Should You Delay Taking Social Security Benefits?

A deep dive into calculating your retirement payouts.

When to Start?

Following the cue from Tuesday’s article, I had intended for this column to be called “Social Security for Beginners, Part 2.” Never mind that. After delving into the material, I realized that most of this content is rarely (if ever) discussed.

Tuesday’s installment detailed how Social Security’s payments increase when recipients delay their claims. The system pays 70% of the participant’s scheduled benefit to those who begin collecting at age 62; the official amount at age 67; and 124% for those who wait until the maximum age of 70. (There’s no advantage to postponing further, aside from bolstering the nation’s finances.)

This structure raises questions about when retirees should begin to collect their benefits. Are they better off collecting less money now, but over a longer period? Or should they let their benefits grow? If so, for how long?

While most of the internet’s Social Security software dodges those issues, confining themselves to projecting potential payouts, some tools do attempt the task. The two primary methods are breakeven analysis and present-value calculations. I will evaluate them with the most basic case: single retirees who are 62 years old and lack special circumstances.

Breakeven Analysis

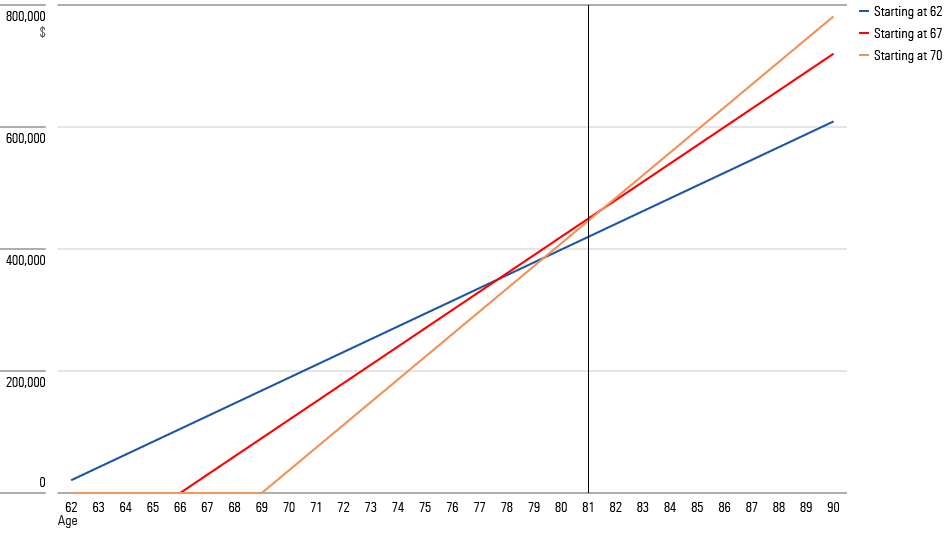

The idea of breakeven analysis is simple. Although we don’t know how long people will live, we can use actuarial projections to determine median life spans. Manipulation of the Social Security Administration’s actuarial life table—the figures cannot be directly obtained from the data—shows that the median death date for 62-year-olds is age 81 for men and age 84 for women.

Breakeven analysis continues by computing the cash flows provided by each of the nine possible claiming strategies, starting at age 62 and concluding at age 70. The top choice is determined to be the one that has generated the highest amount when the median death date arrives.

As drawing nine lines makes for a hopelessly cluttered chart, I pruned the candidate list to the three options of ages 62, 67, and 70. Below are the results if the retiree is male. (Assuming female retirees changes the conclusion, as women live longer. However, the verdicts are independent of income, as Social Security’s age-related formula remains the same for all benefit levels.)

Breakeven Analysis

Breakeven analysis (barely) recommends the goldilocks solution of claiming at age 67. There are, however, additional considerations.

1) Time Value—Money received sooner is more valuable than money received later. In most versions of breakeven analysis, including this one, all dollars count the same.

2) Insurance Value—Social Security is not solely an investment. It is also an insurance policy that protects against longevity risk. Breakeven analysis does not consider the insurance feature.

3) Life Expectancies—The Social Security Administration’s forecasts are but one of many actuarial tables, which vary quite considerably. Using different life-expectancy estimates leads to different conclusions.

