After Earnings, Is Nvidia Stock a Buy, a Sell, or Fairly Valued?

After the company’s strong second-quarter results and a high-flying year, here’s what we think of Nvidia stock.

Nvidia NVDA released its second-quarter earnings report on Aug. 23, 2023, during trading hours. Here is Morningstar’s take on the semiconductor manufacturer’s earnings and stock.

The trillion-dollar question is whether the artificial intelligence market can continue to grow at anywhere close to its current pace, and whether Nvidia can maintain its lead over all other AI solutions. We’re confident in the former trend, but on the second question, we think Advanced Micro Devices AMD and some custom chip solutions will carve out their own shares of the AI pie.

Still, we’re relatively sure that Nvidia can maintain its lead. Spending patterns in cloud computing have clearly shifted toward companies buying every graphics processing unit they can, rather than using CPU-based servers for non-AI workloads. No enterprise can afford to fall behind on AI investment, and no cloud computing provider can fail to offer enough GPUs to support its cloud customers. Consequently, we think AI chip spending will remain quite bright for several more quarters, and likely several more years.

Key Morningstar Metrics for Nvidia

- Fair Value Estimate: $480

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Very High

What We Thought of Nvidia’s Q2 Earnings

- Nvidia has been providing stunningly optimistic guidance in recent months, but it’s been delivering on these expectations, and then some. In May, its forecast of $11 billion in revenue was shocking, yet the firm smashed it and recorded $13.5 billion. Nvidia is now raising the bar higher with a forecast of $16 billion in revenue in the October quarter.

- In this context, it is important for investors to consider that Nvidia is undergoing a massive transformation. Valuation references to trailing earnings, trailing revenue, and such simply do not matter anymore. The company is in a prime position to capitalize on a massive, profitable opportunity, and we tend to think Nvidia is in the early stages of this transformation.

Nvidia Stock Price

Fair Value Estimate for Nvidia

Our fair value estimate of Nvidia is $480 per share, which implies an equity value of over $1.1 trillion.

It also implies a fiscal 2024 (ending January 2024, or effectively calendar 2023) price/adjusted earnings multiple of 45 times and a fiscal 2025 forward price/adjusted earnings multiple of 31 times.

For better or worse, both our fair value estimate and Nvidia’s stock price will be driven by its prospects in the data center business and AI GPUs. We anticipate a massive expansion in the AI processor market in the decade ahead, and we see room both for tremendous revenue growth at Nvidia and for competing solutions from external chipmakers (like AMD or Intel INTC) and in-house solutions developed by hyperscalers (such as chips from Alphabet GOOGL, Amazon.com AMZN, or others).

Read more about Nvidia’s fair value estimate.

