Is Nvidia Stock a Buy, Sell, or Fairly Valued After Earnings?

With AI-driven demand lifting first-quarter earnings, here’s what we think of Nvidia stock.

Nvidia NVDA released its first-quarter earnings report on May 24. Here’s Morningstar’s take on what to think of Nvidia’s earnings and stock.

Nvidia Stock at a Glance

- Fair Value Estimate: $300

- Morningstar Rating: 2 stars

- Morningstar Uncertainty Rating: High

- Morningstar Economic Moat Rating: Wide

What We Thought of Nvidia Q1 Earnings

Wide-moat Nvidia reported first-quarter sales ahead of management’s guidance, while providing guidance for the second quarter significantly above our prior estimates. Management expects second-quarter revenue to be at a midpoint of $11 billion, which would be up 64% year over year and 53% sequentially.

We have increased our fair value estimate to $300 per share from $200 per share, as we raised our forecast for Nvidia’s data center segment revenue to grow at a 30% compound annual growth rate over the next five years (up from 19% previously).

The uplift was primarily driven by unsatiated demand for Nvidia’s latest H100 data center graphics processing unit. Relative to its predecessor, the H100 is 9 times faster in artificial intelligence training and up to 30 times faster in AI inferencing for transformer-based large language models such as Open AI’s ChatGPT.

We believe the data center segment will be the primary driver of management’s rosy second-quarter revenue outlook of $11 billion. Specifically, we think the robust demand for its H100 GPUs will drive second-quarter data center revenue to $7.6 billion, which would be up 100% year over year.

