Our Ultimate Stock-Pickers’ Top 10 High-Conviction and New-Money Purchases

Several funds see value in consumer cyclical, industrials, and financial services.

For the past decade, our primary objective with Ultimate Stock-Pickers has been to uncover investment ideas that both our equity analysts and top investment managers find attractive, in a manner timely enough for investors to gain value. In cross-checking the most current valuation work of Morningstar’s own arsenal of stock analysts against the actions of some of the most recognizable equity managers in the business, we look to uncover good ideas each quarter that will be of interest to investors. With 24 of our Ultimate Stock-Pickers having reported their holdings for the fourth quarter of 2022, we now have a good sense of the stocks that piqued their interest during the period.

While looking at our Ultimate Stock-Pickers’ buying activity, we concentrate on high-conviction purchases and new-money buys. We think of high-conviction purchases as occasions when managers have made meaningful additions to their portfolios, as defined by the size of the purchase in relation to the portfolio’s size. We define a new-money buy strictly as an instance where a manager purchases a stock that did not exist in the portfolio in the prior period. New-money buys may be done either with or without conviction, depending on the size of the purchase, and a conviction buy can be a new-money purchase if the holding is new to the portfolio.

We recognize that our Ultimate Stock-Pickers’ decisions to purchase shares of any of the securities highlighted in this article could have been made as early as the start of October, so the prices paid by our managers could be substantially different from today’s trading levels. Therefore, we believe it is always important for investors to assess for themselves the current attractiveness of any security mentioned here based on a multitude of factors, including our valuation estimates along with our moat, stewardship, and uncertainty ratings.

Since 2020, headwinds created by the pandemic obstructed the markets and sidelined a multitude of industries as governments across the globe instituted lockdowns and imposed restrictions. And just as the market was looking to slowly recover as pandemic restrictions were lifted, the Russian invasion of Ukraine threw another wrench into the global economy, elevating energy prices and creating inflationary pressures that have impacted food and energy markets. The fourth quarter of 2022 has been defined by continued uncertainty, including inflationary pressure, dollar appreciation, and lingering fears of a potential recession. The Fed enacted a 0.25 of a percentage point interest rate increase in early February, a contrast to the 0.5 and 0.75 of a percentage point hikes in December and November 2022, respectively, as inflation appears to be moderating. The current benchmark rate of 4.50% to 4.75% is now a stark contrast to the near-zero levels that were in place since the early days of the pandemic. Despite market headwinds, Ultimate Stock-Pickers still looks to find value in individual stocks during a period of volatility and uncertainty.

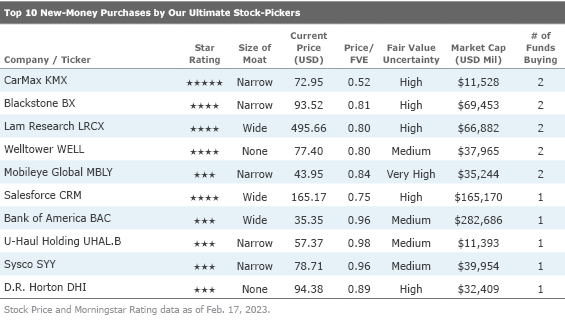

In the top 10 high-conviction purchases list, the buying activity was distributed among a multitude of sectors, including consumer cyclical, industrials, financial services, communication services, technology, basic materials, and healthcare. All 10 companies on the high-conviction purchases list and six of the 10 companies on our new-money purchases list received at least a narrow economic moat rating from Morningstar analysts, keeping in line with trends we have witnessed over the past few years. The three names we find most interesting on the high-conviction purchases and new-money lists are narrow-moat CarMax KMX, narrow-moat Blackstone BX, and wide-moat Lam Research LRCX.

There was very little crossover between our two top 10 lists this period, with just CarMax appearing on both lists. This quarter, both Amazon AMZN and Alphabet GOOGL led the way with five high-conviction purchases from our manager list. Both companies have wide economic moats and are trading at discounts to their fair value estimates, which indicates that money managers continue to place an emphasis toward blue-chip stocks in a period of uncertainty.

One name that stood out for us was narrow-moat CarMax, which attracted four high-conviction purchases during the fourth quarter of 2022 and two of these were also new-money purchases. The name currently trades at about $73, well below Morningstar analyst David Whiston’s fair value estimate of $141.

CarMax sells, finances, and services used and new cars through a chain of over 230 used retail stores. Used vehicle sales typically account for about 83% of revenue and wholesale about 13%, with the remaining portion composed of extended service plans and repair. In fiscal 2022, the company retailed and wholesaled 924,338 and 706,212 used vehicles, respectively. CarMax is the largest used-vehicle retailer in the U.S. but still estimates that it has only about 4% U.S. market share of vehicles 0-10 years old in 2021. The firm seeks over 5% share by the end of calendar 2025 and revenue between $33 billion to $45 billion by fiscal 2026.

Whiston notes that CarMax’s revenue has increased at a compound annual rate of about 13% since fiscal 2000 because of the success of customer-friendly sales practices and use of information technology. When breaking down competitive dynamics, Whiston details that dealerships have tried no-haggle pricing and failed because their salesforces are trained to focus on selling vehicles that earn the highest possible gross profit rather than vehicles that customers actually want or need. A traditional dealership relies on profits from service to offset the typically lower margins it gets on new-vehicle sales. In contrast, CarMax does not hire salespeople from the auto industry, and salespeople receive the same commission regardless of the vehicle sold. They do not even know the profit on the vehicle sold. The CarMax customer stays with the same salesperson throughout the transaction rather than being passed off to a finance department, receiving a buying experience that is hard to match at a dealership. In Whiston’s view, this focus on customer satisfaction, combined with scale advantages that allow for a wide inventory selection and extensive pricing data, creates a narrow economic moat.

