After Earnings, Is Microsoft Stock a Buy, a Sell, or Fairly Valued?

With AI driving demand and strong expectations for Azure growth, here’s what we think of Microsoft stock.

Microsoft MSFT released its first-quarter earnings report on Oct. 24. Here’s Morningstar’s take on Microsoft’s earnings and stock.

Key Morningstar Metrics for Microsoft

- Fair Value Estimate: $370.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

What We Thought of Microsoft’s Earnings

- We raised our fair value estimate for Microsoft to $370 from $360 after it reported good results and guidance for its fiscal first quarter of 2024. Shares are up following earnings, leaving the stock just inside 3-star territory. Microsoft is a name we want to own, but we don’t see a huge valuation layup.

- The company provided a nice upside versus expectations. All segments were better than the top end of guidance, with intelligent cloud (Azure) and more personal computing (Windows and gaming) being relatively stronger. Azure grew 29% year over year versus guidance of 26%. That’s two quarters in a row of strength, plus a good outlook. Margins were once again very strong as well.

- We see strong demand results from Azure in the first quarter, and good office results indicative of a modest recovery (even if management won’t use that word), and we think the table is set for the rest of the fiscal year. In the longer term, we don’t think anything has changed.

- Artificial intelligence is driving demand and test workloads for many clients. We think AI contributed a couple hundred basis points of Azure growth in the quarter. GitHub Copilot already has 1 million users after being in general release for about a year. Microsoft 365 Copilot reached general availability on Nov. 1, so there is a wave of AI revenues coming, even if it takes a year to build.

- On Activision, there wasn’t a ton of commentary. Guidance here was murky, as they described why revenue doesn’t transfer over dollar for dollar and how this is a wash on gross margin. There was certainly no outlook for cost savings. Game pass subscription signups were strong. We think there is an opportunity to propel gaming into the next generation with this acquisition, so we’ll see how this evolves.

- Second-quarter guidance was ahead of both our model and consensus from both a revenue and margin perspective. More importantly, Azure guidance calls for 26%-27% in constant currency, which is a key data point and was better than we were modeling. This signals more definitively that the cloud optimization efforts are mostly behind us. Moreover, management indicated that they expect this level of activity to persist throughout fiscal 2024. Management is guiding for flat operating margins for the year, even with all of the Activision acquisition costs rolling in.

Microsoft Stock Price

Fair Value Estimate for Microsoft

With its 3-star rating, we believe Microsoft’s stock is fairly valued compared with our long-term fair value estimate.

Our fair value estimate for Microsoft stock is $370 per share, which implies a fiscal 2024 enterprise value/sales multiple of 11 times, an adjusted P/E multiple of 34 times, and a 1% free cash flow yield.

We model a five-year compound annual growth rate for revenue of approximately 12% inclusive of the Activision acquisition. We envision stronger revenue growth ahead, as Microsoft’s prior decade was bogged down by the downturn in 2008, the complete evaporation of mobile handset revenue from the disposal of the Nokia business, and the transition to a subscription model. However, we believe macro and currency factors will pressure revenue in the near term. We believe revenue growth will be driven by Azure, Office 365, Dynamics 365, LinkedIn, and emerging AI adoption. Azure in particular is the single most critical revenue driver over the next 10 years in our view, as hybrid environments (where Microsoft excels) drive mass cloud adoption.

We also model operating margins increasing modestly from 42% in fiscal 2023 (actual) to 43% in fiscal 2028, driven by improvements in gross margin as Azure continues to scale, as well as some operating leverage. However, we do expect some pressure on both gross margin and operating margin in fiscal 2024 as an accounting change becomes a headwind and there’s a pickup in expenses from returning to business as usual after COVID-19.

Read more about Microsoft’s fair value estimate.