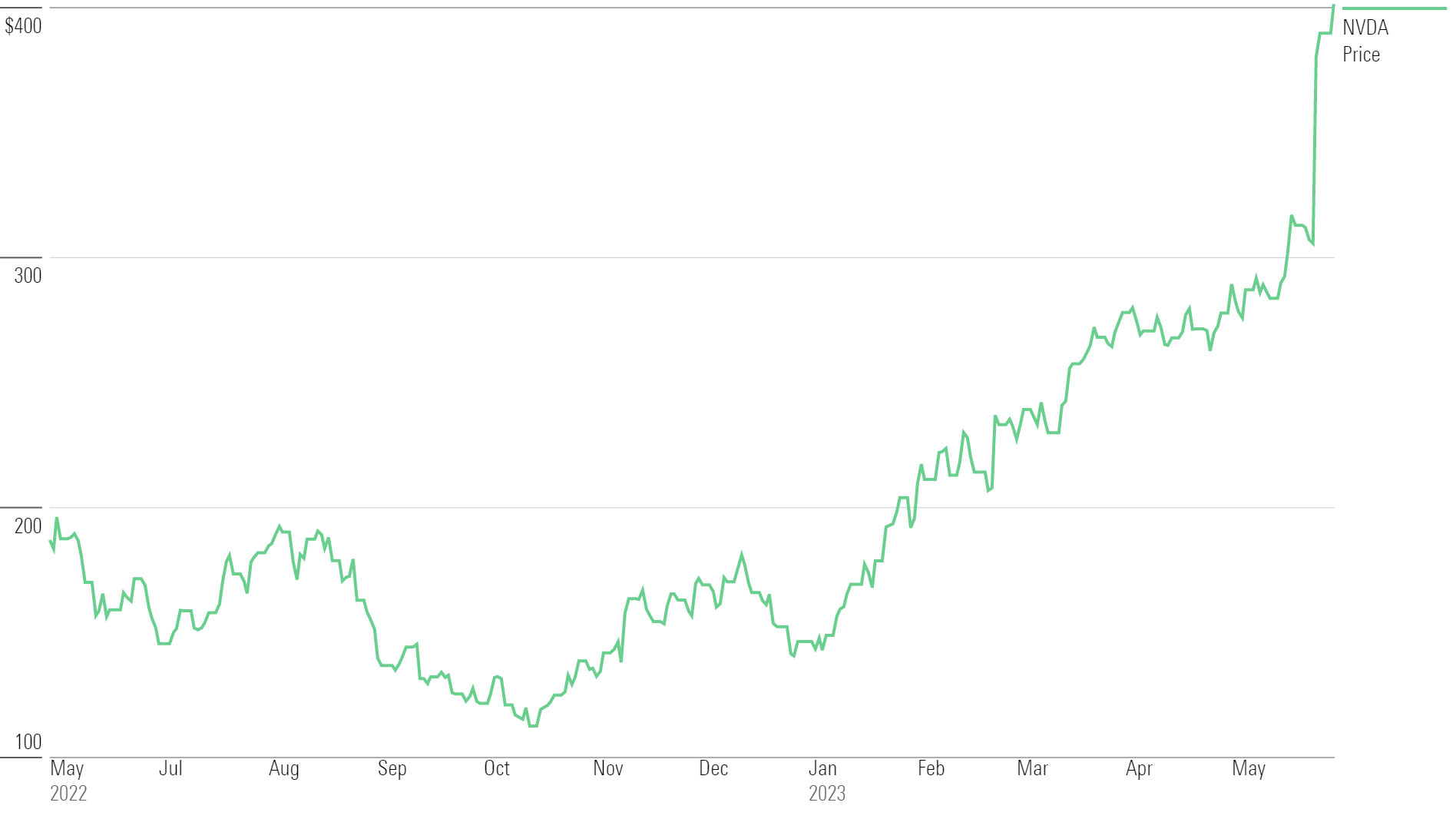

Nvidia Stock Price Chart

Fair Value Estimate for Nvidia Stock

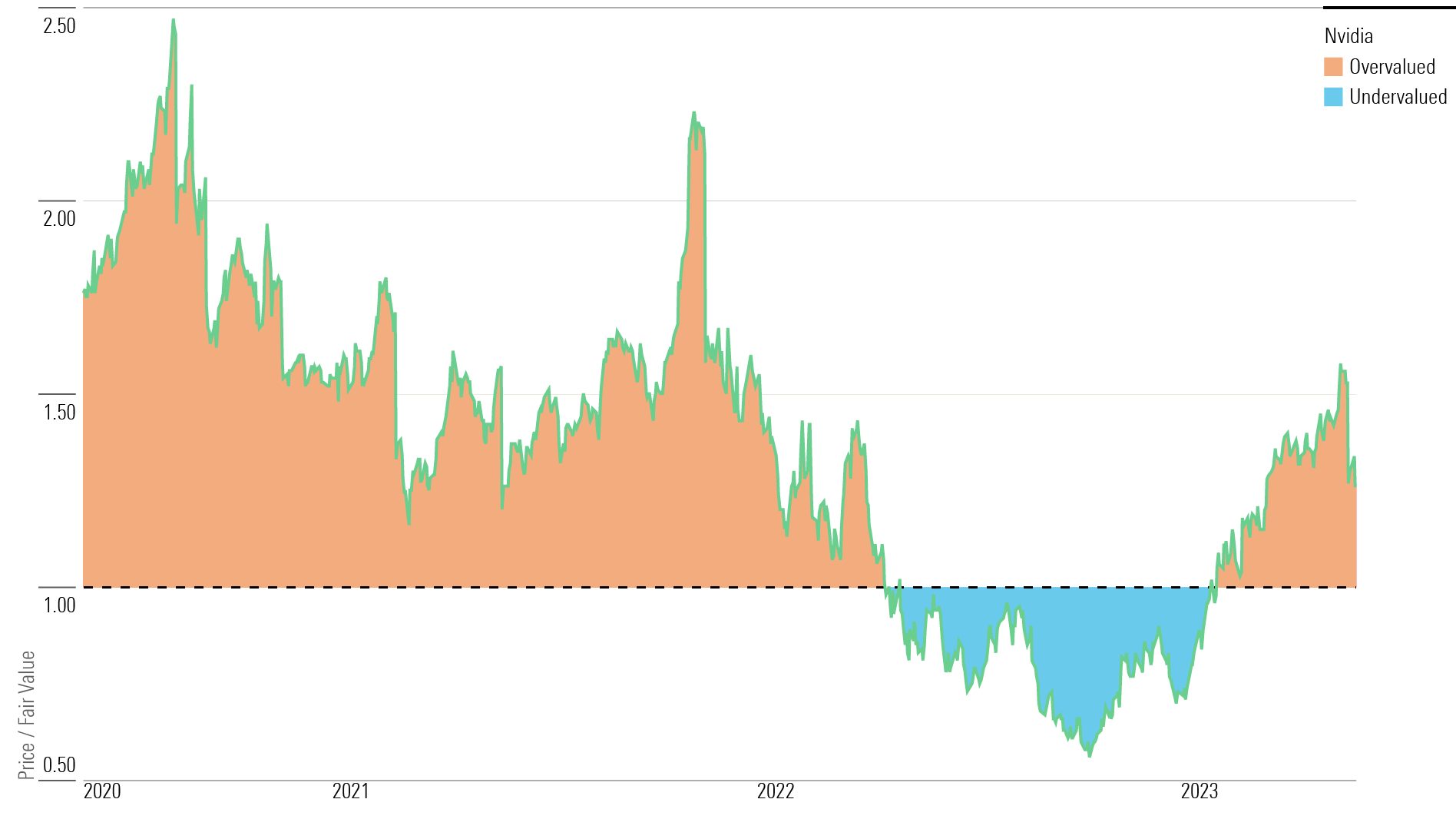

At a 2-star rating, Nvidia stock is overvalued compared with our fair value estimate.

Our $300 fair value estimate assumes a fiscal 2024 (year ending January 2024) adjusted price/earnings ratio of 37 times. We project revenue will increase at a 23% compound annual growth rate through fiscal 2028 as the firm continues to diversify its revenue sources to areas of strong potential.

We think the data center segment will rise at a 30% CAGR through fiscal 2028 as we expect the firm to dominate the training portion of deep-learning AI workloads. Key workloads that supported this growth included large language models (such as ChatGPT), other forms of generative AI, deep recommendation engines, and autonomous vehicle fleet data processing and training.