Present-Value Calculations

Present-value calculations overcome the initial objection to breakeven analysis by accounting for the time value of money. Payments received this year are treated as being more valuable than those received the next year, and so forth.

Also, present-value calculations are conducted over more years than breakeven analyses. Fifty percent of retirees will outlive the median life expectancies. Breakeven analysis ignores everything that happens for retirees who cross that point, while present-value calculations do not.

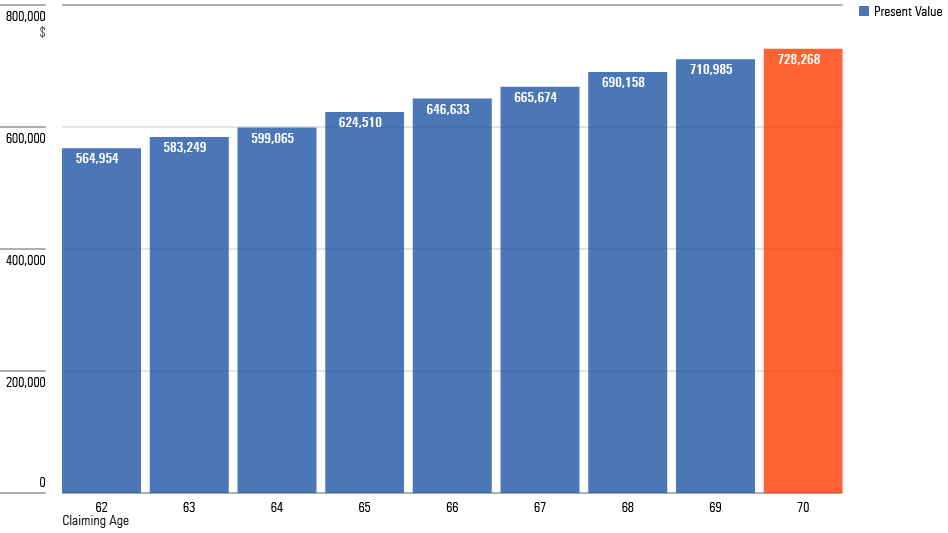

Because Social Security payments are not perpetual bonds, present-value calculations require an end date. This software, which is quite good, opts for age 100, so let’s go with that. The chart below depicts the outcomes for each claiming strategy, assuming a discount rate of 2%, which resembles the interest rate paid by 30-year Treasury Inflation-Protected Securities.

NPV Calculation: Age 100 End Date

Although present-value calculations reduce the appeal of later payments, extending the forecast to age 100 ensures that the advice will be to delay the claiming date. Even if their payments are discounted, considering all those years when the retiree may not still be alive tilts the scale toward strategies that prioritize tomorrow over today. (Note that with present-value calculations, the retiree’s sex is immaterial, as the projections omit life expectancies.)

