You Probably Need to Rebalance

If it’s been a while since you looked at your portfolio weightings, it might be time to adjust.

We’ve previously written about why rebalancing a portfolio at least once a year, or whenever the stock/bond split drifts significantly away from target levels, can help moderate volatility and keep downside losses in check.

In this article, I’ll look at specific asset classes that might need some adjustments if your last portfolio overhaul took place either one, three, or five years ago. To test the weightings, I started with a simple portfolio combining 60% in stock funds and 40% in a bond fund. I allocated one third of the equity weighting to foreign stocks and split the domestic portion between value and growth funds. Over each period, I assumed that investors took a hands-off approach and simply held the underlying assets without making any changes in the interim. In all three cases, the portfolio weightings would have drifted away from target levels, especially with respect to the mix of stocks and bonds but also when it comes to value and growth.

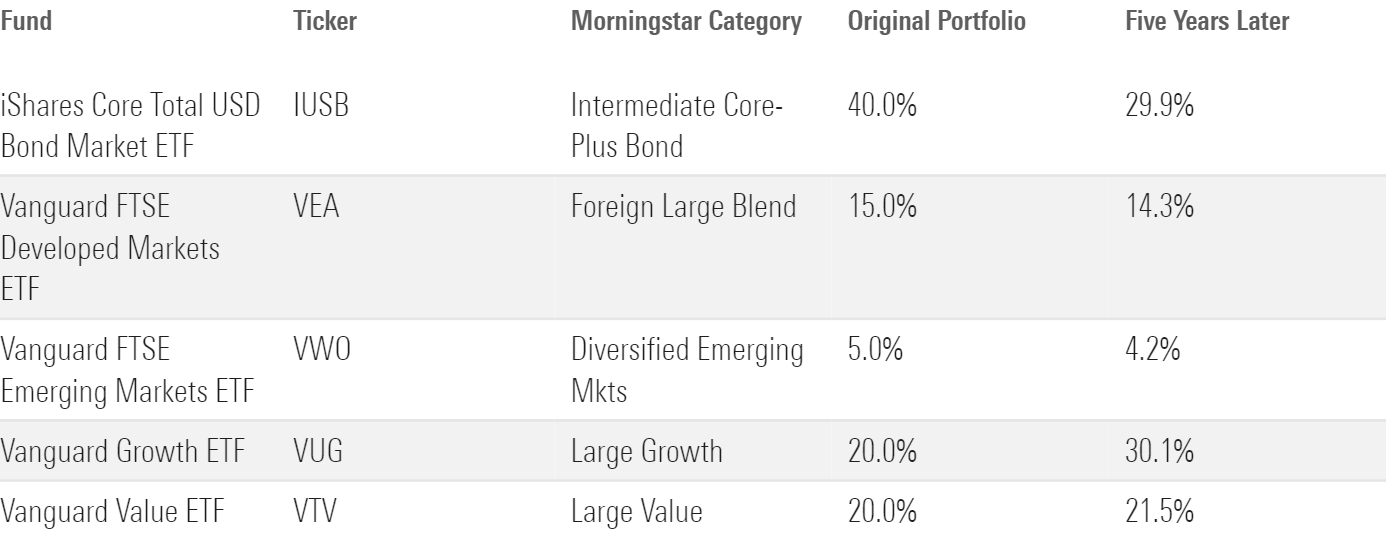

Five Years Since Last Rebalancing

If it’s been several years since your last portfolio rebalancing, your portfolio is probably significantly out of balance.

Five Years Since Last Rebalancing: Fund Weightings

Even after the bear market in 2022, stocks have still outpaced bonds by a decent margin over the trailing five-year period. As a result, my test portfolio’s overall equity exposure expanded from 60% at the beginning of the period to 70.1% by the end. That change would also have a significant impact on a portfolio’s risk profile. To get things back in balance, it makes sense to reallocate assets from stocks to bonds.

Five Years Since Last Rebalancing: Overall Asset Mix (% of Total)

Because U.S. stocks outperformed their non-U.S. counterparts for most of the five-year period, the mix between domestic and foreign stocks is also probably ready for some adjustments. By the end of the five-year period, U.S. stocks would have risen to 51.6% of the overall portfolio—significantly above the original level. The mix between value and growth stocks would be significantly out of whack, with growth stocks accounting for 30.1% of total assets, up from 20% at the beginning of the period. That means growth stocks are a logical place to cut back; those assets can then be redeployed to shore up the fixed-income weighting.

