Should Investors Worry About the Debt-Ceiling Drama?

Investors can look to history for lessons on what the political battle means for their portfolios and the markets.

The U.S. debt ceiling is back in the news, and as deadlines draw nearer, the political theater and dramatic reporting will likely intensify.

For investors, the brinkmanship in Washington adds to the uncertainties and questions around the outlook. How important is the debt ceiling to the markets? What happens if the United States sees its credit rating downgraded? What happens if there is a default? In general, what (if anything) should investors do over this conflict?

While markets never like uncertainty, investors may find it helpful to remember that we’ve been at such a point many times before. We can look at this history for some perspective.

What Is the Debt Ceiling?

The debt ceiling is the legislative cap on the amount of national debt the U.S. Treasury can incur, thus limiting the risk of a public debt crisis.

To meet its obligations (which include paying military salaries, retirement benefits, and interest on the national debt), the Treasury sells bonds (that is, issues new debt) to investors across the globe. Because the U.S. government generally runs budget deficits (meaning it spends more than it collects in tax revenue), the debt ceiling needs to be periodically raised to accommodate additional borrowing. Consequently, the national debt rises.

The challenge is that the debt ceiling is a nominal figure—currently $31.4 trillion—that needs to be continually revised as the economy grows.

What Happens After We Hit the Debt Ceiling?

When the amount of debt outstanding hits the debt limit, you might think it would quickly produce a hard deadline to act upon. With a binding debt ceiling in place, the Treasury would face a situation in which it would not have enough funds to meet all its obligations on time.

This is where “extraordinary measures” come into play. If Congress fails to lift the debt limit, the Treasury would utilize these measures to temporarily keep the government under the borrowing limit, primarily by halting investments in select government funds. This creates headroom under the debt cap, permitting the Treasury to borrow more from the public.

The risk is that a new limit might not be agreed on, which could lead to a technical default of the U.S. government. Treasury Secretary Janet Yellen recently said that a failure to raise the debt ceiling would cause a “steep economic downturn,” and she reiterated a previous warning that the Treasury may run out of measures to pay its debt obligations by June.

Before we get to that point, a large portion of the process will be political theater. There’s much to speculate about: micro details of the debt ceiling, negotiating tactics, who’s to blame, and the final resolution.

But there’s also an evidence-based approach that looks to historical precedent. It won’t provide certainty, but it can grant more clarity.

Have We Hit the Debt Ceiling Before?

It’s called a ceiling, but it’s under constant reconstruction.

