After Earnings, Is Microsoft Stock a Buy, a Sell, or Fairly Valued?

We’re lifting our fair value estimate for Microsoft stock to $360 per share, and continue to view the shares as attractive.

Microsoft MSFT released its fiscal fourth-quarter earnings report on July 26. Here’s Morningstar’s take on what to think of Microsoft’s earnings and stock.

Key Morningstar Metrics for Microsoft

- Fair Value Estimate: $360

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

What We Thought of Microsoft’s Q2 Earnings

Microsoft reported solid results, including upside on both its top and bottom lines. All segments were slightly ahead on revenue, and improved revenue and cost controls helped drive better operating margins.

We see continued signs of encouragement in important areas like Azure, which did slightly better than our estimates amid new $10 million deals. Meanwhile, Microsoft Office and Windows posted good numbers.

However, the outlook overall was slightly shy of our forecast. Further, capacity investments in front of demand driven by artificial intelligence will limit near-term margin expansion, which we think is an easy trade given the opportunity. The upshot of this is that AI demand is already materializing.

Lastly, macroeconomic pressures remain but don’t seem to be worsening.

We see these results as reinforcing our long-term thesis for the company, centering on the proliferation of hybrid cloud environments and Azure, as it continues to use its on-premises dominance to allow clients to move to the cloud at their own pace.

We focus our growth assumptions around Azure, Microsoft 365 E5 migration, and traction with the Power Platform for long-term value creation. We also see a new growth avenue emerging in the form of AI, where Microsoft is positioned as a clear leader.

Overall, Microsoft remains a leader in both public cloud and AI, and it maintains monopoly-like positions in desktop operating systems and office productivity software. We have lifted our fair value estimate for Microsoft stock to $360 per share from $325, and continue to view the shares as attractive.

