Stocks Fairly Valued—What to Do Next? Buck the Trend

Now is the time to think like a contrarian. Identify stocks that have underperformed, are unloved, and—most important—undervalued.

Key takeaways:

- Stocks are fully valued, and the market is starting to feel stretched.

- The value category remains most attractive, with both growth and core overvalued.

- It’s time to start becoming a contrarian investor—invest in those undervalued areas that have lagged the broad market rally.

- Negative sentiment in real estate, utilities, and energy provides opportunities to overweight stocks trading at significant margins of safety.

In December 2021, six of the “Magnificent Seven” stocks were undervalued and rated either 4 or 5 stars. Plus, not only was the growth category trading at a significant discount to our fair value, but technology, in particular, was one of the most undervalued sectors.

Fast-forward to today—three of the Magnificent Seven are overvalued, three are fairly valued, and only one remains undervalued. The growth category is now trading at a 3% premium to fair value, and technology stocks are trading at an 8% premium.

While it has paid to follow the herd over the past year, we think now is a good time to begin investing in contrarian plays, not for the sake of being a contrarian but to take advantage of those undervalued areas that have failed to participate in the market rally because of excessive negative market sentiment.

US Stock Market Not Yet Overvalued, but Starting to Feel Stretched

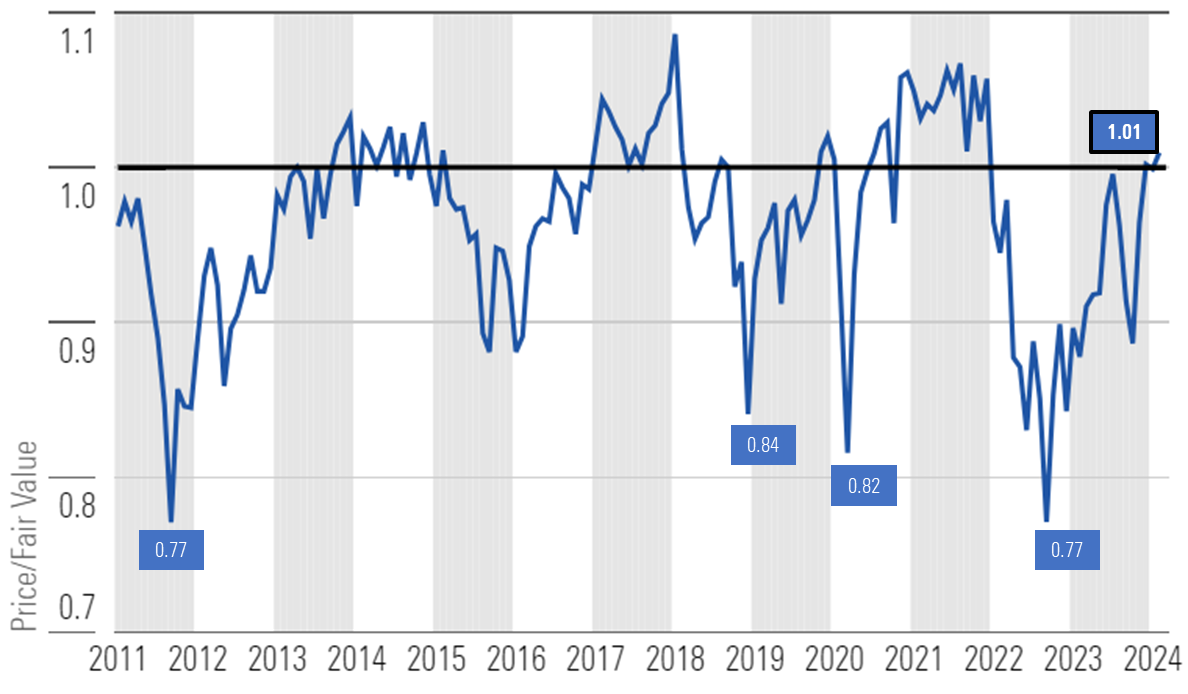

As of Feb. 28, the broad US stock market is trading at a 1% premium over composite of our fair values. While the overall market is still within the range we consider fairly valued, the underlying technical dynamics are starting to feel a bit stretched. By way of historical comparison, since the end of 2010, the stock market has only traded at this much, or more, of a premium 25% of the time.

Price/Fair Value of Morningstar's US Equity Research Coverage at Month-End

The stock market has risen 6.79% for the year to date through Feb. 29. The preponderance of returns is concentrated in the technology and communications sectors, which have risen 10.97% and 10.24%, respectively. These same two sectors also led the market in 2023, rising 59% and 54%, respectively.

