8 Most Undervalued, Quality Bank Stocks

Big names in the banking industry like Truist, U.S. Bancorp, and Wells Fargo are trading at discounted prices.

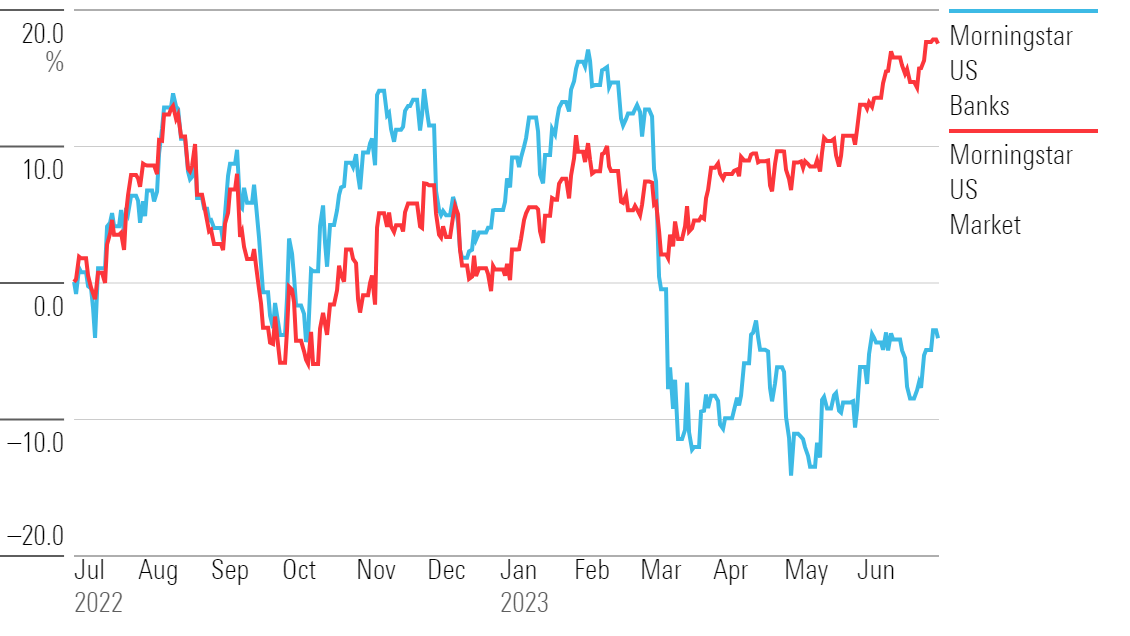

It’s been a tumultuous year for bank stocks, which after a strong start took a sharp dive during the March banking crisis, which saw the collapse of several regional banks and led to broad worries about the health of the banking system.

As the second-quarter earnings season kicks off with the nation’s biggest banks reporting results, the worst fears of the banking crisis have eased. However, this year’s selloff has left many high-quality bank stocks trading in undervalued territory.

Among the prominent bank stocks changing hands at discounted prices are U.S. Bancorp USB, Bank of America BAC, and Wells Fargo WFC.

During the fourth quarter of 2022 and the first quarter of 2023, the Morningstar US Banks Index kept up with the market, outpacing it for the majority of that time period. The index consists of 66 companies from the financial services industry. Bank of America, Wells Fargo, and JPMorgan Chase JPM are among the largest firms in the index.

For much of the 2022 bear market, financial stocks acted as a relatively safe haven. That changed in March, when the regional banking crisis hit and investors worried about the sector’s exposure to potential losses from rising interest rates. As a result, the Morningstar US Banks Index is down 10.3% so far this year, while the Morningstar US Market Index is up 15.4%. For the last 12 months as of July 6, banks are down 4.1% while the overall market is up 17.5%.

Despite the difficult second quarter of 2023, Morningstar equities strategist Eric Compton says the results of the Federal Reserve’s recent stress test for the banking system demonstrate that the industry remains healthy, although it will likely see more regulations implemented in the coming months.

