Costs Weigh on the Nation’s Largest 529 Plan

Virginia’s CollegeAmerica 529 plan earns praise for its investment team and underlying processes, so why does it net a just Bronze rating?

At $91 billion in assets, Virginia’s CollegeAmerica 529 plan accounts for nearly one fifth of the entire 529 industry and is more than twice the size of the second-largest plan. It is sold nationwide entirely through financial advisors; this wide remit and Capital Group’s vast distribution capabilities allow CollegeAmerica to reach more investors than 529 plans sold directly to savers, which tend to be held primarily by in-state residents.

Asset-management behemoth Capital Group, the parent of American Funds, oversees the plan, and its investment expertise is on display here. The plan’s resulting personnel and process rank at or near the top of the class, yet CollegeAmerica nets a Morningstar Analyst Rating of Bronze, two notches below the best 529 plans. Indeed, the plan’s extracurriculars—the layers of fees associated with its distribution model—tarnish its transcript.

A Strong Foundation for CollegeAmerica 529

Capital Group’s dedicated multi-asset team manages the plan. The firm uniquely offers its full American Funds lineup in the plan—allowing advisors to build customized portfolios—with a seven-person target-date committee of skilled investors focusing on the plan’s target-enrollment strategies. This outfit selects from the proven American Funds lineup to build the target-enrollment portfolios and is backed by a stable of analysts, leading to a High People rating. The asset-allocation process is also solid, as the target-enrollment group has leaned into American Fund’s most flexible offerings, such as Gold-rated American Funds New Perspective RNPGX, to harness the insights of one of the deepest investment groups in the industry. The target-enrollment portfolios also use a progressive glide path, an industry best practice, as it helps education savers avoid the risk of meaningfully shifting out of equities just after a market dip, when there is the potential to lock in losses. This supports the CollegeAmerica 529 plan’s Above Average Process rating.

Savers Receive a Costly Lesson on the Impact of Fees

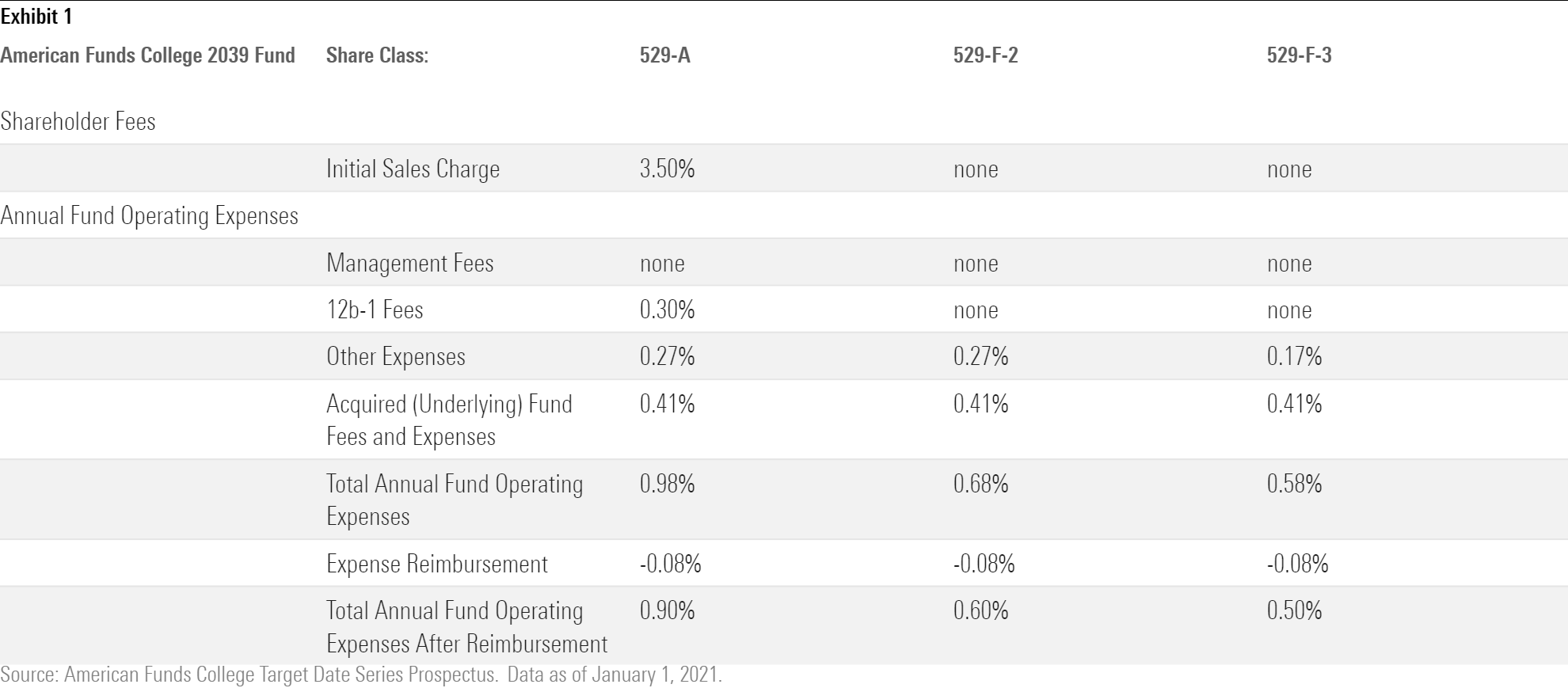

The advisor-sold model is a double-edged sword. While partially responsible for the plan’s hulking asset base, it also exposes investors to additional fees. Left to their own devices, commission-based advisors tend to select share classes that feed them revenue. Exhibit 1 details the fees for the A, F2, and F3 share classes of the American Funds College 2039 529 mutual fund. While most advisors elect to build their own portfolios in CollegeAmerica, they use similar building blocks and thus the 2039 fund’s fee structure serves as an accurate snapshot of the end investor experience.

