What to Know About Recharacterizing Your IRA Contribution

You can switch your traditional or Roth IRA contribution, but critical rules apply.

You have two options for making a regular contribution to an IRA—a traditional and a Roth. Whichever option you choose, your contribution must be made by your tax-filing due date. Extensions do not apply. However, you get an extension if you want to switch from one option to the other. This switch—or recharacterization to use the proper term—must be completed by your tax-filing due date, plus extensions. If you want to recharacterize your IRA contribution, consider the following rules.

Who Can Make the Switch

Basically, anyone can recharacterize a Roth IRA contribution to a traditional IRA contribution. (To recharacterize, the individual must have eligible compensation. Contributions for 2023 are limited to the lesser of 100% of eligible compensation or $6,500. An individual who is at least age 50 by the end of the year is eligible to make a catch-up contribution of up to $1,000.) However, only an individual whose modified adjusted gross income, or MAGI, does not exceed the applicable limit may recharacterize a traditional IRA contribution as a Roth IRA contribution.

Roth to traditional: No income cap.

Traditional to Roth: MAGI limits apply.

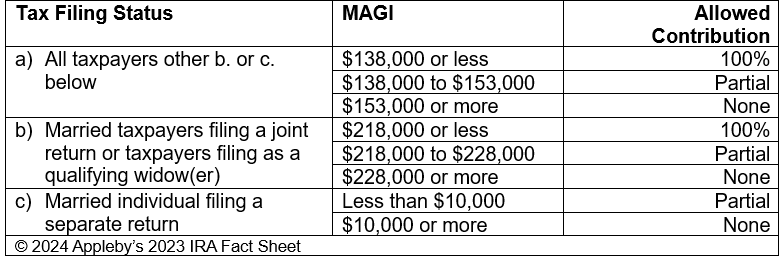

The MAGI caps for Roth IRA contributions for 2023 are as follows.

2023 MAGI Limits for Contributing to a Roth IRA

Examples: Taxpayers whose 2023 tax-filing status is married filing jointly:

- Shirley’s MAGI for 2023 is $250,000. Shirley is not eligible for a regular Roth IRA contribution because her MAGI exceeds $228,000. She may not recharacterize a traditional IRA contribution to a Roth IRA contribution.

- Carla’s MAGI for 2023 is $225,000. Carla falls within the phaseout range and can make a partial (of the total contribution limit) Roth IRA contribution for 2023. Her tax preparer can calculate how much she can contribute to a Roth IRA. If she wants to do the calculation herself, she may use the IRS’ Worksheet 2-2 in Publication 590-A to determine how much she may contribute to her Roth IRA.

- Tim’s MAGI is $130,000. Tim may recharacterize a traditional IRA contribution to a Roth IRA up to the full contribution limit.

What Can You Switch

You can recharacterize any amount you can contribute to the receiving IRA. Using the examples above, any of these three individuals may switch from a Roth IRA to a traditional IRA. But if recharacterizing from a traditional IRA to a Roth IRA:

- Shirley is ineligible because her MAGI is too high for a Roth IRA contribution.

- Carla may recharacterize only the amount she is eligible to contribute to her Roth IRA. If she wants to, she could split her IRA contribution between her traditional IRA and her Roth IRA, as long as the amount recharacterized to her Roth IRA is not in excess of the amount she is eligible to contribute.

- Tim may recharacterize up to the total IRA contribution limit of $6,500, plus $1,000 if he was at least age 50 by the end of 2023.

Any net income attributable must be included when executing a recharacterization. NIA can be earnings or losses.

Example: Assume Tim made a traditional IRA contribution of $6,500 in May 2023. In March 2024, when he recharacterized the $6,500, it had a NIA of $500. The entire $7,000 ($6,500 plus $500) must be recharacterized to the Roth IRA as a 2023 contribution.

Partial recharacterizations are allowed. For example, Tim could recharacterize less than the $6,500 if he wanted to, thus splitting his IRA contribution between his traditional IRA and his Roth IRA.

Why Make the Switch

Individuals can recharacterize an IRA contribution for reasons that include the following:

- Ineligible to deduct a traditional IRA contribution: The IRA owner contributed to a traditional IRA, but they are ineligible to claim a deduction for the amount. If the contribution remains in the traditional IRA, attributable earnings would be taxable when withdrawn. If the contribution is recharacterized to a Roth IRA, earnings would be tax-free when the owner is eligible for a qualified distribution. The Roth IRA would make better tax-sense because the earnings would be tax-free.

- Eligible to deduct a traditional IRA contribution: The IRA owner contributed to their Roth IRA and later decided that it would be more tax-beneficial to make it a traditional IRA contribution and claim the tax deduction, thus reducing the tax impact for the year the contribution is made.

- Ineligible to contribute to a Roth IRA: The IRA owner made their contribution to their Roth IRA. But, like Shirley above, their MAGI is too high for a Roth IRA contribution. Leaving the contribution in their Roth IRA will create an excess (ineligible) contribution that could be subject to excise tax and penalties.

- Individuals can also do a recharacterization simply because they prefer one type of IRA contribution over another.

Where to Make the Switch

The best place to perform a recharacterization is with the custodian who received the original contribution, as it would have all the data needed to calculate the NIA.

If the account has since been transferred to a new custodian, the new custodian might want the IRA owner to calculate the NIA. The IRA owner may use the IRS Worksheet 1-3 in Publication 590-A to calculate the NIA in such cases.

When Must You Make the Switch

Your recharacterization must be completed by your tax-filing due date, plus extensions. If you file your tax return by your tax-filing due date, you receive an automatic six-month extension to recharacterize your IRA contribution. For most taxpayers, this means Oct. 15, 2024, to recharacterize a 2023 traditional or Roth IRA contribution.

How to Make the Switch

You must notify your IRA custodian once you have decided to recharacterize your IRA contribution. Most, if not all, custodians have a form used for recharacterization purposes. Some online versions include built-in calculators that automatically calculate the NIA as the data is entered.

Your recharacterization can be done in-kind, which is beneficial if you want to avoid liquidating securities. For example, if the contribution plus NIA is $7,000, your recharacterization can consist of cash, securities, or a mixture of cash and securities with a total market value of $7,000.

Tell Your Tax Preparer

Your tax preparer must be notified about your recharacterization so that they can report it on your tax return. If your recharacterization was done after your tax return was filed, your tax preparer might need to file an amended tax return. For example, suppose the contribution was initially treated as a deductible on your tax return, but you recharacterized it to your Roth IRA. In that case, your tax preparer must amend your tax return to remove the deduction.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

Denise Appleby is a freelance writer. The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

/d10o6nnig0wrdw.cloudfront.net/07-24-2024/t_99436285e257449398ad25308659356e_name_file_960x540_1600_v4_.jpg)