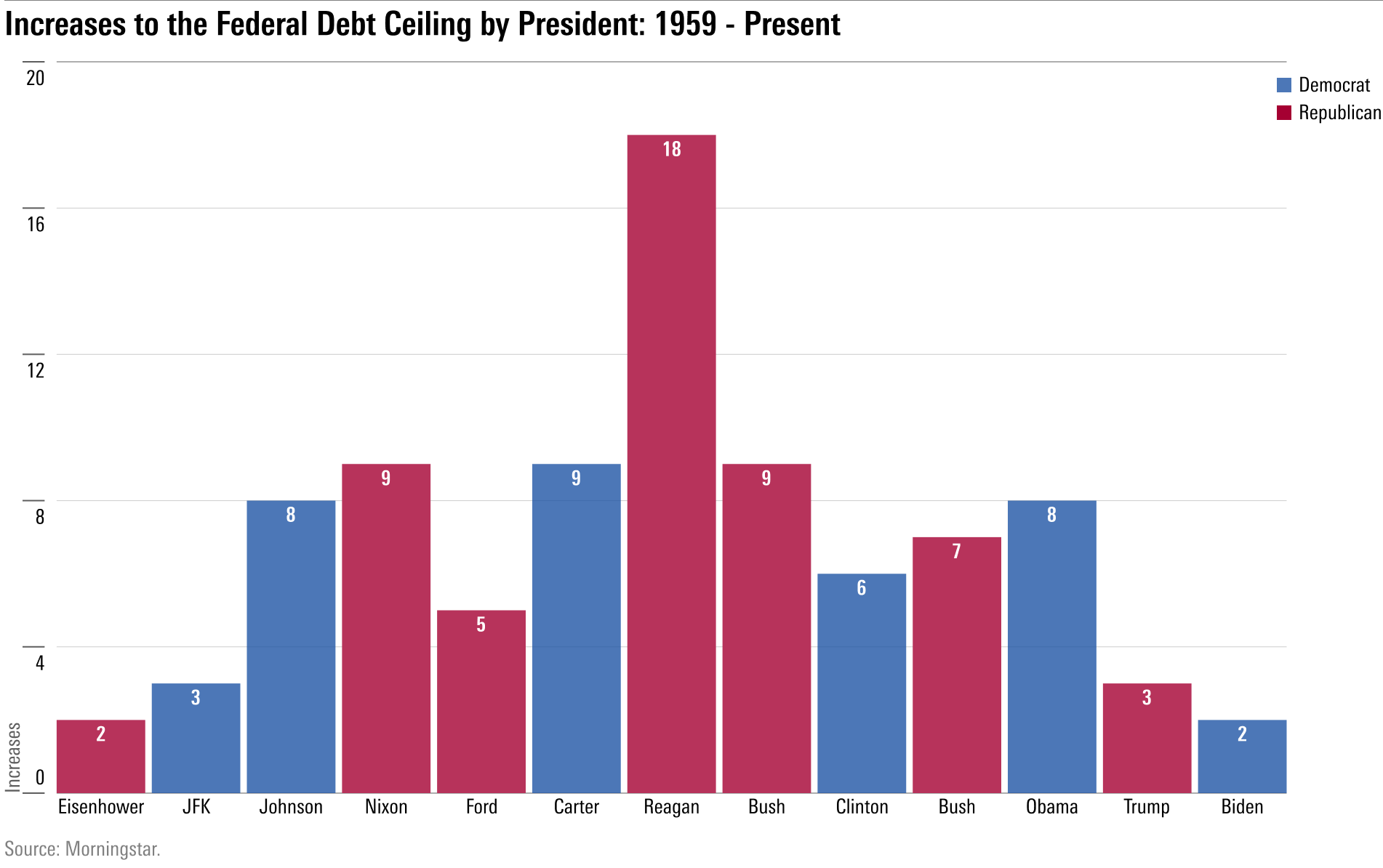

Both political parties have previously lifted the limit. Since 1959, every president has done so. The debt ceiling has been increased 89 times beginning with Dwight D. Eisenhower’s presidency.

Over the past 60 years, the debt ceiling has gone up 53 times under Republican presidents and 36 times under Democratic ones. It’s such a regular occurrence that we should probably expect number 90 soon.

What Happens if the U.S. Credit Rating Is Downgraded?

In 2011, Standard & Poor’s downgraded the U.S. credit rating. It was a major moment in the markets.

The below excerpt is from a Reuters article that ran after it happened:

The United States lost its top-tier AAA credit rating from Standard & Poor’s in an unprecedented blow to the world’s largest economy in the wake of a political battle that took the country to the brink of default.

S&P cut the long-term U.S. credit rating by one notch to AA-plus on concerns about the government’s budget deficit and rising debt burden. The action is likely to eventually raise borrowing costs for the American government, companies, and consumers.

The move reflects the deterioration in the global economic standing of the United States, which has had a AAA credit rating from S&P since 1941, and it could have implications for the U.S. dollar’s reserve currency status.