An investor should never be a contrarian just for the sake of being a contrarian. Yet once a trend has become fully valued, an investor should be willing to buck that trend and begin to tilt one’s portfolio to where valuations are more appealing. We think now is one of those times and are looking to those areas of the market that have underperformed, are unloved, and—most important—undervalued.

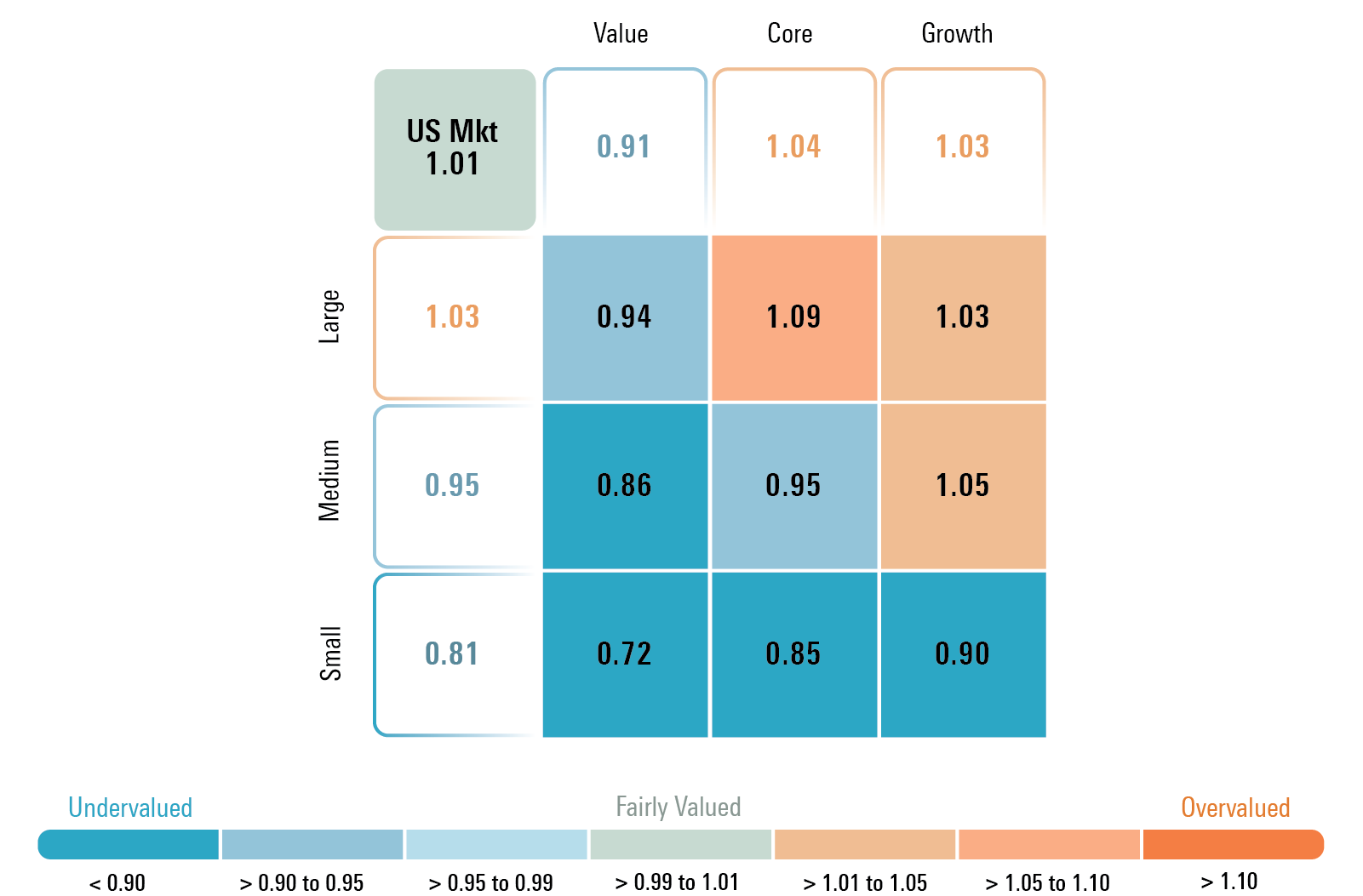

Value and Small Caps Remain Most Attractive

Overvalued stocks can always become more overvalued in the short run, but valuation will always win out in the long run. The value category remains undervalued, trading at a 9% discount to our fair values, whereas core and growth categories are trading at 4% and 3% premiums, respectively. According to these valuations, we advocate investors overweight the value category and underweight both the core and growth categories.

Looking forward, based on a combination of these valuations and our economic outlook, we see a good set up for value stocks. Morningstar’s US economics team expects a soft landing as the rate of economic growth slows over the next two quarters but not enough to lead to a recession. That slowing rate of economic growth will likely weigh on growth stocks, which appear fully valued.