The A share classes in CollegeAmerica hold roughly 85% of plan assets. Granted, the front-end sales charge, also known as a load, comes with caveats. It can be waived depending on the platform and has breakpoints for higher account balances, which can be commingled with other assets. This front-end charge, though, goes mostly to intermediaries, such as broker/dealers or financial institutions, and gets extracted before the first dollar is even invested. For instance, an education saver making a $10,000 investment would have 3.5%, or $350, skimmed off the top immediately, meaning only $9,650 is invested. Also, 12b-1 fees redirect education savers’ investments to advisors and brokers under the guise of distribution and/or service charges. These fees come on top of other expenses, including Virginia’s take and management fees to the underlying funds deployed by the target-enrollment series.

The fees add up quickly, chipping away at the plan’s attractive building blocks. Exhibit 2 depicts the hypothetical growth of CollegeAmerica’s average $34,000 account balance, assuming a 6% annualized return and funded 18 years before enrollment, then adjusts for fees. Granted, the plan’s average account balance is higher than the maximum a married couple could contribute gift-tax-free—$30,000 ($15,000 per individual)--in a single calendar year, but for demonstration’s sake, we’ll use the average.

Before fees, the account balance grows to over $97,000 at enrollment. Of course, no investor receives gross returns. Accounting for all fees and charges, including the full 3.5% sales charge—viewed as an opportunity cost rather than a one-time cost—weighs down the end balance by nearly $17,000.

Old Dominion Helps Itself

The commonwealth of Virginia also levies a fee, included in the “Other Expenses” bucket. Virginia’s agreement with Capital Group states that it gets 0.09% on the plan’s first $20 billion, then lowers the fee to 0.05% until the next breakpoint at $100 billion. As of Sept. 30, the asset-weighted state fee was 0.06%. While this levy looks trivial at first blush, every penny counts when saving for educational expenses. The fee also generates vast profits for the state. Morningstar estimates that CollegeAmerica has sent more than $160 million to the state in the past four years, and its growing asset base means Virginia is on pace to net over $50 million in 2021.

Some states sufficiently aid their advisor-sold plans, justifying some form of compensation. They provide additional oversight, bolster marketing efforts, or work closely with program managers. That argument falls flat for CollegeAmerica, though. Virginia provides little support to Capital Group, making its fee excessive on an absolute and relative basis. Granted, the commonwealth commendably supports its direct-sold plan. Still, Virginia could do more to share the benefits of CollegeAmerica’s immense scale with education savers.

Advisor Plans in Detention

The advisor-sold distribution model faces significant headwinds relative to their direct peers. Morningstar covers 62 education savings plans, with roughly one third sold through advisors. Yet, of the 32 plans that are Morningstar Medalists, only two plans that are sold through advisors—CollegeAmerica 529 Plan and Ohio’s BlackRock CollegeAdvantage 529 Plan—receive the honors, and their ratings peak at Bronze. Fees play a big part in this uneven distribution. The median fee charged by target-enrollment plans across the universe this year was 0.47%, versus 0.33% for direct-sold plans. Finally, even as American Funds is a low-cost leader, its lineup, composed entirely of actively managed funds, is pricier than the passive strategies that it is increasingly competing with in direct-sold plans. Indeed, the CollegeAmerica 529 plan, and all other advisor-sold plans, have a long way to go.

A Brighter Future for CollegeAmerica 529?

Capital Group recently added its cheaper F2 and F3 share classes to CollegeAmerica. These vehicles strip out 12b-1 fees and loads, leaving more for education savers. For instance, the asset-weighted 0.49% expense ratio of the plan’s F2 share classes is much lower than the A shares’ 0.71%. More important, the broader shift away from bundled share classes (those that include loads and 12b-1 fees) seen throughout the asset-management industry seems to be taking hold here. Over the past year, CollegeAmerica’s A share class mutual funds have seen $2.4 million in outflows, versus $3.8 million in inflows for the F2 shares. Savers stand to benefit most from the continued adoption of these lower-cost vehicles, though these unbundled share classes may come with additional expenses from fee-based advisors. Continued asset growth should compress fees as well. Crossing $100 billion in plan assets triggers another breakpoint for the commonwealth of Virginia’s fee and should make relatively fixed costs, such as underlying fund fees, look cheaper.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/cfa8a92a-3493-4cb4-80ba-e3af514136a0.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KD4XZLC72BDERAS3VXD6QM5MUY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BZ4OD6RTORCJHCWPWXAQWZ7RQE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/cfa8a92a-3493-4cb4-80ba-e3af514136a0.jpg)