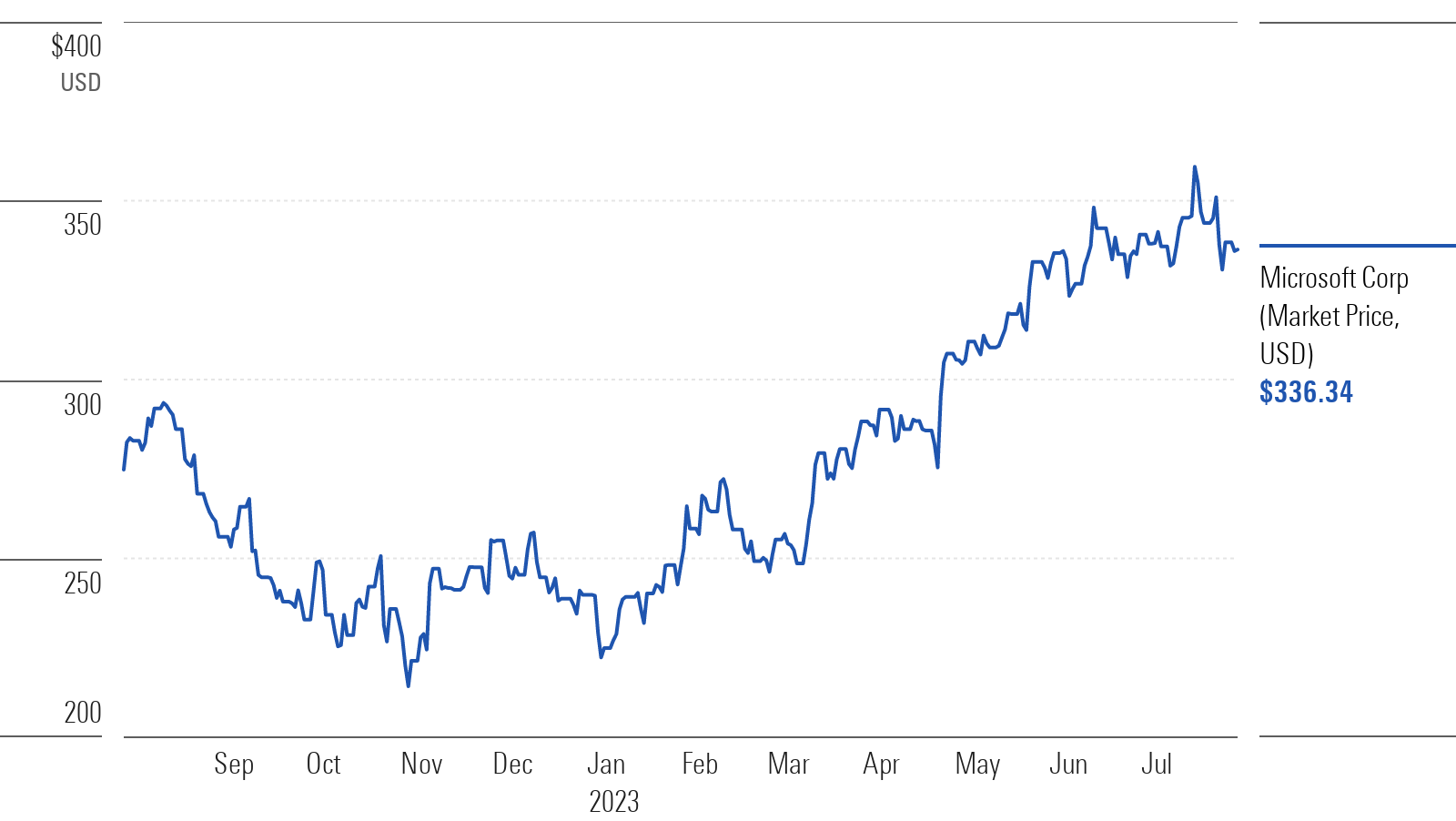

Microsoft Stock Price

Fair Value Estimate for Microsoft

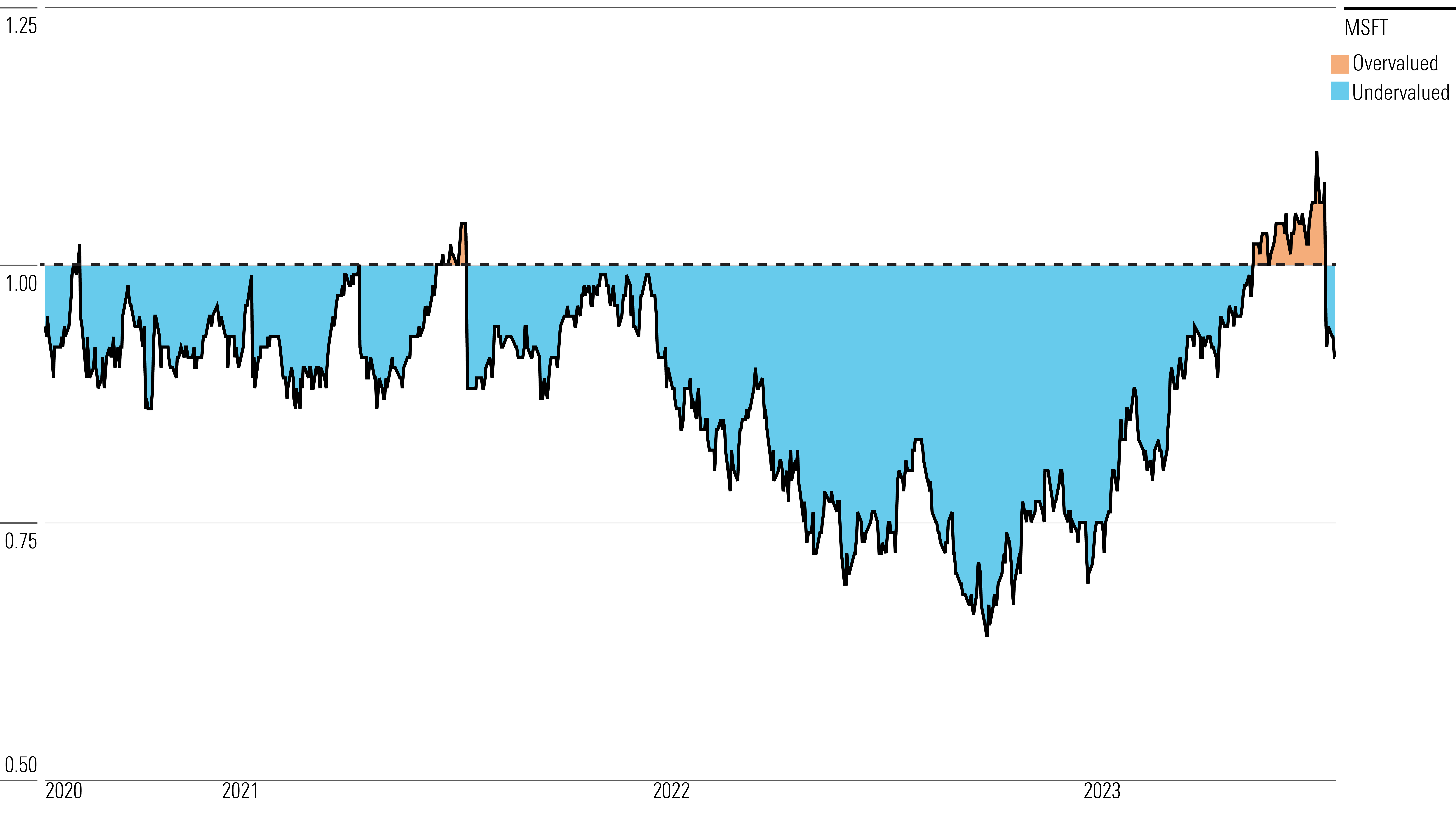

With its 3-star rating, we believe Microsoft’s stock is fairly valued compared with our long-term fair value estimate. However, we view the shares as attractive.