“Our key takeaway is that the banking system remains well capitalized,” Compton says. “The system has enough capital to handle a severe recession and not only survive but also continue to lend to and support the economy. From a capital perspective, the system is healthy.”

Morningstar US Banks Index

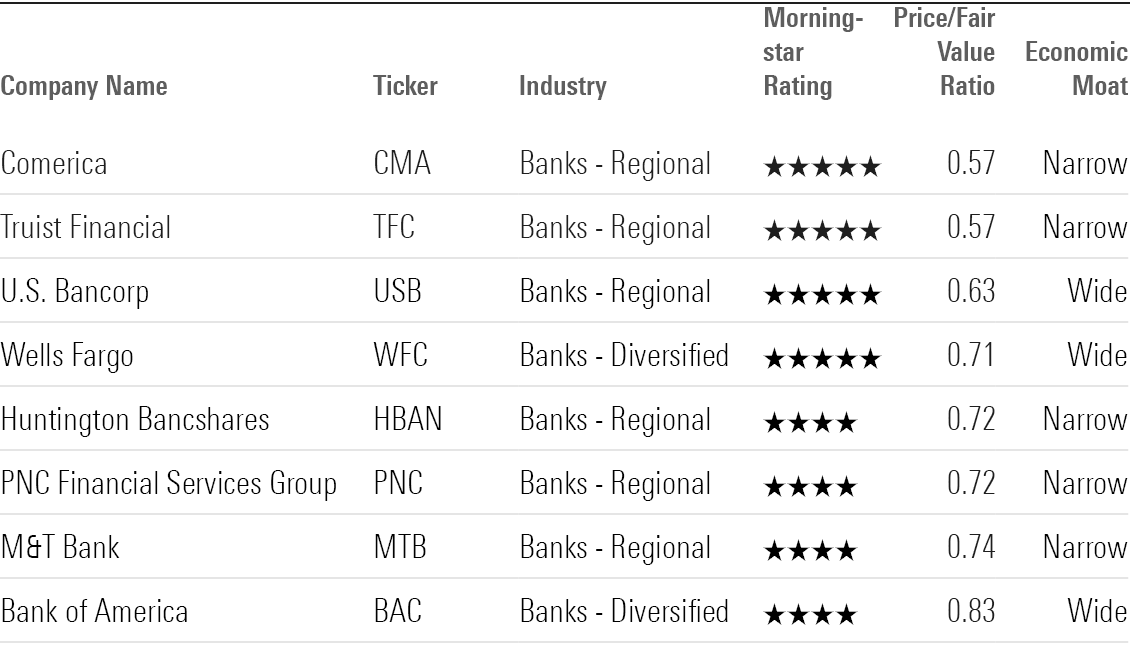

Screening for Undervalued Bank Stocks

We screened the Morningstar US Banks Index for the most undervalued stocks, then narrowed that search to stocks that currently carry a Morningstar Rating of 4 or 5 stars. Of the 66 stocks in the index, 16 are covered by Morningstar analysts. To whittle the list down further, we screened for companies that Morningstar stock analysts believe have economic moats, meaning they show durable competitive advantages. The combination of economic moats and attractive valuations has historically led to strong performance.

In all, eight banks were undervalued and carried a moat rating or wide or narrow as of July 6. These were the most undervalued 4- and 5-star stocks from our screen:

- Comerica CMA

- Truist Financial TFC

- U.S. Bancorp

- Wells Fargo

- Huntington Bancshares HBAN

- PNC Financial Services Group PNC

- M&T Bank MTB

- Bank of America

The most undervalued stock was Comerica, which as of July 6 was trading at a 43% discount to its fair value estimate. The least undervalued stock was Bank of America, trading at 17% below its fair value estimate of $76.

