Tax-Deferred Retirement-Saver Portfolios for Fidelity Investors

The firms’ bond funds are topnotch, but its equity lineup also has some solid options for accumulators.

Investing in an IRA or brokerage account? The world is your oyster. You can have your pick among individual stocks, bonds, mutual funds, and exchange-traded funds, and even venture into esoteric assets such as commodities.

If you’re investing in a company retirement plan, by contrast, you’ll usually have to choose among a constrained choice of investments, often from a single provider. And for years, one of the biggest names in the 401(k) space has been Fidelity Investments.

I've created model portfolios to illustrate how investors who are in accumulation mode can build portfolios using Fidelity funds. Of course, not every fund that I've used in these portfolios will be found on every Fidelity 401(k) menu, but investors can use the general framework to build out their own portfolios.

About the Portfolios

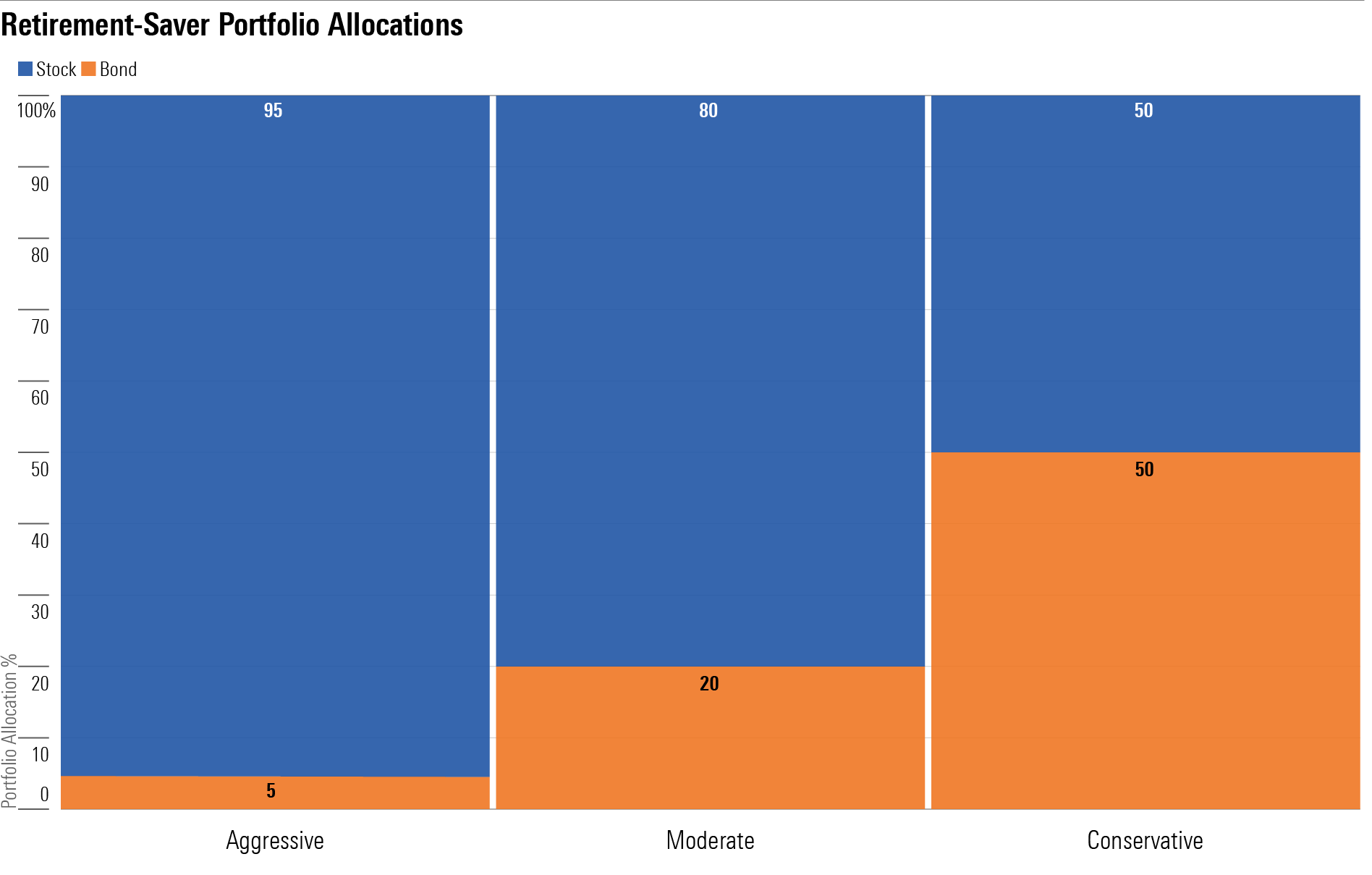

I’ve created three Fidelity Retirement Saver portfolios: Aggressive, Moderate, and Conservative. These portfolios are geared toward investors in tax-deferred accounts like IRAs and 401(k)s, meaning that I have selected investments without regard for tax efficiency.

As with the other portfolios, I used Morningstar’s Lifetime Allocation Indexes to guide the baseline asset allocations. I then relied on Morningstar’s Medalist ratings to help populate the portfolios, while also consulting with Morningstar’s analyst team. I used the share class with the lowest minimum investment amount for these portfolios, but investors who have access to lower-expense share classes should, of course, opt for those instead.

The portfolios are geared toward investors’ tax-sheltered accounts, so I didn’t consider holdings tax efficiency when populating the portfolios.

How to Use Them

My key goal with these portfolios is to depict sound asset-allocation and portfolio-management principles rather than to shoot out the lights with performance. That means that investors can use them to help size up their own portfolios’ asset allocations and sub-allocations. Alternatively, investors can use the portfolios as a source of ideas in building out their own portfolios. As with the Bucket portfolios, I’ll employ a strategic (that is, long-term and hands-off) approach to asset allocation; I’ll make changes to the holdings only when individual holdings encounter fundamental problems or changes, or if they no longer rate as Morningstar Medalists.

The portfolios vary in their amounts of stock exposure and in turn their risk levels. The Aggressive portfolio is geared toward someone with many years until retirement and a high tolerance/capacity for short-term volatility. The Conservative portfolio is geared toward people who are just a few years shy of retirement. The Moderate portfolio falls between the two in terms of its risk/return potential.

Aggressive Tax-Deferred Retirement-Saver Portfolio for Fidelity Investors

Anticipated Time Horizon to Retirement: 35-40 years

Risk Tolerance/Capacity: High

Target Stock/Bond Mix: 95/5

- 15%: Fidelity Contrafund FCNTX

- 15%: Fidelity Value Discovery FVDFX

- 25%: Fidelity Total Market Index FSKAX

- 40%: Fidelity International Discovery FIGRX

- 5%: Fidelity Total Bond FTBFX

Moderate Tax-Deferred Retirement-Saver Portfolio for Fidelity Investors

Anticipated Time Horizon to Retirement: 20-25 years

Risk Tolerance/Capacity: Moderate

Target Stock/Bond Mix: 80/20

- 13%: Fidelity Contrafund FCNTX

- 10%: Fidelity Value Discovery FVDFX

- 25%: Fidelity Total Market Index FSKAX

- 32%: Fidelity International Discovery FIGRX

- 20%: Fidelity Total Bond FTBFX

Conservative Tax-Deferred Retirement-Saver Portfolio for Fidelity Investors

Anticipated Time Horizon to Retirement: 2-5 years

Risk Tolerance/Capacity: Low

Target Stock/Bond Mix: 50/50

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/SIEYCNPDTNDRTJFNF6DJZ32HOI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)