The Diversification Strategy That’s Older Than Target-Date Funds

Despite stiff competition, target-risk strategies continue to be compelling.

Target-risk strategies are worth reconsidering in light of evolving investor demands. These precursors to target-date portfolios have gained new life as the strategy of choice in the fast-growing model-portfolio market. Though they haven’t experienced inflows of late like their target-date siblings, target-risk mutual funds still hold substantial assets. Why and how have these offerings remained resilient? Do they merit a place in a retirement investment lineup today?

Deep Roots, but the Forest Consists of Layers

Let’s first look at their origins. In the early 1970s, target-risk strategies evolved out of balanced funds, which provide investors a diversified total portfolio of stock and bonds, so investors aren’t required to aggregate the asset classes on their own. By the early 1990s, several years of stock market turbulence led many investors to ask for strategies that were managed according to a specified risk mandate, and this was when target-risk mutual funds gained traction. Fidelity’s Asset Manager series, Manning & Napier’s Pro-Blend series (mutual fund versions of target-risk separate accounts that had been around since the early 1970s), T. Rowe Price’s Personal Strategy funds (now rebranded to join its Spectrum asset-allocation portfolios lineup), and Vanguard’s LifeStrategy series were all launched during this period. Target-risk funds grew steadily in the ensuing bull market, and assets surged further when the funds held up relatively well in the 2000-02 bear market and stocks then rebounded. By 2005, target-risk funds exceeded $100 billion in assets.

However, a formidable competitor emerged—target-date funds.

While the first target-date series was launched in 1994, it flew under the radar at first. Target-date structures require developing a glide path, or a plan for evolving a portfolio’s risk profile dynamically over time to maximize capital appreciation in early years and preserve those gains up to the point that money is withdrawn for uses such as retirement income. Like target-risk strategies, target-date funds appealed to a broader audience in the 2000-02 bear market as the risks of choosing narrowly focused funds came to the fore. Instead, these one-stop offerings benefited from diversification and evolving risk profiles that helped investors increase their chances of generating the funds needed to retire with some confidence over an extended time horizon. The floodgates really opened in 2006 when the Pension Protection Act encouraged employers to automatically enroll new employees in target-date funds in retirement plans. Target-date funds’ assets vaulted from $70 billion at the end of 2005 to $253 billion four years later—surpassing target-risk mutual funds in the process. Target-date funds have continued to rake in the cash; they held roughly $1.5 trillion at the end of October 2022, even as some retirement plans have shifted assets to target-date collective investment trusts.

Target-Risk Funds Remain a Strong—and Growing—Option

Target-risk funds aren’t investment artifacts, though. They still hold a considerable portion of investors’ assets—$291 billion in mid-November 2022. What explains target-risk strategies’ resilience in the face of stiff competition? Simply put, the structure remains compelling. These are broadly diversified strategies, often holding equities across market caps, styles, and regions as well as investment-grade and high-yield bonds in the U.S. along with sovereign debt from elsewhere. Thus, they typically smooth returns compared with all-stock benchmarks—and sometimes bond indexes as well.

For example, in 2022′s near-bear market through October, there weren’t many places to hide; the S&P 500 dropped 17.7%, and the Bloomberg U.S. Aggregate Bond Index lost 15.7%. Meanwhile the average fund in the allocation–50% to 70% equity Morningstar Category lost a bit less (15.0%), partly owing to some exposure to non-U.S. stocks, which performed relatively better during the period. While a 15% loss isn’t great, providing a little cushion against major benchmarks in a tough environment makes it less likely that investors will get spooked and flee. And these offerings are candid about the risk profile employed, which is typically featured in the strategy label; investors have choice, but the typical versions—conservative, moderate, and aggressive—aren’t overwhelming or difficult to understand (though the nuance across labels can pose issues for investors, a topic for a future installment of this series).

Another reason that target-risk strategies remain a mainstay of investing menus: Many investors follow the old “if it ain’t broke, don’t fix it” adage. As previously discussed, these are diversified offerings intended to help an investor satisfy a mandate. If the risk label matches the expectations of the investor, and the total portfolio weathers the ups and downs of markets over a long time horizon, many investors would lack the impetus to change. Why reallocate to an investment that is more complicated or that might require rebalancing and greater attention? For many, a target-risk strategy balances customization with straightforwardness.

And target-risk strategies have staged an unexpected and powerful comeback in a different, fast-growing format: the model portfolio.