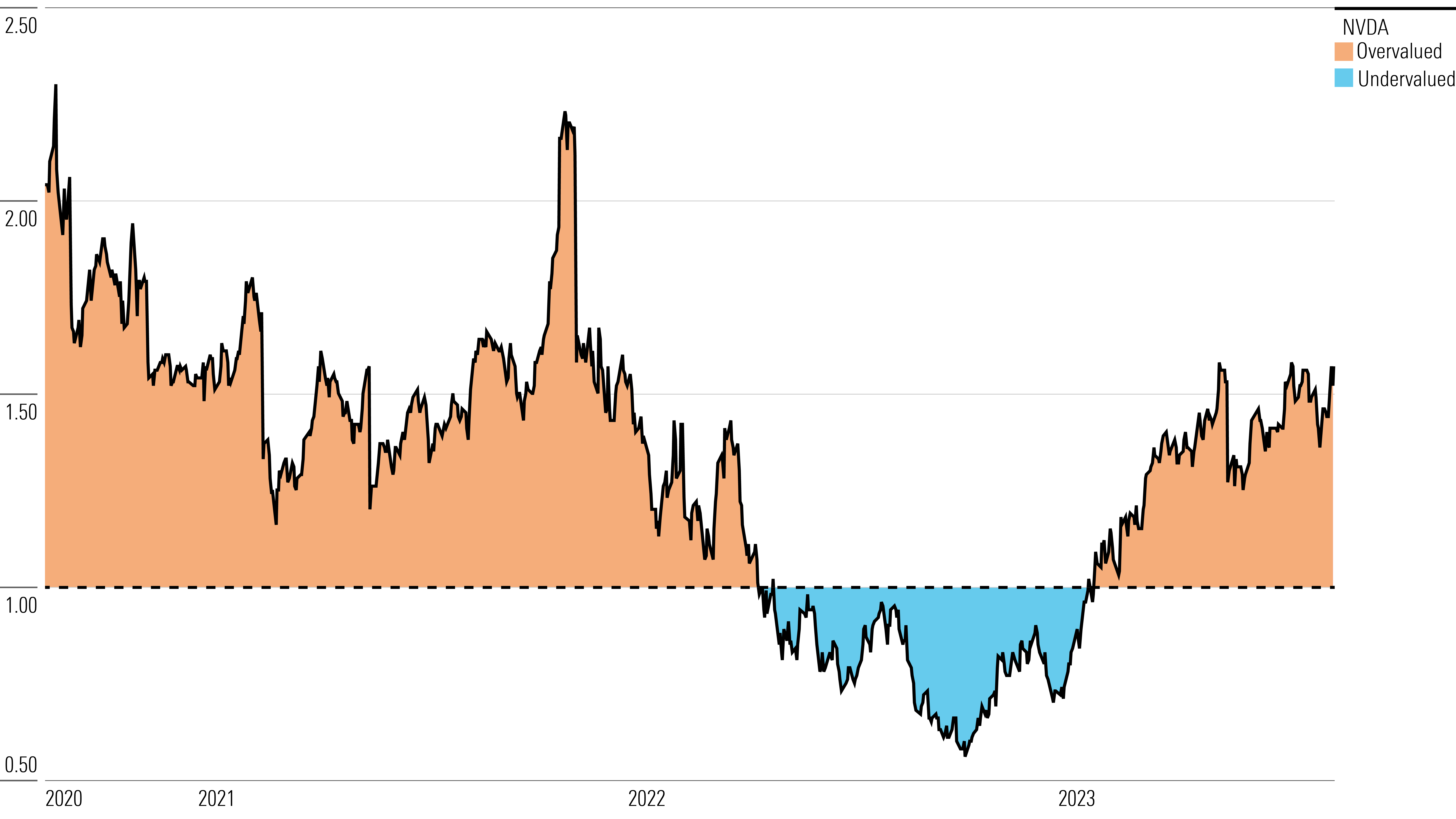

Nvidia Historical Price/Fair Value Ratios

Economic Moat Rating

We assign Nvidia a wide economic moat thanks to intangible assets around its graphics processing units and, increasingly, switching costs around its proprietary software, such as its Cuda platform for AI tools, which enables developers to use Nvidia’s GPUs to build AI models.

Nvidia was an early leader and designer of GPUs, which were originally developed to offload graphic processing tasks for PCs and gaming consoles. Nvidia has emerged as the clear market share leader in discrete GPUs (it has a share of over 80%, per Mercury Research).

We attribute Nvidia’s leadership to intangible assets associated with GPU design, as well as the associated software, frameworks, and tools developers need to work with these GPUs.

In our view, recent introductions such as ray-tracing technology and the use of AI tensor cores in gaming applications are signs that Nvidia has not lost its GPU leadership in any way. A quick scan of GPU pricing in both gaming and the data center business shows that the company’s average selling prices can often be twice as high as those of its closest competitor, AMD.

Read more about Nvidia’s economic moat rating.

Risk and Uncertainty

We assign Nvidia a Morningstar Uncertainty Rating of Very High. In our view, the firm’s valuation will be tied to its ability to grow within the data center and AI sectors.

Nvidia is an industry leader in GPUs used in training AI models, and it is carving out a good portion of the demand for chips used in AI inference workloads (which involves running a model to make a prediction or output). We see a host of tech leaders vying for Nvidia’s leading AI position.

We think it is inevitable that leading hyperscale vendors, such as Amazon’s AWS, Microsoft MSFT, Google, and Meta Platforms META, will seek to reduce their reliance on Nvidia and diversify their semiconductor and software supplier base, including the development of in-house solutions. Google’s TPUs and Amazon’s Trainium and Inferentia chips were designed with AI workloads in mind, while Microsoft and Meta have announced semiconductor design plans. Among existing semis vendors, AMD is quickly expanding its GPU lineup to serve these cloud leaders. Intel also has AI accelerator products today and will likely remain focused on this opportunity.

Read more about Nvidia’s risk and uncertainty.

NVDA Bulls Say

- Nvidia’s GPUs offer industry-leading parallel processing, which was historically needed in PC gaming applications but has expanded into crypto mining, AI, and possibly future applications as well.

- Nvidia’s data center GPUs and Cuda software platform have established the company as the dominant vendor for AI model training, a use case that should rise exponentially in the years ahead.

- The firm has a first-mover advantage in the autonomous driving market that could lead to widespread adoption of its Drive PX self-driving platform.

NVDA Bears Say

- Nvidia is a leading AI chip vendor today, but other powerful chipmakers and tech titans are focused on in-house chip development.

- Although Cuda is currently a leader in AI training software and tools, leading cloud vendors would likely prefer to see greater competition in this space, and may shift to alternative open-source tools if they were to arise.

- Nvidia’s gaming GPU business has often seen boom-or-bust cycles based on PC demand and, more recently, cryptocurrency mining.

This article was compiled by Caryl Anne Francia.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/U746MWXQHFFZPLSMTEJSUD7HLY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OBA7UVI75RGFDOHGJTZ2FK542Q.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)