Our economics team also forecasts that interest rates will decline across the yield curve. Declining interest rates are positive for all stocks, but especially for sectors often found in the value index. A decline in interest rates could lead to a rebound in demand for dividend-paying stocks—which also tend to be overweighted in the value category.

By capitalization, our valuations provide support for an overweight position in small-cap, a modest overweight in mid-cap, and an underweight in large-cap stocks. Small-cap stocks have lagged, as the market has been overly concerned that rising interest rates would suppress earnings growth as they are subject to greater refinancing risk. Small caps were also pressured, as the market had been pricing in a greater probability of a potential recession.

Looking forward, we think the set up is positive for small-cap performance. From a pure valuation point of view, they remain at a significant margin of safety from our intrinsic valuations. From a historical point of view, small caps tend to do well when the Fed begins to cut interest rates.

Morningstar’s US economics team projects the Fed will begin to lower the federal-funds rate in May or June. Our economics team also projects long-term interest rates will subside over the course of this year and into next year. A decline across the yield curve will remove the overhang that future earnings will be suppressed as small caps refinance low-cost maturing debt. Lastly, a soft economic landing would be beneficial as traders have steered clear of small caps over the concern they would suffer the most in a recession.

Price/Fair Value by Morningstar Style Box Category

Contrarian Calls: Underperforming, Unloved, and Undervalued

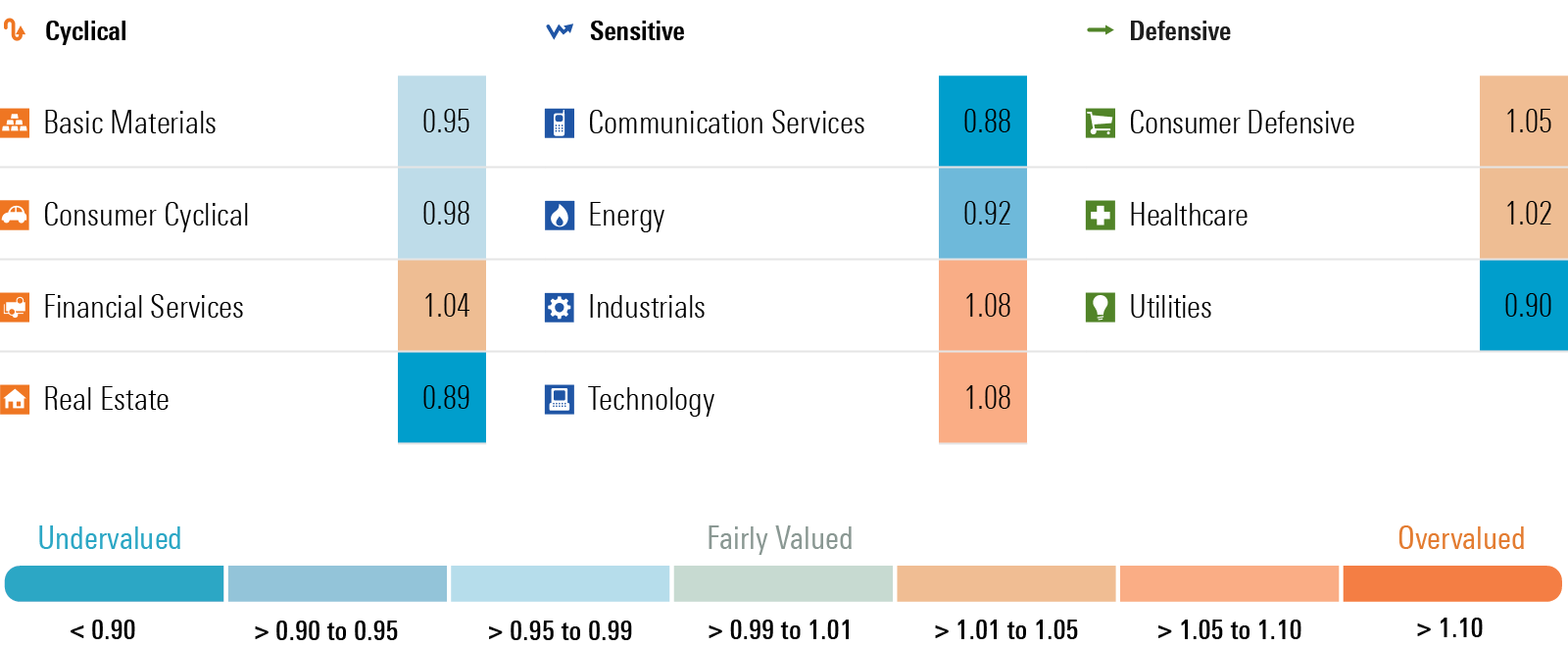

So, where to begin looking for those contrarian calls? We searched for those sectors that have lagged the broad market performance, exhibit a high degree of negative market sentiment, and yet trade at a significant discount to our intrinsic valuation.