Indeed, the vast majority of model portfolios (about 70%) employ target-risk strategies. Structurally, those models look similar to mutual fund counterparts—portfolios stocked with open-end funds and exchange-traded funds, with most sticking to a prescribed stock/bond mix and some using tactical allocation calls over the top. To give a sense of how fast this area is growing, 780 target-risk model portfolios (45% of the entire model portfolio group in Morningstar’s database) were launched in the five years through September 2022. And model portfolios as a whole had assets under advisement of $349 billion in March 2022, according to Morningstar data—a 22% increase from nine months prior.

Why have target-risk strategies become so prevalent in the model-portfolio universe? They afford flexibility; advisors can use them as a one-stop shopping option or in tandem with a client’s existing holdings. They are simpler for an advisor to implement than a target-date approach as asset-allocation shifts aren’t required. And implementing a portfolio of recommended individual stocks and bonds requires far more work, too. (Advisors are also more actively involved and look more knowledgeable when using target-risk models as opposed to defaulting to a target-date mutual fund.) For asset managers, target-risk strategies represent a fairly simple way to potentially add value for their clients while also steering money to their fund lineups.

The Best Target-Risk Strategies Now

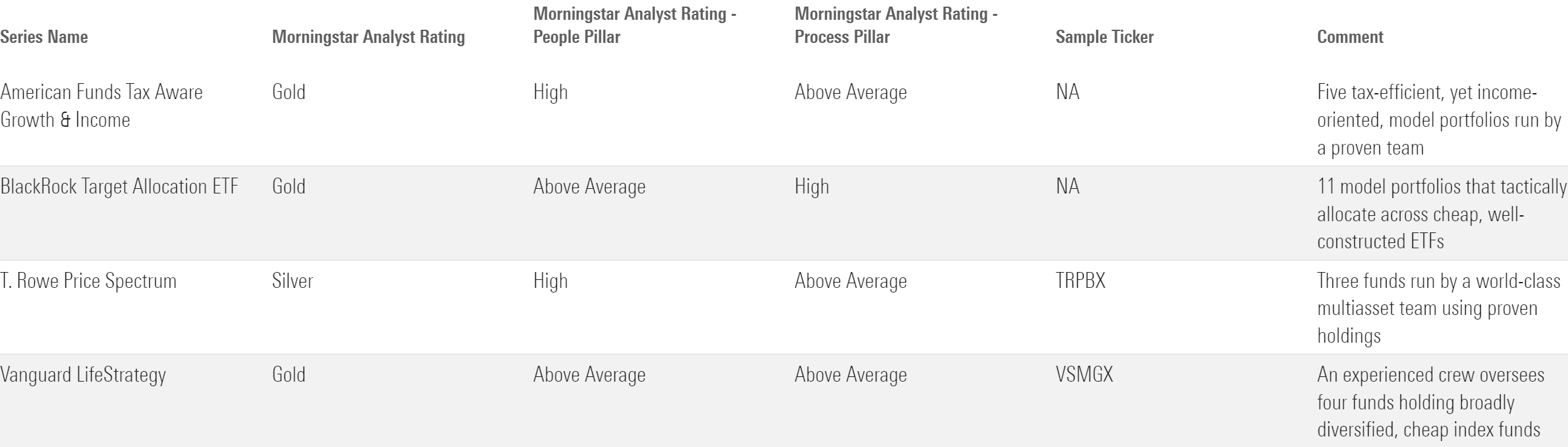

Some target-risk strategies hold substantial appeal beyond diversification. Four target-risk mutual fund series earned Morningstar Analyst Ratings of Bronze or better for their cheapest share classes as of Nov. 23, 2022: Vanguard LifeStrategy, T. Rowe Price Spectrum, MFS Allocation, and Manning & Napier Pro-Blend. Well-resourced management teams, appealing costs, and often-strong underlying holdings support these ratings. And investors have stuck with these funds; these four series hold $83 billion, or nearly 30%, of all target-risk fund assets.

A plethora of target-risk model portfolios have earned our confidence as well—more than 200 garner Morningstar Medalist ratings from our manager research analysts. Vanguard advises a fourth of that group. Its solid asset-allocation team uses the firm’s cheap building blocks to earn high ratings, including more than 45 Golds. BlackRock advises 37 medalists, Schwab’s cheap index funds earn two dozen medals for its model portfolio lineup, and American Funds, Dimensional Fund Advisors, and Goldman Sachs run about 15 medalists each. Fidelity and T. Rowe Price also manage a handful.

This is the first of several forays that Morningstar analysts plan to make into target-risk research. Stay tuned for more in 2023.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e9419b77-5e99-4d39-8b08-8c553bef37bd.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WDFTRL6URNGHXPS3HJKPTTEHHU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e9419b77-5e99-4d39-8b08-8c553bef37bd.jpg)