Our fair value estimate for Microsoft is $360 per share, which implies a fiscal 2024 enterprise value/sales multiple of 11 times, an adjusted price/earnings multiple of 34 times, and a 3% free cash flow yield. We model a five-year compound annual growth rate for revenue of approximately 10%. We believe revenue growth will be driven by Azure, Office 365, Dynamics 365, LinkedIn, and emerging AI adoption.

Azure in particular is the single most critical revenue driver over the next 10 years, in our view, as hybrid environments (where Microsoft excels) drive mass cloud adoption. We believe the combination of Azure, DBMS, Dynamics 365, and Office 365 will drive above-market growth as CIOs continue to consolidate vendors. We believe More Personal Computing will grow modestly above GDP over the next 10 years.

We also model operating margins increasing modestly from 42% in fiscal 2023 (actual) to 43% in fiscal 2028, driven by improvements in gross margin as Azure continues to scale, as well as some operating leverage. However, we do expect some pressure on both gross margin and operating margin in fiscal 2024 because of investment in Azure capacity and a pickup in expenses due to the return to business as usual after COVID-19.

Read more about Microsoft’s fair value estimate.

Microsoft Price/Fair Value

Economic Moat Rating

For Microsoft overall, we assign a wide moat rating arising from switching costs, network effects, and cost advantages. We believe the firm is a leader across a variety of key technology areas, which should result in economic returns well in excess of its cost of capital for years to come. We believe Microsoft’s different segments and products benefit from different moat sources.

Microsoft’s Productivity and Business Processes segment includes Office, Dynamics, and LinkedIn. We assign this segment a wide moat based on high switching costs and network effects. We believe that Microsoft Office, including both 365 and the perpetual license version, is protected by a wide moat driven by high switching costs and network effects. Together the two products account for approximately 26% of revenue and are growing in the low double-digit area.

Office 365 represents more than half of Office revenue. We expect perpetual license sales of Office to continue to decline in terms of both absolute dollars and as a percent of revenue, with growth in Office 365 more than offsetting that decline.

An office productivity suite generally consists of spreadsheet (Excel), word processing (Word), and presentation (PowerPoint) software applications. Other applications can also be bundled in. Microsoft offers a variety of versions of the Office 365 suite, and increasingly fewer perpetual license versions. Office 365 starts at approximately $6 per month and tops out at approximately $35 per user per month. Lower-cost and even free versions are available for students and the education vertical more generally. The perpetual license version is $150. Office 365 already has more than 165 million subscribers.

Microsoft’s Intelligent Cloud segment includes Windows Server, SQL Data Base Management System, Azure, Enterprise Services, and Visual Studio. We assign the segment a wide moat rating based on high switching costs, network effects, and cost advantages.

Read more about Microsoft’s moat rating.

Risk and Uncertainty

Microsoft faces risks that vary among the products and segments. High market share in the client-server architecture over the last 30 years means significant high-margin revenue is at risk, particularly in OS, Office, and Server. Microsoft has thus far been successful in growing revenues in a constantly evolving technology landscape and is enjoying success in both moving existing workloads to the cloud for current customers and attracting new clients directly to Azure. However, it must continue to drive revenue growth of cloud-based products faster than revenue declines in on-premises products.

Microsoft is acquisitive, and while many small acquisitions are completed that fly under the radar, the company has had several high-profile flops, including Nokia and aQuantive. The LinkedIn acquisition was expensive but served a purpose, and seems to be working out well. It is not clear how much Microsoft bought in the Permira-led Informatica LBO, and it may have been an important strategic investment, but Informatica was certainly not a growth catalyst. GitHub was expensive but strategic and seems to be shaping up as a success, while the ZeniMax deal should boost the company’s first-party video game publishing efforts. We expect the Nuance acquisition to be digestible, but the recently announced Activision Blizzard acquisition is the company’s largest ever and might warrant more attention.

The public cloud build-out remains in its early phases. AWS has taken the market by storm, with Azure trailing, but the two are seen as clear leaders.

While we do not see significant ESG risks, we note that Microsoft faces strong competition for software engineers on the hiring front, and also faces risks arising from a potential data breach within its data centers

Read more about Microsoft’s risk and uncertainty.

MSFT Bulls Say

- Public cloud is widely considered to be the future of enterprise computing, and Azure is a leading service that benefits from this evolution, first to hybrid environments and ultimately to public cloud environments.

- Microsoft 365 continues to benefit from upselling into higher-priced stock-keeping units as customers are willing to pay up for better security and Teams Phone, which should continue over the next several years.

- Microsoft has monopoly-like positions in various areas (OS, Office) that serve as cash cows to help drive Azure growth.

MSFT Bears Say

- Momentum is slowing in the ongoing shift to subscriptions, particularly in Office, which is generally considered a mature product.

- Microsoft lacks a meaningful mobile presence.

- Microsoft is not the top player in its key sources of growth, notably Azure and Dynamics.

This article was compiled by Saaketh Tirumala.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/U746MWXQHFFZPLSMTEJSUD7HLY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OBA7UVI75RGFDOHGJTZ2FK542Q.jpg)