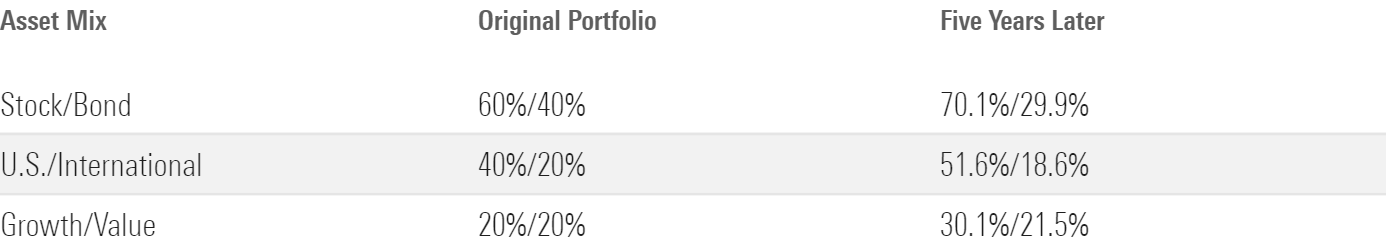

Three Years Since Last Rebalancing

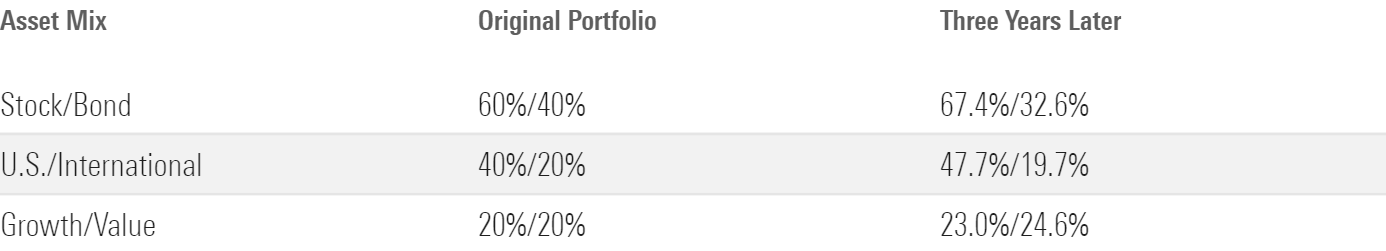

If it’s been about three years since your last portfolio overhaul, it’s probably time for some adjustments.

Three Years Since Last Rebalancing: Fund Weightings

Stocks would have grown to about 67.4% of total assets, while bonds would be more than 7 percentage points below the target level. U.S. stocks would have drifted up to 47.7% of assets, compared with 40% in the original portfolio. The mix between growth and value didn’t change dramatically, as value stocks held up much better than growth during the 2022 bear market, but growth issues returned to the fore in 2023. Both value and growth would have been overweight compared with their target levels, making them both logical candidates to trim back and redeploy the proceeds into bond funds.

Three Years Since Last Rebalancing: Overall Asset Mix (% of Total)

