After Earnings, Is Charles Schwab Stock a Buy, a Sell, or Fairly Valued?

With cash sorting among clients decreasing, here’s what we think of Schwab’s stock.

Charles Schwab SCHW released its third-quarter earnings report on Oct. 16. Here’s Morningstar’s take on Schwab’s earnings and stock.

Key Morningstar Metrics for Charles Schwab

- Fair Value Estimate: $80.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: High

What We Thought of Schwab’s Q3 Earnings

- Results were fairly in line with what we were expecting. We knew client assets would be under some pressure from rising interest rates and the fall in equity markets. The company also telegraphed that net new client assets would be a bit lower due to the attrition of TD Ameritrade clients as their accounts transferred to the Schwab platform.

- Net interest income, or NII, continued to be under some pressure from cash sorting (clients moving their cash from low-interest accounts into other products, such as money market funds and certificates of deposits), but the decrease was much lower than in the previous two quarters. Cash sorting in the third quarter was similar to what was seen in the second quarter. Both the second and third quarters saw significantly lower cash sorting than the second half of 2022 and the first quarter of 2023.

- We continue to believe that Schwab should soon be able to consistently pay down its high-cost supplemental funding, which will lead to material NII and earnings growth.

- Regulatory capital ratios remained fairly strong. The company’s relatively low duration in its available-for-sale securities portfolio meant it didn’t incur too much in unrealized losses from rising interest rates. The market seems to be comfortable with the company’s liquidity and capital levels.

- Schwab has a large banking business and a low credit risk in its portfolio. However, its portfolio does have interest rate risk, and higher rates could pressure the stock.

- Overall, we assess that Schwab stock is materially undervalued. We believe that as cash sorting lessens, NII and earnings will experience material growth, at least until the Federal Reserve starts cutting interest rates. In the medium- to long-term, revenue and earnings should experience meaningful growth with client assets, resumption of deposit growth at the company’s bank, and reinvestment of the company’s banking portfolio at higher interest rates.

Charles Schwab Stock Price

Fair Value Estimate for Charles Schwab Stock

With its 4-star rating, we believe Schwab’s stock is undervalued compared with our long-term fair value estimate of $80.00.

In the medium term, we forecast a 7% compound annual growth rate for net revenue, as trading revenue flattens, client assets increase at a 10% rate from recent bear market lows, and deposits increase after cash sorting headwinds subside in 2023. Much of the revenue growth is attributable to NII from the resumption of deposit growth and reinvesting of maturing fixed-income proceeds.

We project asset-management revenue increasing at a normalized 4%-6% compound annual growth rate. The growth is from the overall increase in client assets and the movement of client cash into money market funds, partially offset by pricing cuts.

We value Schwab at $120 per share in our upside scenario and $42 per share in our downside scenario, which corresponds to a 2024 price/earnings ratio of 25 times in the upside case and 23 times in the downside. The main drivers of the difference between these scenarios are the normalized levels of interest rates, asset levels, and operating margins.

Read more about Charles Schwab’s fair value estimate.

