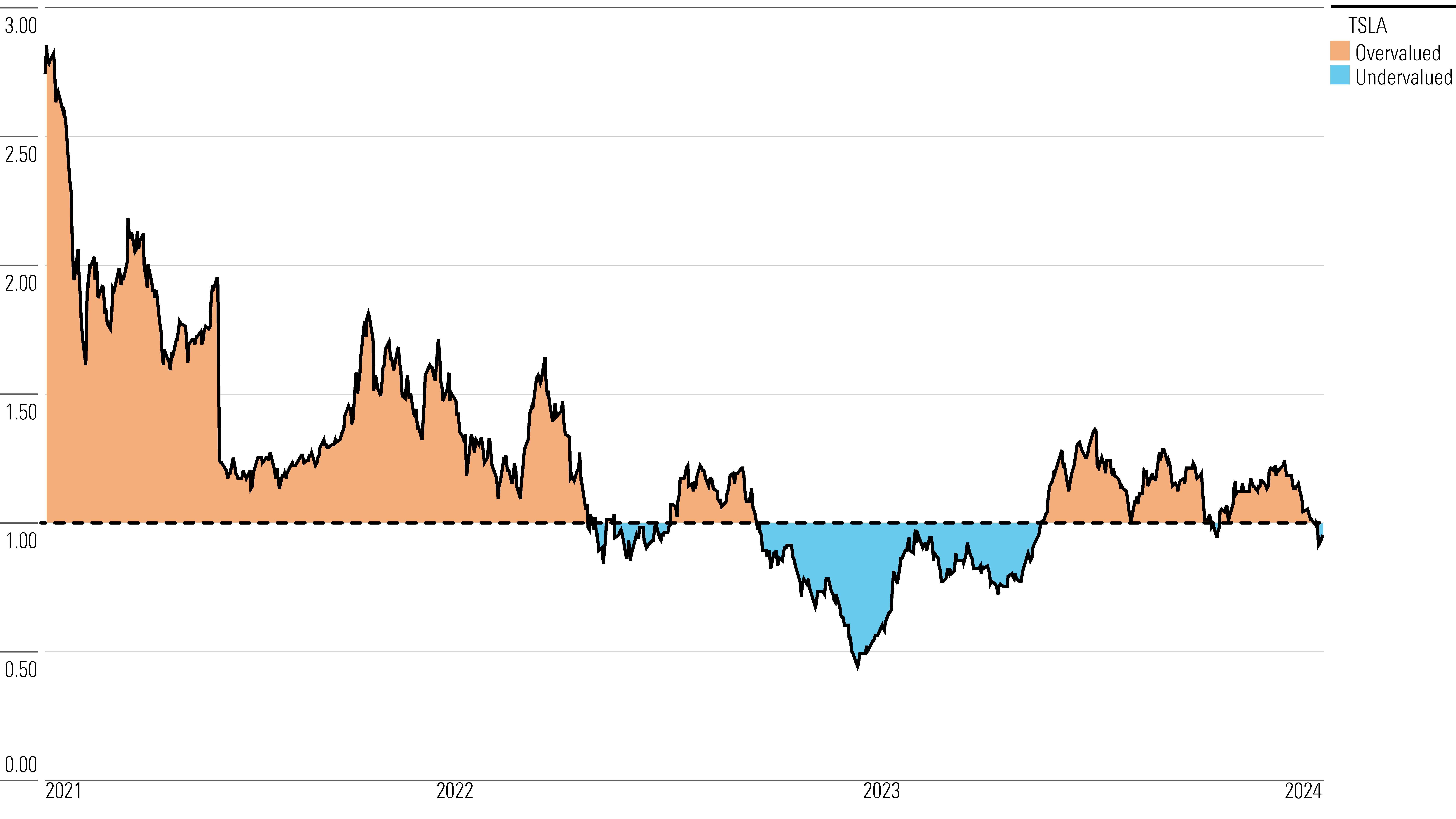

TSLA Review PF Chart

Economic Moat Rating

We award Tesla a narrow moat, based on its intangible assets and cost advantage. The company’s strong brand cachet as a luxury automaker commands premium pricing, while its EV manufacturing expertise lets it make vehicles more cheaply than its competitors.

We think Tesla’s combination of intangible assets and cost advantage will persist and allow the firm to generate excess returns on capital. We see the potential for the firm to outearn its cost of capital over at least the next 20 years, which is the measurement we use for a wide moat rating. However, the second 10-year period carries significant uncertainty for both Tesla and the broader automotive industry, given the rapid advancement of autonomous vehicle technologies that could transform how consumers use vehicles. As such, we view a narrow moat rating, which assumes a 10-year excess return duration, as more appropriate.

Read more about Tesla’s moat rating.

Risk and Uncertainty

We assign Tesla a Very High Morningstar Uncertainty Rating, as we see a wide range of potential outcomes for the company.

The automotive market is highly cyclical and subject to sharp demand declines based on economic conditions. As the EV market leader, Tesla is subject to growing competition from traditional automakers and new entrants. As new lower-priced EVs enter the market, Tesla may be forced to continue to cut prices, reducing the firm’s industry-leading profits. With more EV choices, consumers may view Tesla less favorably. The firm is investing heavily in capacity expansions that carry the risk of delays and cost overruns. The company is also investing in R&D in an attempt to maintain its technological advantage and generate software-based revenue with no guarantee these investments will bear fruit. Tesla’s CEO owns a little over 20% of the company’s stock and uses it as collateral for personal loans, which raises the risk of a large sale to repay debt.

Tesla faces environmental, social, and governance risks. As an automaker, Tesla is subject to potential product defects that could result in recalls, including its autonomous driving software. We see a moderate impact should this occur. Another risk involves employee retention. If Tesla is unable to retain key employees, such as CEO Elon Musk, its favorable brand image could decline. Should the company not be able to retain production line employees, it could see delays. We see a low probability but moderate materiality for both risks.

Read more about Tesla’s risk and uncertainty.

TSLA Bulls Say

- Tesla has the potential to disrupt the automotive and power generation industries with its technology for EVs, AVs, batteries, and solar generation systems.

- Tesla will see higher profit margins as it reduces unit production costs over the next several years.

- Through the combination of Tesla’s industry-leading technology and its unique supercharger network, the company’s EVs offer the best function of any on the market, which should help the firm maintain its market-leader status as EV adoption increases.

TSLA Bears Say

- Traditional automakers and new entrants are investing heavily in EV development, which will result in Tesla seeing a deceleration in sales growth and being forced to cut prices due to increased competition, eroding profit margins.

- Tesla’s reliance on batteries made in China for its lower-price Model 3 vehicles will hurt sales, as these autos will not qualify for U.S. subsidies.

- Solar panel and battery prices will decline faster than Tesla can reduce costs, resulting in little to no profits for the energy generation and storage business.

This article was compiled by Frank Lee.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RNODFET5RVBMBKRZTQFUBVXUEU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LJHOT24AYJCHBNGUQ67KUYGHEE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ca8d2ce1-cd0f-433b-a52b-d163be882398.jpg)