After Earnings, Is Disney Stock a Buy, a Sell, or Fairly Valued?

With free cash flow nearing pre-pandemic numbers, here’s what we think of Disney stock

The Walt Disney Company DIS released its fiscal fourth-quarter earnings report on Nov. 8. Here’s Morningstar’s take on Disney’s earnings and stock.

Key Morningstar Metrics for The Walt Disney Company

- Fair Value Estimate: $145.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

What We Thought of The Walt Disney Company’s Earnings

- The two especially notable/unexpected things that drove Disney stock higher were streaming strength and the outlook for future costs and free cash flow. The 7 million streaming subscribers added—virtually all attributable to Disney+—followed a period of little growth to that point in 2023. The figure didn’t sacrifice average revenue per subscriber, which continued growing at Disney+. Despite valid fears about declines in Disney’s linear TV business, the company now expects $8 billion in free cash flow in fiscal 2024, levels not seen since before the pandemic.

- There was enough in Disney’s earnings report to give hope to investors with both bullish and bearish outlooks. On one hand, the results support the thesis that there is a lot of strength in Disney as a whole, and that challenges in one line of business (linear TV) are not enough to warrant how much the stock has sold off. On the other hand, the linear networks business (which no longer includes ESPN) continued to struggle. Still, the decent results out of ESPN (1% growth) should at least make bears reevaluate how quickly that business could deteriorate.

Disney Stock Price

Fair Value Estimate for Disney

With its 4-star rating, we believe Disney’s stock is undervalued compared with our long-term fair value estimate.

Our updated $145 fair value estimate reflects slower subscriber growth and lower losses from streaming. We expect an average annual top-line growth of 6% through fiscal 2027. We now project losses for the streaming segment to continue through fiscal 2024, for linear advertising to decline over the next five years, and that there will be a continued decline in linear network margins.

We project average annual sales growth from the linear television networks to be flat in fiscal 2023-27 (1% for affiliate fees and -2% for advertising), as our projections for U.S. pay TV penetration assume an ongoing decline. The loss of subscribers at ESPN and other pay TV channels will be offset by domestic price increases.

We expect fiscal 2023 admissions revenue will remain ahead of fiscal 2019, despite consumer worries about the economy and inflation. We project that merchandise, food, and beverage revenue will see similar growth, as will resorts revenue. The parks and consumer segment suffered a 37% decline in revenue in fiscal 2020 and a 3% decline in fiscal 2021. Following a strong bounce back of 73% in 2022, we expect more normalized growth of 5% over the next five years.

We estimate 12% average annual growth for the direct-to-consumer segment, as we are modeling strong subscriber growth for Disney+ and Hulu, along with further price increases. We now project that Disney-branded services will hit 235 million paid subscribers by the end of fiscal 2027. This growth assumes a continued international rollout and improved penetration in the larger Western markets. We believe the segment will post its first positive annual operating income in fiscal 2025.

Read more about Disney’s fair value estimate.