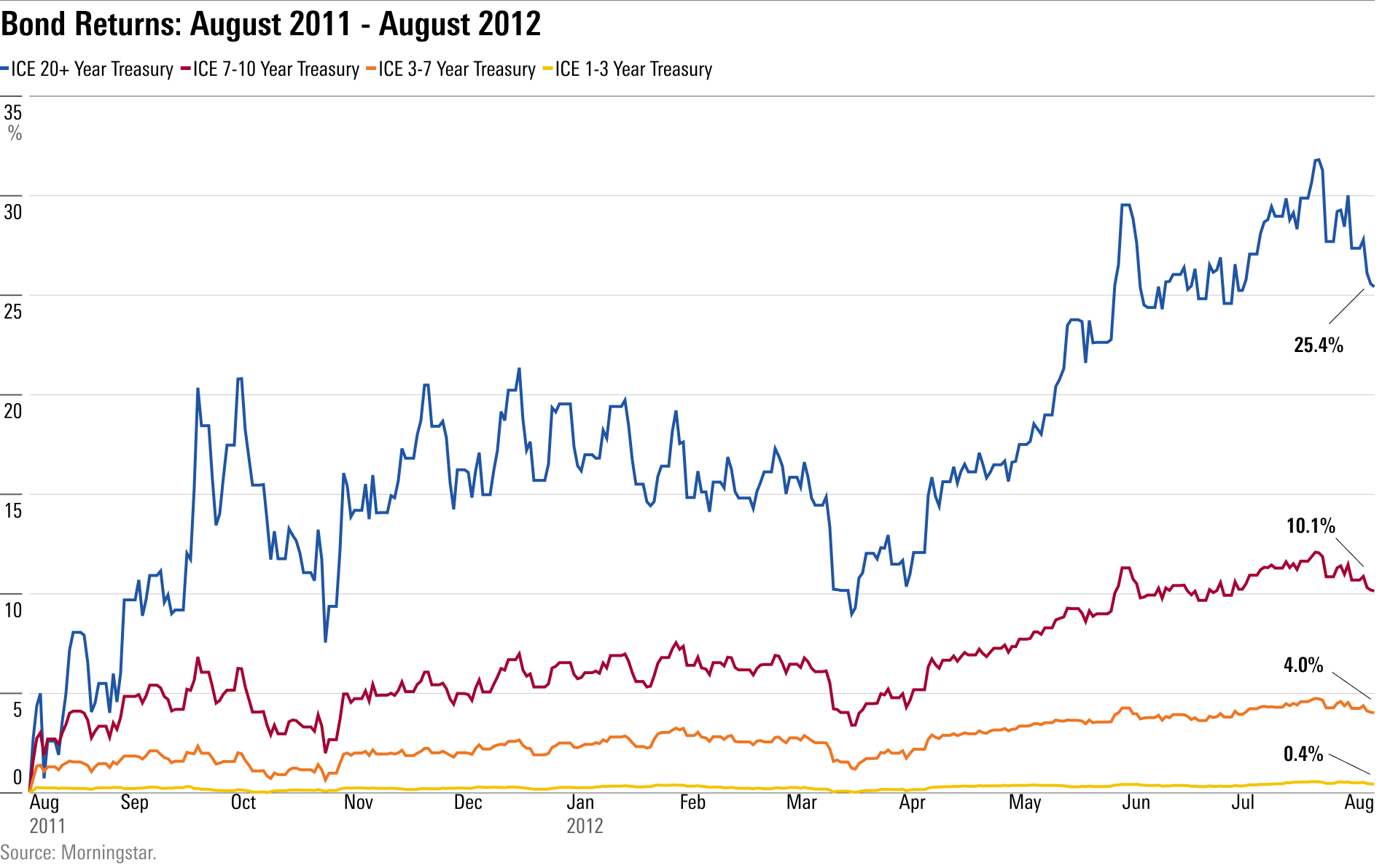

But what actually happened was different from what the writer predicted. These were the returns of various bond indexes one year after the downgrade:

Despite the downgrade, bond prices rallied as interest rates fell.