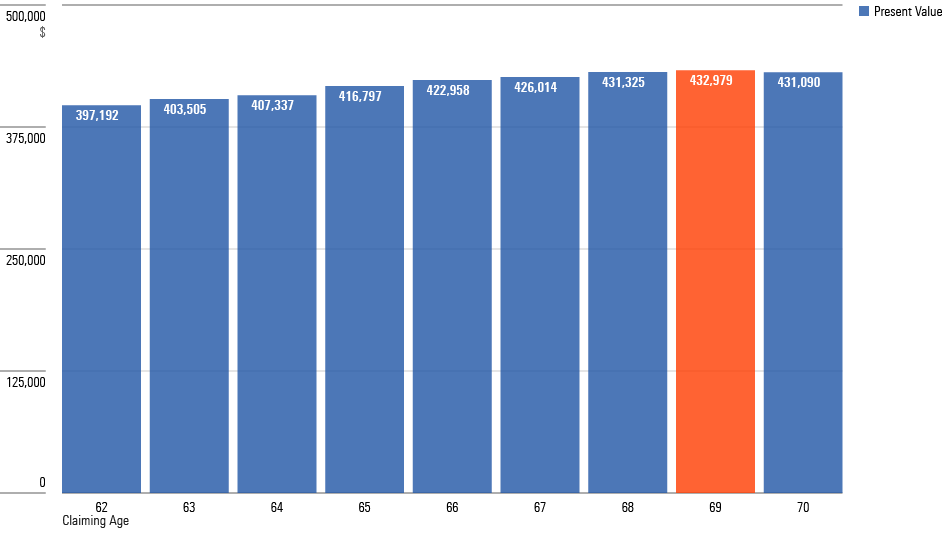

So far, so good. However, you may be wondering just how much 62-year-old retirees should prize that age 99 payment. (I certainly did.) Present-value calculations treat those earnings as inevitably arising, but they are much less likely to be paid than, say, the age 65 benefit. Perhaps retirees should place greater value on the birds that are closer to being in their hands.

One way to do that is to shrink the assessment’s time horizon. Shortening the period to age 85 from age 100 still favors later claiming strategies, but to a lesser extent than before. The suggested claiming age becomes 69 rather than 70.

NPV Calculation: Age 85 End Date

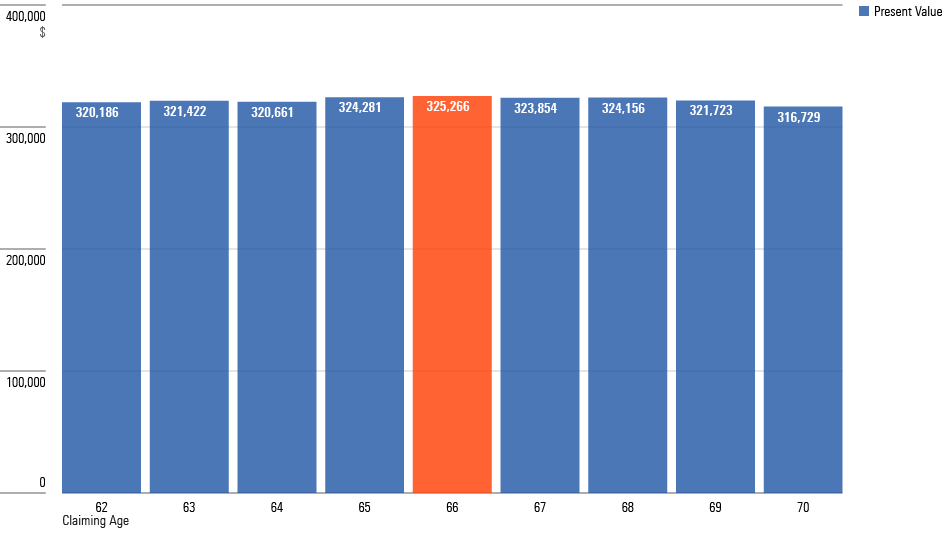

Another way to place more emphasis on cash that will soon be received, rather than during future decades, is to increase the discount rate. The 2% figure, after all, was arbitrarily selected. Perhaps receiving money earlier is worth 4% annually to prospective retirees (a reasonable argument, I think, given that the earlier payments are scheduled, the likelier it is that retirees will be around to collect them).

If the discount rate is so raised, while retaining the age 85 end date, the recommended claiming age drops to 66.

NPV Calculation: Age 85 End Date, Higher DIscount Rate

Conclusion

Each of these four calculations strikes me as acceptable. So, too, do methods that I have not yet encountered, such as probability-driven payoffs, wherein each year’s scheduled payment is weighted by the likelihood that the retiree will still be alive. (This method, too, would require a discount rate, but unlike the present-value calculation, it would not require that the user arbitrarily select a termination date.)

The point of this column is not to advocate one approach over the other, but instead to point out that even for the simplest of Social Security situations, identifying the right claiming date is an individual decision. Calculators can help to illuminate the choices, but retirees ultimately are responsible for the final step.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YBH7V3XCWJ3PA4VSXNZPYW2BTY.png)

/d10o6nnig0wrdw.cloudfront.net/04-24-2024/t_a8760b3ac02f4548998bbc4870d54393_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/O26WRUD25T72CBHU6ONJ676P24.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)