Undervalued Bank Stocks

Comerica

- Stock Price: $44.27

- Fair Value Estimate: $76.00

“Comerica is a financial services company headquartered in Dallas. It is primarily focused on relationship-based commercial banking. In addition to Texas, Comerica’s primary geographies are California and Michigan, along with locations in Arizona and Florida and select businesses in several other states as well as Canada.

“The bank has concentrations in the commercial real estate market, dealer floor plan lending, and mortgage banking. Comerica has a relatively small energy portfolio, which we expect will remain at 5% or less of the total loan book. The bank also has two business units primarily focused on serving institutional investors: the technology and life sciences unit and the equity fund services unit. Overall the bank has a diversified set of commercial-focused lending and advisory segments.

“While earnings growth is coming to a halt, Comerica has been one of the biggest beneficiaries of the current backdrop of higher rates, with returns on tangible equity hitting the high 20s. The flip side of this business model is that the bank can be pressured during periods of low rates, although management has put on additional hedges to limit this volatility.”

—Eric Compton, strategist

Truist Financial

- Stock Price: $32.19

- Fair Value Estimate: $54.00

“Truist is a regional bank with a presence primarily in the Southeastern United States. In addition to commercial banking, retail banking, and investment banking operations, the company operates several nonbank segments, primarily its insurance brokerage business.

“Truist has been through a number of changes over the last couple of years, not least of which was the large merger between BB&T and SunTrust in late 2019. We think this has formed one of the better regionals in the United States from a competitive standpoint. Truist boasts some of the best scale among U.S. regional banks, and it also has a uniquely complete platform across retail, commercial, advisory, wealth, and insurance.

“With superior credit efficiency (stemming from BB&T’s operations), operating efficiency in the top quartile of U.S. regionals under our coverage (particularly after incorporating cost savings from the merger), and a decent cost of deposits, we believe Truist deserves a narrow moat rating. We forecast Truist earning returns that easily exceed its cost of equity of 9%, with returns on tangible equity reaching the high teens through the cycle.”

—Eric Compton

U.S. Bancorp

- Stock Price: $33.74

- Fair Value Estimate: $53.00

“U.S. Bancorp is the largest non-global systemically important bank in the U.S. and has been one of the most profitable regional banks we cover. Few domestic competitors can match its operating efficiency and returns on equity over the past 15 years. While the bank has performed admirably, if we were to have a complaint, it would be that it has had a hard time further optimizing efficiency and returns while some peers seem to be gradually ‘catching up’ over time.

“U.S. Bancorp’s latest strategy has been to focus on its payments ecosystem, expand its branch footprint, and pursue new acquisitions and partnerships. The bank has expanded its footprint into several new population centers over the last several years, has partnered with State Farm (which can now sell U.S. Bancorp products into its customer network), and is investing in its payments ecosystem in a bid to win more software-centric merchant acquiring business while also cross-selling more payments-related services to its corporate banking clients, and vice-versa.”

—Eric Compton

Wells Fargo

- Stock Price: $42.32

- Fair Value Estimate: $61.00

“Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

“Wells Fargo remains in the middle of a multiyear rebuild. The bank is still under an asset cap imposed by the Federal Reserve, and we don’t see this restriction lifting in 2023. Wells Fargo has years of expense savings-related projects ahead as it attempts to get its efficiency ratio back under 60%. We also see a multiyear journey of repositioning and investing in the firm’s existing franchises, including growing its middle market investment banking wallet share, investing in the cards franchise, and revitalizing a wealth segment that has lost advisors for years. These tasks take on increased importance for a bank that has been on defense for years after its fake accounts scandal broke in late 2016.”

—Eric Compton

Huntington Bancshares

- Stock Price: $10.84

- Fair Value Estimate: $15.00

“Huntington has a network of branches and ATMs across eight Midwestern states. Founded in 1866, Huntington National Bank and its affiliates provide consumer, commercial, treasury management, wealth management, brokerage, trust, insurance, and small business services. Huntington also provides auto dealer, equipment finance, national settlement, and capital market services that extend beyond its core states.

