HSA Users Need Advice

And policymakers need to better understand the health savings account market.

Health Savings Accounts, or HSAs, are a relatively new type of account. The U.S. Congress created them in 2003, but it wasn’t until 2010 that more than 10% of the working population had access to them, according to research from the Kaiser Family Foundation. As a result, according to HSA consultancy Devenir, assets deposited in HSAs were only $37 billion at the end of 2016, an amount that pales in comparison to more-established tax-advantaged accounts, such as the $5 trillion deposited in 401(k)s and $8.1 trillion in IRAs.

Additionally, few workers use their HSAs as investments, leaving their HSA assets in checking accounts instead. That’s a problem because for workers who have sufficient savings and can pay for their health expenses with their HSAs or other savings, investing extra assets can be a powerful way to prepare for health expenses in retirement. We see widespread confusion due to a lack of guidance on how to best use HSAs. Further, many who want to invest find that their HSA fund lineups leave something to be desired.

HSAs Poised to Continue to Grow Today, about 30% of workers have access to HSAs, and the accounts are well positioned to continue to grow. To have access to an HSA, a worker must be enrolled in a high-deductible health plan, or HDHP. Employers like these plans because they cost less to offer to their employees than traditional plans. In a survey of more than 800 employers, Aon, a benefits consultancy, found that 64% offered an HDHP as an insurance option, with an additional 22% indicating they were evaluating offering an HDHP in the next three to five years. Another 15% offered an HDHP as their only health insurance plan. Devenir similarly sees growth in the market and estimates total assets deposited in HSA accounts will rise to $53.2 billion at the end of 2018.

Recent legislative efforts will nudge even more workers into high-deductible health plans with HSAs. Both recent healthcare bills in the U.S. House of Representatives and Senate dramatically raised contribution limits on HSAs to as much as $13,600 for a worker using a family plan. Although the healthcare bills failed to pass, there is a strong push to expand HSAs that could also be part of a tax reform effort.

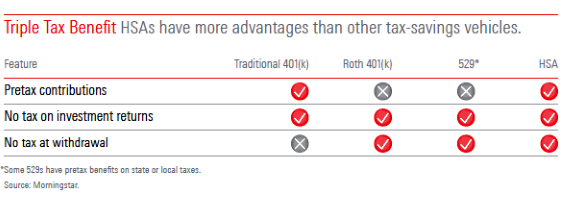

Secure Retirement HSAs are a powerful tool that can enable accountholders to achieve a more secure retirement. They compare favorably to other tax-advantaged accounts in that they offer a triple tax advantage, as shown in the exhibit below. Contributions are on a pretax basis, investment returns grow tax-free, and withdrawals are tax-free for qualified medical expenditures.

Perhaps the best way to use an HSA, from a wealth-maximization perspective, is to pay for medical expenses incurred out of pocket and invest HSA funds, allowing them to grow tax-free over the course of a career. Of course, this is only true for workers who can pay for their out-of-pocket expenses with existing HSA balances and other savings.

Those lucky enough to be able to apply such a strategy can invest their HSAs for inevitable retirement medical expenses, including Medicare premiums. Fidelity estimated that a 65-yearold couple retiring today can expect to pay about $260,000 in healthcare costs in retirement, and even more if they wish to insure against long-term-care costs. Also, HSA accountholders can essentially reimburse themselves for past expenses. For example, if a patient pays out of pocket for an emergency room visit from savings other than her HSA investment account, she can withdraw that money 30 years later, after the principal has had ample time to compound.

If accountholders find themselves in a position in which they have more money in their HSA than they can expect to spend on healthcare costs, HSA funds may be withdrawn for any purpose after age 65 and will be taxed at the accountholder’s marginal rate, much like an IRA. HSAs can also benefit seniors already in retirement, as they can be used to pay for Medicare part B, C, and D premiums.

But Few Take Full Advantage Despite the triple tax advantage and benefits for retirees, few workers know how to maximize the benefits of these accounts. In research I conducted several years ago, I found that of the HSA accountholders eligible to invest their funds, only 5% actually did so. Other recent studies have similarly concluded that few HSA accountholders invest their assets.

Why? One reason could be that no one is giving advice to those workers who stand to be benefit the most from investing in HSAs. Employers might think that many of their workers are not in a position financially to safely extend their savings to HSAs after investing for retirement and college. So, they do not give workers the same generic save-more advice for HSAs that they give for retirement accounts.