While we expect gaming to remain a major source of revenue, the cryptocurrency crash has materially curbed demand for Nvidia’s GPUs for mining purposes. We estimate gaming GPU sales will be up 7% in fiscal 2024 following a sharp decline of 27% in fiscal 2023. Over the next five years, we project that gaming revenue will rise at an 8% CAGR.

In automotive, we think Nvidia will capture a healthy portion of the self-driving opportunity, culminating in a 39% CAGR in automotive revenue through fiscal 2028, following a soft fiscal 2021 and 2022 due to the coronavirus and the chip shortage that hampered auto production.

Read more about Nvidia’s fair value estimate.

Nvidia Price/Fair Value

Economic Moat Rating

We believe Nvidia possesses a wide economic moat stemming from its intangible assets related to the design of graphics processing units. The firm is the originator of and leader in discrete graphics, having captured the lion’s share of the market from longtime rival AMD. We think the market has significant barriers to entry in the form of advanced intellectual property, as even chip leader Intel INTC was unable to develop its own discrete GPUs (despite its vast resources) and ultimately needed to license IP from Nvidia to integrate GPUs into its PC chipsets (though, more recently, Intel is vying to develop its own discrete GPU). To stay at the cutting edge of GPU technology, Nvidia has a large research and development budget relative to AMD and smaller GPU suppliers, which allows it to continuously innovate and fuel a virtuous cycle for its high-margin chips.

Nvidia has taken steps to leverage its GPU prowess into other markets such as data center and automotive that represent meaningful growth opportunities. GPUs are being used to accelerate computation workloads with the goal of training AI systems to perform complex tasks such as driving cars. We note these tasks are computationally intensive endeavors that are more achievable with CPUs and GPUs working in tandem versus CPUs in isolation.

Consumer internet and cloud behemoths such as Alphabet GOOGL, Meta META, Amazon.com AMZN, and Microsoft MSFT have found GPUs to be adept at accelerating cloud workloads that use deep-learning techniques to achieve speech recognition (Siri, Google Now, Alexa, Cortana), photo recognition (identifying faces in pictures on Facebook, videos of cats on YouTube), and recommendation engines (Netflix and Amazon). More recently, large language models that use generative AI such as ChatGPT have risen in prominence and utilize thousands of GPUs to be trained.

Nvidia has a first-mover advantage in the accelerator market as it looks to foster continued AI adoption in both the cloud and on the road.

DPUs are a new class of product that Nvidia is promoting for data centers that offload and accelerate workloads that may run on a CPU, thus allowing CPUs to focus on core applications. Specifically, DPUs can be used as a Smart NIC, or network interface card, for software-defined networking, storage, and security. Nvidia CEO Jensen Huang estimates roughly 50% of the computer cores in modern data centers are handling functions that could run on a DPU. This dynamic puts server CPU vendors at risk, though we note Intel, Xilinx, and other chip firms also have comparable programmable Smart NIC solutions.

Read more about Nvidia’s moat rating.

Risk and Uncertainty

Our Morningstar Uncertainty Rating for Nvidia is High. The firm has benefited from strong PC gaming momentum in recent years. However, many of the most popular games are competitive multiplayer online games (esports) that require low-end discrete GPUs for latency reasons versus high-end GPUs for cutting-edge graphics.

Nvidia has a first-mover advantage in chip solutions for AI and autonomous-vehicles, though its lead may not last if superior alternatives arise (other forms of acceleration for AI or other self-driving platforms). Also, the rate of disruption tends to be quicker in these markets that are very performance-sensitive. We note GPUs were designed to do one thing very well: render graphics for realistic images, games, videos, and so on. Leveraging GPUs in deep-learning applications among other areas mostly occurred due to a lack of better alternatives. As alternatives arise, Nvidia’s recent explosive growth could be difficult to maintain.

We do not foresee any material environmental, social, or governance issues on the horizon. Perhaps the greatest risk is the potential scarcity of experienced chip design talent within the industry.

Read more about Nvidia’s risk and uncertainty.

NVDA Stock Bulls Say

- The proliferation of the AI and deep-learning phenomena that rely on Nvidia’s graphics chips presents the firm with a massive growth opportunity.

- The firm has a first-mover advantage in the autonomous driving market that could lead to widespread adoption of its Drive PX self-driving platform.

- The increasing complexity of graphics processors provides a barrier to entry for most potential rivals, as it would be difficult to match Nvidia’s large research and development budget.

NVDA Stock Bears Say

- The artificial intelligence opportunity remains nascent, and it is not a foregone conclusion that Nvidia’s GPUs will dominate.

- Nvidia’s automotive endeavors face plenty of competition, as numerous chipmakers are targeting the market.

- A large portion of sales comes from the maturing PC industry via PC gaming.

This article was compiled by Muskaan Hemrajani.

Get access to full Morningstar stock analyst reports, along with data and tools to manage your portfolio through Morningstar Investor. Learn more and start a seven-day free trial today.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5c8852db-04a9-4ec5-8527-9107fff80c09.jpg)