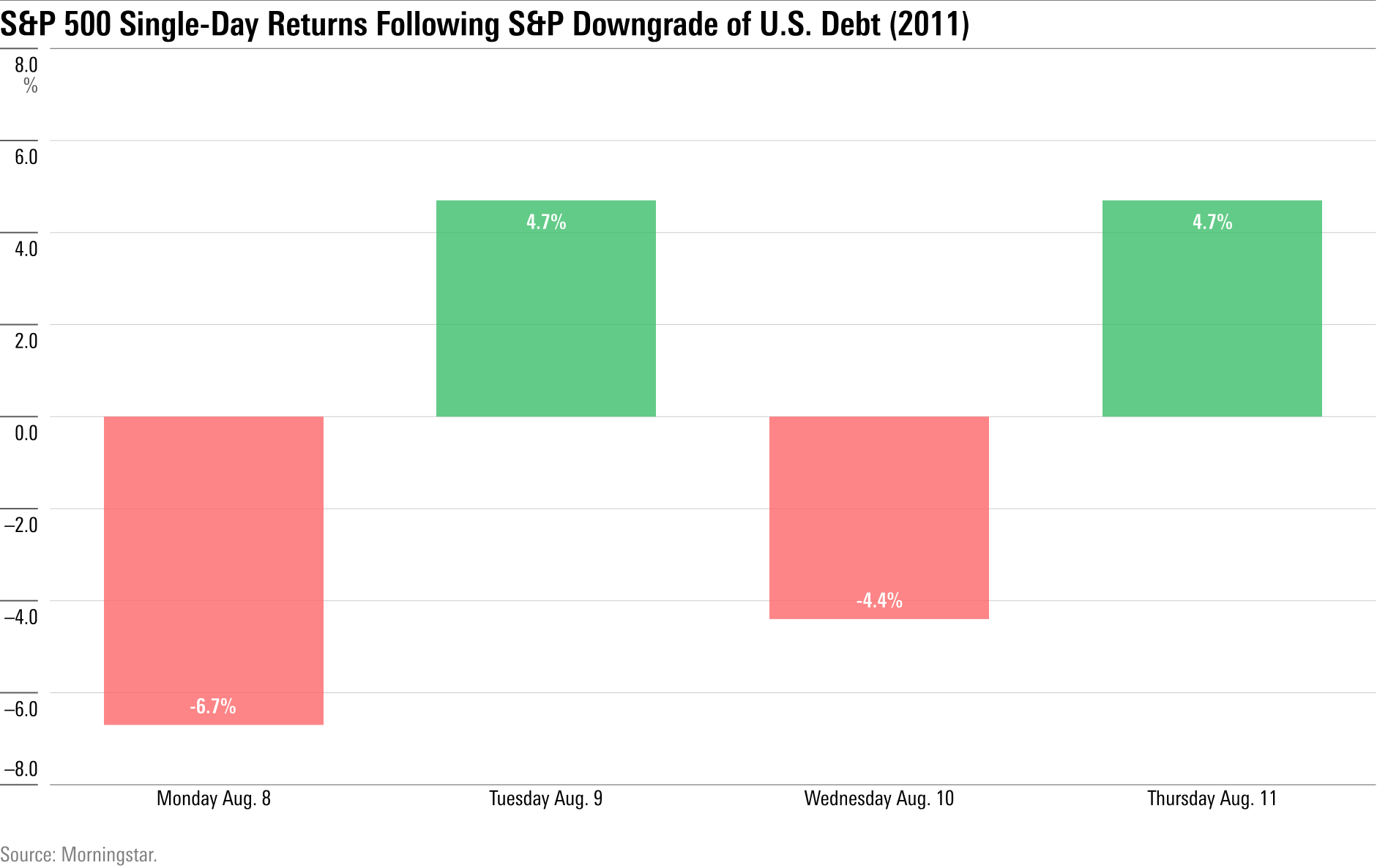

For stocks, things got a lot bumpier. The downgrade was made public on Friday, Aug. 5, 2011, after the market closed. The market went for a wild ride the following week.

There were big up days and big down days as the market filtered through the news. It was a volatile time, to say the least.