Also, some HSA plan providers do not allow for first-dollar investing, instead requiring the accountholder to build their savings and cross a threshold before the option to invest becomes available to them. The introduction of this friction all but assures that some less-engaged accountholders will not invest their assets. Some HSA providers, such as local banks and credit unions, may not even offer an investment lineup with their HSAs, providing only checking accounts. In a low interest-rate environment, where meaningful returns are hard to come by, the lack of an investment lineup hampers accountholders and their ability to use their HSAs as a supplement to retirement savings.

Weak Options Among the accountholders who do invest their HSA assets, the investing experience is substandard. As you'll read in this issue's Spotlight section, Morningstar assessed 10 prominent HSA providers and concluded that these accounts are ripe for improvement ("Room for Improvement," Page 38). The report found that only one plan provider earned a positive assessment for use as both a spending vehicle and an investment vehicle.

When we looked at nine plan providers solely on the investment account side, only four providers earned positive assessments; four earned neutral scores, and one earned a negative assessment. Of the four that earned a positive assessment, only one provider earned positive scores for all four pillars of our assessment process: menu design, investment quality, price, and performance.

These conclusions certainly do not describe everyone’s experiences with HSAs, as this report was not an exhaustive review of every HSA plan provider. However, by focusing on 10 of the larger HSA providers, we think the results suggest that providers should vastly improve their investment options.

Education Gaps Remain In addition to weak investment options, another area that needs improvement is education. True, providing education on using HSAs is more complicated than giving guidance around retirement savings. In addition to problems such as asset allocation and risk tolerance, accountholders must solve for additional variables when making decisions about HSA contributions and distributions. Accountholders must consider their deductible and out-of-pocket maximum, and whether they intend to invest HSA funds, and if so, whether they have sufficient liquid assets to pay for medical expenses out of pocket. Also, retirement and college generally have predictable timeframes. Healthcare expenditures do not.

But finding ways to educate participants would go a long way toward helping them get the most out of their HSAs. This will become particularly important if efforts to raise HSA contribution limits are successful.

Policymakers: HSA Market Is Still Nascent As policymakers consider expanding HSAs, they should keep in mind that few people get the full benefits of their HSAs today and that the provider market needs improvement. Fundamentally, this is because the market is still small, and the industry and plan sponsors are still learning to communicate the benefits of HSAs to participants.

However, one possible approach would be for Congress to create an HSA “sidecar.” An HSA sidecar would work in a similar way to a “deemed” or “sidecar” IRA, which permits employers to allow employee contributions to an IRA outside of the workplace-sponsored plan but maintain it as a part of the plan’s assets. The HSA sidecar would similarly allow a plan sponsor to offer employees an opportunity to invest HSA funds in their workplace-sponsored retirement plan. Accountholders could then have access to the same investment options available through their employer-sponsored retirement plan.

However, such an approach would need to be carefully designed to ensure participants receive holistic guidance before deciding to invest. As I noted earlier, people investing their HSA money for retirement expenses need to be able to cover possible out-of-pocket costs for healthcare, which could be up to $13,600 for a family covered by a high-deductible health plan. Further, we may well see a trend toward higherquality HSA fund lineups, obviating the need for the sidecar solution.

Still, if policymakers pursue legislation that expands HSAs, they should consider sidecars an option if there are sufficient guardrails and education to ensure people invest when appropriate.

An Underused Tool HSAs can be a powerful tool for workers saving for retirement. Accountholders who can pay for medical expenses out of pocket can leverage the triple-tax-advantaged status of HSAs and reimburse themselves for expenses after their investment principal has had time to grow. Or they can use their HSAs to pay for the considerable medical expenses they can expect to face in retirement. However, many accountholders do not pursue these opportunities, and those who do are sometimes saddled with less-than-stellar investment options.

Holistic education surrounding HSAs can help improve accountholders’ experiences and outcomes. The decision to invest, after all, requires accountholders to consider whether they have the sufficient household savings to do it. Further, a sidecar HSA could allow the accountholder to access the same investment options available through their workplace-sponsored retirement account, which may have a better fund lineup and lower fees.

With better messaging and guidance surrounding HSAs, accountholders will then be better positioned to leverage these improved investment options.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WDFTRL6URNGHXPS3HJKPTTEHHU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)