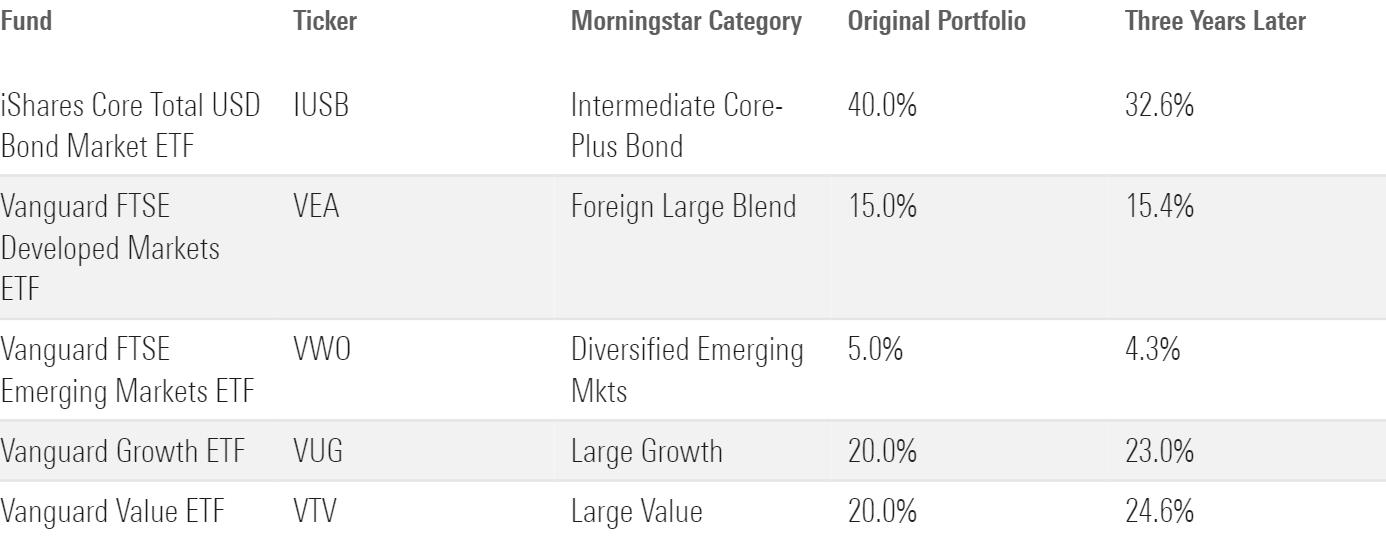

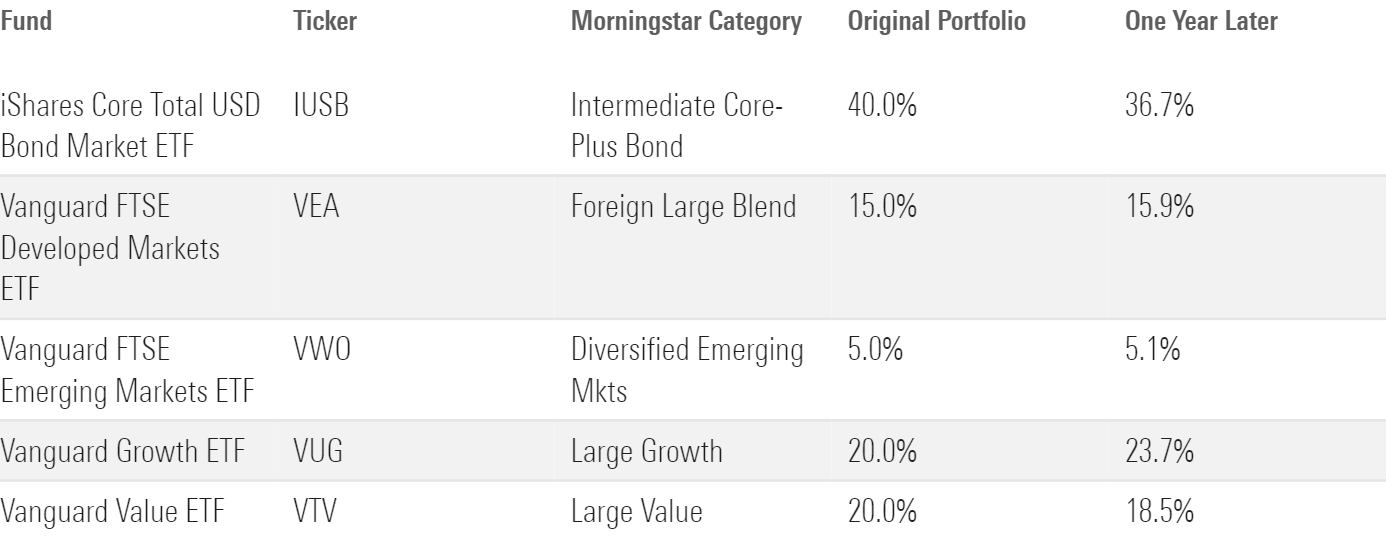

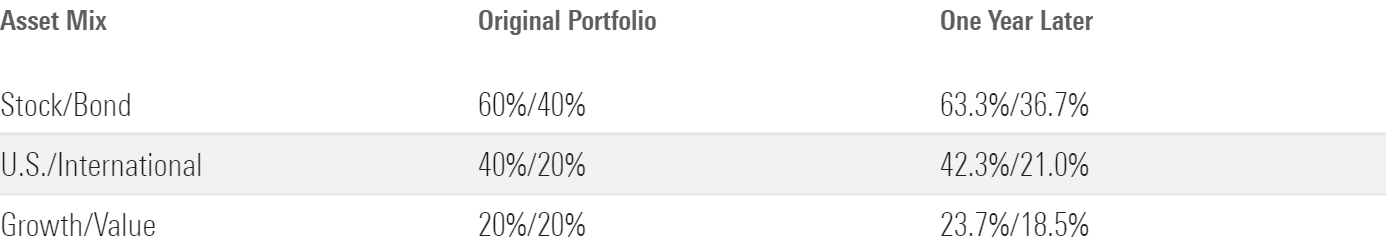

One Year Since Last Rebalancing

If it’s only been a year since you last rebalanced, your portfolio probably doesn’t need a major overhaul.

One Year Since Last Rebalancing: Fund Weightings

Because U.S. stocks gained about 20% for the year-to-date period through Nov. 30, 2023, while bond returns were much lower, the portfolio’s overall equity exposure would have increased to about 63.3% of assets, up from 60% previously. To keep things in balance, it makes sense to prune back equity exposure (especially from the growth side of the portfolio) and redeploy some assets back into bonds. Because U.S. stocks have outperformed international issues by a wide margin over the past year, they would now consume about 42% of assets, up from 40% originally. Growth stocks, meanwhile, would also have drifted over the original target.

One Year Since Last Rebalancing: Overall Asset Mix (% of Total)

How to Rebalance

If you suspect that it might be time to rebalance, the best way to start is by getting a handle on your portfolio’s current asset mix. For Morningstar Investor subscribers, our portfolio tool can provide a quick view of the combined asset exposure for your underlying holdings. If you find that certain areas have drifted away from target levels, some remodeling might be in order.

It’s easiest to make changes in tax-advantaged accounts, such as an IRA or a 401(k), because you can shift holdings around without any adverse tax consequences. As long as you buy and sell holdings within the same tax-deferred account, there should be no realized capital gains to worry about. Many 401(k) plan providers also allow you to put rebalancing on autopilot by selecting a target asset allocation and setting up preferences for automatic rebalancing.