“Huntington acquired financial services company FirstMerit in 2016, which added much-needed scale and efficiency while improving market share. After cutting over 40% of FirstMerit’s original cost base, Huntington sold its more expansive product set in new markets. Growth in home lending in Chicago and the RV/boat financing unit has been very strong ever since. Meanwhile, Huntington’s auto financing franchise remains strong as ever.

“Amid the current banking industry turmoil, we expect Huntington will face increased funding costs but nothing that poses any existential risks. In fact, the overall stability of the deposit base coming out of the first quarter was encouraging to us.”

—Eric Compton

PNC Financial Services Group

- Stock Price: $125.36

- Fair Value Estimate: $175.00

“PNC is one of the larger regional banks in the U.S., has a fairly diversified fee base, and has a national presence but is concentrated primarily in the East and Midwest. The bank has grown substantially thanks to acquisitions. It transformed itself with the integration of the troubled National City (doubling in size in the process) in 2008, acquired RBC’s U.S. branch network in the Southeast in 2012, and more recently acquired BBVA USA in 2021 (resulting in a roughly 25% increase in size).

“PNC has been successful at organically expanding its customer base, both in commercial banking and in retail. The expanding client base has led to solid loan, deposit, and fee income growth. Selling new products into the formerly underperforming RBC branch network has worked, and PNC now seems poised to repeat this effort with the acquisition of BBVA. The bank is also attempting to grow its Midwest commercial franchise along with retail growth efforts in the same areas where commercial expansion was successful.

“In 2023 and beyond, we’re hoping for slightly above-average growth as the bank optimizes the old BBVA footprint, although the current banking turmoil and overall economic environment could delay how some of these benefits show up in the financials.”

—Eric Compton

M&T Bank

- Stock Price: $129.47

- Fair Value Estimate: $169.00

“M&T is one of the largest regional banks in the United States. The bank was founded to serve manufacturing and trading businesses around the Erie Canal. The bank’s main stronghold is its commercial real estate operations, with much of the rest of its business comprising other commercial-focused (as opposed to retail-focused) operations, although the bank does have retail operations. M&T has a history of good management, good underwriting, and deep on-the-ground relationships. The bank is a solid regional operator.

“MTB acquired People’s United Bank in April 2022, further expanding its reach in the Northeast and its equipment financing-related product offerings. We liked the pricing of the deal and expect that cost savings alone will justify it. With merger-related expenses set to drop to essentially zero in 2023, we’re about to get a good look at the true expense run rate for the combined entity. After this, it will be up to the bank to drive additional revenue growth as new commercial products are cross-sold into newer geographies and M&T also potentially picks up some new retail customers along the way.”

—Eric Compton

Bank of America

- Stock Price: $28.66

- Fair Value Estimate: $35.00

“Bank of America is one of the largest financial institutions in the United States. It is organized into four major segments: consumer banking, global wealth and investment management, global banking, and global markets. Bank of America’s consumer-facing business lines include its network of branches and deposit-gathering operations, retail lending products, credit and debit cards, and small-business services. The company’s Merrill Lynch operations provide brokerage and wealth-management services, as does its private bank. Wholesale lines of business include investment banking, corporate and commercial real estate lending, and capital markets operations. Bank of America has operations in several countries but is primarily U.S.-focused.

“Bank of America has emerged as one of the preeminent U.S. banking franchises. The bank now has one of the best retail branch networks and overall retail franchises in the United States, is a Tier 1 investment bank, is a top-four U.S. credit card issuer, is a top-three U.S. acquirer, has a solid commercial banking franchise, and owns the Merrill Lynch franchise, which has turned into one of the leading U.S. brokerage and advisor firms.”

—Eric Compton

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/11520ec8-017f-48a5-99dd-e50a7df9126e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/11520ec8-017f-48a5-99dd-e50a7df9126e.jpg)