According to management, the firm will give any further improvements in operating expenses back to the customer as a price decrease instead of seeking higher gross margins. Whiston likes this strategy; CarMax’s scale allows it to price below smaller dealerships, and lowering prices should increase comparable-store sales while keeping competitors away, though some large dealers are copying CarMax’s shopping experience. The company can often make up any lost margin via its highly profitable finance arm, CarMax Auto Finance (finances about 41% of unit sales). The company’s omnichannel program, which finished rolling out in the second quarter of fiscal 2021, enables consumers to shop digitally and in-store, which should allow for fewer store openings over time. In Whiston’s opinion, these factors should keep the company growing for many years, despite more competition from franchised dealers and online-only startups. Whiston acknowledges some of the headwinds that current used vehicle pricing can create for the firm but accounted for lower revenue growth in his most recent December 2022 update.

Two of our money managers made high-conviction new-money purchases of Blackstone, a narrow-moat company currently trading at a discount to Morningstar analyst Greggory Warren’s fair value estimate of $115.

Warren considers Blackstone to be the preeminent alternative asset manager, with $974.7 billion in total assets under management, or AUM, including $718.4 billion in fee-earning AUM, at the end of December 2022. The company has scale in each of its four business segments: private equity (24% of fee-earning AUM and 31% of base management fees), real estate (39% and 40%), credit & insurance (27% and 20%), and hedge fund solutions (10% and 9%). Warren adds that Blackstone has also built out a large base of employees—including in-house executives, consultants, and advisors—that have decades of industry experience and can successfully revitalize a company or property through cost-cutting, acquisitions, or other strategic maneuvers.

Unlike the more traditional asset managers, that have had to rely on investor inaction (driven by either good fund performance or investor inertia/uncertainty) to keep annual redemption rates low (generally in a 20%-30% range for long-term AUM), the products offered by alternative asset managers can have lockup periods attached to them, which prevent investors from redeeming part or all of their investment for a prolonged period of time. Generally, Warren favors longer lockup periods, which offer up more substantial switching costs, with private equity tending to offer the longest lockup periods of 7-10 years compared with quarterly for most hedge funds and fund of fund products (after a specified period of time has passed from the initial investment). According to Warren, this arrangement has allowed Blackstone to post an annual redemption (retention) rate of less than 10% (more than 90%) on average the past 5-10 years even with about one third of its total and fee-earning AUM tied up in products redeemable on a quarterly basis.

During the past 5-10 years, the company has produced ROICs that have generally been 400 basis points to 900 basis points above his estimated cost of capital. While Warren expects the firm to expand its level of excess returns over the next 5-10 years (given the level of interest that still exists for alternatives), he believes it will become increasingly more difficult for the company to consistently generate an abundant level of excess returns beyond that period as increased competition from peers, continued pressure on fees, a higher overall tax rate (after converting from a publicly traded partnership to a corporation), and a general maturation of the industry (from a solid period of above average growth in the face of shifting investor demand for alternatives) weigh on results. As such, Warren believes the firm has only a narrow economic moat around its operations even though it exhibits characteristics of a wide-moat firm.

Our Ultimate Stock-Pickers also made two new-money purchases in wide-moat Lam Research, a manufacturer of equipment used to fabricate semiconductors. The firm is focused on the etch, deposition, and clean markets, which are key steps in the semiconductor manufacturing process, especially for 3D NAND flash storage, advanced DRAM, and leading-edge logic/foundry chipmakers. Lam’s flagship Kiyo, Vector, and Sabre products are sold in all major geographies to key customers such as Samsung Electronics 005930, Micron MU, Intel INTC, and Taiwan Semiconductor Manufacturing TSM.

Lam Research currently trades at a discount to Morningstar analyst Abhinav Davuluri’s fair value estimate of $620. He believes Lam has a wide economic moat as a result of cost advantages and intangible assets related to equipment design. Davuluri surmises Lam’s leadership position creates scale advantages that fuel research and development spending at levels only Applied Materials AMAT and Tokyo Electron 8035 can match. At the end of 2021, Lam had an installed base of 75,000 units, up from 40,000 in 2015. As such, this large installed base creates stickiness and offers Lam an intimate look into problems faced by chipmakers, providing valuable information it can use to implement solutions and additional capabilities in future tools.

Chipmakers that have continued along the trajectory prescribed by Moore’s law have endured significant challenges in terms of cost and complexity. Equipment providers are vital to making the pursuit more economical via advanced chip manufacturing tools. Davuluri posits Lam has benefited from the sharp rise in etch, deposition, and clean steps required as a result of major inflections, including FinFET transistors and planar to 3D NAND, that feature multiple patterning and vertical layers well suited for Lam’s advanced etch and deposition offerings. Consequently, he believes Lam is poised to grow faster than the overall equipment industry, as he thinks it can capture a larger share of the market with technically superior tools.

According to Davuluri, the volatile nature of demand for semiconductors directly affects the cyclicality of the equipment market. Lam, along with its peers, has benefited from an increase in service revenue in recent years, which he believes will mitigate the volatility of equipment orders. Specifically, maintenance and engineering costs and spare parts are tied into service contracts, that deliver a stable revenue stream distinct from tool purchases. As traversing Moore’s law becomes increasingly difficult, Davuluri expects the service segment will grow as chipmakers increase their reliance on field service engineers from Lam and its peers while also helping entrench vendors’ installed base of tools at customer facilities.

Disclosure: Ari Felhandler has an ownership interest in Taiwan Semiconductor Manufacturing. Verushka Shetty and Eric Compton have no ownership interests in any of the securities mentioned above. It should also be noted that Morningstar’s Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LUIUEVKYO2PKAIBSSAUSBVZXHI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)