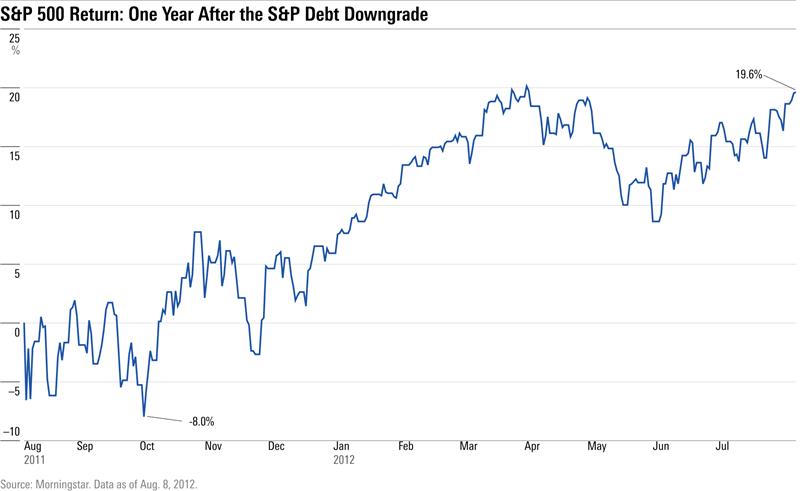

By October 2011—only three months after the downgrade—the S&P 500 had declined 8%, but a furious rally followed. A year later, the S&P was up nearly 20%.

What Happens if the Government Defaults?

If Congress does not suspend or raise the debt limit, the Treasury would likely prioritize paying its obligations while curbing discretionary expenditures.

The outcome can’t be predicted with certainty, but it would likely create a challenging economic environment with more volatility in financial markets. While that prospect is alarming, it also seems unlikely, given that a compromise has been reached 89 times in this same situation since 1959.

$31 Trillion National Debt in Context

Much of the political battle over the debt ceiling centers on how much outstanding debt the U.S. has.

There’s been an explosion in federal debt; it was $15 trillion in 2011, and today it’s approximately $31 trillion. It’s doubled in 10-plus years. With that data point in isolation, you could assume the U.S. is stuck in a debt spiral.