Those sectors are real estate, utilities, and energy.

Real Estate

Few sectors have as much prevailing negative sentiment as the real estate sector. Through Feb. 29, the Morningstar US Real Estate Index has dropped 2.66%. The real estate sector is currently trading at an 11% discount to our fair values estimates.

The value of urban office space has dropped precipitously, and its near-term outlook remains cloudy. What we have found is that downward contagion from office valuations has pulled down the entire real estate sector, thus providing opportunities in other types of real estate.

For example, real estate dedicated to healthcare such as medical offices has much more defensive characteristics. Examples include Ventas VTR and HealthPeak PEAK, stocks that are both rated 5 stars. In addition, triple-net lease providers such as 5-star-rated Realty Income O also have defensive characteristics.

Utilities

The utilities sector is highly correlated to interest rates and is used by some investors as a substitute for fixed income. The utilities sector soared well into overvalued territory when interest rates were at their lows and investors were reaching for yield and then plummeted last fall as long-term rates rose. Through Feb. 29, the Morningstar US Utilities Index has dropped 1.79%. The utilities sector is currently trading at a 10% discount to our fair values estimates.

Fundamentally, according to our equity research team, the utilities sector is in as good of a position as we have ever seen. We expect the transition to renewable energy and investment in transmission networks will provide a long runway of growth. We also expect the utilities sector will experience a tailwind from declining interest rates as our US economics team forecasts yields will subside across the entire yield curve this year and next.

Two of our more-contrarian calls include Duke Energy DUK and Entergy ETR. Both stocks are rated 4 stars, sport attractive dividend yields, and trade at some of the greatest discounts to fair value in the utilities sector.

Energy

The energy sector has been wildly volatile over the past four years. Oil prices plummeted during the early months of the pandemic, bounced as oil companies drastically cut production, spiked after the Russian invasion of Ukraine, and have recently settled down as supply and demand dynamics have stabilized. Through Feb. 29, the Morningstar US Energy Index has only risen 2.52%, significantly lagging the broader market. The energy sector is currently trading at an 8% discount to our fair values estimates.

Compared with our valuations, it appears that the market is overly pessimistic as to the long-term demand for oil. We forecast that oil demand will continue to increase until later this decade, before it begins to slowly decline thereafter. We also think investing in energy stocks provides a natural hedge to portfolios against either inflation or geopolitical risks.

Our most contrarian call is 5-star-rated APA Corp APA. According to our valuation, we do not think the market is applying any value to APA for its joint venture with TotalEnergies TTE in Suriname. If APA and Total move forward with developing this oil play, we think it could double APA’s production over next decade. In our downside scenario, if they don’t move forward with this discovery, we still think the stock is trading at or below its fair value.

Two other undervalued stocks include 4-star-rated Exxon Mobil XOM and Devon Energy DVN. Exxon is our preferred stock among the global majors and Devon among the US regionals.

Contrarian Calls: Outperforming, Loved, and Overvalued

So, where should investors look to start taking profits today? In our opinion, it is in those sectors that have significantly outperformed, have exuberant market sentiment, and are now trading in overvalued territory.

Technology

Excitement surrounding the development and growth potential of artificial intelligence has spurred the technology sector to new heights. After soaring 59% last year, the Morningstar US Technology Index has risen 10.96% thus far this year. Following this rally, the technology sector is now trading at an 8% premium to our fair value.

Anything to do with artificial intelligence has spiked, and the obvious beneficiaries from AI are generally fully-to-overvalued. In fact, some of the most overvalued stocks across our coverage have soared on the market’s perception of their leverage to AI growth trends. Examples include 1-star rated ARM Holdings ARM and Dell Technologies DELL. Yet, it is not just the AI plays that have risen into overvalued territory. Other more-mundane technology companies such as 2-star rated International Business Machines IBM and Oracle ORCL have ridden the technology wave higher.

Where we still see opportunities in the technology sector include:

- Second-derivative plays on AI such as 4-star-rated Cognizant Technologies CTSH, which provides consulting services.

- Companies that are not related to AI and have been overlooked by the market such as 4-star-rated Teradyne TER.

- Those stocks that were once pandemic highfliers that have now fallen too far such as Zoom Video Communications ZM.

Morningstar Price/Fair Value by Sector

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/S7NJ3ZTJORFVLCRFS2S4LRN3QE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/54f9f69f-0232-435e-9557-5edc4b17c660.jpg)