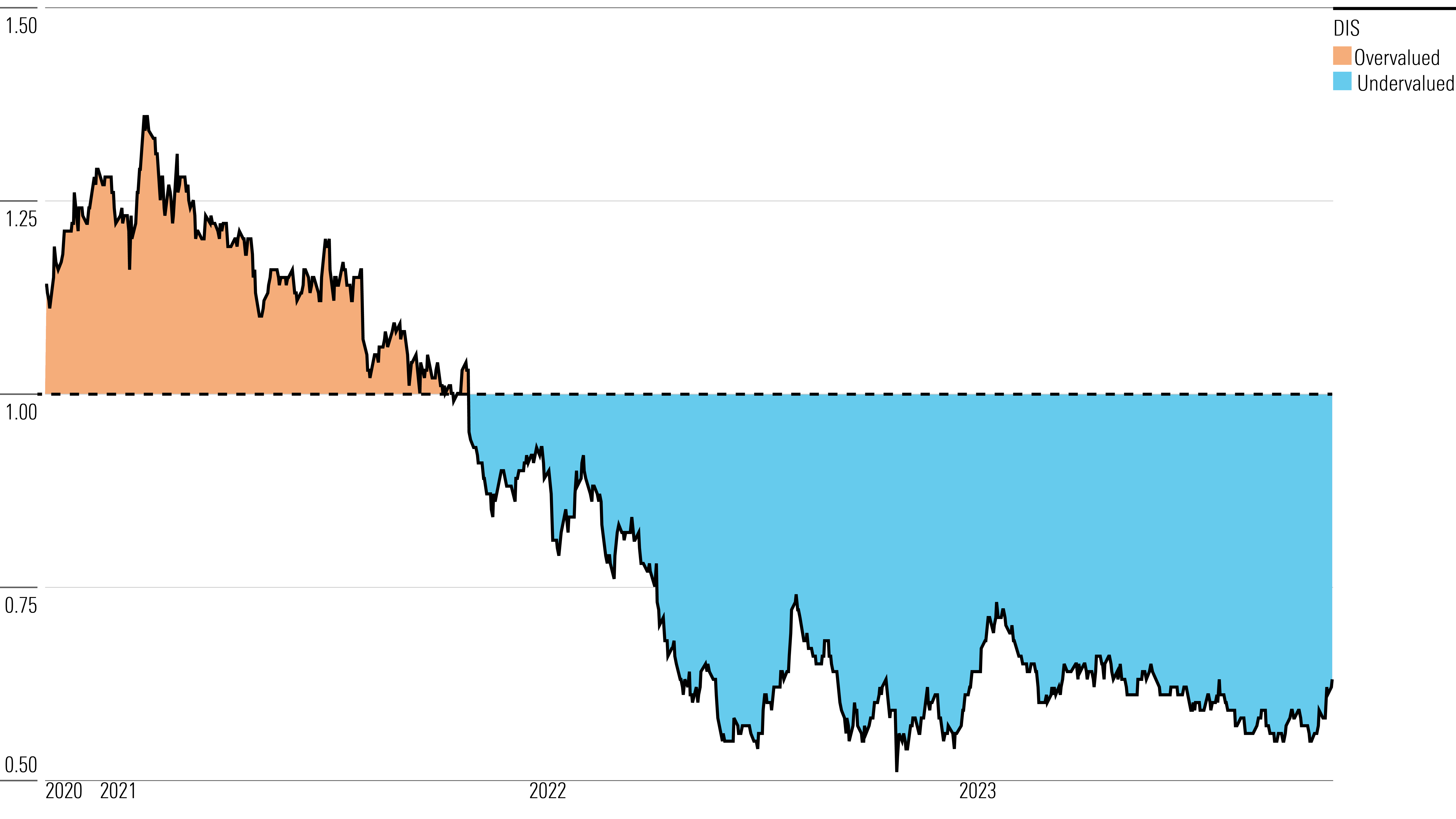

Disney Historical Price/Fair Value Ratio

Economic Moat Rating

We assign Disney a wide economic moat, based on its media networks and brand recognition.

The company’s networks remain important pieces of the traditional pay TV bundle. While cord-cutting remains an issue, premier cable networks like ESPN and FX still generate significant cash flows from both affiliate fees and advertising, with price increases historically outpacing customer losses. Disney’s roster of networks provides distributors with not only general entertainment but also live sports at ESPN and news coverage at ABC—two genres keeping many subscribers in pay TV. While we expect pay TV subscribers to continue to decline annually, the underlying networks remain profitable, and the cash generated will continue to be reallocated to support direct-to-consumer efforts at Disney.

The media network component also includes the Disney Channel, one of two dominant cable networks for children, which allows the firm to introduce and extend its strong content portfolio. With its 2019 purchase of the Fox entertainment assets, Disney enhanced its pay TV lineup by adding multiple channels with strong appeal to adults. FX and FXX are homes for critically acclaimed original scripted shows. All this content now finds its way onto Disney+ or Hulu, strengthening those platforms’ competitive positions in the streaming landscape.

Disney has mastered the process of monetizing its world-renowned characters and franchises. The company has moved beyond the historical view of a brand that children recognize and parents trust by acquiring and creating new franchises and intellectual property. Recent successes with Pixar and Marvel have helped create new opportunities for adults who may have outgrown their attraction to the company’s traditional characters. The 2012 acquisition of Lucasfilm added another avenue to engage with children and adults. Disney uses the success of its filmed entertainment not only to drive Disney+ subscriptions, but also to create new experiences at its parks and resorts, merchandising, TV programming, and even Broadway shows. Each new franchise deepens the Disney library, which should continue to generate value over the years.

Read more about Disney’s moat rating.

Risk and Uncertainty

We assign Disney a High Morningstar Uncertainty Rating, based on the competitive linear and streaming media markets the company operates in, along with the level of advertising and parks revenue that’s exposed to the economy and economic cycles.

Disney’s results could suffer if it cannot adapt to the changing media landscape. Basic pay TV service rates have continued to increase, which could cause consumers to cancel subscriptions or reduce their level of service.

ESPN garners the highest affiliate fees of any basic cable channel, and a decrease in pay TV penetration would slow revenue growth. The cost of sports rights may continue to skyrocket, putting pressure on margins.

The company’s ad-supported broadcast networks, along with its theme parks and consumer products, will suffer if the economy weakens.

Making movies is a hit-or-miss business, which could result in big swings in profitability for the filmed entertainment segment. The firm is increasingly tied to blockbuster films, making these swings even larger.

Read more about Disney’s risk and uncertainty.

DIS Bulls Say

- The parks and resorts segment will rebound strongly from the pandemic, as families still view the parks as prime vacation destinations.

- Disney+ has a long runway for growth, both in the United States and internationally. The firm’s original series and the deep and constantly expanding library will drive the growth.

- Although making movies is a hit-or-miss business, Disney’s popular franchises and characters reduce this volatility over time. Additionally, the firm’s annual slate does not generally rely on one big picture, reducing the downside of a flop.

DIS Bears Say

- The media networks division’s business model depends on the continued growth of affiliate fees. Any slowdown in this growth (as pay television subscribers continue declining) could tremendously hit profitability.

- The streaming space is becoming increasingly crowded. Disney may need to continue to fund losses in this segment beyond fiscal 2024.

- Developing mass-market hit programs can be unpredictable, especially as media fragmentation continues. The race to attract and retain talented creatives has been and will remain very competitive and expensive.

This article was compiled by Brendan Donahue.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/83fcd1d4-0576-422a-a260-91e1689417ed.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_d0e8253d77de4af9ae68caf7e502e1bf_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/83fcd1d4-0576-422a-a260-91e1689417ed.jpg)