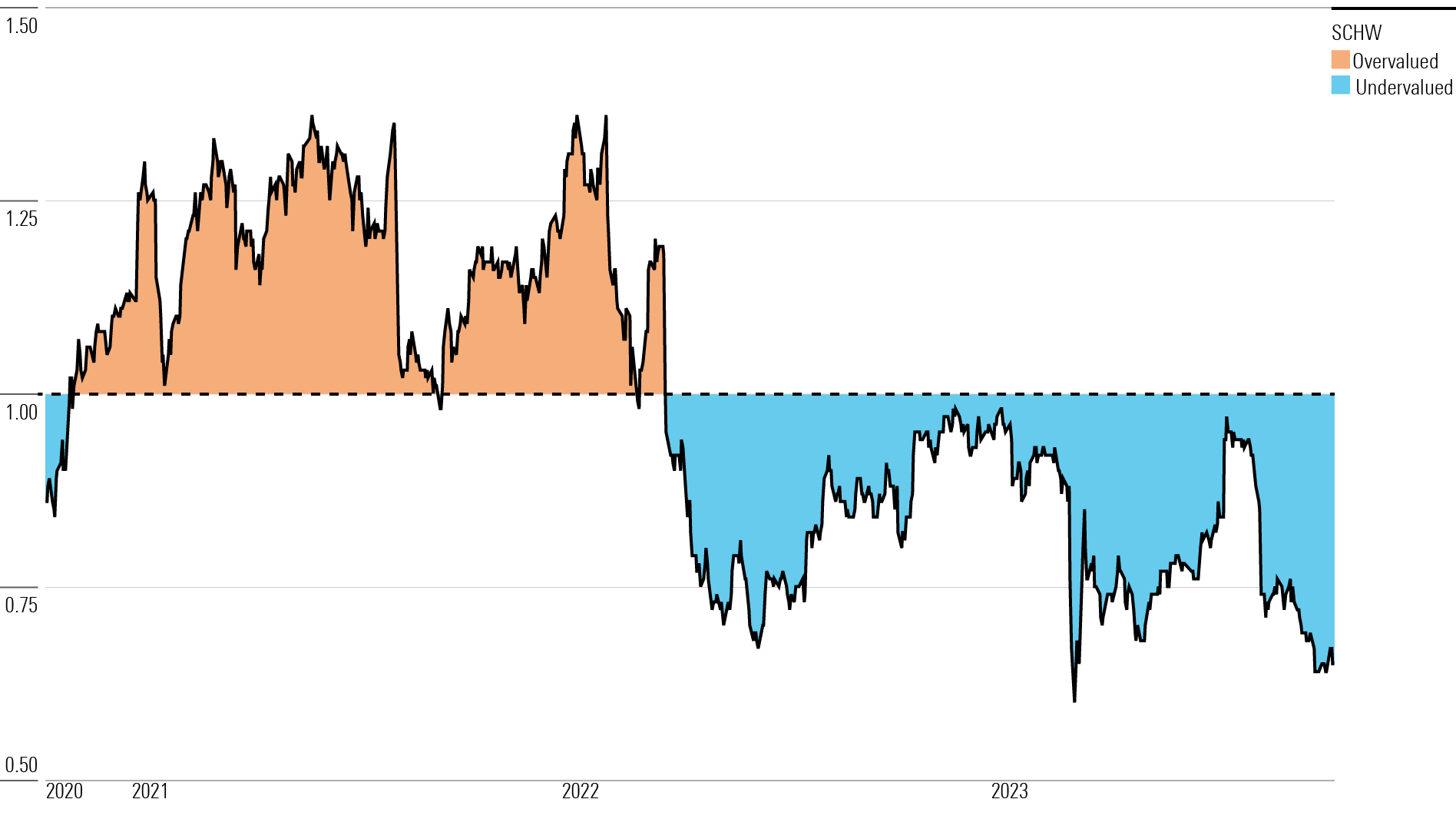

Schwab Historical Price/Fair Value Ratio

Economic Moat Rating

We assign Schwab a wide moat, arising from its massive scale and industry-leading cost efficiency. We believe the company could endure severe competitive pressures and still earn above its cost of capital.

Schwab’s low costs and large client base give it the flexibility to create products with value propositions comparable or superior to those of its peers—products that it can ramp quickly. While a relative latecomer to creating its own exchange-traded product line, Schwab is now among the top 10 largest exchange-traded fund companies in terms of assets. Its new online advisory platform will also benefit from its low cost and client reach, which will enable it to be more profitable than existing players and leapfrog them in assets.

Charles Schwab Bank is one of the largest banks in the United States, with more than $300 billion in deposits at the end of 2022. It has low operating costs because of its synergy with the company’s brokerage business. Credit costs are also low, as much of the bank’s portfolio is in low-risk agency mortgage-backed securities, and loans are primarily made to the company’s relatively affluent clients.

Read more about Charles Schwab’s moat rating.

Risk and Uncertainty

We assign Schwab a High Uncertainty Rating.

Major risks include the future of interest rates, a decrease in deposits, and fee pressures. Interest rates are the key driver of the company’s earnings over the next several years. Due to the staggered reinvestment of Schwab’s portfolio, interest rates have to remain high for it to fully reprice.

In a recession with accommodative monetary policy, portions of the company’s investment portfolio could be stuck at a lower rate. Asset-management revenue could also come under pressure, but it’s likely to be more from a shift in asset mix to passive investment products from the company’s proprietary and Mutual Fund OneSource products, which have higher revenue yields.

Read more about Charles Schwab’s moat rating.

SCHW Bulls Say

- Schwab is solidifying its position as a leader in investment services, and it may be able to expand into other financial services.

- Merging with TD Ameritrade will come with material revenue and expense synergies that will be realized over the next couple of years.

- Schwab’s scalable and vertically integrated business model should enable it to convert an increasing percentage of revenue into earnings and be in the better parts of the value chain as the investment services industry evolves.

SCHW Bears Say

- A loss of deposits and higher funding costs are potential near-term negatives.

- While Schwab has the resources to adapt, financial technology innovation has increased in recent years and could disrupt parts of the investment services industry. Zero-dollar-commission business models and robo-advisors are recent trends that have challenged the status quo.

- A Europe- or Japan-like scenario of near 0% interest rates for an extended period would significantly reduce earnings and likely necessitate a change in business model. The Fed may have to lower interest rates if a recession occurs.

This article was compiled by Brendan Donahue.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TP6GAISC4JE65KVOI3YEE34HGU.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_d0e8253d77de4af9ae68caf7e502e1bf_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/75bbf764-3b6f-4f5a-8675-8f9488c74c04.jpg)