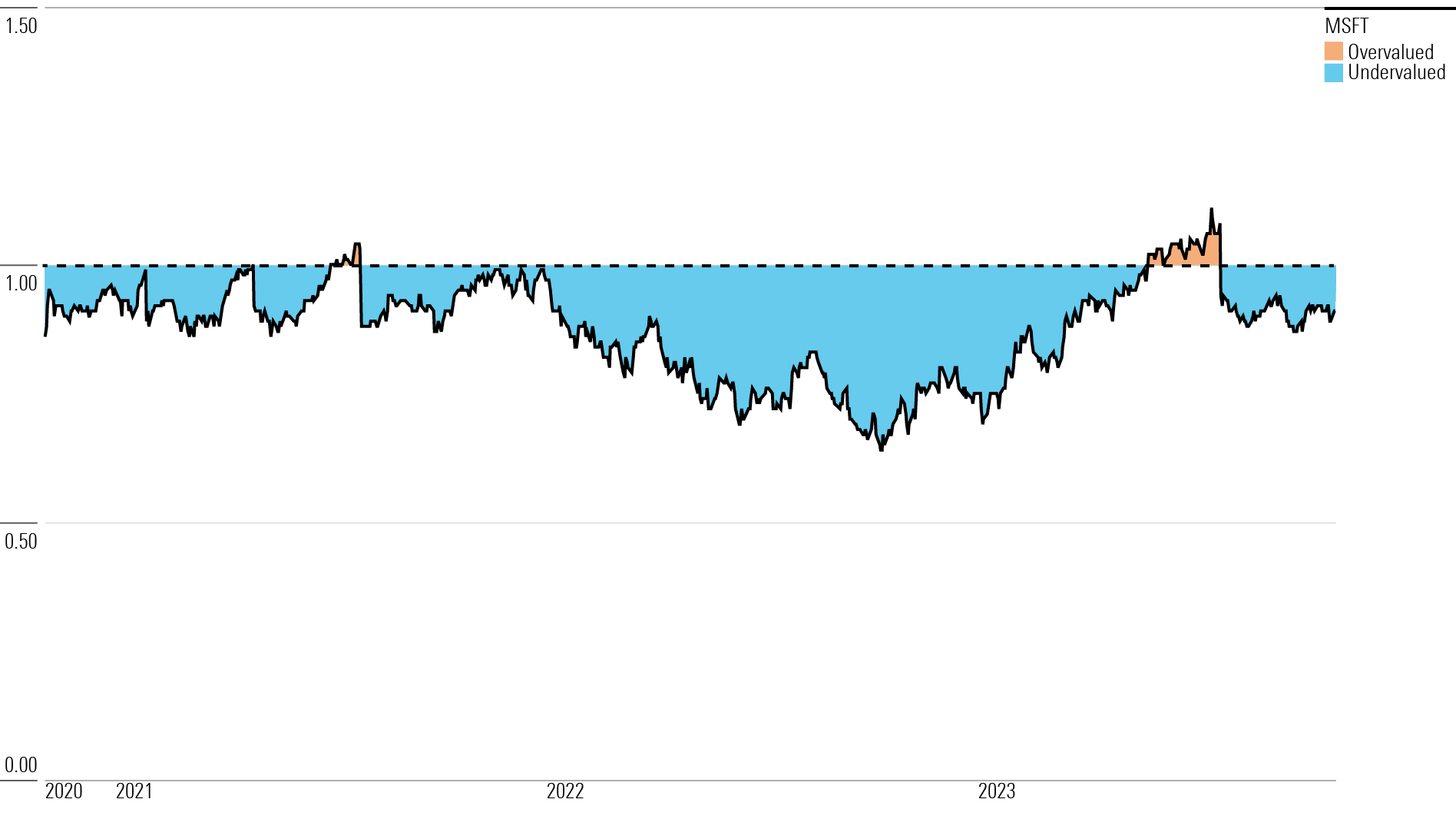

Microsoft Historical Price/Fair Value Ratio

Economic Moat Rating

Morningstar gives Microsoft an overall wide moat arising from switching costs, network effects, and cost advantages. We believe the firm is a leader across a variety of key technology areas, which should result in economic returns well in excess of its cost of capital for years to come.

We believe Microsoft’s different segments and products benefit from different moat sources. The Productivity and Business Processes segment includes Office, Dynamics, and LinkedIn. We assign it a wide moat based on high switching costs and network effects. We believe Office, including both 365 and the perpetual license version, is protected by a wide moat driven by high switching costs and network effects.

In our opinion, high switching costs and cost advantages drive a wide moat for Azure. It’s clearly the growth engine for the Intelligent Cloud segment and one of the critical products the “new” Microsoft will be built around. Azure is a next-generation service offering that builds upon the Dynamics 365 and Office 365 Software as a Service business to offer Infrastructure as a Service and Platform as a Service. We estimate revenue from Azure itself is a mid-to-high-single-digit percentage of revenue, growing by more than 75% annually.

We believe the company’s presence in traditional on-premises deployments of Server (and SQL database) have helped guide customers toward Azure for both fully public and hybrid deployments. It is simply the path of least resistance for many CIOs—Microsoft offers a worry-free product and a seamless transition from on-premises to Azure. Users would overwhelmingly not even notice that the company shifted workloads to the cloud.

Read more about Microsoft’s moat rating.

Risk and Uncertainty

Microsoft faces risks that vary among its products and segments. High market share in the client-server architecture over the last 30 years means significant high-margin revenue is at risk, particularly in OS, Office, and Server. Microsoft has thus far been successful in growing revenues in a constantly evolving technology landscape, and it’s enjoying success in both moving existing workloads to the cloud for current customers and attracting new clients directly to Azure. However, it must continue to drive revenue growth of cloud-based products faster than revenue declines in on-premises products.

Microsoft is acquisitive, and while many small acquisitions are completed that fly under the radar, the company has had several high-profile flops, including Nokia and aQuantive. The LinkedIn acquisition was expensive but served a purpose, and seems to be working out well. It is not clear how much Microsoft bought in the Permira-led Informatica LBO, and it may have been an important strategic investment, but Informatica was certainly not a growth catalyst. GitHub was expensive but strategic, and it seems to be shaping up as a success, while the ZeniMax deal should boost the company’s first-party video game publishing efforts. While Nuance was not hard to digest, the $69 billion Activision deal was completed in October 2023 and will likely be a bit more involved.

Read more about Microsoft’s risk and uncertainty.

MSFT Bulls Say

- Public cloud is widely considered to be the future of enterprise computing, and Azure is a leading service that benefits the evolution first to hybrid environments and then ultimately public cloud environments.

- Microsoft 365 continues to benefit from upselling into higher-priced stock-keeping units as customers are willing to pay up for better security and Teams Phone, which should continue over the next several years.

- Microsoft has monopoly-like positions in various areas (OS, Office) that serve as cash cows to help drive Azure growth.

MSFT Bears Says

- Momentum is slowing in the ongoing shift to subscriptions, particularly in Office, which is generally considered a mature product.

- Microsoft lacks a meaningful mobile presence.

- Microsoft is not the top player in its key sources of growth, notably Azure and Dynamics.

This article was compiled by Adrian Teague.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_d0e8253d77de4af9ae68caf7e502e1bf_name_file_960x540_1600_v4_.jpg)