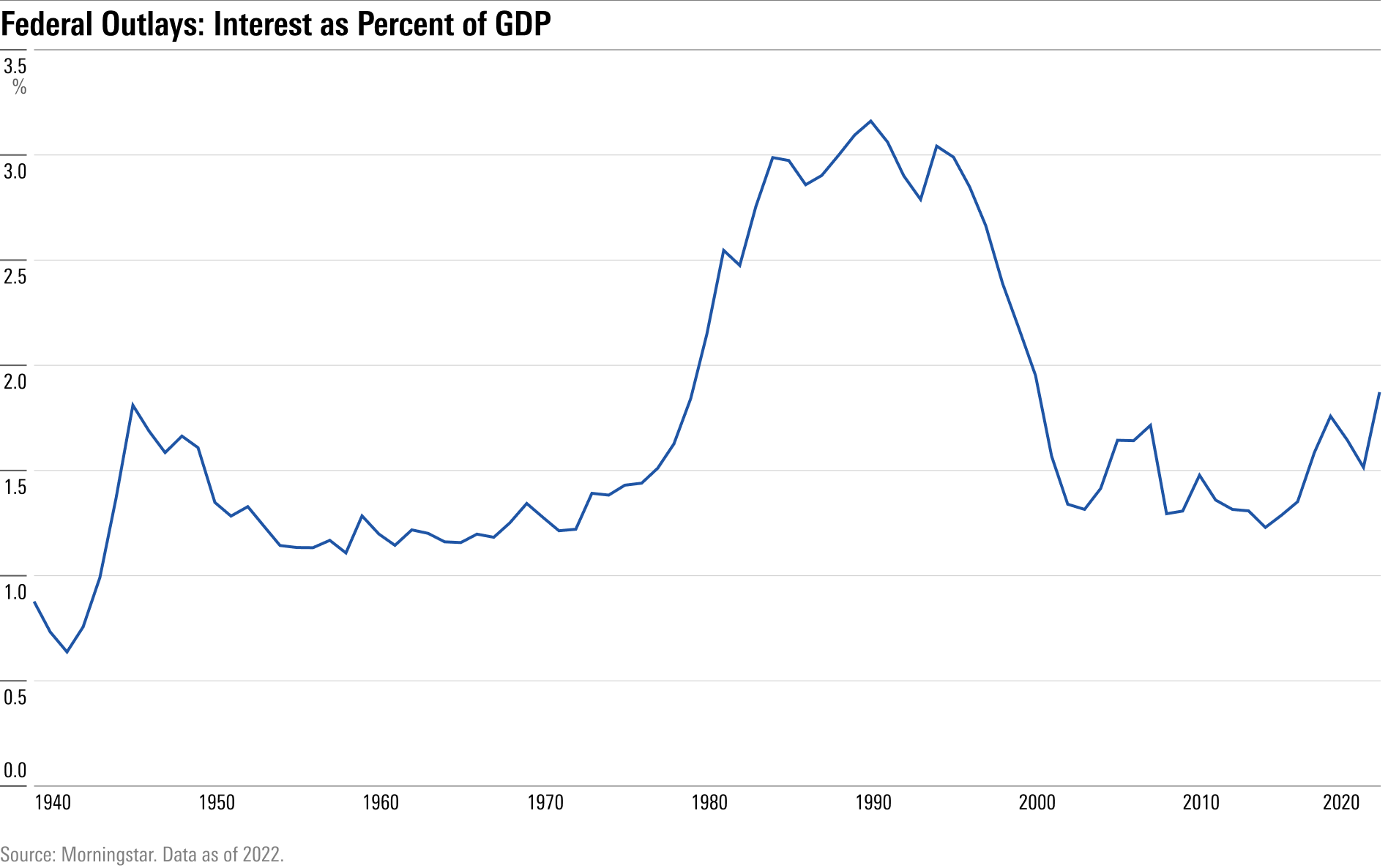

But numbers—especially ones this large—have nuances. One way to look at the overall level of debt is to measure the interest the U.S. government pays on debt as a percentage of gross domestic product.

Interest payments on debt are much lower today than in the 1980s or 1990s. Even though its debt has risen substantially, the U.S. can still afford to pay it.

While the debt was lower in the ‘80s and ‘90s, rates were higher then, and the economy was smaller as well. In 2011, the U.S. GDP was $15 trillion. Today it’s more than $26 trillion.

The simplest observation would be that the federal debt grows as the economy grows, but ultimately the entire pie expands.

Should Investors Be Concerned About the Debt Ceiling?

Does the debt ceiling matter for portfolio decisions? The answer depends on your time horizon.

If an investor is looking at the next six months, this tumult could be a swing factor in the market’s direction between now and year-end.

If the time frame is multiyear or longer, investors can take solace knowing that instances in which the U.S. approaches its debt ceiling are mere footnotes in market history. They can instead focus on long-term investments and accommodate potential short-term bumps.

Remember Warren Buffett’s concept of the “too hard” pile: If he doesn’t understand a business or industry, he sets it aside and moves on. If people want to follow the political process around the debt ceiling because they find it interesting or enjoy the spectacle, they can do so. But from an investment perspective, this subject belongs in the “too hard” pile.

Investors should focus on what they can control. They have no control over politics, tax policy, the economy, or the sequence of market returns. But they can set goals, maintain their asset allocations, control costs, and keep their emotions in check.

Admittedly, it’s more interesting to debate politics than it is to consider what investors can control. But making the right boring decisions can make a world of difference in the long run.

Morningstar Investment Management LLC is a Registered Investment Advisor and subsidiary of Morningstar, Inc. The Morningstar name and logo are registered marks of Morningstar, Inc. Opinions expressed are as of the date indicated; such opinions are subject to change without notice. Morningstar Investment Management and its affiliates shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Before making any investment decision, please consider consulting a financial or tax professional regarding your unique situation.

Morningstar Investment Management LLC is a Registered Investment Advisor and subsidiary of Morningstar, Inc. The Morningstar name and logo are registered marks of Morningstar, Inc. Opinions expressed are as of the date indicated; such opinions are subject to change without notice. Morningstar Investment Management and its affiliates shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Before making any investment decision, please consider consulting a financial or tax professional regarding your unique situation.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.