Required minimum distributions, which are mandatory annual withdrawals that apply to investors age 73 and older who own tax-deferred accounts, are another logical opportunity to employ rebalancing strategies. Investors don’t have a choice about taking at least the required minimum amount out of their accounts each year, so it makes sense to target appreciated asset classes when raising cash before taking the distribution.

Things get trickier with taxable accounts. Rebalancing typically means cutting back on winners, which are likely to have accumulated capital gains. Tax-loss harvesting, which involves selling assets with unrealized capital losses, can help offset some of the gains. (But because you’ll likely need to redeploy proceeds from the gains into the same areas that generated the losses, be careful not to get caught up in wash-sale issues.) If you’re still adding assets to a taxable account, steering that new money to areas that are below your target level is another way to minimize the tax pain of rebalancing.

Conclusion

It’s important to note that portfolio rebalancing is mainly a tool for controlling risk—not necessarily for improving returns. Broad market trends can often persist for multiple years, meaning that simply letting a portfolio’s winners ride can pay off at times. For example, U.S.-based stocks have outperformed their non-U.S. counterparts by a wide margin over eight of the past 10 calendar years (including the first 11 months of 2023). As a result, selling domestic winners to maintain a given weighting in international stocks has not led to better returns. That said, reversion to the mean is a powerful force, and even long-lived trends don’t last forever. One of the virtues of rebalancing is to avoid getting caught flat-footed when market trends eventually reverse course.

A version of this article was previously published on Dec. 6, 2021.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/URSWZ2VN4JCXXALUUYEFYMOBIE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CGEMAKSOGVCKBCSH32YM7X5FWI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)